Best Spread Betting Platforms 2026

Want to bet on the price movement of securities like stocks in Apple without owning the shares? You can do this on a spread betting platform, where your profit or loss depends on how accurate you are and your stake size.

We’ve been testing the biggest names in the industry to find the best spread betting platforms in 2026.

Top 6 Spread Betting Brokers

Many spread betting firms impressed us during testing, but these 6 platforms emerged a cut above the rest:

-

1

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

2

AvaTrade

AvaTrade -

3

Spreadex

Spreadex -

4

Trade Nation

Trade Nation -

5

Vantage

Vantage -

6

Markets.com

Markets.com

Why Are These Providers The Best For Spread Betting?

Here’s a quick rundown on why these platforms stand out as the best for spread betting:

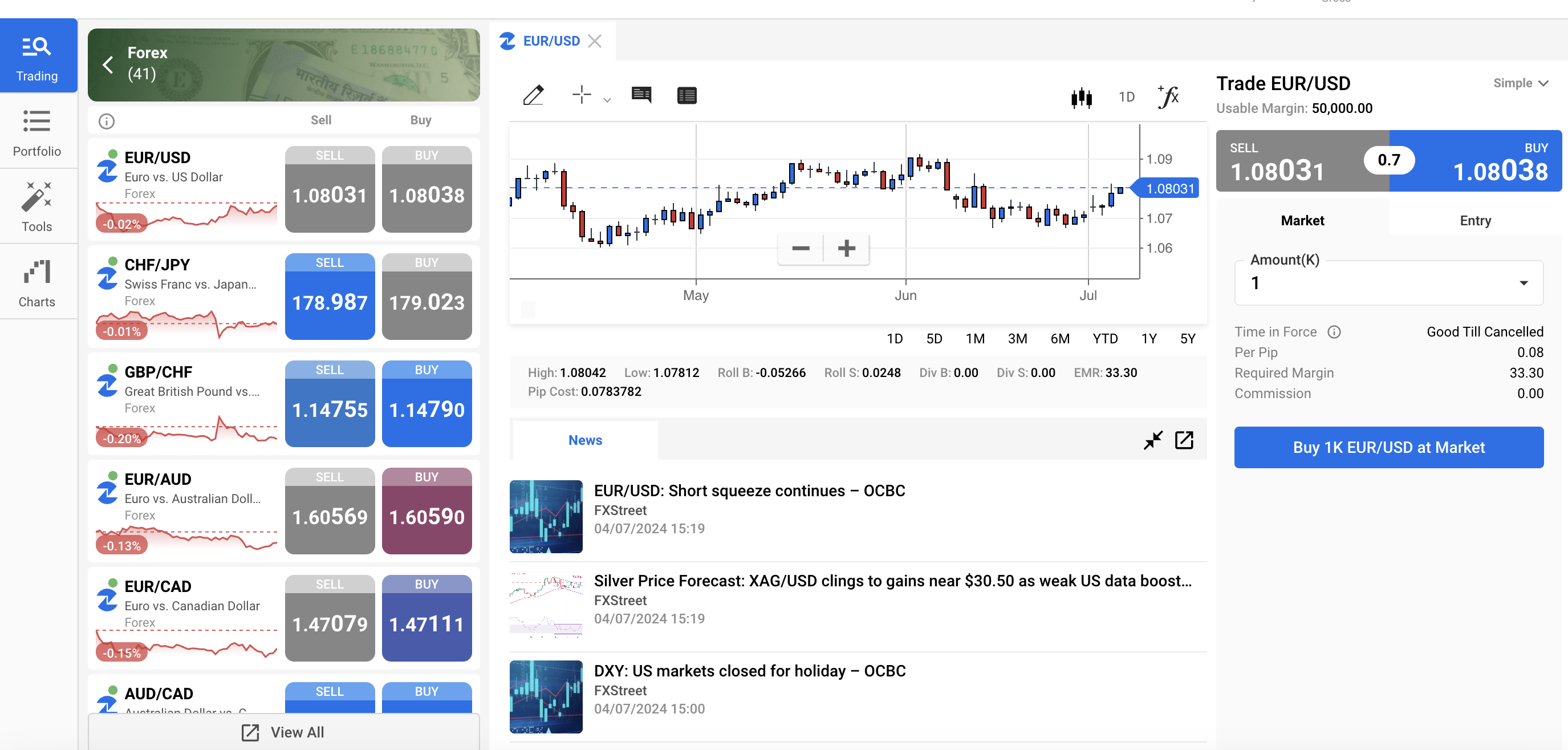

- Pepperstone is the best spread betting platform in 2026 - Pepperstone offers a competitive range of 1200+ spread betting instruments covering forex, indices, commodities, shares and ETFs. Spreads are some of the most competitive that we’ve seen during tests, starting from 0.6 pips for EUR/USD. Spread betting is also available on the MT4, MT5, cTrader and TradingView terminals, offering more platform flexibility than most alternatives.

- AvaTrade - AvaTrade is a first-rate spread betting platform with opportunities on 1000+ stocks, indices, commodities and currencies, sporting leverage up to 1:400. The MetaTrader platforms cater to seasoned traders with advanced charting tools and alerts, while the extensive Academy is home to terrific education with 18 courses, 150 lessons, 50 quizzes and a video tutorial explaining how to spread bet at AvaTrade.

- Spreadex - Spreadex stands out as one of the few brokers that specializes in spread betting, offering 10,000+ instruments (rivalling top contenders like IG with 17,000+). There’s also valuable spread betting education covering strategies, tips and analysis. With user-friendly TradingView charts and advanced order types, both beginners and experienced spread betters are well catered to.

- Trade Nation - Trade Nation offers hundreds of instruments via spread bets, though this notably trails top alternatives like CMC Markets (12,000+) and Spreadex (10,000+). We found the TN Trader platform to be a standout option for beginners during tests, thanks to its straightforward fixed-spread model. That said, offering just one platform for spread betting makes the broker more restrictive than most competitors.

- Vantage - Vantage continues to offer commission-free spread betting on forex, indices and precious metals. With 15 indices, including less commonly offered instruments like the VIX and Bovespa, Vantage is particularly suited to experienced equities traders. It’s also one of the few brokers that offers an unlimited demo account, allowing you to practice your strategies continuously.

- Markets.com - Spread betting at Markets.com is accessible with a low $200 minimum deposit and a wide choice of markets, from IPOs and commodities to curated stock “blends.” Traders can use both MT4 and the proprietary platform, gaining access to advanced charting, XRay live trading tips, and analysis tools that work well for both beginners and seasoned investors.

How Safe Are These Spread Betting Platforms?

How secure are the top spread betting brokers and how do they protect your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Pepperstone | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Spreadex | ✘ | ✔ | ✔ | |

| Trade Nation | ✘ | ✔ | ✔ | |

| Vantage | ✘ | ✔ | ✔ | |

| Markets.com | ✔ | ✔ | ✔ |

Compare Mobile Spread Betting

Find out how good these providers are for placing spread bets on mobile devices:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| Spreadex | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Vantage | iOS & Android | ✘ | ||

| Markets.com | iOS, Android | ✘ |

Are The Top Spread Betting Brokers Good For Beginners?

Beginners should use a broker that allow spread betting with a demo account plus other features new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Spreadex | ✘ | £0 | £0.01 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Vantage | ✔ | $50 | 0.01 Lots | ||

| Markets.com | ✔ | $200 | 0.01 Lots |

Are The Top Spread Betting Brokers Good For Advanced Traders?

Experienced traders should look for powerful tools to maximize the spread betting experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Spreadex | ✘ | ✘ | ✘ | ✔ | 1:30 | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 (entity dependent) | ✘ | ✘ |

| Vantage | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| Markets.com | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✔ | 1:500 | ✔ | ✘ |

Compare The Ratings Of Top Spread Betting Brokers

Discover how the top spread betting score in every critical area based on our in-depth testing:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| AvaTrade | |||||||||

| Spreadex | |||||||||

| Trade Nation | |||||||||

| Vantage | |||||||||

| Markets.com |

Compare Spread Betting Fees

Spread betting costs add up over time - here’s how the top providers compare on pricing:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Pepperstone | ✔ | $0 | |

| AvaTrade | ✔ | $50 | |

| Spreadex | ✘ | £0 | |

| Trade Nation | ✔ | $0 | |

| Vantage | ✘ | $0 | |

| Markets.com | ✘ | $10 |

How Popular Are These Spread Betting Platforms?

Many traders gravitate toward the most popular spread betting brokers - the ones with the largest client base:

| Broker | Popularity |

|---|---|

| Vantage | |

| Markets.com | |

| Pepperstone | |

| AvaTrade | |

| Spreadex |

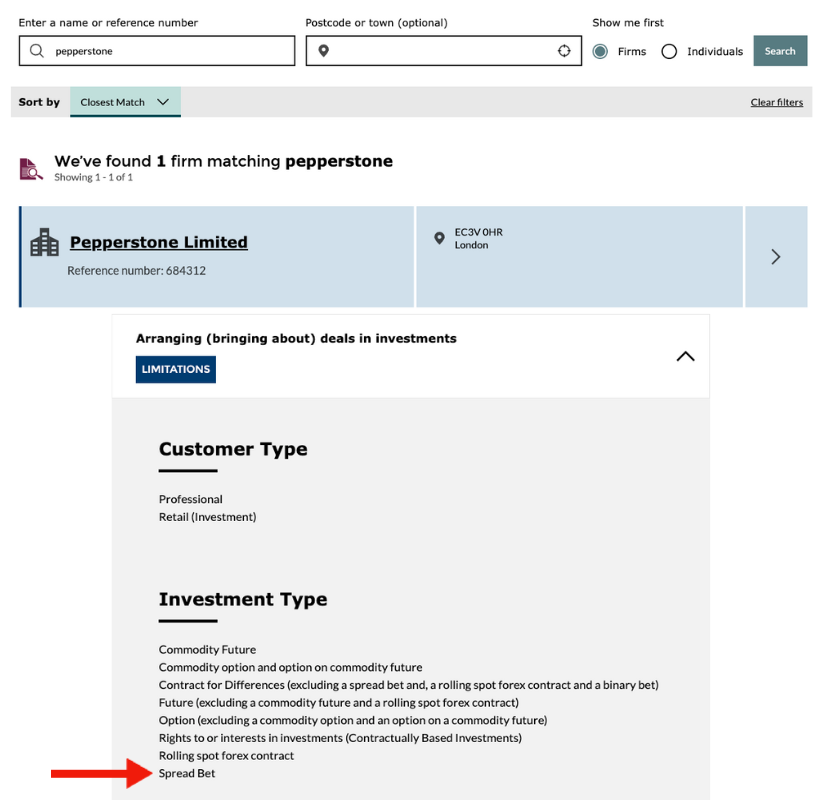

Why Spread Bet With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Why Spread Bet With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Why Spread Bet With Spreadex?

"Spreadex will appeal to UK day traders who are interested in both spread betting on financial markets and placing traditional bets on sports events. Fees are low on short trades and profits are tax-free on spread bets. There's also a powerful proprietary charting platform, plus £0 minimum deposit required to get started. "

Tobias Robinson, Reviewer

Spreadex Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting |

| Regulator | FCA |

| Platforms | Spreadex Platform, TradingView, AutoChartist |

| Minimum Deposit | £0 |

| Minimum Trade | £0.01 |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, CHF |

Pros

- Spreadex has introduced trading signals to its desktop platform, powered by Autochartist, providing real-time, pattern-based insights to help traders identify potential opportunities.

- There are some attractive new account promotions, including double the odds and matched betting offers

- A rare broker that provides access to lower market cap stocks traded on the AIM

Cons

- There's no support for expert advisors or other trading bots

- No third-party e-wallets are accepted

- The limited customer service can make it time-consuming to troubleshoot problems

Why Spread Bet With Trade Nation?

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- Full range of investments via leveraged CFDs for long and short opportunities

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

Why Spread Bet With Vantage?

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- It’s quick and easy to open a live account – taking less than 5 minutes

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- Unfortunately, cryptos are only available for Australian clients

Why Spread Bet With Markets.com?

"Markets.com is best suited to retail investors who trade frequently but don’t want to calculate commissions, thanks to its spread-only pricing (EUR/USD around 1.3 pips). It especially appeals to short-term traders who value fast execution, flexible asset choice spanning 2,200+ instruments and proprietary tools like hedge fund confidence indices and insider trade alerts."

Christian Harris, Reviewer

Markets.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds |

| Regulator | CySEC, FSCA, SVGFSA |

| Platforms | Web Platform, MT4, MT5, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK, CHF, PLN, CZK |

Pros

- Markets.com provides commission-free trading on most assets with spreads starting from around 0.6 pips on major forex pairs, making it cost-effective for casual traders.

- Markets.com’s Hedge Fund Confidence and Insider Trading tools pulls SEC filings into the dashboard within 24 hours of disclosure, helping to spot fund moves and C-suite buys before most retail newsfeeds updated.

- Within the 2,200+ CFDs, Markets.com offers thematic baskets like the Warren Buffett Blend and Cannabis Blend, which behaved like ready-made mini-ETFs during testing, saving the work of balancing weights manually.

Cons

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

- While CySEC and FSCA oversight is solid, the SVGFSA entity offers 1:500 leverage under a light-touch framework, meaning protections like compensation schemes and strict conduct rules lag behind the strictest regulatory standards.

- Inactivity charges kick in after just 3 months, while variable spreads are wider than top ECN brokers during testing, which may deter day traders and high-frequency traders.

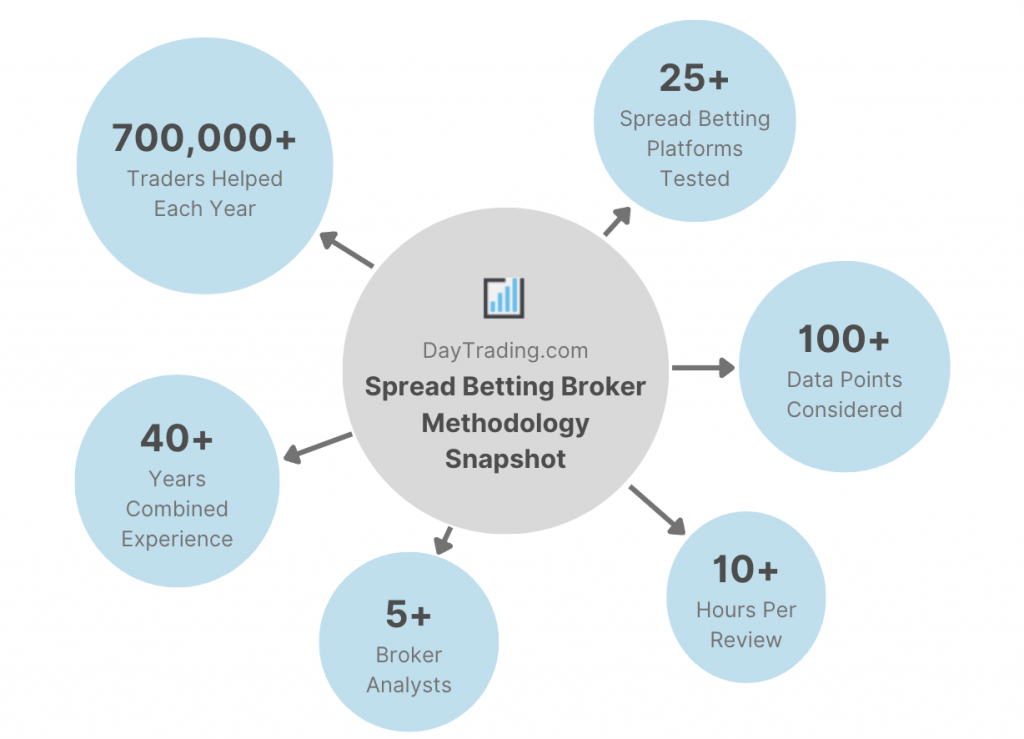

How Did We Chose The Best Spread Betting Platforms?

We took our database of 140 brokers and trading platforms and pinpointed the 25+ that offer spread betting trading.

We then ranked the shortlisted providers by their overall rating, which blends 200+ data entries with the direct observations of our testers following hours of hands-on evaluations.

- We checked that every broker offers a spread betting account with an accessible deposit of <$250.

- We only recommended brokers we’d trust with our own money after verifying their regulatory credentials.

- We prioritized brokers with excellent spread betting fees after evaluating their spreads and other charges.

- We confirmed brokers offer a range of financial markets, providing diverse trading opportunities.

- We selected brokers with reliable support based on our spread betting inquiries during testing.

- We investigated each broker’s order execution because fast speeds are key for successful spread betting.

- We examined each broker’s margin requirements to ensure they are transparent for traders using leverage.

How To Pick A Spread Betting Broker

Trust

Only use an established spread betting provider with many years in the industry and authorization from a ‘green tier’ regulator. This is the best way to protect yourself from trading scams.

This is key given that the UK’s Financial Ombudsman Service has highlighted the dubious practices adopted by some spread betting companies. In one case study, “Geraldine made significant losses on a spread-betting platform” that she thought was making money by referring clients to a workshop that taught useless strategies so they could profit from their users’ losing trades.

Spread betting is legal and regulated in several prominent countries, including Australia, Singapore, South Africa and Ireland. However, the largest market is in the UK, where the top providers are regulated by the Financial Conduct Authority (FCA) – a ‘green tier’ body.

- Pepperstone has earned and maintained an excellent 4.6/5 Trust score owing to its authorization from four ‘green tier’ regulators and stellar reputation since 2010. It has also scooped our ‘Best Overall Broker’ and ‘Best Trading App’ awards in recent years.

Markets

Pick a broker that offers spread betting on the financial markets you’re interested in.

From our investigations, most platforms offer spread bets on stocks, indices, forex and commodities. However, some providers stand out by providing a much richer suite of trading opportunities, such as bonds, interest rates, and cryptos, that may appeal to seasoned traders.

- IG blows the competition out of the water with over 17,000 markets you can spread bet on, from currencies, indices, and commodities to upcoming IPOs. It’s also one of the few brokers we’ve used that supports spread betting on the weekend via IG’s out-of-hours markets.

Fees

Choose a platform with low trading fees to help you towards a successful spread betting journey.

Unlike contracts for difference (CFDs), commissions are not typically charged on spread bets so the primary cost to consider is the spread – the difference between the bid and ask price. Spread betting companies normally incorporate a fee for their services into the spread.

Some companies specialize in certain markets with low prices. However, they will then offer other markets at less attractive prices, just to ensure they have a presence. Specific spread betting forex brokers, for example, may offer you a better deal than a jack of all trades, master of none firm.

Also, while less relevant for day traders, if you hold a spread bet open overnight you may incur a charge (futures can be more cost-effective for longer-term trades).

- Vantage stands out with excellent fees on spread betting markets during tests, including 0.1 on EUR/USD, 0.3 on oil and 3.1 on S&P 500, delivering a low-cost trading environment across a variety of asset classes. With no deposit, withdrawal or inactivity fees, it also keeps additional costs to an absolute minimum.

Tools

Choose a broker that offers reliable and powerful charting platforms. The best software will offer a wide range of tools for technical analysis, including various chart types, drawing tools and timeframes.

Some providers offer proprietary platforms with unique tools, notably IG’s Online Platform, CMC Markets’ Next Generation platform, and FXCM’s Trading Station.

Alternatively, or additionally, brokers may offer third-party solutions which do not natively offer spread betting, but can support this style of trading. The most widely available platforms we see are TradingView, MetaTrader 4, MetaTrader 5 and cTrader.

I don’t think TradingView can be beaten when it comes to ease of use and features – it offers the complete trading experience in my view. It’s also being increasingly integrated by spread betting brokers, notably Pepperstone.

- FXCM caters to all types of spread betters at every experience level with their wide range of platforms, including Trading Station, MT4 and TradingView. There’s also an unlimited number of demo accounts, which are a great place to start for all spread betters, so you can find the platform that ticks your boxes.

Execution Quality

Choose a broker with fast and reliable order execution – these are crucial for fast-paced trading styles like spread betting.

High-quality execution will help ensure your trades are executed at the requested time and price. In general, we view anything below 100 milliseconds (ms) as ‘fast’, but some trading platforms go much further.

- FxPro is one of the fastest spread betting platforms that we’ve evaluated, with extremely impressive speeds of less than 11 ms. Prices are sourced from 12+ liquidity providers, making the firm an excellent choice for active spread betters looking for fast execution, tight spreads and reduced price slippage.

Margin Requirements

A key component of spread betting is leverage – which allows you to trade much larger positions by putting down a small outlay, known as ‘margin’.

It’s essential to choose a provider with transparent margin requirements so you understand how much capital you need to put down and maintain in your account, plus how much leverage (borrowed funds) you can access. For example, equities often require a 10% margin. So, if you’re a high-volume trader you’ll need significant capital.

Notable spread betting jurisdictions like the UK cap leverage to a maximum of 1:30.

This means that if I want to bet on EUR/USD with a margin of $250, my potential profits could be magnified to the value of $7,500 (30 x $250), less any fees.Of course, my losses will also be magnified so risk management is essential, with tools like stop-loss and take-profit orders popular with spread bettors.

- Trade Nation offers transparent leverage and margin depending on the entity you sign up with, with 1:30 available at the FCA and ASIC-regulated entities. Higher leverage of 1:500 is also available globally, though we don’t recommend high leverage for beginners.

Support

Access to convenient, prompt and dependable support is key when you’re using short-term trading products like spread betting. It’s also an important safety cushion for beginners who typically need more support getting started.

Most platforms provide assistance through live chat, telephone and email as standard, though the trend towards automated chatbots I’ve found extremely frustrating in recent years, sometimes hampering your ability to get urgent trading issues resolved quickly.

- Pepperstone is one of the few brands that offer assistance that’s performed excellently over the years, with 24/5 response hours and staff that are knowledgeable about spread betting products. It also offers some well-written guides for beginners new to spread betting.

Should I Start With A Spread Betting Demo Account?

Spread betting demo accounts are an excellent starting point for newer traders and those unsure about which provider to use. We have indicated in our comparison table above which platforms offer a demo mode for spread betting.

Importantly, a good demo account should closely imitate the live spread betting platform. This is crucial not only to familiarize yourself with a particular software, assets and tools, but also in helping you select the broker which best suits you.

Users are able to test the amount they want to invest in spread betting assets as any losses incurred will only be of the virtual money the platform allocates when the account is opened. Some demo accounts remain open indefinitely, while some close after a set period. Some firms will also replenish your virtual bankroll if you run out of funds.

Article Sources

- FCA Restricts CFDs and Spread Bets - FCA

- Case Study - Geraldine Lost Money On A Spread-Betting Platform - Financial Ombudsman Service

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com