TibiGlobe Review 2024

Pros

- The $50 minimum deposit is comparatively low and there are no deposit fees, making TibiGlobe accessible for aspiring traders on a budget.

- TibiGlobe offers access to the advanced MetaTrader 5 platform for desktop, browser and mobile trading, providing excellent charting tools, configurable indicators and level 2 market data.

- Cryptocurrency deposits and withdrawals are supported, notably Bitcoin (BTC), Ethereum (ETH), Tether (USDT) USD Coin (USDC), and Binance Coin (BNB).

Cons

- The TibiGlobe website and user account section need work to fix multiple dead links and error messages, which doesn’t help to instil confidence and reaffirm its position as an under-developed broker.

- Traders from outside of South Africa may find TibiGlobe less suitable due to regional support limitations and weak regulatory oversight, especially compared to globally-established and multi-regulated broker, IG.

- The investment offering of around 125 instruments seriously trails category leaders like BlackBull with its 26,000+ assets, limiting the range of day trading opportunities.

TibiGlobe Review

In this TibiGlobe review, we weigh the advantages and drawbacks of creating an account, thoroughly examining the day trading environment. Our assessment draws from direct experience with the platform, coupled with comparisons from our database comprising nearly 500 brokers.

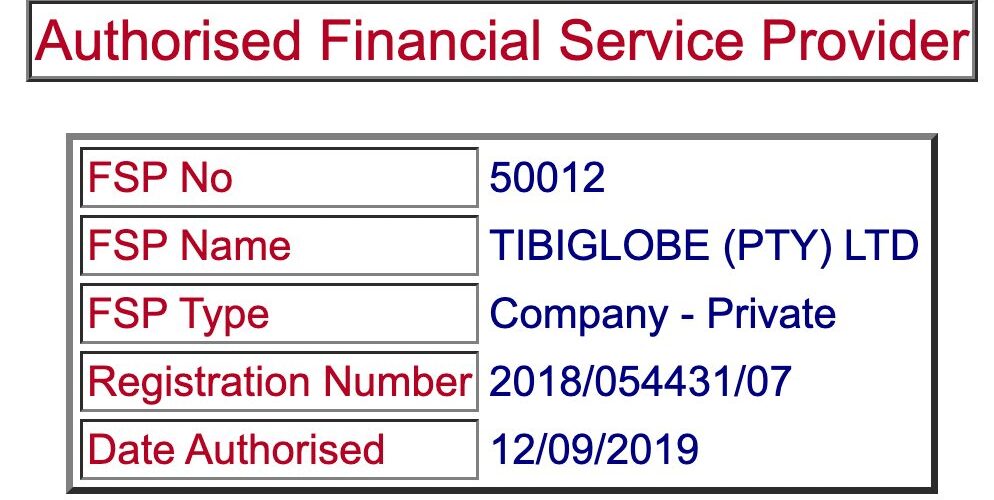

Regulation & Trust

2.5 / 5TibiGlobe is authorized by the Financial Sector Conduct Authority (FSCA). The FSCA is a ‘Yellow-Tier’ regulator, meaning it offers fairly strong investor protection but not as robust as that provided by ‘Green-Tier’ regulators, such as the Financial Conduct Authority (FCA) in the UK.

This adds a considerable level of risk to traders outside of South Africa. And while TibiGlobe houses a registered office in Limassol, Cyprus for its payment agent, TibiCashier Ltd, it’s important to note that the brokerage is currently not regulated by the Cyprus Securities & Exchange Commission (CySEC) or any other European Union (EU) jurisdiction.

TibiGlobe is also relatively new to the industry. Only established in 2018, it lacks the track record of the best brokers, notably our most trusted broker in 2024 – IG, which has 13 regulatory licenses and over 50 years of experience.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.3 / 5Accounts

TibiGlobe offers four accounts with varying pricing structures and deposit requirements:

- Spread: $50 deposit. Suitable for day traders looking for simple, commission-free pricing.

- Raw: $200 deposit. Suitable for day traders looking for tight spreads with a $6 commission.

- Pro: $2,000 deposit. Suitable for experienced day traders looking for commission-free pricing with tighter spreads.

- VIP: $5,000 deposit. Suitable for advanced day traders looking for tight spreads with lower commissions of $3.

Setting up a demo account with TibiGlobe was an efficient, fully digital process that only took a few minutes to complete.

Setting up a live account was more problematic because I kept experiencing error messages on the platform. In addition, TibiGlobe didn’t make it clear to me how to complete the KYC process concerning document uploads, making for a frustrating onboarding experience.

Unlike more established brokers, notably eToro, TibiGlobe doesn’t offer interest on uninvested cash balances. This means you can’t earn extra while weighing potential market opportunities.

Deposits & Withdrawals

Regardless of where your account is registered, you’ll find reliable payment methods at TibiGlobe. These include traditional bank cards like Visa and Mastercard, as well as the AstroPay e-wallet.

What’s more, TibiGlobe embraces cryptocurrency funding, accepting popular options such as Binance Coin (BNB), Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC).

The convenience of funding live trading accounts with either EUR or USD, also allows you to bypass conversion fees when bank accounts are denominated in these currencies.

There are no deposit fees. Similarly, withdrawals are fee-free, although it’s important to keep in mind potential exchange rate charges when transferring funds in a currency other than your account’s currency.

I’ve found that most payments are processed almost instantly, while withdrawals typically land in my account within three working days. Although most withdrawals don’t incur fees, I’ve noticed that smaller amounts might be subject to charges.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, Bitcoin Payments, Credit Card, Debit Card, Mastercard, Visa, Wire Transfer | Credit Card, Debit Card, Mastercard, PayPal, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Minimum Deposit | $50 | $0 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

2.3 / 5TibiGlobe’s selection of trading instruments is limited compared to the top brokers. TibiGlobe offers just over 125 CFD assets, which pales in comparison to XTB’s expansive offering of over 5,800 instruments.

The CFD roster includes 45+ currency pairs, 60+ stocks, 4 crypto pairs, 9 indices, and 6 metals. This sparse selection may suffice if you’re focused on day trading only a handful of assets, but it can be restrictive for advanced traders looking for a wide range of opportunities.

As expected for a CFD broker, there are no options for long-term investing, such as ETFs, bonds, or mutual funds.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Margin Trading | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Leverage

TibiGlobe specializes in trading assets via CFDs, offering opportunities for both long and short trades with considerable leverage, reaching up to 1:500 for the most liquid assets. This level of leverage is consistent with the practices we see at offshore-based brokers.

Notably, due to the absence of onboarding for an EU- or UK-regulated entity, TibiGlobe isn’t bound by the 1:30 leverage restriction imposed by many regulators.

One notable drawback I’ve encountered in my own trading journey with TibiGlobe is the restriction on customizing the default leverage level. This limitation impedes my ability to effectively manage risk.

Fees & Costs

2.5 / 5TibiGlobe offers a choice of pricing structures to suit different traders. However, fees trail the cheapest brokers, notably IC Markets, unless you deposit a significant amount.

The Spread account features commission-free trading with spreads from 1.4 pips – significantly higher than the 0.8 pip minimum spread in IC Markets’ equivalent account.

The Raw account features tighter spreads but applies a commission fee of $12 fee per lot traded – significantly higher than the $7 commission in IC Markets’ equivalent account.

The Pro account features commission-free trading with lower fees than the Spread solution starting from 0.8 pips – rivalling IC Markets’ equivalent account, however the $2,000 minimum deposit is 10x greater than IC Markets’ $200 minimum investment.

The VIP account features tighter spreads but applies a lower commission than the Raw solution with a $6 fee per lot traded – beating IC Markets’ equivalent MetaTrader account, though again, the $5,000 deposit requirement is significantly steeper than IC Markets’ $200 starting investment.

Similar to most brokers, TibiGlobe charges swap fees for holding positions overnight, determined by the instrument traded and tom-next rates.

It’s also worth noting that Islamic accounts at TibiGlobe incur holding charges for positions left open across consecutive trading sessions, varying based on the product and duration of the position being held. For major, minor, and exotic foreign exchange pairs, a charge is applied if the position remains open for more than 7 calendar days.

Disappointingly, there is an inactivity fee of $7 per month if an account hasn’t been used for 6 months, though this shouldn’t impact active day traders.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 14.1 | 0.8 | 0.08-0.20 bps x trade value |

| FTSE Spread | 362.16 | 1.0 | 0.005% (£1 Min) |

| Oil Spread | 25 | 2.8 | 0.25-0.85 |

| Stock Spread | Variable | 0.02 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

2.8 / 5TibiGlobe utilizes MetaTrader 5 (MT5), a leading third-party platform renowned for its robust technical analysis capabilities and wide array of custom strategies and indicators.

MT5 caters to various operating systems, including Windows and Mac, and offers web and mobile applications for seamless accessibility.

Yet despite its status as a market leader, I’ve found TibiGlobe’s MT5 to be somewhat unintuitive, especially for beginners, and particularly when compared to XTB’s platform, xStation 5.

While MT5 simplifies the process of locating specific instruments, I’ve found it lacking in built-in features such as a filterable news channel, stock screener, sentiment heatmaps, or integrated market analysis tools for gaining fundamental insights into individual assets.

And while MT5 excels in offering comprehensive features for technical analysis, TibiGlobe’s exclusion of popular third-party platforms like cTrader or TradingView could be restrictive for short-term traders who prefer these alternatives.

Additionally, aspiring traders may miss the absence of a trading calculator to assist in computing essential parameters like margin and commission for each trade.

Furthermore, the platform’s lack of email, SMS, and push notifications means day traders may not be promptly informed of crucial market developments, hindering their ability to react swiftly.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

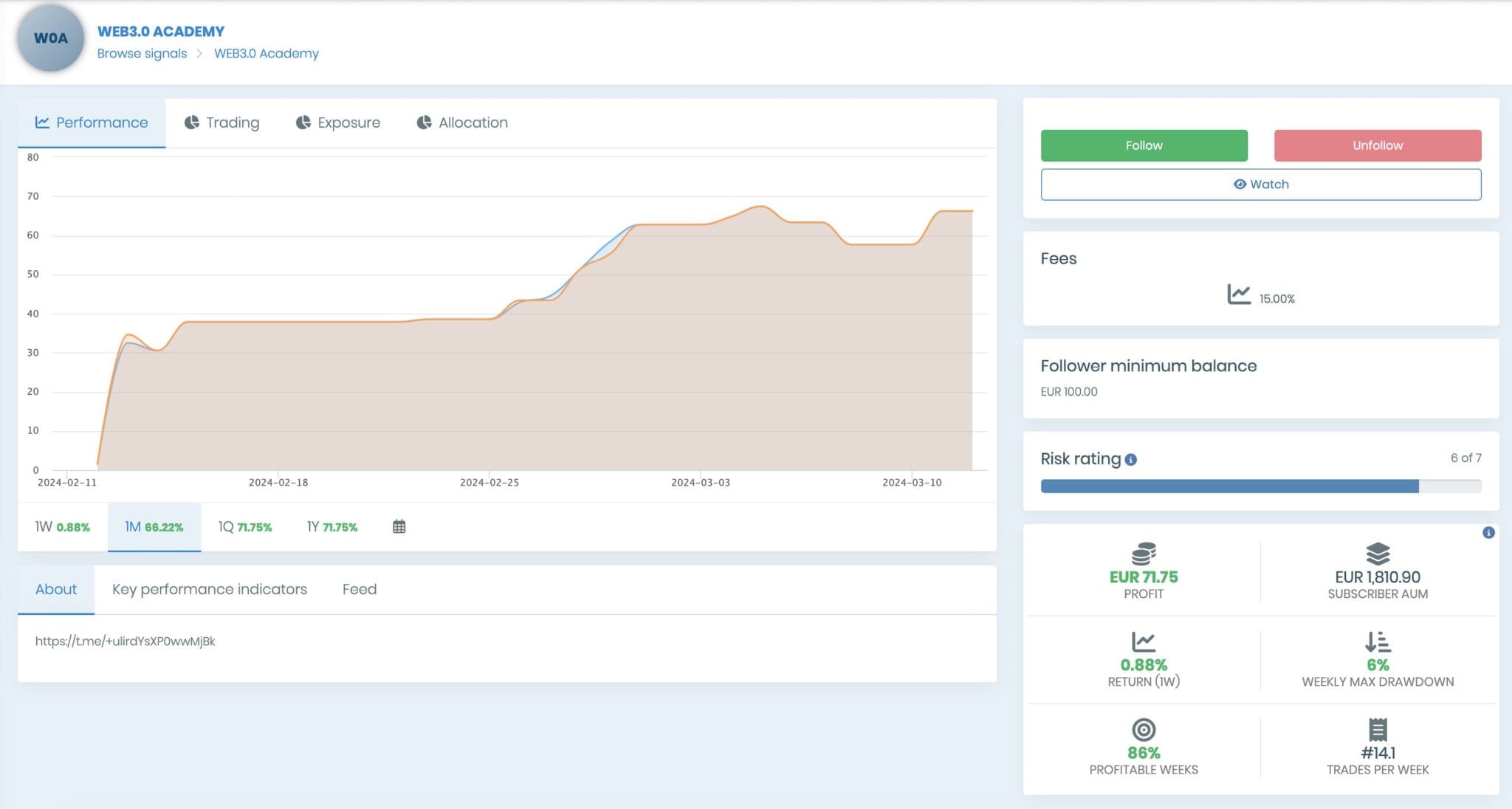

One standout feature TibiGlobe integrates into MT5 is social trading, allowing newcomers to replicate the trades of seasoned traders while enabling these traders to earn from their followers’ trades.

However, even here, I’ve noticed that compared to other copy trading platforms like eToro or cTrader, TibiGlobe’s selection of strategy providers is still very limited.

Research

1 / 5The lack of research materials provided by TibiGlobe is disappointing, particularly when compared to category leaders like Interactive Brokers.

While MT5 is a robust platform for presenting real-time charts and technical analysis tools, enabling traders to delve into market trends and anticipate future movements, TibiGlobe falls short in integrating additional resources such as news feeds, expert analysis, market sentiment indicators, trading signals, or regular webinars and podcasts for weekly market analysis.

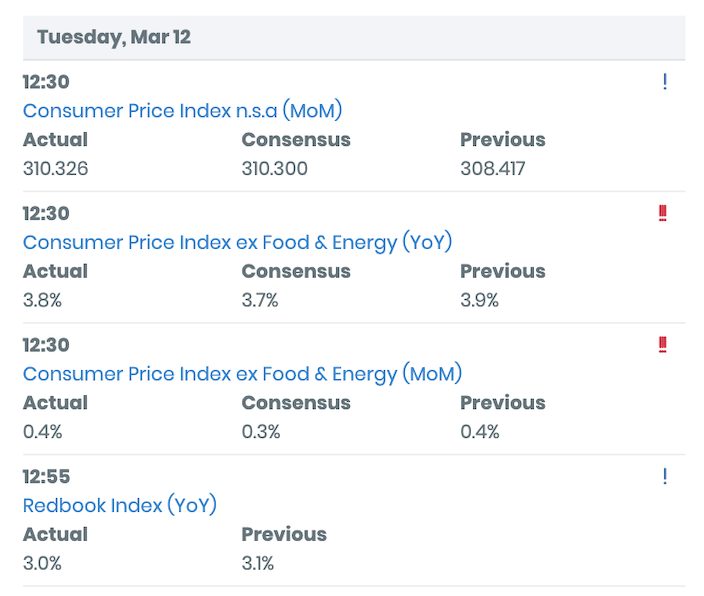

Although TibiGlobe does offer an economic calendar that can be filtered by country, allowing me to monitor events that may impact the markets, I’ve noticed a lack of concise summaries or historical data for selected events.

Additionally, when trading stocks, I’ve found the absence of market analysis a considerable limitation, as it prevents me from accessing crucial information such as a stock’s market capitalization, earnings per share (EPS), price-to-earnings (P/E) ratio, and debt-to-equity ratio.

Furthermore, I’ve grown accustomed to utilizing other research tools provided by different brokers, which are noticeably absent on the TibiGlobe platform. These include a stock screener to refine suitable trading stocks and a heatmap tool that offers a visual representation of market movers in both the stock and forex markets.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

1 / 5Beginner traders will be very disappointed by the lack of educational content provided by TibiGlobe.

While leading brokers, notably IG, typically offer a diverse range of educational resources, including instructional videos, articles covering various trading topics, and platform guidance, TibiGlobe’s offerings currently consist of only three basic e-books and a brief glossary of trading terms.

I also read the e-books and the guide on ‘Trading Strategies’, in particular, is so high level it will be of limited practical value for newer traders.

What’s particularly concerning is the absence of educational materials covering essential aspects of trading, account management, and navigating the MT5 platform.

Also despite the presence of a link to upcoming webinars, it appears that these are merely placeholders on the website, as the links are still inactive.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

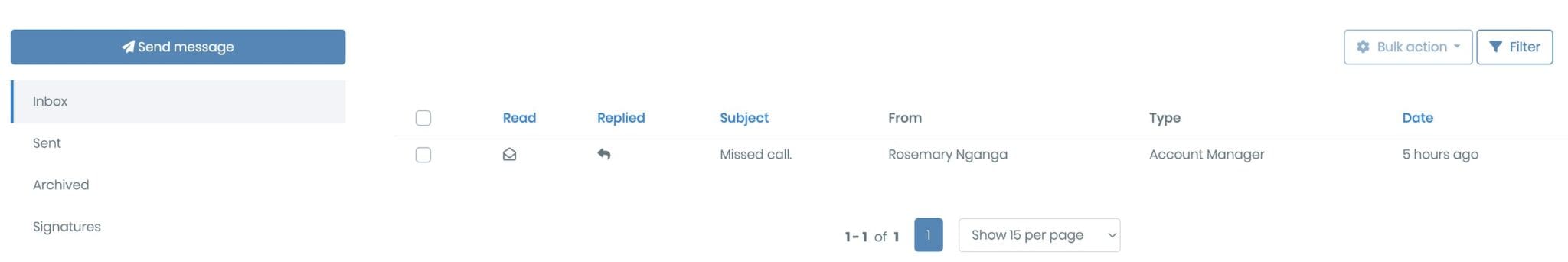

2.8 / 5It’s apparent that TibiGlobe’s support network is still developing due to being a relatively new broker. The platform offers support primarily through phone assistance accessible at its South African and Cyprus offices, as well as email communication and an efficient ticketing system via the account dashboard.

Additionally, certain account holders benefit from having a dedicated account manager available to address any inquiries or concerns related to their accounts.

However, it’s frustrating that there is no live chat support for urgent matters – a contact channel provided by almost every leading broker.

Despite this, TibiGlobe does maintain a presence on social media platforms such as LinkedIn, though neither its Twitter or Instagram pages were active during testing.

| TibiGlobe | IG | Interactive Brokers | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With TibiGlobe?

TibiGlobe is a viable option for traders seeking high leverage, particularly in stock trading. Its appeal is notably enhanced for traders based in South Africa and other African nations due to its regional presence and adherence to regulatory standards on the continent with authorization from the FSCA.

However, TibiGlobe is still a relatively new company. More established brokers provide tighter spreads, faster execution times, a wider range of instruments, stronger regulatory credentials, and superior support.

Overall, TibiGlobe still has some way to go if it’s to rival the best day trading brokers.

FAQ

Is TibiGlobe Legit Or A Scam?

TibiGlobe (PTY) Ltd is a legitimate company incorporated under the laws of South Africa and regulated by the Financial Sector Conduct Authority (FSCA).

Is TibiGlobe Suitable For Beginners?

TibiGlobe is not the optimal choice for novice traders. Although it provides a user-friendly platform, a limited copy trading service and a demo account, it falls short in terms of educational resources essential for beginners to comprehend the markets and enhance their skills.

Does TibiGlobe Offer Low Fees?

TibiGlobe is not the most cost-effective broker. Fees trail the cheapest brokers in the Spread and Raw accounts while the Pro and VIP accounts offer more competitive pricing but require a much higher deposit than many rival brokers.

Is TibiGlobe A Good Broker For Day Trading?

TibiGlobe can be a suitable option for day trading but it’s not the best broker. It provides a variety of popular trading instruments such as stocks, metals, indices, currency pairs, and cryptocurrencies through MetaTrader 5. Price alerts and notifications are particularly useful for active traders who need to stay updated on market movements throughout the trading day.

Does TibiGlobe Have A Mobile App?

TibiGlobe offers a mobile app as part of its MT5 platform access, which is available across different account types and is supported for both iOS and Android devices. This well-presented and easy-to-use app allows traders to engage with the markets and manage their day trades on the go.

Top 3 Alternatives to TibiGlobe

Compare TibiGlobe with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

TibiGlobe Comparison Table

| TibiGlobe | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2.3 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by TibiGlobe and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TibiGlobe | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

TibiGlobe vs Other Brokers

Compare TibiGlobe with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of TibiGlobe yet, will you be the first to help fellow traders decide if they should trade with TibiGlobe or not?