Factor Investing

Factor investing is a strategy that focuses on selecting securities based on certain characteristics – known as factors – that have been proven to drive investment returns over time.

They exist, and aren’t arbitraged out of market, because they represent a form of risk compensation, not inefficiencies built into markets (which tend to be discovered and fleeting).

This approach helps investors build more efficient and diversified portfolios, ultimately improving risk-adjusted returns.

In this article, we’ll look into the key factors in investing, including value, size, momentum, quality, volatility, yield, and growth.

Key Takeaways – Factor Investing

- Factor investing is a strategy that focuses on selecting securities based on specific characteristics, or factors, that have historically driven investment returns.

- Common factors include value, size, momentum, quality, volatility, yield, and growth. Each offers unique opportunities for enhancing portfolio performance.

- Factor investing can be applied to various asset classes, requires careful factor selection and portfolio construction, and can be combined with other strategies.

Types of Factors

Value

Value investing is the process of selecting undervalued securities that trade below their intrinsic value.

Identifying stocks that are undervalued, we can potentially profit from the market’s eventual recognition of the security’s true value.

The most common valuation metrics include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-cash-flow (P/CF) ratio.

Size

Size, as a factor, refers to the market capitalization of a company, which is calculated by multiplying the total number of outstanding shares by the current market price per share.

Historically, small-cap stocks have outperformed large-cap stocks, offering higher returns but also higher volatility.

This phenomenon is known as the “size effect.”

Size-based investing involves allocating a portion of a portfolio to small-cap or mid-cap stocks to capture this excess return potential.

The size factor has proven less influential since the financial crisis, as large caps have done better for many reasons (e.g., diversification, scale, control of key technologies).

Momentum

Momentum is based on the idea that securities that have performed well in the recent past will continue to do so in the near future.

This factor relies on technical indicators, such as moving averages and relative strength, to identify trends and price movements.

Usually the past 12 months are used, taking out the previous month (to avoid noise).

Momentum strategies can be employed across different asset classes and time horizons, and can be combined with other factors to enhance portfolio performance.

Quality

Quality focuses on companies with strong financial positions, stable earnings, low debt levels, and effective management teams.

These characteristics are believed to contribute to a company’s ability to generate consistent returns and outperform the market over time.

Quality can be assessed using metrics such as return on equity (ROE), return on assets (ROA), and debt-to-equity ratio.

Volatility

Volatility is a measure of the degree of variation in a security’s price over time.

Low-volatility investing is based on the belief that securities with lower price fluctuations will produce higher risk-adjusted returns than more volatile securities.

This factor can be particularly beneficial during periods of market turbulence, as low-volatility stocks often exhibit greater resilience.

Common metrics used to assess volatility include standard deviation and beta.

Yield

Yield is a measure of the income generated by an investment relative to its price.

In the context of factor investing, yield typically refers to dividend yield, which is the annual dividend payment divided by the stock’s price.

High-yield investing focuses on selecting securities with above-average dividend payments, as these investments can provide a steady income stream and potential capital appreciation.

Growth

Growth prioritizes companies with higher-than-average revenue and earnings growth rates.

These firms are expected to deliver superior returns by capitalizing on market opportunities and expanding their businesses.

Growth investors often focus on industries with strong future prospects, such as technology or healthcare.

Common growth metrics include earnings per share (EPS) growth and revenue growth.

Fama-French 3-Factor Model

The Fama-French 3-Factor Model is a widely-used asset pricing model developed by Nobel laureate Eugene Fama and Kenneth French in the early 1990s.

This model extends the Capital Asset Pricing Model (CAPM) by incorporating two additional factors: size and value.

The model is designed to explain the variation in stock returns by considering three factors:

Market Risk (Beta)

Similar to CAPM, the Fama-French model acknowledges that stocks with higher beta, or sensitivity to market movements, should offer higher expected returns to compensate investors for taking on additional risk.

Size (SMB – Small Minus Big)

This factor accounts for the size effect, which suggests that small-cap stocks, on average, outperform large-cap stocks over time.

The SMB factor is calculated by subtracting the return of a portfolio of large-cap stocks from the return of a portfolio of small-cap stocks.

Value (HML – High Minus Low)

This factor captures the value premium, which is the tendency for value stocks (those with low price-to-book ratios) to outperform growth stocks (those with high price-to-book ratios) over time.

HML is calculated by subtracting the return of a portfolio of growth stocks from the return of a portfolio of value stocks.

The Fama-French 3-Factor Model is widely used by academics and practitioners for portfolio analysis, risk management, and performance evaluation.

It serves as the foundation for many multi-factor models that incorporate additional factors, such as momentum and quality.

Factor Statistics

We have a fuller article on factor statistics located here.

But here we’re going to look at correlations, return, and volatility of various factors:

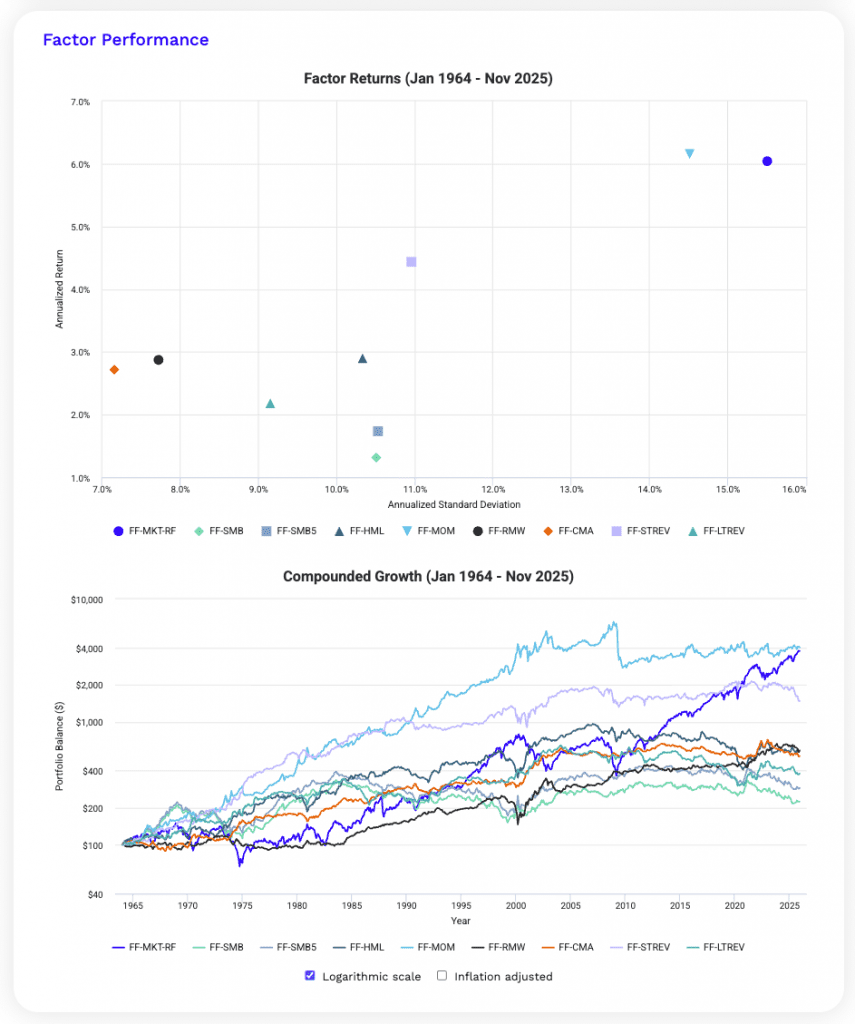

Fama-French Research Factors

| Factor | Key | Rm-Rf | SMB | SMB5 | HML | MOM | RMW | CMA | STREV | LTREV | Annualized Return | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Market | FF-MKT-RF | 1.00 | 0.30 | 0.28 | -0.21 | -0.17 | -0.19 | -0.35 | 0.30 | -0.01 | 6.04% | 15.50% |

| Size (FF3) | FF-SMB | 0.30 | 1.00 | 0.98 | -0.14 | -0.05 | -0.40 | -0.17 | 0.17 | 0.25 | 1.32% | 10.51% |

| Size (FF5) | FF-SMB5 | 0.28 | 0.98 | 1.00 | 0.01 | -0.08 | -0.34 | -0.08 | 0.17 | 0.32 | 1.74% | 10.53% |

| Value | FF-HML | -0.21 | -0.14 | 0.01 | 1.00 | -0.20 | 0.09 | 0.68 | 0.02 | 0.52 | 2.90% | 10.33% |

| Momentum | FF-MOM | -0.17 | -0.05 | -0.08 | -0.20 | 1.00 | 0.08 | -0.01 | -0.30 | -0.09 | 6.15% | 14.51% |

| Profitability | FF-RMW | -0.19 | -0.40 | -0.34 | 0.09 | 0.08 | 1.00 | 0.01 | -0.07 | -0.26 | 2.87% | 7.72% |

| Investment | FF-CMA | -0.35 | -0.17 | -0.08 | 0.68 | -0.01 | 0.01 | 1.00 | -0.13 | 0.51 | 2.72% | 7.17% |

| Short Term Reversal | FF-STREV | 0.30 | 0.17 | 0.17 | 0.02 | -0.30 | -0.07 | -0.13 | 1.00 | 0.10 | 4.44% | 10.96% |

| Long Term Reversal | FF-LTREV | -0.01 | 0.25 | 0.32 | 0.52 | -0.09 | -0.26 | 0.51 | 0.10 | 1.00 | 2.18% | 9.15% |

| Factor correlations and returns statistics from January 1964 to November 2025 | ||||||||||||

The market and momentum factors deliver the highest returns here. Momentum gives strong performance but high volatility.

Value, profitability, and investment provide moderate returns with lower risk and useful diversification (due to low or negative correlations with the market).

Size effects are modest. Reversal factors offer diversification benefits but weaker standalone returns.

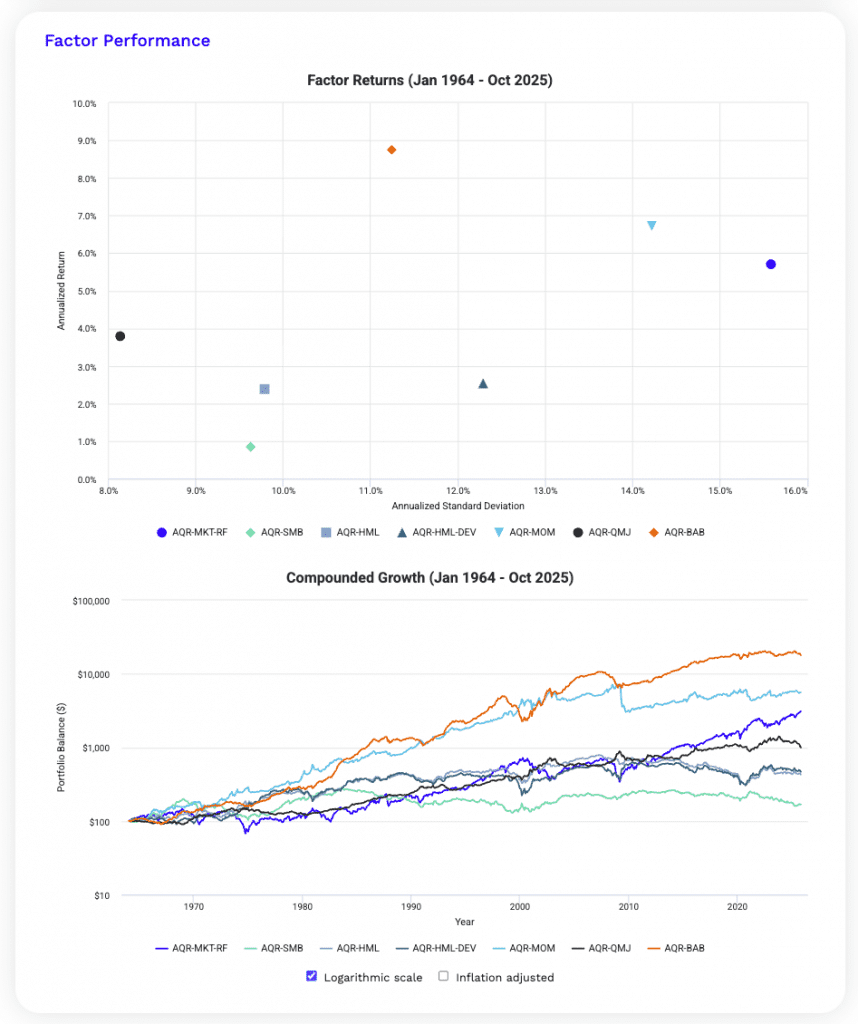

AQR Factors

Factor Correlations

| Factor | Key | Rm-Rf | SMB | HML | HML-DEV | MOM | QMJ | BAB | Annualized Return | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|---|---|

| Market | AQR-MKT-RF | 1.00 | 0.31 | -0.23 | -0.06 | -0.19 | -0.53 | -0.09 | 5.71% | 15.58% |

| Size | AQR-SMB | 0.31 | 1.00 | -0.07 | 0.02 | -0.14 | -0.51 | -0.04 | 0.85% | 9.63% |

| Value | AQR-HML | -0.23 | -0.07 | 1.00 | 0.79 | -0.14 | -0.06 | 0.36 | 2.39% | 9.79% |

| Value | AQR-HML-DEV | -0.06 | 0.02 | 0.79 | 1.00 | -0.64 | -0.23 | 0.12 | 2.53% | 12.29% |

| Momentum | AQR-MOM | -0.19 | -0.14 | -0.14 | -0.64 | 1.00 | 0.31 | 0.21 | 6.73% | 14.22% |

| Quality | AQR-QMJ | -0.53 | -0.51 | -0.06 | -0.23 | 0.31 | 1.00 | 0.20 | 3.79% | 8.14% |

| Bet Against Beta | AQR-BAB | -0.09 | -0.04 | 0.36 | 0.12 | 0.21 | 0.20 | 1.00 | 8.75% | 11.25% |

| Factor correlations and returns statistics from January 1964 to October 2025 | ||||||||||

AQR factors show momentum and bet-against-beta (BAB) as the strongest return drivers. BAB gives the highest risk-adjusted performance.

Quality gives solid returns with low volatility and strong defensive properties, which shows in negative market correlation.

Value and value-deviation are highly correlated but cyclical, while size contributes little in standalone return.

So, overall, diversification benefits come mainly from quality, momentum, and BAB.

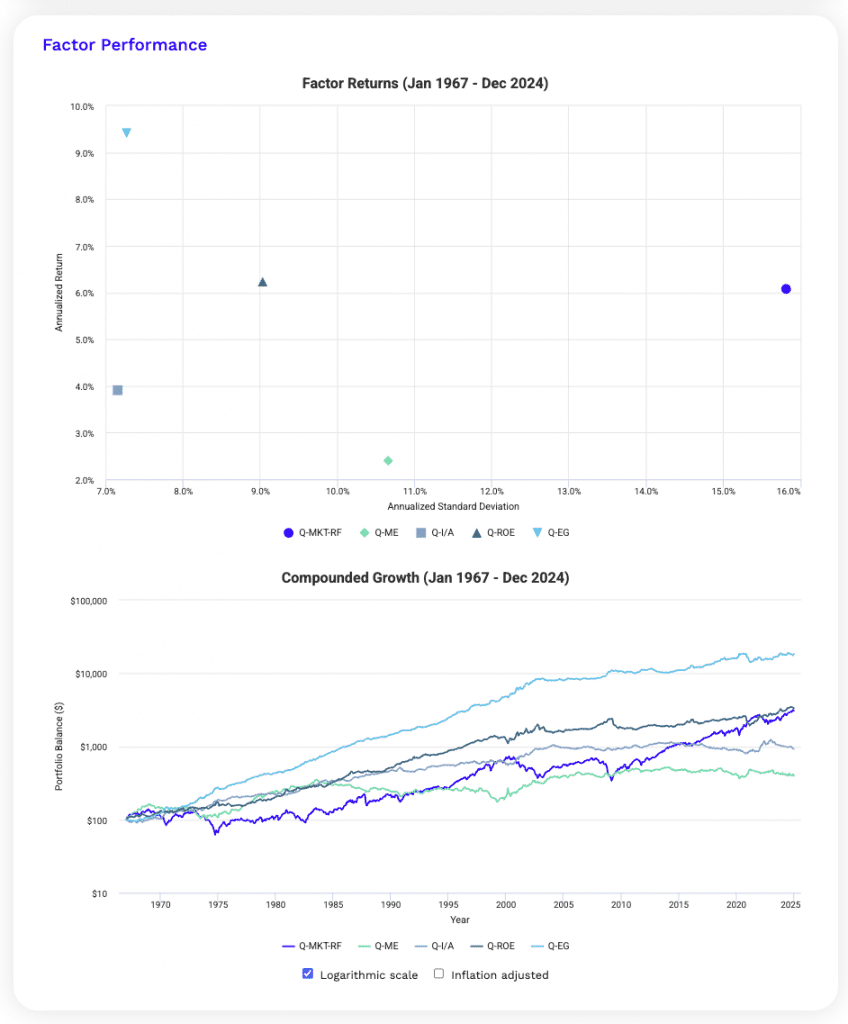

q-Factors

Factor Correlations

| Factor | Key | Rm-Rf | ME | I/A | ROE | EG | Annualized Return | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|

| Market | Q-MKT-RF | 1.00 | 0.28 | -0.35 | -0.22 | -0.43 | 6.08% | 15.82% |

| Size | Q-ME | 0.28 | 1.00 | -0.09 | -0.32 | -0.41 | 2.40% | 10.66% |

| Investment | Q-I/A | -0.35 | -0.09 | 1.00 | 0.05 | 0.18 | 3.92% | 7.15% |

| Return on Equity | Q-ROE | -0.22 | -0.32 | 0.05 | 1.00 | 0.53 | 6.23% | 9.03% |

| Expected Growth | Q-EG | -0.43 | -0.41 | 0.18 | 0.53 | 1.00 | 9.42% | 7.26% |

| Factor correlations and returns statistics from January 1967 to December 2024 | ||||||||

Expected growth and ROE deliver the highest returns with moderate volatility and strong correlation.

Investment offers defensive diversification via negative market exposure.

Size is modest.

Overall, profitability and growth dominate risk-adjusted performance.

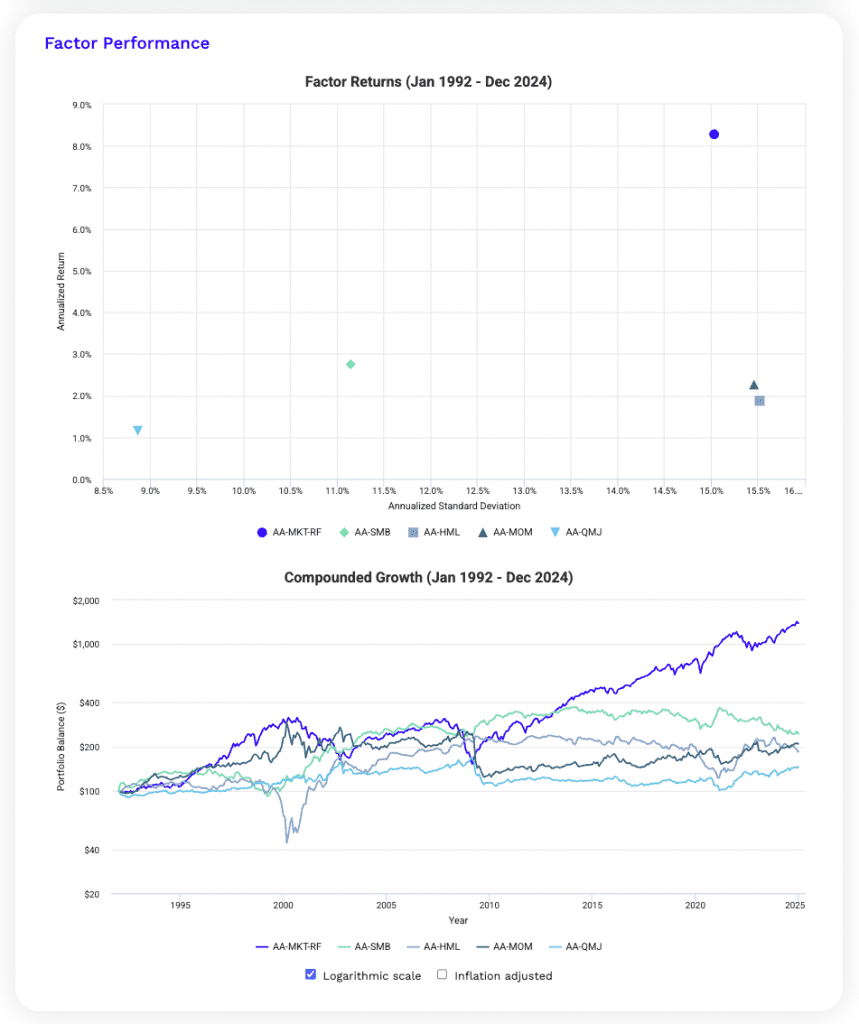

Alpha Architects

Factor Correlations

| Factor | Key | Rm-Rf | SMB | HML | MOM | QMJ | Annualized Return | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|

| Market | AA-MKT-RF | 1.00 | 0.27 | -0.32 | -0.25 | -0.34 | 8.28% | 15.03% |

| Size | AA-SMB | 0.27 | 1.00 | -0.27 | -0.19 | -0.40 | 2.75% | 11.15% |

| Value | AA-HML | -0.32 | -0.27 | 1.00 | -0.30 | 0.12 | 1.87% | 15.52% |

| Momentum | AA-MOM | -0.25 | -0.19 | -0.30 | 1.00 | 0.73 | 2.26% | 15.46% |

| Quality | AA-QMJ | -0.34 | -0.40 | 0.12 | 0.73 | 1.00 | 1.15% | 8.87% |

| Factor correlations and returns statistics from January 1992 to December 2024 | ||||||||

Alpha Architect factors show modest premia outside the market.

Momentum and quality are highly correlated, which limit diversification.

Value and size underperform with higher volatility.

Returns are driven primarily by market exposure.

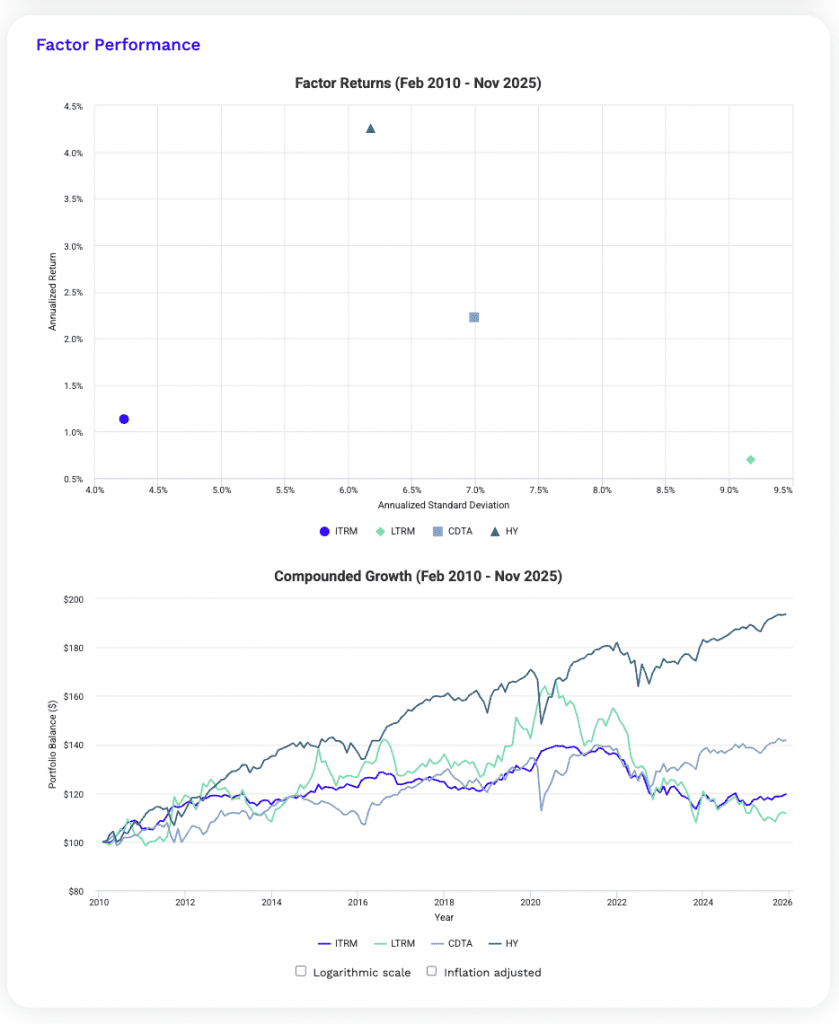

Fixed Income Factors

Factor Correlations

| Factor | Key | ITRM | LTRM | CDT | HY | Annualized Return | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|

| Intermediate Term Rate Risk | ITRM | 1.00 | 0.73 | 0.06 | 0.00 | 1.13% | 4.23% |

| Long Term Rate Risk | LTRM | 0.73 | 1.00 | -0.03 | -0.11 | 0.70% | 9.17% |

| Credit Risk | CDTA | 0.06 | -0.03 | 1.00 | 0.87 | 2.23% | 6.99% |

| High Yield Credit Risk | HY | 0.00 | -0.11 | 0.87 | 1.00 | 4.26% | 6.17% |

| Factor correlations and returns statistics from February 2010 to November 2025 | |||||||

Fixed income returns are driven by credit, especially high yield.

Rate risk offers lower returns and diversification.

How Do Traders and Investors Construct Portfolios Based on Factors?

Constructing a factor-based portfolio involves the following steps:

Identifying Factors

Traders and investors first identify the factors they believe will drive investment returns.

This decision is usually based on historical performance, economic rationale, and empirical research.

Factor Selection

Once the relevant factors are identified, investors select securities that exhibit the desired factor characteristics.

For example, if an investor wants to focus on the value factor, they would select undervalued stocks based on valuation metrics like P/E, P/B, or P/CF ratios.

Portfolio Construction

The next step is to construct a portfolio by allocating a certain percentage of the portfolio to each security or factor.

This can be achieved through equal-weighting, market capitalization-weighting, or risk-based weighting methods.

Diversification

To reduce risk and enhance returns, investors typically diversify their portfolios by combining multiple factors.

For instance, an investor could allocate a portion of their portfolio to value stocks, another portion to small-cap stocks, and another portion to high-quality stocks to get some level of factor diversification within a single asset class.

Risk Management

Managing risk is crucial in factor-based investing.

Investors should regularly monitor and rebalance their portfolios to ensure that factor exposures are maintained at desired levels and that the portfolio’s risk profile remains aligned with the investor’s objectives.

Performance Evaluation

Traders and investors should regularly evaluate the performance of their factor-based portfolios against relevant benchmarks to determine if the selected factors are generating the desired results.

This may lead to adjustments in factor weights or the addition or removal of factors based on their contribution to portfolio performance.

By following these steps, traders and investors can construct a factor-based portfolio that aims to exploit specific return drivers, reduce risk, and ultimately enhance risk-adjusted returns.

FAQs – Factor Investing

What is factor investing?

Factor investing offers a systematic approach to constructing portfolios that capitalize on specific characteristics that have historically driven investment returns.

By understanding and implementing these factors in their investment strategies, traders/investors can enhance portfolio performance and manage risks better.

And each factor has its unique set of risks and benefits, and the most successful trading/investment strategies often combine multiple factors to achieve a well-balanced and diversified portfolio.

What is the main advantage of factor investing?

Factor investing aims to improve risk-adjusted returns by targeting specific characteristics or factors that have historically driven investment returns.

It enables investors to diversify their portfolios and reduce risk by focusing on multiple factors instead of individual stock-picking.

Can factor investing be applied to other asset classes besides stocks?

Yes, factor investing can be applied to various asset classes, including bonds, commodities, and currencies.

The key is to identify the factors that drive returns in each asset class and construct portfolios accordingly.

How can I determine which factors are most relevant to my investment goals?

The selection of factors depends on your investment objectives, risk tolerance, and investment horizon.

Research and historical performance can provide insights into the effectiveness of different factors in various market conditions.

Consulting with a financial advisor can also be important in tailoring an investment strategy to your specific needs based on your goals and risk tolerance..

How often should I rebalance my factor-based portfolio?

The rebalancing frequency depends on the factors and the overall investment strategy.

Some investors may choose to rebalance their portfolios quarterly or annually, while others may opt for a more dynamic approach that adjusts factor exposures based on market conditions.

Regular rebalancing helps maintain desired factor exposures and control portfolio risk.

Can I use factor investing in conjunction with other investment strategies?

Yes, factor investing can be combined with other investment strategies, such as fundamental analysis or technical analysis, to enhance portfolio performance.

Many traders/investors who use it use a multi-strategy approach that blends factor investing with other techniques to achieve a well-diversified and balanced portfolio.

Do factors always outperform the market?

No, factor performance can vary over time and across different market conditions.

Some factors may outperform in certain periods, while others may underperform.

It’s essential to diversify across multiple factors to help reduce the impact of any single factor’s underperformance on the overall portfolio.

How can I implement factor investing in my portfolio without extensive financial knowledge?

One way to implement factor investing without in-depth financial knowledge is through factor-based exchange-traded funds (ETFs) or mutual funds.

These investment vehicles offer diversified exposure to specific factors and can be easily added to your portfolio.

Conclusion

Factor investing is an investment strategy that focuses on selecting securities based on specific characteristics, known as factors, that have historically driven investment returns.

These factors are typically identified through statistical analysis of historical data and are believed to have a persistent effect on stock returns over time.

Some of the most commonly recognized factors:

- Value: Value stocks are those that are considered undervalued by the market relative to their fundamentals, such as earnings, book value, or cash flow. Investors believe that these stocks are priced lower than their intrinsic value and will eventually rise in price, providing long-term returns.

- Size: The size factor suggests that smaller companies tend to outperform larger ones over time. This may be due to smaller companies having more room for growth and being more nimble in adapting to changing market conditions.

- Momentum: Momentum stocks are those that have exhibited strong price trends in the recent past. The momentum factor suggests that these stocks are likely to continue their upward trend for a while, providing good returns for investors.

- Quality: Quality stocks are those that are considered to have strong financial fundamentals, such as high profitability, low debt levels, and stable earnings growth. Investors believe that these stocks are less risky and more likely to provide consistent returns over time.

- Volatility: The volatility factor suggests that stocks with lower volatility tend to outperform those with higher volatility over time. This is because investors are willing to pay a premium for less risky stocks, which can lead to higher returns.

- Yield: The yield factor suggests that stocks with higher dividend yields tend to outperform those with lower yields. This is because dividend-paying stocks are often seen as more stable and less risky than non-dividend-paying stocks, providing long-term returns for investors.

- Growth: Growth stocks are those that are expected to have strong earnings growth in the future. The growth factor suggests that these stocks are likely to provide high returns over time, although they may also be more volatile.

Overall, factor investing is a strategy that involves investing in a diversified portfolio of stocks that exhibit certain characteristics or factors that are believed to provide long-term returns.

Investors can use these factors to construct portfolios that align with their investment goals and risk tolerance.