Trading Elections and Political Outcomes

Elections are always a time when traders and investors think about the implications of the results on their portfolios.

However, in general, market participants tend to spend too much time thinking about the outcome and effect on their allocations.

Elections create another set of probabilities to deal with and represent opportunity. But timing them and getting the “trades right” is likely to create more in the way of disappointment and excessive transaction costs than excess returns.

Predicting the winner(s)

The first issue with elections is that in many years you don’t know who will win.

And even if you have a model that can predict the winner of the election in advance, and in a way that’s better than the consensus, it’s still difficult to turn this into winning portfolio bets because reactions to elections are highly unpredictable.

For quantitative investors, mining a lot of data on something like the US presidential elections is not easy. They occur only every four years.

US elections have now occurred for centuries. But the really old ones don’t have much relevance to helping inform how to generate profits on current ones and their aftermath. There’s not much to learn about Benjamin Harrison’s win in the 1888 election.

It’s also hard to apply lessons from the elections in other countries. In general, there is not a lot to work with.

Markets bake in probabilities before they occur in accordance with what’s likely to happen if said candidate (or his/her opponent) wins.

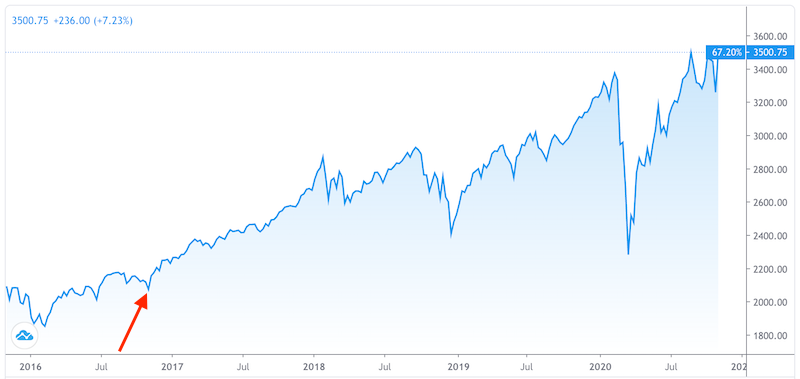

The 2016 election was one of the most popular in history due to the market ramifications it had.

It was one of the rarer cases where many investors missed what would happen to the point where they were able to profit from it.

Most thought Clinton would win. Moreover, because of the non-traditional style of Donald Trump, many opined that the market would fall by a lot if he won and the market would react positively if a “more normal” candidate like Clinton won.

When Trump won, the market did initially fall quite a bit.

But it rebounded in a big way once investors came around to the implications of deregulation and a drop in the personal and corporate tax rates (giving people more disposable income, on average, and making companies worth more by retaining more of their profits).

Many had Clinton winning and betting on stocks to go up due to the “normal candidate” thesis.

Even though Clinton didn’t win, stocks still went up regardless.

(Source: tradingview.com)

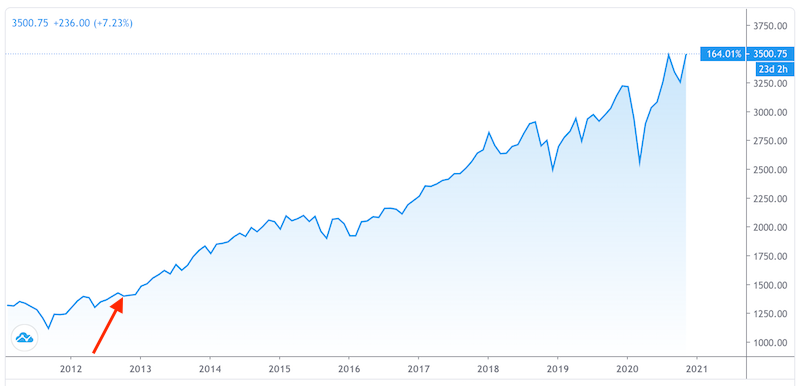

The 2012 election had a similar type of thinking going in.

Some bet on a Romney win and a similar pop in stocks due to deregulation and lower tax rates.

Romney didn’t win, but the market was still up over the coming four years.

Going beyond elections and market direction

Election-related investing goes beyond just market direction.

The 2016 US election had a big divide on candidates’ differences on regulation. Clinton was viewed as more pro-regulation of businesses and Trump more toward deregulation.

Traders believed the heavily regulated energy and financial sectors would benefit from his presidency.

Even despite a rollback of some regulatory rules, the sectors still underperformed.

Factors like low interest rates and their impact on net interest income as well as lower demand for gasoline and fuel have overwhelmed the effects of deregulation.

In other words, you can still get the results of an election correct, the policies they campaign on correct (i.e., effectuated in practice), and still have the wrong trade(s) on.

The 2020 US Elections

In 2020, it was a lot of the same.

Predictions abounded about the outcome of the election when it comes to forecasting the House and Senate results in combination with the Presidency – “blue wave”, “red wave”, split government in its various possibilities.

Many drew up complex matrices of outcomes and the believed probabilities associated with each, and potential market reactions.

Even with all the possibilities, it’s still not easy to forecast what will occur on any given outcome.

Some believe a “blue wave” will make things easier to pass, resulting in a big stimulus bill that will be bullish for markets.

Some believe a split government with the Republicans holding onto the Senate will lower the odds of a Democrat House and President from hiking personal and corporate tax rates as well as more heavily regulating businesses. This could also be considered bullish.

Then there’s the actions of the Federal Reserve, which is non-political in nature and exists outside the scope of elected leaders.

Much of the election focus is centered on tax policy and how those expectations will flow through into markets. But even a consensus on that is hard to come by.

Even if a Biden administration wants to increase personal and corporate tax rates – a drag on equities – higher spending programs may give more financial support to those with higher marginal propensities to consume, in turn helping growth and equities in a different way.

What to do about elections?

The answer is that you shouldn’t really worry about elections in terms of the impact on your portfolio.

Trading is a complex pursuit because the extent of the influences of what’s unknown is always going to be greater than what you do know in relation to what’s discounted in the price.

Betting on election outcomes is a difficult strategy. They may create a boost to volatility, but it’s not worth making large-scale changes to your asset allocation.

The same diversification and balance required to build a quality portfolio applies through and after elections just as it does through any other event.

Racking up unnecessary transaction costs just to give yourself something that might be better than a coin flip may not produce the kind of rewards you’re looking for.