Best Forex Trading Platforms In Canada 2026

Jump into our selection of the best forex trading platforms in Canada. We’ve tested every broker to ensure they offer currency pairs of interest to Canadian traders like USD/CAD and that they are regulated by the Canadian Investment Regulatory Organization (CIRO) for a secure trading experience.

Top 6 Forex Trading Platforms In Canada

After evaluating hundreds of brokers, these 6 emerged as superior options for forex traders in Canada:

-

1

FXCC

FXCC -

2

IC Markets

IC Markets -

3

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

4

Fusion Markets

Fusion Markets -

5

AvaTrade

AvaTrade -

6

FOREX.com

FOREX.com

Here is a short summary of why we think each broker belongs in this top list:

- FXCC - FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

- Fusion Markets - Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

Best Forex Trading Platforms In Canada 2026 Comparison

| Broker | CIRO Regulated | CAD Account | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit |

|---|---|---|---|---|---|---|

| FXCC | - | - | 70+ | 0.2 | / 5 | $0 |

| IC Markets | - | ✔ | 75 | 0.02 | / 5 | $200 |

| Eightcap | - | ✔ | 50+ | 0.0 | / 5 | $100 |

| Fusion Markets | - | ✔ | 90+ | 0.05 | / 5 | $0 |

| AvaTrade | ✔ | ✔ | 50+ | 0.9 | / 5 | $300 |

| FOREX.com | ✔ | ✔ | 84 | 1.2 | / 5 | $100 |

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| GBPUSD Spread | 1.0 |

|---|---|

| EURUSD Spread | 0.2 |

| EURGBP Spread | 0.5 |

| Total Assets | 70+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP |

Pros

- Competitive and transparent ECN spreads from 0.0 pips with zero commissions, making FXCC one of the cheapest forex brokers

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

- FXCC has added MT5, and in our hands-on tests, it matched MT4’s trading conditions with fast execution, enhanced charting, and depth of market tools.

Cons

- Although the MetaTrader suite continue to shine for technical analysis, the subpar design dampens the trading experience, especially compared to modern alternatives like TradingView

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- While the range of currency pairs exceeds most alternatives, the selection of additional assets is narrow, and notably, there are no stocks

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| GBPUSD Spread | 0.13 |

|---|---|

| EURUSD Spread | 0.05 |

| EURGBP Spread | 0.09 |

| Total Assets | 90+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:50 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

How Did DayTrading.com Choose The Best Forex Brokers?

To find the top FX platforms in Canada, we used our directory of 140 brokers and followed this process:

- We focused on brokers offering trading on currencies like the Canadian Dollar (CAD).

- We filtered for forex trading platforms that accept Canadian investors and residents.

- We ensured brokers were authorized by the Canadian Investment Regulatory Organization (CIRO) or other relevant body.

- We ranked platforms by their total rating, which combines 100+ data points with insights from our testers.

What Is A Forex Broker?

A forex broker provides traders with access to the global foreign exchange market, allowing them to speculate on the fluctuating prices of currencies.

Here’s how it works in Canada:

- Choose a forex broker that accepts Canadian traders. Take into account your needs, for example, a fast platform with excellent charting tools suitable for forex day trading.

- Open an account. This typically requires verifying your identity and address, which you can do by providing a copy of your provincial/territorial driver’s identification card, such as the Ontario Photo Card.

- Deposit Canadian Dollars in your account. Minimum deposits have come down in recent years, and typically range from $0 to $250, or C$0 to C$350.

- Trade currencies online. You can either buy or sell currencies directly or use derivatives like forex CFDs, placing trades on your broker’s desktop platform, web terminal, or increasingly, forex app.

CIRO Oversight

The Canadian Investment Regulatory Organization (CIRO) oversees all investment dealers and trading activity in the Canadian financial markets, including foreign exchange dealing.

Forex brokers are normally required to become Dealer Members of the CIRO to operate in Canada. Firms also have to comply with the relevant provincial legislation.

The CIRO is a ‘green tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating. This means it provides robust oversight of brokers through continuous monitoring and the highest level of safeguards to retail investors, including:

- Access to the Canadian Investor Protection Fund (CIPF), which can reimburse accounts up to C$1 million in the event of broker insolvency. As a comparison, most offshore brokers provide zero investor protection.

- Limits on the leverage retail investors can use to trade forex, capped at 1:50. This means a C$100 outlay could buy you C$50,000 in purchasing power. As a comparison, many offshore brokers offer leverage of 1:1000 and above on currencies, significantly increasing the size of potential losses.

- Accounts that segregate client funds from operational capital to prevent misuse. As a comparison, some weakly regulated brokers may commingle client and company money, heightening the risks of fraud.

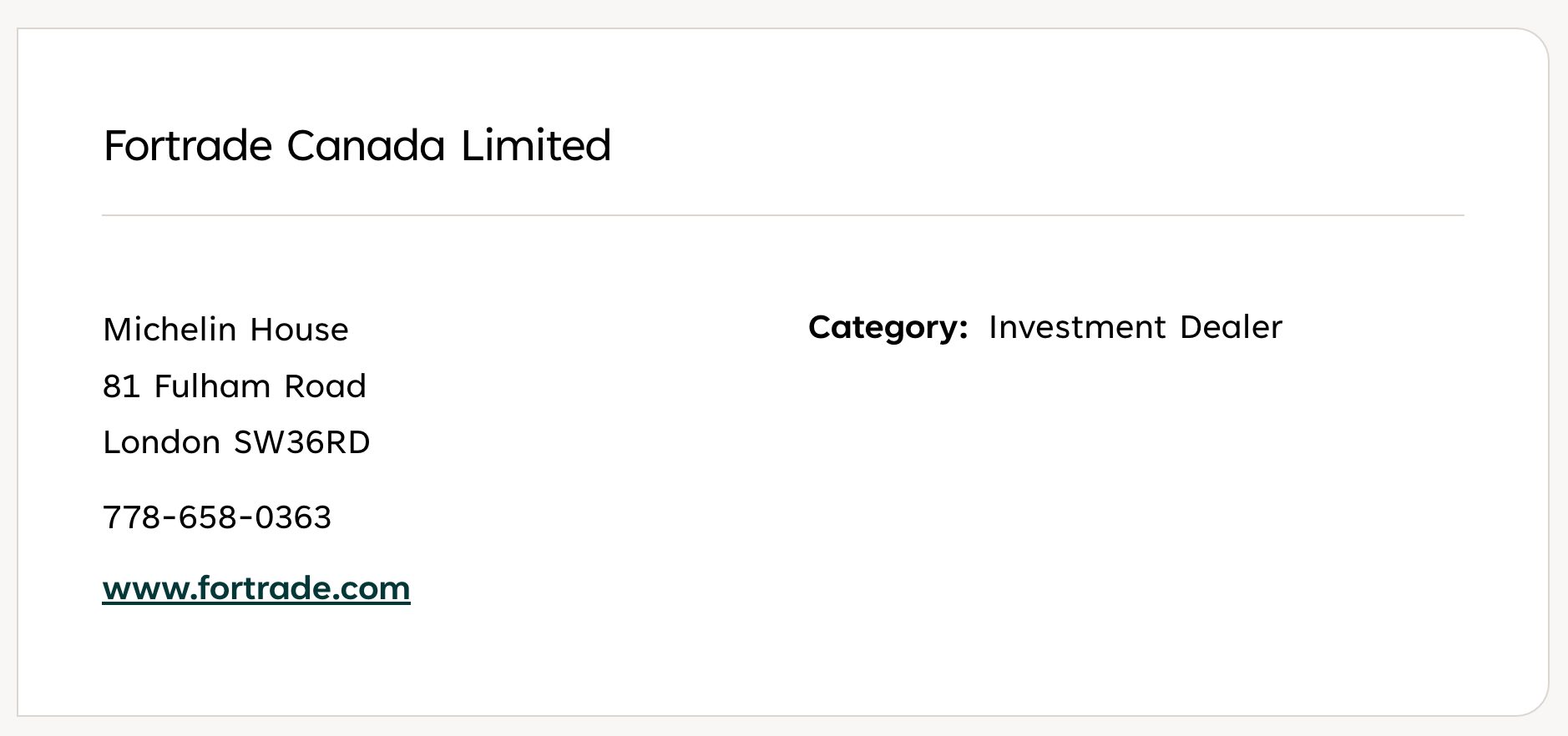

You can see below where I checked that Fortrade is authorized in the CIRO’s directory of ‘Dealers We Regulate’.I simply entered the broker’s name in the search bar, clicked ‘Apply’ and scrolled down to see the results.

How Do Forex Brokers Make Money?

Forex platforms in Canada typically make money through two primary fee structures:

Spreads (Commission-Free)

The spread of an asset is the difference between the bid and ask prices, which forex brokers can either charge as a fixed or free-floating fee.

Brokers with fixed spreads provide a guaranteed price of trading, whereas variable spreads will change with market volatility and liquidity. Our analysis shows variable spreads are often much lower than fixed ones, especially at liquid times, although fixed spreads may be better during times with fewer active investors.

Spreads are displayed as a bid exchange rate vs an ask exchange rate. For example, a CAD/USD pair quoted at 1.1000/1.1002 means that you could buy USD with CAD at a rate of 1.1000, but you could only sell at a rate of 1.1002. The spread is thus 1.1002 minus 1.1000, which equals $0.0002, or 2 pips.

Lower Spreads (With A Commission)

The other main fee to consider is commission, charged by many forex platforms. Commission fee structures are typically presented as a flat fee, such as $7 per round per lot, or $100,000.

The cheapest forex trading platforms in Canada charge low spreads, from near zero and flat commissions, which can be beneficial for active trading strategies like forex scalping, allowing traders to enter and exit positions quickly with more precise costs.

Indirect Costs

Forex brokers can also make money through other avenues, notably overnight financing fees (day traders can avoid these), currency conversion (if you deposit CAD to a USD account), account maintenance (many firms charge a monthly fee after a period of inactivity), and for access to premium features (like market analysis, real-time data, and hosting a virtual private server (VPS)).

I always recommend familiarizing yourself with a broker’s fee schedule BEFORE depositing any Canadian Dollars.The top platforms are transparent about costs, even providing minimum and average spreads for their catalog of currency pairs.

Comparing Forex Trading Platforms

Every trader’s needs are different, so the choice of forex trading platform is ultimately a personal one.

Having said that here are 5 key things to think about based on our many years in the industry and countless hours evaluating Canadian forex brokers:

1. Which currencies do you want to trade?

If you have a good idea of which currency pairs you want to explore, take a look at a forex broker’s product list to see what they offer.

For Canadians, it’s worth noting that while major pairs like USD/CAD are often provided, minor and exotic pairs like AUD/CAD or CAD/ZAR are less common.

CMC Markets is the exception here, bucking the trend with more currency pairs (over 300) than any other brokerage we’ve evaluated, and 34 featuring the CAD. It also stands out by offering a CAD Index, providing an alternative way to speculate on the value of the Canadian Dollar.

2. Are trading costs competitive?

Aside from spreads and commissions, consider the kind of strategies you may implement when comparing online brokers as this can also impact the associated fees. For example, day traders may want raw spreads from 0.0 pips with a low commission per lot.

FOREX.com excels here, with spreads from 0.3 pips on CAD/USD during our latest tests, and a $7 commission per lot, helping it earn 4.6/5 in our Fees & Costs Rating.

For Canadian residents with an account denomination other than CAD, also be aware of currency conversion fees each time you add or withdraw funds from your account.

3. Is the broker regulated by the CIRO?

As outlined above, Canada’s main financial regulatory body is the Canadian Investment Regulatory Organization (CIRO). However, each region has a local agency. For example, the Ontario Securities Commission will likely oversee forex trading platforms in Ontario to some degree.

Using a licensed broker is advisable to minimize risk and ensure adequate legal protections. Remember though, many international brokers will have separate regulatory oversight depending on where they are based and operate. Scroll to the website footer to find this information or reach out to the broker’s customer service team.

AvaTrade for example, operates in Canada in collaboration with a division of Friedberg Mercantile Group Ltd, which is regulated by CIRO. AvaTrade has also scooped DayTrading.com’s ‘Best Forex Broker’ award for delivering in every area for FX traders.

4. Do you enjoy using the platform?

The trading platform, whether desktop, web or mobile, can make or break your Canadian forex trading experience. If a platform is slow, you may miss out on trading opportunities. On the other hand, a platform with advanced tools and complex interfaces can overwhelm beginners.

Two of the most-renowned platforms offered by most forex brokers in Canada are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They offer a range of in-built indicators, customizable charts, and access to algorithms, plus various timeframes, order types, and risk management tools.

Some Canadian FX brokers may offer different commercial or proprietary platforms. If this is the case, ensure there is a good range of charting tools, indicators and analysis options, as well as any additional services you may require.

FOREX.com for example, offers a bespoke web trader and mobile app that I’ve really enjoyed using. The benefits include 70+ technical indicators and 50+ drawing tools.

5. Is it convenient to deposit and withdraw?

Consider the payment options available for deposits and withdrawals. Some payment solutions are typically processed rapidly, such as global brands Visa or Mastercard or local payment solutions like Interac, allowing you to get started quickly.

Other, more secure methods, such as bank wire transfers, can take up to five working days. That said, Canadian forex trading platforms that accept transfers from some of the biggest banks in the country, such as the Royal Bank of Canada (RBC), may offer favorable processing times.

For example, CMC Markets makes account funding a breeze for Canadian traders with 6+ payment methods, a CAD account and zero transfer fees.

Bottom Line

The quality of forex brokers in Canada has grown over the years as the market has become more popular. Nowadays, the top forex platforms in Canada are supported by both the CIRO and local financial watchdogs.

To find the right broker for your needs, use DayTrading.com’s pick of the best forex trading platforms that accept Canadian traders.

Recommended Reading

Article Sources

- Canadian Investment Regulatory Organization (CIRO)

- Canadian Investor Protection Fund (CIPF)

- Regulated Investment Dealers - CIRO

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com