How Top Hedge Funds Really Manage Risk (and What You Can Copy)

If hedge funds have one real strength, it isn’t picking the hottest stock or calling the next major macro shift. It’s how they manage risk.

Many beginning traders imagine hedge funds as bold gunslingers.

They think of concentrated bets, calling the next big thing, exotic derivatives, or extreme leverage. And yes, some of that happens to some extent.

But in reality, risk management is the backbone. Even when something is presented in the media as a big bet, there are likely guardrails and offsets around the trade.

The best funds stay alive not because of bold predictions, but because of carefully designed risk frameworks.

Their job isn’t to be right all the time. It’s to never have unacceptable outcomes.

That difference explains why some of the best hedge funds survive decades while most individual traders flame out fairly quickly.

If you can limit your left-tail risk and keep drawdowns manageable, it’s much easier to grow your account and overall wealth.

We explore this more below and how you can copy how the very best traders and hedge funds accomplish this.

Key Takeaways – How Top Hedge Funds Really Manage Risk

- The irony is that the hedge fund model is built on principles most of us already know. Don’t risk everything on one bet. Don’t confuse luck with skill. Don’t put all your eggs in the same basket.

- It’s important to inculcate those rules seriously without exception.

- Survival before profits – Protect your capital first. Avoid positions that could wipe you out, no matter how tempting.

- Risk-adjusted thinking – Judge returns relative to the risk taken. Consistency matters more than big wins. Big losses aren’t compensated by corresponding big gains.

- Real diversification – Spread across strategies, asset classes, countries, currencies, and factors. Remember that most stocks are highly correlated.

- Guardrails and rules – Pre-define limits and follow them.

- Simple hedges – Use stop-losses, cash, or basic puts. Protection matters more than complexity.

Hedge Fund Risk Management Tactics

- Survival/defense first, profits second

- Focus on risk-adjusted returns (Sharpe, Sortino, drawdown metrics)

- Prioritize consistency over raw gains

- Diversify beyond stocks

- Across asset classes (equities, bonds, commodities, currencies, cash)

- Across factors (value, momentum, quality, volatility)

- Across strategies (macro, quant, defensive)

- Position sizing and exposure control

- Value-at-Risk (VaR) models

- Stress tests using past crises

- Strict drawdown limits

- Scale into and out of trades gradually

- Hedging and overlays

- Options, futures, swaps

- Macro hedges vs. position-specific hedges

- Correlation and regime analysis

- Track how assets move together in stress

- Adjust when correlations spike

- Liquidity management

- Maintain cash buffers

- Hold assets that can be sold quickly (or be compensated accordingly)

- Behavioral safeguards

- Hedge funds have strict independent risk teams

- Playbooks for volatility spikes and tail events (e.g., buying cheap OTM hedges well ahead of time)

- Scenario planning

- Culture of humility, constant review of assumptions

- Individual investor adaptations

- Set personal guardrails (max loss or drawdown limits)

- Keep a trading journal for discipline

- Size positions as a % of account, not dollar targets

- Mix strategies (trend, value, defensive, cash)

- Balance short- and long-term bets

- Use simple hedges (stop-losses, index puts, OTM options, uncorrelated assets)

Core Principles of Hedge Fund Risk Management

If you ask most what makes hedge funds successful, they’ll say it’s about spotting winners, timing markets, or pulling clever tricks with leverage.

But their real edge is much less glamorous. It’s risk management.

The best funds aren’t run by adrenaline junkies trying to outguess the market. They’re run by people obsessed with survival, consistency, and balance.

The principles are surprisingly simple; principles you can actually borrow for your own trading.

Survival First, Profits Second

Here’s the hard truth: if you blow up, nothing else matters. Hedge fund managers know this better than anyone. That’s why preserving capital is their north star.

Think about the math. Lose 50%, and you need to double your money just to get back where you started.

That’s a hole you don’t want to be in. So funds play the long game. They’ll gladly pass on a tempting bet if it risks crippling the portfolio.

This is what people mean when they talk about the “don’t blow up” mindset. It’s not about avoiding risk entirely, but about making sure no single mistake can take you out of the game.

Retail traders often chase home runs. Hedge funds are more like marathon runners pacing themselves. 1% gain one month, 0.5% loss one month, 2% gain one month, etc.

Stay in the race long enough, and you’ll have more chances to win.

Risk-Adjusted Returns, Not Absolute Returns

Here’s another big difference: hedge funds don’t care as much about raw returns.

To them, a trader who doubles their money by going all-in on risky bets isn’t a genius. They’re just lucky.

What professionals actually care about is how much return they generate for every unit of risk they take while keeping it within certain risk parameters.

That’s where metrics like the Sharpe ratio come in.

Imagine two portfolios: one makes 20% a year but swings up and down like a rollercoaster with 30% drawdowns common, the other makes 10% steadily with much less drama.

A hedge fund – especially if they want to attract institutional clients and keep them – is going to be in the second one every time. Because it’s more predictable and repeatable.

A sovereign wealth fund (i.e., an example of a hedge fund client) might not care much about the stock market. They might have a mandate of beating their domestic inflation rate by 5% each year, with volatility and drawdown limitations.

Risk-adjusted thinking changes how you see success.

Instead of asking, “How much did I make?” the better question is, “How efficiently did I earn it?”

That mindset is why so many top funds look “boring” compared to the myth of hedge funds as fearless gamblers. Consistency is the real criteria.

Diversification Beyond Basics

Many think diversification means owning a bunch of different stocks. That can help, but only to an extent.

Ask anyone who lived through 2008 or 2020; when people want out, most stocks move together.

Suddenly, a “diverse” portfolio is all sinking in the same boat.

Hedge funds approach diversification differently.

They don’t just spread across names, they spread across asset classes, factors, and strategies.

That means mixing stocks with bonds, commodities, currencies, and sometimes more unique, customized stuff.

It also means blending different styles: momentum, value, macro bets, arbitrage.

The idea isn’t to have more things in the portfolio, it’s to have things that don’t all depend on the same outcome.

Here’s an example: let’s say equities fall. A hedge fund might have government bonds or a volatility trade that helps to pick up the slack.

In good times, those positions may feel boring. In bad times, they’re the reason the fund keeps its drawdowns to reasonable levels.

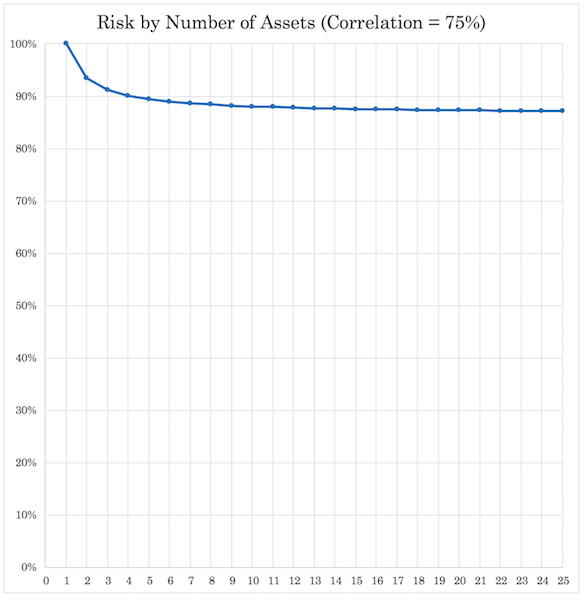

And this is why just owning more stocks have little marginal effect past a point. Adding your 41st stock to a portfolio of 40 doesn’t help much (or at all) if they all mostly move together.

In this article, we explained that if stocks are 75% correlated, on average, then adding more of them starts to flatten the marginal value (as it pertains to risk) quickly:

What matters is finding exposures that zig when others zag.

Tools and Techniques Used by Top Hedge Funds

Hedge funds have various ways to control risk. Some are technical and some are surprisingly common sense.

The goal is always the same: limit downside, stay liquid, and make sure no single event can knock them out.

Let’s break down a few of the most important ones.

Position Sizing and Exposure Control

One of the least glamorous, yet most critical, decisions a hedge fund makes is how big a position should be.

Most blow-ups in financial history didn’t happen because the original idea was wrong. They happened because someone bet too big.

Hedge funds use several tools to prevent that. Value-at-Risk (VaR) is one. In plain English, VaR estimates how much money you could lose in a worst-case scenario over a given period.

It’s not perfect. Critics argue it underestimates risk during crises. But it gives managers a yardstick for exposure.

On top of that, funds run backtests and stress tests.

They’ll feed portfolios through simulations of past disasters (the 2008 crash, the dot-com bust, the COVID panic) to see how much pain they’d suffer if history repeated itself. This helps them avoid blind spots.

They can even use synthetic data and simulate things where there is no historical precedent.

Then there are drawdown limits. Many firms have strict rules about how much loss they’ll tolerate before cutting exposure.

For example, if a portfolio falls 10% from its peak, managers may be forced to shrink positions until risk is back under control.

Finally, funds rarely “go all in.” Instead, they scale into and out of trades.

They’ll start small, see how the thesis plays out, and only build if conditions support it. It’s like dipping your toes in the water before diving in.

Hedging and Overlay Strategies

Another big part of the toolkit is hedging. At its core, hedging is just buying insurance.

Hedge funds know they can’t predict everything, so they pay up to protect against tail events.

They use derivatives like options, futures, and swaps for this purpose. A simple example: a fund holding a lot of equities might buy index put options.

If the market tanks, those puts rise in value and offset losses elsewhere.

There are two broad flavors of hedging:

- Macro hedges, which cover the entire portfolio against a big event like a recession or market crash.

- Position-specific hedges, which are more surgical, protecting a single trade from going sideways.

Hedges aren’t free and they eat into returns when things go well.

But that’s the trade-off: pay a little now so you don’t have unacceptable losses later.

The best funds think about hedges the same way you think about car insurance. You hope you never need it, but you’re glad it’s there if anything happens.

Correlation and Regime Analysis

Diversification only works if your assets don’t all move in the same direction. The trouble is that correlations change depending on the market regime.

In normal times, stocks and bonds may move independently. In crises, though, everything can suddenly crash together as liquidity dries up.

They measure how assets behave in stress scenarios – in the tails – not just in calm markets.

When correlations spike, managers adjust portfolios. That might mean cutting exposure in areas that have become dangerously tied together, or adding strategies that thrive in chaos.

A famous example: during the 2008 crisis, many assets that were historically uncorrelated suddenly became tightly linked.

The lesson is simple but important: diversification isn’t static.

You have to keep asking, “What happens if everything starts moving together?” Hedge funds don’t just assume yesterday’s relationships will hold tomorrow.

Liquidity Management

If there’s one lesson that repeats in financial history, it’s this: it’s not enough to be right, you also have to be able to get in and out when you want (and without extremely high transaction costs).

That’s what liquidity management is all about. Hedge funds keep cash buffers and invest in assets they can sell quickly. They don’t want to be stuck holding something that looks great on paper but can’t be exited when the market panics.

The collapse of Long-Term Capital Management (LTCM) in the 1990s is the classic cautionary tale. Their trades weren’t necessarily bad, but they forgot to take into account their own influence on the market. Liquidity dried up, leverage magnified the problem, and the fund imploded.

Archegos Capital in 2021 blew up for similar reasons. They held huge, leveraged positions in a few stocks. When those stocks dropped, Archegos couldn’t meet margin calls, and the whole thing unraveled almost overnight.

Top hedge funds never forget these lessons. That’s why they always keep a margin of safety.

The Bigger Picture

None of these tools (VaR models, hedges, correlation tracking, liquidity buffers) are perfect on their own.

Markets are too unpredictable for any single method to guarantee safety. But layered together, they form a powerful defense system.

Think of it like flying a plane. Pilots don’t rely on one gauge to stay in the air. They check altitude, speed, fuel, weather, and backup instruments.

Hedge funds do the same with risk. It’s constant monitoring, adjusting, and humility.

Take risk, but understand it and manage it well.

And while the execution can be complex, the underlying lesson is simple enough for anyone:

- size your bets carefully

- protect yourself with insurance

- don’t assume diversification always works, and

- keep enough cash so you’re never trapped

That’s how you stay in the game.

Behavioral and Organizational Risk Management

At the end of the day, risk management is as much about psychology and culture as it is about math.

The smartest hedge funds know this, which is why they don’t just rely on formulas.

They build organizational guardrails that keep egos, blind spots, and emotions from sinking the ship.

Let’s look at three key parts of this behavioral layer of risk management.

Independent Risk Teams

One of the most important safeguards inside a top hedge fund is the separation between traders and risk officers. The people making bets aren’t the same people policing risk.

Why? Because traders are wired to see opportunity.

They believe in their ideas, sometimes fiercely. That conviction is valuable; it’s what makes them pull the trigger on out-of-consensus trades.

But conviction can also morph into overconfidence. If you let the same person monitor risk, human nature kicks in. They’ll justify keeping a position longer than they should. They’ll bend rules to give themselves “one more day.”

Independent risk teams prevent that. They sit in a separate group, often reporting directly to the CIO or even the board.

They have the authority to say, “This position is too big” or “You’ve hit your drawdown limit, cut exposure now.”

In other words, they act as internal checks and balances. Traders push for returns, risk teams push for survival. That tension is healthy.

It’s the financial equivalent of having both an accelerator and a brake in the same car. Without it, you either don’t move, or you crash.

Playbooks and Guardrails

Another way hedge funds protect themselves is by not waiting until a crisis to figure out what to do. They create playbooks and guardrails ahead of time.

Think of it like a fire drill. You don’t want to be figuring out where the exits are when the building is already full of smoke.

Hedge funds run through “what if” scenarios in advance.

What if volatility suddenly doubles? What if the market gaps down 15% overnight? What if liquidity dries up and we can’t sell a major position?

These scenarios aren’t just academic exercises. They result in pre-defined rules.

For example:

- If volatility spikes past a certain level, cut position sizes across the board.

- If a portfolio suffers a 10% drawdown, reduce risk by 50% until stability returns.

- If a tail event occurs (say, a sovereign default), trigger a pre-set hedge or rebalance.

By having these responses codified, funds take emotion out of the equation.

In the heat of a crisis, it’s easy for fear or denial to take over. Playbooks are there so action happens automatically, without second-guessing.

Some funds even run crisis drills where they simulate market shocks and practice executing their rules.

It may sound over the top, but when the real thing hits, those rehearsals make the difference between panic and calm execution.

Culture of Humility and Adaptability

Finally, and maybe most importantly, the best hedge funds cultivate a culture of humility. They know markets have a way of humbling anyone who is highly certain of everything.

Overconfidence is one of the biggest risks in investing. The moment a fund believes “we’ve cracked the code,” it’s usually a bad path to be on.

Markets change. Regimes shift. What worked in the past and today may not work in the future.

To guard against this, top firms embed humility into their culture.

That doesn’t mean they lack conviction; it means they combine conviction with constant self-checks.

They regularly hold post-mortems on trades, asking: Were we right for the right reasons, or just lucky? Did we miss warning signs? Are our assumptions still valid?

This continuous review of assumptions keeps them adaptable.

Bridgewater, for example, is famous for its culture of debate. AQR is equally known for relentlessly questioning whether its factor models still hold up in the current market.

Humility also shows up in position sizing.

Even when a fund has a “high-conviction” idea, it rarely bets a significant portion of the portfolio. They always leave room for being wrong. That mindset (confidence tempered with caution) is what allows them to survive over decades.

The Human Side of Risk

When you step back, all these organizational safeguards (independent risk teams, playbooks, humility) are about protecting against human nature.

Markets tempt us to overreach when things are going well and to freeze when things turn bad. Hedge funds know this, so they design systems that keep them from becoming their own worst enemy.

It’s not about eliminating risk entirely. That’s impossible. It’s about making sure risk is managed in a way that removes ego from the equation, which is often the biggest hidden liability.

What Retail Traders and Investors Can Copy

Hedge funds may operate with billions, armies of analysts, and cutting-edge systems, but the principles they use to manage risk are surprisingly transferable.

You don’t need complex derivatives or a formal background in quantitative finance to apply these ideas.

What you need is discipline, structure, and the willingness to think more like a professional than a gambler.

Here are four areas where everyday investors can borrow directly from the playbook of top hedge funds.

Set Guardrails for Yourself

The most important lesson is to decide how much pain you can take before you start.

Hedge funds use strict rules around drawdowns and exposure, and retail investors should too.

Define your maximum drawdown or the largest loss you are willing to accept before you cut back risk.

For example, you might decide that if your account falls 15% from its high, you will either buy OTM put options to provide a strict boundary or reduce position sizes until you stabilize.

The key is not just to set the rule but to stick to it. That is harder than it sounds. When losses start piling up, the natural instinct is to hope things will turn around.

This is why they write their rules down in advance and treat them as non-negotiable.

Keeping a trading journal can help. Document your rules, your reasons for each trade, and how you will respond to different outcomes.

That way, when emotions run high, you have a written guide reminding you what the rational version of yourself already decided.

Think in Risk Units, Not Dollar Signs

One of the simplest yet most powerful mental shifts you can make is to stop thinking about trades in terms of absolute dollars.

This is called position sizing relative to account size, and it changes everything. If you risk one or two percent per trade, even a string of losses will not wipe you out.

You may feel frustrated, but you will still be in the game. If you size trades emotionally, based on how much you want to make, it is only a matter of time before one bad streak does permanent damage.

Consistency matters more than home runs. A fund that makes steady gains with controlled losses can compound for decades.

An individual who swings for the fences may get lucky once or twice, but eventually, the odds catch up.

If you focus on building reliable, repeatable processes and keeping risks small, the profits will take care of themselves over time.

Diversify Across Strategies, Not Just Stocks

Most retail investors think diversification means owning more stocks, but that is only a small piece of the puzzle.

Hedge funds diversify across independent strategies, not just names. You can borrow that idea, even with a modest portfolio.

Instead of putting everything into one style, combine a few approaches.

For instance, you could hold some trend-following positions that benefit when markets run strongly in one direction. Add some value investments that try to capture long-term fundamentals.

Keep a portion in defensive assets like bonds or gold that may hold up in downturns. And don’t forget cash, which gives you flexibility and the ability to add (or at least do things) when opportunities come up.

The goal is balance. Some strategies will do best in booming markets, others in choppy or even declining ones.

But by blending them, you reduce the risk that all your bets fail at once. This doesn’t require dozens of accounts or complex products.

Even a handful of well-thought-out allocations can mimic the same principle that protects multi-billion-dollar portfolios.

Another part of this is balancing short-term and long-term bets. Hedge funds know that timing is tricky, so they mix positions that may pay off quickly with those designed to compound slowly over years.

Retail investors often go all-in on one timeframe, which makes them vulnerable if that specific environment changes.

Use Simple Hedging

You don’t need exotic instruments to protect yourself.

A few simple things can go a long way. Buying index puts can act like portfolio insurance during a market crash. Setting stop-loss orders on individual positions prevents small losses from snowballing into catastrophic ones.

Holding some uncorrelated assets such as gold, Treasury bonds, or even just cash can buffer the portfolio when equities stumble.

The key is to remember that hedging is about principles, not products.

Hedge funds use swaps, structured notes, and other complex overlays because they operate at a scale that requires it. You don’t need that complexity.

You can achieve the same effect with straightforward products that are easy to understand and execute.

And keep in mind that hedges are not meant to make you money all the time. Just like insurance, you pay a cost for protection.

It might feel frustrating when a hedge drags on returns during calm markets, but when volatility spikes, you will be grateful you had it.

Case Studies / Anecdotes

It is one thing to talk about risk management in theory. It’s another to see how the biggest names in the hedge fund world actually do it.

Each of the top firms has its own style, shaped by the personalities of their founders, the lessons of past crises, and the culture they build around risk.

Let’s look at three well-known examples and what makes them stand out.

Bridgewater’s “All-Weather” Approach

Bridgewater is famous for one of the simplest yet most powerful ideas in investing: build a portfolio that can survive any environment.

Dalio realized decades ago that the future is unknowable.

Instead of trying to predict what will happen, why not prepare for every possibility and spread your risk across it so the portfolio is less biased?

This became the foundation of the All-Weather portfolio.

Bridgewater balances exposures so the fund can handle growth booms, recessions, inflation spikes, or deflationary slowdowns.

Stocks do well when growth is stronger than expectation and inflation is modest. Bonds often shine when growth slows. Commodities and inflation-linked assets protect against rising prices.

The fund is never fully exposed to one outcome when blending the mix together.

Here’s an example allocation:

- 35% stocks (equity index funds)

- 10% inflation-protected securities (e.g., TIPS)

- 10% cash/short-term bonds

- 25% nominal bonds (government and corporate bonds)

- 20% commodities (gold, silver, and other precious metals, along with standard commodities)

It’s the humility behind this approach that’s key.

Many traders and investors believe they can predict the future. Bridgewater designs beta portfolios assuming they can’t.

That mindset (preparing instead of predicting) is a subtle but powerful form of risk management.

Citadel’s Strict Drawdown Rules

Citadel is about discipline and control. Founded by Ken Griffin, Citadel runs like a machine. After barely surviving 2008, it has a relentless focus on preventing losses from spiraling.

One of Citadel’s defining features is its strict drawdown rules. Traders are given clear limits: if their strategy loses beyond a set percentage, they are forced to cut back or stop trading altogether.

There is no negotiation. There are no exceptions. Even if a trader believes passionately that the market will turn, the rule still applies.

This can feel harsh, but it is precisely what keeps the fund alive. Every trader, no matter how talented, will go through bad streaks.

Without guardrails, emotions take over, and people double down to try to win back losses. That is how blow-ups happen. Citadel’s system removes that temptation.

What makes Citadel unique is its culture of accountability. The rules apply equally to everyone, from junior traders to senior portfolio managers. It’s about process. That uniform discipline is one of the reasons Citadel has survived multiple market crashes and come out stronger each time.

AQR’s Factor Diversification

While Bridgewater focuses on macro balance and Citadel on strict discipline, AQR (founded by Cliff Asness and his colleagues) is known for a more scientific and academic-like approach.

AQR believes that returns come from exposure to certain factors, which are persistent patterns in markets.

Examples include value (cheap stocks tend to outperform expensive ones over time), momentum (assets that are going up often keep going up), and quality (companies with strong fundamentals often deliver steadier returns).

AQR’s strategy is to spread across many of these factors, in equities, bonds, commodities, and currencies, to create a broad base of uncorrelated returns.

We recently did an article covering macro momentum, which is an example strategy.

What makes AQR unique is its belief in breadth over boldness. They don’t rely on a single brilliant prediction.

Instead, they diversify across dozens of small edges. Each factor may not work all the time, but the combination smooths out the ride.

It’s the investing version of “don’t put all your eggs in one basket”; not just across assets, but across ideas.

This approach also reflects humility, but in a different way than Bridgewater’s.

Bridgewater admits it can’t know the future, and AQR admits that any single strategy will go through painful stretches.

So, AQR’s approach is to reduce the odds that everything fails at once by diversifying across factors.

The Common Thread

Bridgewater, Citadel, and AQR are very different in style.

One spreads across macro environments, another enforces iron discipline on traders, and the third diversifies across factors.

Yet they all share the same DNA: an obsession with survival and limiting losses.

Each firm has designed a system to protect against the biggest danger in investing: overconfidence.

Whether it is Bridgewater saying “we don’t know,” Citadel saying “rules first,” or AQR saying “no single idea is enough,” the theme is the same.

For individual traders/investors, the lesson isn’t to copy their exact strategies. You don’t need your own All-Weather model, Citadel-style risk committee, or AQR’s factor database.

The takeaway is that the best firms succeed not because they’re always right, but because they design systems that protect them when they’re wrong.

Conclusion

With hedge funds, their real advantage isn’t necessarily secret information and it’s definitely not perfect predictions.

It’s rigorous control of risk.

That is good news, because you can apply the same principles without billions under management.

Define your limits, size positions by risk, diversify intelligently, and protect yourself with simple hedges.

Survival comes first, profits second.

Do that consistently and you’ll discover the edge that keeps hedge funds alive can work for you too.