Central Bank Portfolios

What do central banks own in their portfolios and why is it important?

Fundamentally, understanding why markets are doing what they’re doing is a function of who’s buying and who’s selling and for what reasons.

Since central banks are some of the largest asset managers globally, it helps to understand their influence and their motivations and what it means for our own portfolios.

Key Takeaways – Central Bank Portfolios

- Central banks don’t only set policy, but act as some of the world’s largest asset managers.

- The balance of sheet of the main central banks (e.g., Fed, ECB, PBOC) are in the trillions of dollars, so their buying and selling habits can dictate market moves, making what they hold and do of central interest to traders.

- Don’t just watch interest rates, but also pay attention to the buying and selling activity of their balance sheets.

- The composition of central bank portfolios can enable traders to identify sources of demand, identify protected asset classes, and spot structural shifts in the global economy.

Why This Matters for Traders & Investors

The “Whale” Effect

Central banks are price-insensitive buyers.

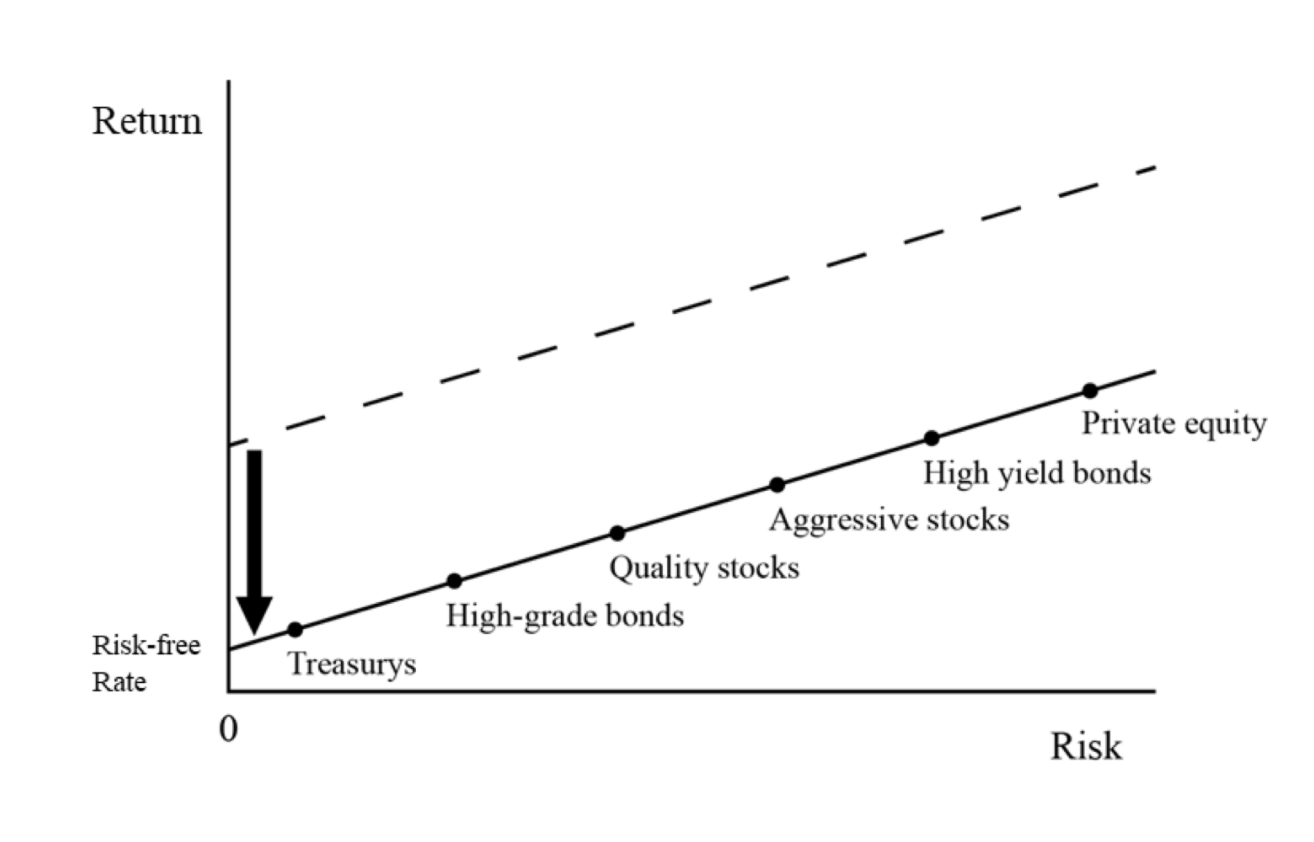

When they enter a market (e.g., buying corporate bonds), they cause yields to fall and force private money into riskier assets as safer assets yield less attractive rates of return.

Money Creation Power

Unlike a hedge fund, a central bank “prints” the money it uses to buy assets.

Buying = Injecting new money (liquidity adds)

Selling (or letting mature) = Liquidity Drains/QT

Altering Incentives

Suppressing yields on safe assets (government bonds) forces the entire economy to borrow more and speculate on riskier ventures like stocks and real estate.

The “Put” Option

Knowledge that a central bank can buy assets creates a psychological floor for markets (e.g., the “Fed Put“).

The Four “Buckets” of Central Bank Portfolios

Let’s break down assets by type and motivation.

1. The Monetary Policy Portfolio (Domestic Assets)

The primary lever for effectuating monetary policy involves buying/selling domestic government bonds (e.g., Treasuries, Gilts, JGBs) and agency MBS (mortgage-backed securities).

Short-Term Rates

To control short-term rates (like the fed funds rate), they trade T-Bills (short-term Treasuries) and use Repos:

When it comes to buying (or Repo), the Fed buys T-bills from banks, adding cash to reserves -> Lowers Rates.

When it comes to selling (or Reverse Repo), the Fed sells T-bills to banks, draining cash -> Raises Rates.

Long-Term Rates

For QE/QT (quantitative easing/quantitative tightening), they buy longer-duration bonds. In this case, the motivation is to control the yield curve and for smoother market functioning (avoiding liquidity gaps).

Trader Note: This is the engine of QE (quantitative easing). When this bucket grows, stocks generally rise due to excess liquidity.

Yields fall, which incentivizes more money into riskier assets.

2. The Foreign Exchange (FX) Reserves

FX reserves are foreign sovereign debt (e.g., China holding US Treasuries) and generally the debt of major reserve currencies (USD, EUR, JPY) that are globally considered quality stores of value.

They provide currency stablization and import cover (the ability for a country’s foreign reserves to pay for its imports).

Trader Note: Sudden changes here can indicate currency intervention (e.g., Japan selling USD to prop up the Yen).

3. The Physical Asset Portfolio (Gold)

This refers to physical gold bars.

Central banks (led by China, Poland, India, and Turkey) have been buying gold at record rates to diversify away from the US Dollar and sanction risks.

Even though gold doesn’t pay a yield like most bonds, it’s considered a timeless store of value.

Gold can be used to hedge against geopolitical strife when there’s less trust between countries and also to circumvent sanctions risk.

The US, for example, can unilaterally decide not to pay its obligations to countries it has conflict with or it wishes to punish. This is a real factor behind the global de-dollarization trend.

Moreover, part of it is basic economics. The USD is still the global reserve currency. But it has structural and climbing deficits, which create the need to sell a lot of debt for which there’s inadequate demand.

The fear, beyond the risk of not being paid at all due to geopolitical problems, is that the bonds will fall a lot in value or that they’ll be paid back in depreciated money.

4. The “Risk” Portfolio (Equities & ETFs)

Direct ownership of public company stocks.

The Swiss National Bank (SNB) and Bank of Japan (BOJ) are rare but important examples.

The SNB acts like a massive hedge fund. It owns billions in US tech stocks (Apple, Nvidia, Microsoft) to weaken the Swiss Franc to help prevent deflation.

The BOJ owns ~7% of the entire Japanese equity market via ETFs.

But when stimulation is ineffective when hitting zero, or slightly below zero, on front-end rates and zero/near-zero on longer-duration rates, then going into corporate bonds and equities is the next step.

Case Studies: Specific Central Bank Behaviors

The Federal Reserve (US)

With the Fed, the focus is on domestic Treasury bonds and mortgage-backed securities (MBS).

Going from QE to QT is considered a headwind for markets, all else equal. And going from QT to QE/asset buying is considered a tailwind.

The Swiss National Bank (SNB)

The SNB focused on foreign equities as a way to export capital (CHF -> e.g., USD) to weaken their currency and avoid deflation in their domestic economy (e.g., it benefits exporters, though external goods cost more in local currency terms).

The SNB has been a major “whale” in the US stock market.

If the SNB rebalances or sells equities to strengthen its domestic currency, that can create selling in US markets.

The Bank of Japan (BoJ)

With the BOJ, the focus is on yield curve control (setting yields on longer-term bond yields) and equity ETFs.

The BOJ is the only major central bank to buy domestic stock ETFs directly to prop up the market.

Betting against the BOJ’s ability to keep yields low has been a popular macro trade for decades, with limited success due to a lack of inflationary pressure.

Mechanics of Influence: How They Move Markets

Flow vs. Stock

It’s not just the size of the portfolio (stock) that matters, but the rate of change (flow).

The Signaling Channel

The announcement of a future purchase program moves prices before a single dollar is spent.

This is due to private market participants buying/selling to try to front-run the moves based on the new information.

This is also why forward guidance is an important mechanism of economic and market management.

Crowding Out

When central banks buy a lot of “safe” collateral (bonds), banks and traders are forced to lend to riskier borrowers. In turn, this has the effect of compressing credit spreads.

How Central Bank Portfolios are Evolving

Greening the Balance Sheet

Central banks (like the ECB) are tilting portfolios toward “Green Bonds” and issuers with better climate scores and effectively penalizing carbon-heavy industries.

Probably not a major trend, but something to have in mind.

CBDCs (Central Bank Digital Currencies)

If issued, CBDCs would become a liability on the balance sheet, potentially requiring larger asset holdings to back them.

Larger Bank Reserves

Larger bank reserves can also increase the size of the balance sheet.

Summary of Each Central Bank and Processes

The Federal Reserve (US)

The engine of global liquidity. When this portfolio expands, risk assets (stocks/crypto) tend to rise.

- Total Assets = ~$6.7 Trillion (Est. 2025)

- Primary Goal = Influence domestic interest rates and mortgage availability.

| Asset Class | Allocation | Description |

| US Treasuries | ~63% | mostly longer-dated notes and bonds to suppress yields. |

| Agency MBS | ~33% | Mortgage-Backed Securities (Fannie Mae/Freddie Mac) to support the housing market. |

| Liquidity Facilities | <5% | Short-term loans to banks (Discount Window, BTFP) for emergency funding. |

| Gold | 0%* | Technically the Fed holds gold certificates, but the physical gold is owned by the US Treasury, not the Fed. |

Trader Takeaway

Watch the “SOMA” (System Open Market Account) report every Thursday.

If the Fed is letting Treasuries “roll off” (mature without replacing them) or actively selling, they’re draining liquidity (quantitative tightening), which is a headwind for the S&P 500.

If they’re adding, that’s considered quantitative easing, a tailwind for risk assets.

The “Hedge Fund”: Swiss National Bank (SNB)

Often the most aggressive major central bank. Because Switzerland is too small for its own money supply, the SNB prints Francs and buys foreign assets to weaken its currency.

- Total Assets = ~$800 Billion+ USD

- Primary Goal = Devalue the Swiss Franc (CHF) to prevent deflation and help exporters.

| Asset Class | Allocation | Description |

| Foreign Bonds | ~75% | Government bonds from the EU (Euro) and US (Dollar). |

| Foreign Equities | ~25% | Direct ownership of stocks. They act like a massive index fund. |

Top Equity Holdings (Public Filings)

- Apple (AAPL): ~$11 Billion

- Microsoft (MSFT): ~$10 Billion

- Nvidia (NVDA): ~$13 Billion

- Other major stakes: Amazon, Meta, Alphabet… the usual suspects you’ll see weighted most heavily in the S&P 500 and Nasdaq.

Trader Takeaway

The SNB is effectively a “long-only” tech-focused investor. When the Swiss Franc gets too strong, the SNB prints Francs and buys foreign stocks.

Bank of Japan (BoJ)

The only central bank that buys domestic stock ETFs and real estate to prop up its own economy.

- Total Assets = ~¥696 Trillion (Est. 2025)

- Primary Goal = Yield Curve Control (YCC) and fighting deflation.

| Asset Class | Allocation | Description |

| JGBs (Gov’t Bonds) | ~80% | The BOJ owns more than 50% of all outstanding Japanese government debt. |

| Domestic ETFs | ~5-6% | They own ~7% of the entire Japanese stock market via ETFs. |

| J-REITs | <1% | Japanese Real Estate Investment Trusts (commercial property). |

| Loans | ~13% | Low-interest loans to Japanese commercial banks. |

Trader Takeaway

The BOJ is currently trying to “unwind” (sell) its massive ETF positions without hurting the Tokyo market. Any news on “BOJ ETF disposal” triggers high volatility in the Nikkei 225 index.

Generic Emerging Market (e.g., Brazil, India)

The standard portfolio for countries protecting themselves against a currency crisis.

- Primary Goal = “Import Cover” (having enough money to pay for oil/food if their currency collapses).

| Asset Class | Allocation | Description |

| US Dollar Assets | ~58% | US Treasuries (the global safe haven/world’s primary reserve currency). |

| Euro Assets | ~20% | German Bunds or French OATs. |

| Gold | 10-15% | Notably increasing. Countries like China and Poland are aggressively buying gold to diversify away from the USD (sanction proofing, declining US influence). |

| Other Currencies | ~7% | Yen (JPY), British Pound (GBP) |

Conclusion

Don’t fight the central banks. Are they easing interest rates and buying assets? That supports asset prices all else equal.

And central banks don’t buy and sell strictly for prudent economic reasons but rather to effectuate policy.

They can effectively create their own money to do so

Actionable Checklist:

- Is the Fed’s balance sheet expanding or contracting? (Weekly H.4.1 report).

- Are foreign central banks dumping Treasuries to defend currencies or some other goal (de-dollarize for prudent balancing purposes, to limit sanction risk)?

- Is there a “bid” under the market from explicit central bank buying (like in Japan for most of this century)?