FP Markets Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Global Forex Value Broker 2023 - Global Forex Awards

- Best Forex Partners Programme Asia 2023 - Global Forex Awards

- Best Forex Broker Europe 2023 - Global Forex Awards

- Best Global Forex Value Broker 2022 - Global Forex Awards

- Best Global Forex Value Broker 2021 - Global Forex Awards

Pros

- FP Markets has a seamless onboarding experience, standing out with crypto deposits and over 10 base currencies, catering to global traders.

- FP Markets offers a superb selection of tradable assets, especially since expanding its suite of commodities and supporting over 10,000 stocks.

- FP Markets delivers fast and dependable support, available 24/5 with average response times of less than 1 minute during testing.

Cons

- Although Traders Hub provides rich research, notably the Daily Report, Technical Report, Market Insights, and Fundamental Analysis, it needs to widen its daily content variety and keep its forex news updated to match category leaders like IG.

- FP Markets’ Iress platform is only available to clients in Australia. It also primarily emphasizes stock trading over forex trading, and data fees can accumulate rapidly unless you're an active trader or maintain a high-balance account.

- While pricing in the Raw account is excellent, spreads in the Standard account trail the cheapest brokers with a 1.1-pip average spread on the EUR/USD compared to the 0.8-pip average at IC Markets.

FP Markets Review

This review of FP Markets evaluates the day trading experience, drawing from firsthand tests and comparisons with suitable alternatives from our extensive database of over 500 online brokers.

Regulation & Trust

FP Markets is trusted. It’s well-established and is authorized by two ‘green-tier’ regulators:

- First Prudential Markets Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC)

- First Prudential Markets Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC)

Additionally, segregated accounts are used to separate clients’ funds from the broker’s operational capital, ensuring that trader funds remain protected even in the event of the broker’s insolvency.

On the downside, FP Markets does not offer negative balance protection to clients under ASIC and the FSA in St Vincent and the Grenadines, whereas it does provide this feature under CySEC. This means you could lose more than your account balance if you day trade through these entities.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, CySEC, FSA, CMA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

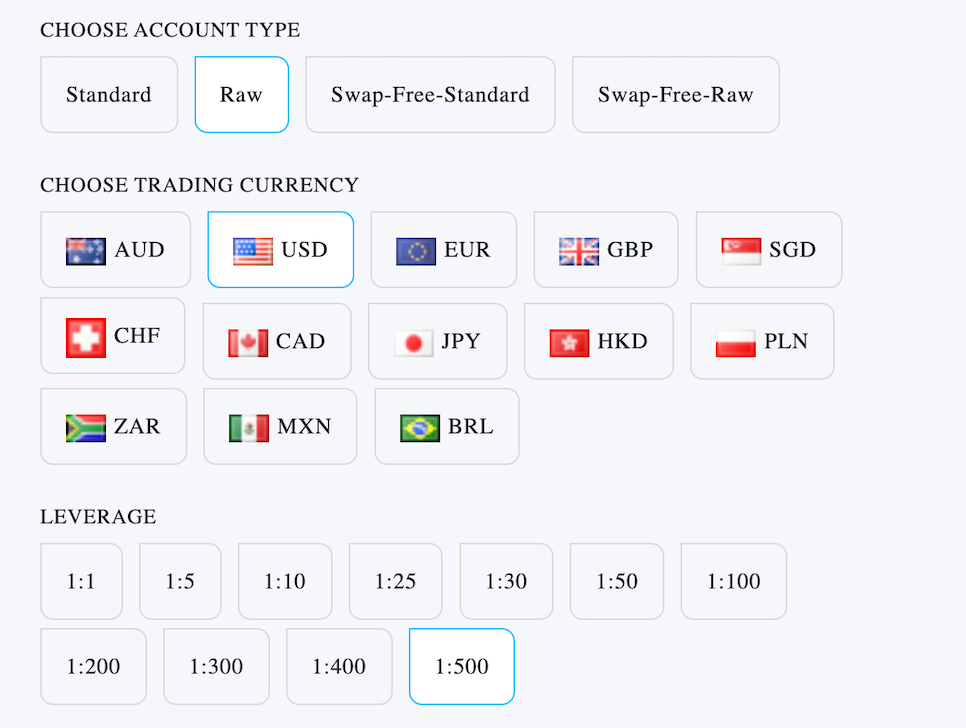

FP Markets offers an excellent selection of live accounts, catering to traders at at levels. There is Standard and Raw, plus an Islamic swap-free solution, as well as PAMM/MAM trading accounts.

The Standard and Raw accounts feature a minimum trade size of 0.01 lots, rapid order execution, and the option for VPS (Virtual Private Server) access. They also offer a maximum leverage of 1:500, which can be altered manually all the way down to 1:1 from within your account page.

Additionally, they feature a modest minimum deposit requirement of $40, which is relatively low compared to brokers like IC Markets which require $200.

The primary distinction between the Standard and Raw accounts lies in their spreads and commission fees. The Standard account is commission-free but offers spreads from 1 pip, whereas the Raw account incurs a charge of $3 per lot per trade, but offers spreads from 0 pips. The Raw account is therefore best suited to active day traders and scalpers looking to make profits from small price movements.

FP Markets utilizes a combination of order-routing methods. Forex products are traded through ECN (Electronic Communication Network), while CFD products employ DMA (Direct Market Access) channels. DMA CFDs offer advantages like reduced spreads and swifter execution, as orders are transmitted directly to the underlying market without intermediaries such as dealers or market makers.

Setting up and funding a live trading account with FP Markets is not only straightforward but also incredibly swift.

Demo Accounts

FP Markets offers a demo account seamlessly through the MT4 and MT5 platforms.

What’s great is that the demo account functions exactly like live accounts. I could place orders, explore various strategies, and test the waters without risking real money.

However, keep in mind that orders made in demo mode aren’t executed in the live market, potentially giving you quicker execution times for your trades.

One thing that’s particularly beneficial is the absence of time constraints on the demo account. This means you can take your time learning without feeling rushed.

However, it’s important to note that if your FP Markets demo account remains inactive for more than 30 days, it will expire.

Deposits & Withdrawals

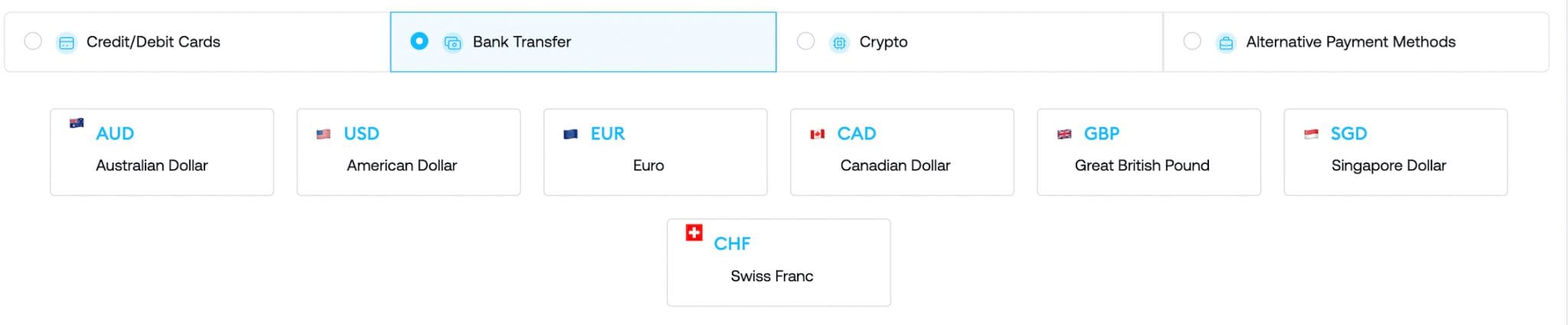

From traditional bank transfers to credit and debit cards and a variety of e-wallet options, FP Markets ensures that funding your trading account is hassle-free.

While it’s disappointing that FP Markets doesn’t support PayPal, they make up for it by offering the option to fund your account with cryptocurrencies such as USDT, BTC, ETH, and LTC. This unique feature sets FP Markets apart from the majority of other brokers that don’t offer crypto funding.

What’s more, they offer accounts in 10 different currencies, including EUR, GBP, USD, AUD, CAD, SGD, HKD, JPY, NZD, and CHF, catering to a diverse global audience seeking alternatives to the standard USD or EUR-denominated accounts.

FP Markets doesn’t impose deposit fees, but it’s worth noting that banking charges may apply. However, for deposits exceeding $10,000, FP Markets will reimburse any third-party bank charges.

When it comes to withdrawals, FP Markets provides a seamless experience. While options like Apple Pay and Google Pay aren’t available, withdrawals are typically processed using the same method as the initial deposit. Once the entire deposit amount has been withdrawn, alternative withdrawal methods can be utilized for any remaining funds.

It’s worth mentioning that while FP Markets itself doesn’t charge any withdrawal fees, there may be third-party charges involved. However, in my experience, withdrawals are processed swiftly, typically within 1-2 working days.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Dragonpay, FasaPay, Finrax, Google Pay, Mastercard, Neteller, Perfect Money, Rapid Transfer, Skrill, Sticpay, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $40 | $100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

FP Markets offers a superb selection of assets for short-term trading, especially since expanding its suite of commodities, now offering over 70 ranging from precious metals like gold and silver to energy resources such as oil and natural gas.

In forex, FP Markets offers more than 70 currency pairs, including major, minor, and exotic options, far surpassing most alternatives.

For cryptocurrency enthusiasts like myself, FP Markets allows engagement with popular digital assets like Bitcoin, Ethereum, Ripple, and more. Additionally, you can trade a variety of stock CFDs, although options like mutual funds and futures are notably absent.

However, the availability of instruments varies depending on the platform used. For example, while the MetaTrader platform provides access to approximately 130 tradeable symbols, the Iress platform caters to global clients with over 10,000 shares, 70+ forex pairs, four metals, 12 indices, five cryptocurrencies, and three commodities.

It’s unfortunate that FP Markets doesn’t offer any passive income options, such as earning interest on unused account balances, unlike competitors like eToro and XTB, which offer up to 5.3% and 5.2% respectively on cash balances.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (UK), 1:500 (Global) | 1:200 | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

FP Markets provides exceptionally competitive pricing, positioning it as one of the most cost-effective brokers worldwide, particularly for its commission-based ECN account option.

Trading fees differ depending on the type of account you opt for. The Raw account features direct market pricing, with spreads starting from 0 pips, accompanied by a $3 commission fee per side.

Conversely, the Standard account operates on a commission-free model, offering floating spreads starting from 1 pip.

In practical terms, I encountered GBP/USD spreads at 1.9 pips on the Standard account compared to 0.8 pips on the Raw account.

Similarly, Gold spreads were observed at 0.18 pips on the Standard account versus 0.08 pips on the Raw account.

FP Markets deactivates inactive accounts after three months. However, unlike other brokers including IG – who impose an inactivity fee ($15 per month) – FP Markets does not levy any such fee, and dormant profiles can be reactivated at any time.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.64 | 100 | 0.005% (£1 Min) |

| Oil Spread | 0.04 | 0.1 | 0.25-0.85 |

| Stock Spread | Variable | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

With five trading platforms to choose from – MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and Iress (exclusive to Australian clients) – each platform offers a unique set of features and customization capabilities tailored to traders’ needs.

What I appreciate about FP Markets is that each platform is easily accessible, whether on desktop or mobile devices or through a web browser.

MT4 is a popular choice thanks to its comprehensive features. From custom alerts to one-click trading and a plethora of analytical tools, MT4 offers a robust trading experience.

MT5, on the other hand, offers more advanced features such as additional timeframes and support for trading in stocks and futures markets. Its improved strategy tester and the ability to hedge and net positions within the same account make it suitable for a broader range of financial instruments.

While FP Markets doesn’t support cTrader’s excellent copy social trading platform – which I find disappointing – it compensates with its own Copy Trading tool available on MT4 and MT5 terminals. This tool simplifies the process of identifying profitable opportunities and exploring new instruments.

One feature I particularly appreciate across all platforms is the ability to maintain control with a simple click. Whether halting trading at any time or utilizing risk management parameters like take profits and stop losses, FP Markets ensures day traders have the tools they need to manage their trades effectively.

I’m also excited to see FP Markets has expanded its platform selection by incorporating trading directly from within TradingView, a fantastic charting solution and social trading network.

Its effortless design and extensive array of indicators make it an outstanding choice for traders seeking a contemporary alternative to traditional platforms.

Lastly, for Australian clients, the Iress trading suite offers a comprehensive platform with Direct Market Access (DMA) functionality, providing lower spreads and faster execution by transmitting orders directly to the underlying market.

It’s a testament to FP Markets’ commitment to offering diverse and advanced trading solutions to its clients.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile App | iOS & Android | iOS | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

FP Markets houses most of their own research materials in the Traders Hub section of their website, categorized into technical and fundamental analysis.

However, in comparison to leading brokers like IG and Saxo, FP Markets has room for improvement in its research offerings and could benefit from expanding its daily content variety.

Currently, FP Markets provides daily written articles and video content on its official YouTube channel, with market headlines sourced from reputable institutions such as Citibank, Rabobank, and Reuters streaming within the MetaTrader platforms.

The research section includes a Daily Report, Technical Report, weekly Market Insights outlook, and a Fundamental Analysis section featuring daily articles on global markets. I was disappointed to see a lack of updated content within the Forex News section.

Third-party research is provided by Trading Central and Autochartist charting services which aim to pinpoint trading opportunities by continuously monitoring financial markets around the clock, delivering real-time alerts for both opportunities and risks. Both tools can be accessed directly via the client portal for ease of use, or via supported trading platforms such as MetaTrader and cTrader.

Trading Central, however, is a more comprehensive research platform that extends its range of analytical tools to include an Economic Calendar, Market Buzz, and Crowd Insight.

By sifting through numerous data sources, Trading Central lets you customize information according to your preferences and trading objectives. This data can aid in identifying optimal entry and exit points, devising trade scenarios, and validating short-term strategies using indicators.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

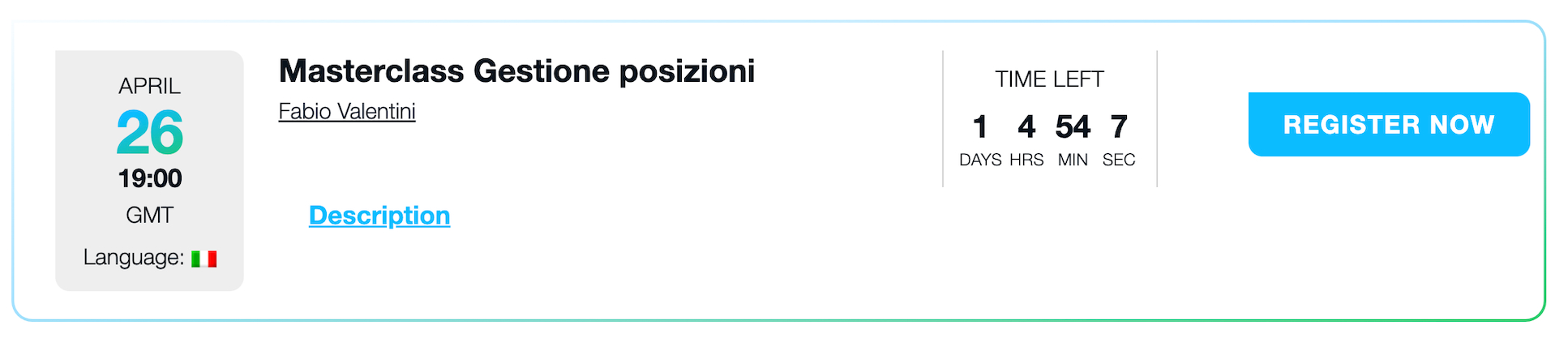

FP Markets is clearly commited to supporting beginner traders. From video tutorials and webinars to articles, podcasts, and trading guides, the broker offers a comprehensive range of learning materials.

I’ve personally found their active YouTube channel to be particularly valuable in supplementing my understanding of trading concepts.

These resources cover a wide array of topics, including trading strategies, technical analysis, risk management, and market analysis, catering to newcomers and helping them grasp the essentials of trading while refining their skills.

Yet while the trading courses are categorized by experience level, I’ve noticed that the advanced section is somewhat lacking, comprising only three video courses. However, other sections of the site offer progress-tracking and quizzes, enhancing the learning experience.

Expanding the range and depth of educational materials, along with improving these aspects, would position FP Markets more competitively against industry leaders like Admiral Markets and IG.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

FP Markets offers 24/5 customer support, available through various communication channels including phone, email, live chat, and social media.

I’ve had the opportunity to engage with FP Markets’ live chat support, and I must say I’ve been impressed by their swift response time, averaging under one minute.

Despite occasional language barriers resulting in broken English responses, all my inquiries have been promptly addressed.

For general questions and concerns, the FAQ section also proves to be a valuable resource, providing comprehensive information on various topics such as account closure procedures, margin requirements (including stop-out levels and margin calls), withdrawal policies, and tutorials on creating a demo login.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With FP Markets?

FP Markets emerges as a top choice for traders of any expertise level. Their impressive array of trading platforms, coupled with a wide range of tradable assets and competitive fee structure, sets the broker apart in the market.

What really impresses me is the broker’s commitment to trader education. They offer innovative tools like comparative analysis and trend exploration, which greatly enhance the trading experience.

Additionally, their responsive customer support and flexible, secure deposit and withdrawal options add to the overall appeal of FP Markets.

FAQ

Is FP Markets Legit Or A Scam?

We gave FP Markets an average to high Regulation & Trust Rating. This is because it’s got nearly 20 years in the industry and is authorized by two ‘green tier’ regulators in our classification system:

- First Prudential Markets Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC)

- First Prudential Markets Pty Ltd is regulated by the Australian Securities & Investments Commission (ASIC)

Just keep in mind that if you trade through its offshore entity, which is registered with the FSA in St Vincent and the Grenadines you won’t receive negative balance protection, so you could lose more than your balance.

Is FP Markets A Regulated Broker?

FP Markets is a regulated broker. They are authorized and regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) of St. Vincent and the Grenadines.

These regulatory authorities oversee the operations of FP Markets to ensure compliance with financial regulations and the protection of investors’ interests.

Is FP Markets Suitable For Beginners?

FP Markets is suitable for beginners due to its excellent educational resources, demo accounts for practice, responsive and helpful live chat staff, and support for a variety of trading platforms including the most user-friendly option based during testing – TradingView.

On the downside, there is no proprietary application that can further help to simplify trading.

Does FP Markets Offer Low Fees?

FP Markets offers competitive fees compared to many other brokerage firms, with relatively low spreads and commissions, especially for certain asset classes like forex.

However, the specific fees can vary depending on the trading account type and the financial instruments being traded, so review the fee structure carefully before engaging in trading.

Is FP Markets A Good Broker For Day Trading?

FP Markets is an excellent broker for day trading due to its fast execution speeds, access to a wide range of markets, and choice of advanced charting platforms including MetaTrader, cTrader and TradingView.

The broker’s competitive pricing and algo trading support through Expert Advisors and VPS hosting will also benefit day traders.

Best Alternatives to FP Markets

Compare FP Markets with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

FP Markets Comparison Table

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 4 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $40 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | ASIC, CySEC, FSA, CMA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | 100% Anniversary Bonus | – |

| Platforms | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:30 (UK), 1:500 (Global) | 1:200 | 1:50 |

| Payment Methods | 16 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by FP Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FP Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | No |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | Yes | No |

FP Markets vs Other Brokers

Compare FP Markets with any other broker by selecting the other broker below.

The most popular FP Markets comparisons:

- FP Markets vs IC Markets

- Oanda vs FP Markets

- ActivTrades vs FP Markets

- Exness vs FP Markets

- Fusion Markets vs FP Markets

- FP Markets vs IG

Customer Reviews

4 / 5This average customer rating is based on 1 FP Markets customer reviews submitted by our visitors.

If you have traded with FP Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FP Markets

Article Sources

- FP Markets Website

- First Prudential Markets Ltd - CySEC License

- First Prudential Markets Pty Ltd - ASIC License

- FP Markets LLC - FSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’ve used FP Markets for years and placed lord knows how many day trades. For trading metal CFDs they’re a solid firm – tight spreads, fast execution, really strong software. They were beginning to feel a bit outdated in the back-end but I’m much happier now they’ve revamped their client portal to bring it into the 21st century. What I like about FP over many other brokers is that you can deposit and withdraw in BTC.