ForexTB Review 2024

Awards

- Best Crypto CFDs Trading Platform Global 2022 - World Business Outlook

- Fastest Growing CFD Broker in Europe 2020 - Global Brands Magazine

Pros

- ForexTB is authorized by the CySEC in Europe, a trusted regulator, though it reached a €270k settlement in 2022 for possible violations.

- Analytics from Trading Central is included, which offers additional technical tools, analytical reviews, fundamental news, and access to primary sources of information, helping to inform trading decisions.

- The proprietary platform is simple by design but offers essential features with optimal charting tools, plus a limited version is accessible prior to registration.

Cons

- ForexTB offers wider spreads than many competitors, notably low-cost brokers like IC Markets, especially if you opt for the Basic account.

- FXTB imposes a €20 inactivity fee after just one month, deterring casual traders, while only VIP account holders get unlimited free withdrawals.

- The educational guides lack practical examples, charting analysis and interactive elements, making them of limited use for newcomers, especially compared to category leaders like IG.

ForexTB Review

This ForexTB review critically evaluates the broker’s day trading environment following firsthand tests and comparisons with our 500-strong database of online brokers.

Regulation & Trust

3 / 5ForexTB holds a license from the Cyprus Securities & Exchange Commission (CySEC), a ‘green-tier’ regulator, ensuring compliance with the European MiFID directive.

ForexTB also emphasizes transparency through an extensive legal section on its website, offering traders segregated funds, negative balance protection, and coverage from the Investor Compensation Fund up to €20,000.

However, traders outside of Europe won’t receive protection through a trusted regulator. It also reached a €270,000 settlement in 2022 with the CySEC for possible violations of the 2017 Investment Services Law.

Ultimately, ForexTB lacks the industry standing of the safest brokers.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

2 / 5Trading Accounts

FXTB offers four accounts tailored for retail clients:

- Basic – requires a minimum deposit of €250 with typical spreads of 3.0 pip on EUR/USD.

- Gold – requires a substantially larger deposit of €25,000, but offers narrower spreads of 2.7 pips on EUR/USD.

- Platinum – requires a hefty €100,000 minimum deposit, but rewards users with reduced EUR/USD spreads of 2.1 pips.

- VIP – requires a staggering €250,000 minimum deposit, but offers even tighter spreads of 1.6 pips on the EUR/USD.

While on the surface these accounts cater to various budgets, they don’t surpass many rivals. Competitors like Eightcap and IC Markets boast narrower spreads with minimum deposits as low as €100. Ultimately, FTXB’s tighter spreads do not justify the significant deposit requirements.

The account opening process is fairly typical – you need to complete an online application form and submit personal identification, proof of residence, and details of your trading experience.

Before committing any real funds, I took advantage of ForexTB’s demo account, a feature they offer across their platforms.

With access to a generous €100,000 in virtual funds, I could truly put the platforms through their paces under authentic market conditions.

Deposits & Withdrawals

ForexTB offers a diverse range of funding and withdrawal options, including payment cards, e-wallets, and bank wire transfers, catering to multiple currencies such as USD, GBP, JPY, EUR, and RUB.

However, ForexTB doesn’t support funding with cryptocurrencies, distinguishing it from competitors like SimpleFX.

Deposits are free of charge and usually processed the same day, although frequent withdrawals could incur costs, as each account type entitles users to a set number of free withdrawals before charges are applied.

Basic and Gold accounts grant one free monthly withdrawal, while Platinum accounts extend to three, and VIP accounts enjoy unlimited free withdrawals. This limitation may pose challenges for individuals who prefer greater flexibility and control over their funds.

Withdrawal requests are typically processed within 24 business hours, with credit cards and e-wallets requiring a minimum withdrawal of €80.

That said, I encountered instances where delays arose due to incorrect documentation during withdrawal requests, highlighting the importance of attention to detail in such transactions.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Credit Card, Debit Card, Giropay, iDeal, Mastercard, Neteller, PayPal, Przelewy24, Skrill, Sofort, Venmo, Visa, Wire Transfer | Credit Card, Debit Card, Mastercard, PayPal, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $250 | $0 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3 / 5ForexTB offers over 300 financial assets, including 45 currency pairs, major corporation stocks, commodities such as precious metals, energies, and agricultural products, along with stock indices and cryptocurrencies. However, there are no ETFs, options, or bonds.

The range of CFDs at FXTB will probably be fine for beginner traders with EUR/USD and GBP/USD currency pairs, plus commodities including gold, silver and crude oil.

However, the overall number of instruments is severely restrictive compared to category leaders like Blackbull Markets or IG, who offer a more complete environment for advanced traders with thousands of assets.

The margin call/stop out is 50% for all retail clients.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Indices, Stocks, Commodities, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (Retail), 1:400 (Professional) | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

2.5 / 5ForexTB generates revenue from spreads that vary depending on the account type and the specific instrument being traded. Yet they seriously trail the cheapest brokers, especially in the Basic account which will be the only affordable option for many retail traders.

There are also additional fees. These include withdrawal fees once the monthly allowance has been exhausted and the possibility of encountering charges when withdrawing funds to an e-wallet. Overnight fees also apply, though day traders can avoid these by closing positions by the end of the trading session.

Additionally, there is an inactivity fee, set at €20 per month after just one month of no trading activity. This is one of the shortest periods of inactivity to incur a penalty that we’ve seen. This fee is also high compared to brokers like XTB, which imposes a €10 fee after 12 months of inactivity.

Finally, while ForexTB provides comprehensive information on fees in their ‘General Fees’ documentation, available in the ‘Legal’ section of their website, we learned that charges can change, sometimes with little notice. Therefore, it’s crucial to remain vigilant, as there may be additional fees that apply to individual circumstances.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | From 1.6 | 0.8 | 0.08-0.20 bps x trade value |

| FTSE Spread | 425 | 1.0 | 0.005% (£1 Min) |

| Oil Spread | 10 | 2.8 | 0.25-0.85 |

| Stock Spread | Variable | 0.02 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

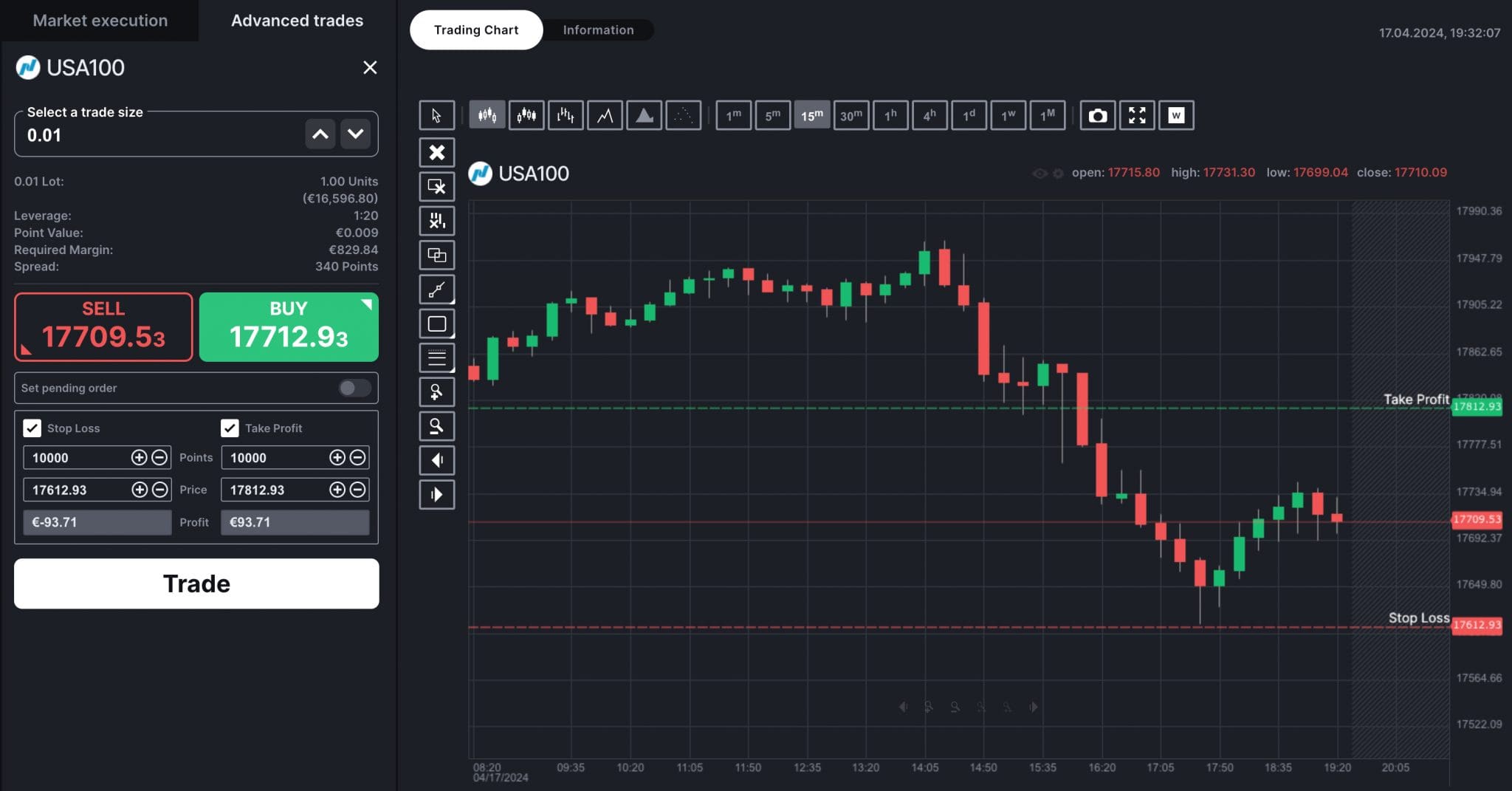

3 / 5WebTrader

There are two platform options available to traders. The first is ForexTB’s proprietary web-based system, aptly named WebTrader, developed in-house for seamless accessibility directly from the FXTB website.

This eliminates the need for any software downloads and presents a clean interface and intuitive navigation.

While using the WebTrader platform, I’ve found it to be relatively basic compared to similar offerings from other brokers. However, it does boast some useful features such as one-click trading, six chart types, and a variety of indicators.

I also appreciate the ability to overlay multiple graphing tools for market sentiment analysis and the option to switch between light and dark modes.

Overall, I’ve found WebTrader to be a user-friendly platform that simplifies the trading process, particularly for newcomers to the market.

MetaTrader 4

ForexTB also supports the widely recognized MetaTrader 4 (MT4) platform, which caters to more experienced traders seeking a comprehensive and data-rich environment.

With access to over 2,000 technical indicators and 24 chart analysis tools, along with complete trading and asset histories, MT4 provides a customizable interface tailored to advanced traders.

The platform also supports automated trading and allows for seamless switching between nine timeframes while enabling you to open an unlimited number of charts.

However, I noted some limitations during testing. Unlike competitors such as Hantec Markets, FXTB does not offer support for MT4’s Multi-Account Manager (MAM) feature, which simplifies the management of multiple accounts from a single interface.

Additionally, ForexTB does not support MetaTrader 5, nor does it facilitate day trading directly from increasingly popular platforms like cTrader and TradingView.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | WebTrader, MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

3 / 5ForexTB’s research offerings are lacking compared to industry leaders such as IG. In particular, there is a shortage of depth, breadth, and consistency in the available resources.

That said, ForexTB integrates with Trading Central, a reputable third-party provider renowned for its robust technical analysis-based trading ideas, particularly suited for short-term strategies.

One notable feature accessible to all live account holders is the ‘Market Buzz’ news feed, powered by Trading Central. This feed provides valuable analytics and sentiment indicators, enhancing the trading experience.

I particularly appreciate the ability to input specific symbols or names into the search box, allowing for the isolation of news related to particular assets, which has proven convenient for tracking indices or currency pairs.

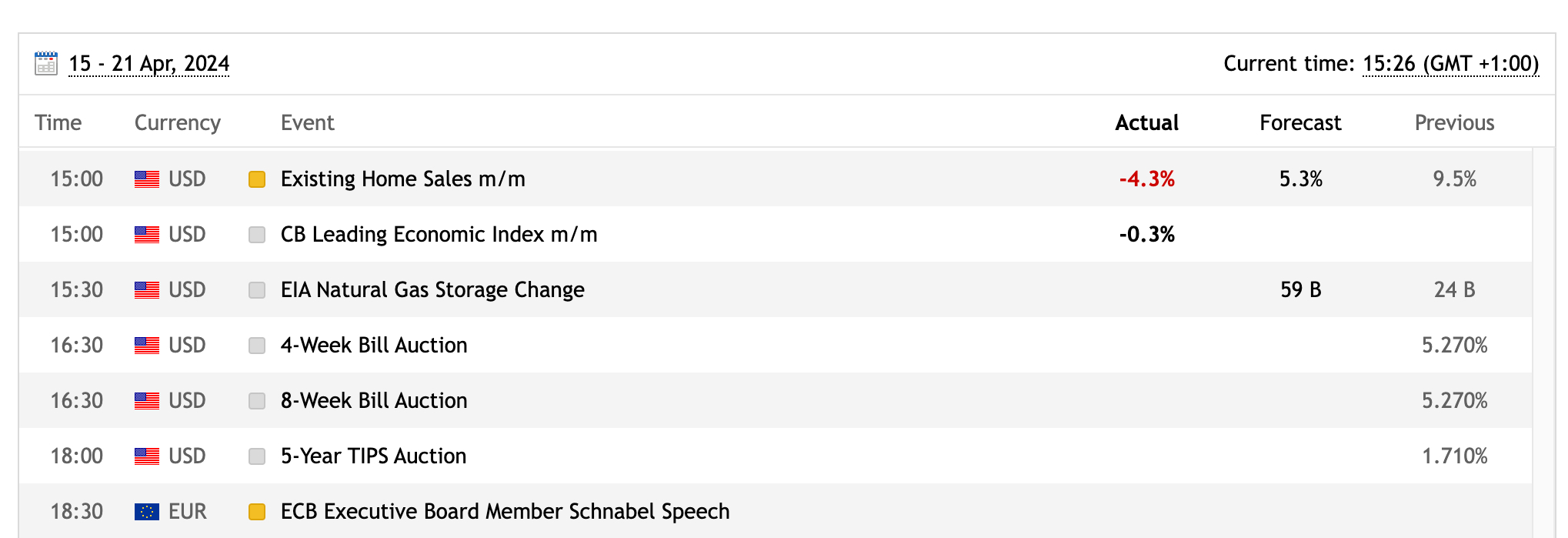

ForexTB offers additional resources such as daily signals and market news, courtesy of Trading Central, along with an economic calendar and an asset calculation tool.

The asset calculation tool is also a nice touch for beginners, simplifying tasks such as finding spreads, swaps, trade sizes, and fees with just a few clicks.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

2.5 / 5The educational resources are basic, especially compared to brokers like eToro which excel in providing exemplary educational resources that cater to aspiring traders.

The education section on the website is divided into two main sections: ‘Education’ and ‘CFD’. The written content is somewhat superficial, lacking practical examples with charts to illustrate concepts effectively.

The content covers fundamental topics such as introducing CFDs, stocks, indices, technical and fundamental analysis, and leverage. Additionally, there is a glossary of terms available, along with a link to live webinars.

However, I noted that there are no past or future events listed, which limits the availability of live learning opportunities. And while there are a few trading e-books accessible on the site, registration as a client is required to view them, which could be a deterrent for some users.

ForexTB could significantly improve its educational content by providing more in-depth and practical resources suitable for traders of all levels.

This could include comprehensive tutorials, case studies, interactive quizzes, and practical trading exercises to enhance learning outcomes.

Offering regular webinars and live trading sessions facilitated by experienced traders would also provide valuable real-time insights and support for those seeking to improve their skills.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

2 / 5ForexTB’s customer support is disappointing. The broker adopts a barebones approach, offering only phone and email – there’s a notable absence of live chat or social media options.

While the website does feature an FAQ section and educational resources, I’ve found that these are no substitute for the responsive human interaction that many day traders seek when encountering urgent issues.

If you want support you can depend on, especially for urgent trading queries, Plus500 is a stand-out alternative. It offers 24/7, reliable assistance via live chat, WhatsApp, email and popular social media platforms.

| ForexTB | IG | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With ForexTB?

ForexTB is a mediocre broker, lacking standout features that distinguish it from competitors.

Notably, the company maintains relatively high spreads, which can undermine the effectiveness of short-term strategies like scalping and day trading.

Additionally, withdrawal fees, subpar support, basic education and research, plus high minimum deposit requirements, lower its appeal.

Ultimately, there are superior alternatives available, particularly for day traders based outside the EU seeking lower costs.

FAQ

Is ForexTB Legit Or A Scam?

ForexTB is regulated and operates in compliance with the European directive MiFID II, so it should adhere to regulatory standards to ensure honesty, transparency, and personal data protection for all clients.

Is ForexTB A Regulated Broker?

ForexTB is regulated in the European Economic Area (EEA) by the Cyprus Securities and Exchange Commission (CySEC).

Is ForexTB Suitable For Beginners?

ForexTB is an average choice for beginners. Despite a user-friendly platform, free demo account and third-party research tools, the basic educational resources are a huge disadvantage for novice traders, while an inactivity fee kicks in after just one month.

Does ForexTB Offer Low Fees?

ForexTB does not compete with the cheapest brokers. The tightest spreads are reserved for those that deposit substantial sums for premium accounts, while the Basic account features above-average spreads on popular asset classes, including currencies and commodities.

Is ForexTB A Good Broker For Day Trading?

ForexTB is an average broker for day trading. Their platforms, MT4 and the proprietary WebTrader, provide the necessary tools for day traders to analyze the markets. However, high fees and unreliable support make it less suitable for fast-paced day trading strategies.

Top 3 Alternatives to ForexTB

Compare ForexTB with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

ForexTB Comparison Table

| ForexTB | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Indices, Stocks, Commodities, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | WebTrader, MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Retail), 1:400 (Professional) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 13 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by ForexTB and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ForexTB | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

ForexTB vs Other Brokers

Compare ForexTB with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of ForexTB yet, will you be the first to help fellow traders decide if they should trade with ForexTB or not?