Spread Betting Tutorial

Spread betting is a high-risk, high-reward way to speculate on the financial markets. This guide covers everything you need to get started, from explaining spread betting basics to understanding the tax benefits.

Top Spread Betting Brokers

These 4 spread betting providers are regulated and offer a range of markets, low fees and excellent platforms:

-

1

Spreadex

Spreadex -

2

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

3

AvaTrade

AvaTrade -

4

Trade Nation

Trade Nation

What Is Spread Betting?

Spread betting is a trading method where you speculate on the price movement of financial assets, such as stocks, commodities, or in forex, without owning the underlying assets.

Unlike traditional stock trading, where you buy and own shares, spread betting involves making bets on whether an asset’s price will rise (buying) or fall (selling).

In spread betting, you place a bet on the spread, which is the difference between the buying (bid) price and the selling (ask) price of the asset. You profit or incur losses based on the extent to which your prediction is correct, and your stake size determines the magnitude of your gains or losses.

Spread betting typically involves leverage, allowing you to control a more extensive position with a smaller initial investment. While this can magnify profits, it also escalates potential losses.

The cost of initiating your trade is typically integrated into the spread. As a result, the spread entails buying slightly above the market price and selling slightly below it.

Take the FTSE 100, for example, with a spread of 1 point. This signifies that the buy price is situated 0.5 points higher than the current market price, and the sell price is 0.5 points below. Within this 1-point spread, your broker’s fees for opening and closing your position are encompassed.

In some countries, such as the UK, spread betting offers tax advantages over traditional trading methods.

However, the high level of risk involved, coupled with the use of leverage, means that it’s crucial to understand the markets you’re trading in, employ effective risk management strategies, and be aware of the local regulatory and tax implications.

What Markets Can You Spread Bet On?

Spread betting allows you to speculate on the price movements of a wide range of financial markets. The markets available for spread betting can vary depending on the spread betting provider and the regulations in your region, but typically include:

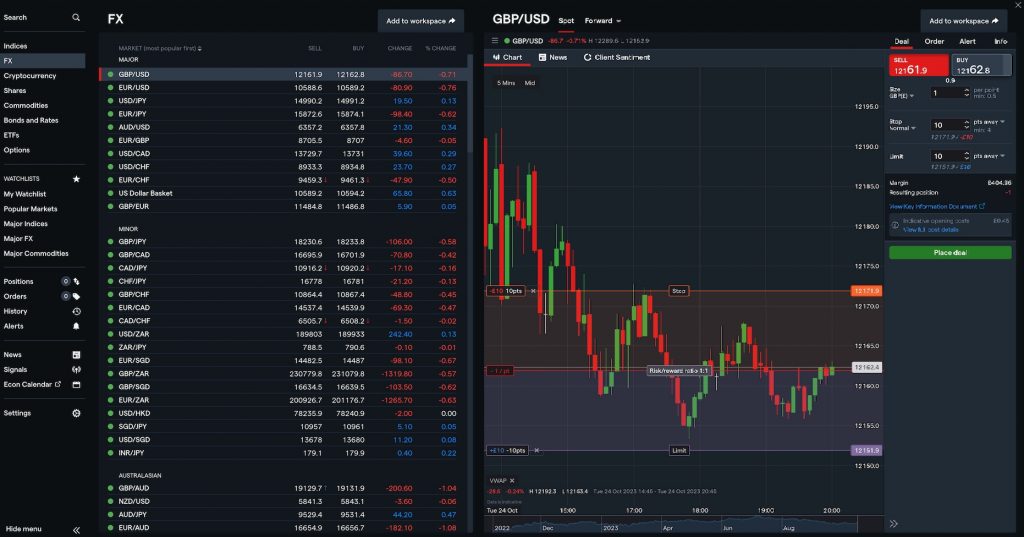

- Currencies: The forex market offers opportunities to spread bet on currency pairs, such as EUR/USD or GBP/JPY. This is one of the most popular asset classes with spread bettors. Traders will be quoted a bid and ask price, they then have to decide whether they think the price will end up lower than the bid or higher than the ask. A narrower spread generally means lower transaction costs and greater potential profits for active traders.

- Stocks: You can spread bet on individual company stocks, such as Apple or Meta, by betting on whether their prices will rise or fall.

- Indices: Major stock market indices including the S&P 500 or Nasdaq 100 can be traded through spread betting.

- Commodities: This includes assets like gold, oil, and agricultural products. You can speculate on whether their prices will go up or down.

- Bonds: Some platforms offer spread betting on government bonds and other fixed-income securities.

- Cryptocurrencies: With the rise of cryptocurrencies like Bitcoin and Ethereum, some spread betting providers offer the ability to bet on their price movements.

- Interest Rates: You can place spread bets on interest rates, including short-term interest rates or government bond yields.

- Options And Futures: Some providers allow you to speculate on the future prices of financial derivatives.

- Sectors: Rather than betting on individual stocks, you can spread bet on entire sectors, like technology, energy, or healthcare.

- Volatility Indices: Some platforms offer spread betting on indices that measure market volatility, including the VIX.

Spread Betting Vs CFD Trading

Spread betting and contracts for difference (CFDs) are both forms of derivative trading, but they have some key differences:

Market Access

Spread betting typically offers access to a wide range of financial markets, including stocks, indices, currencies, commodities, and more.

CFD trading similarly offers access to a variety of financial markets, such as stocks, indices, forex, and commodities.

Ownership Of Assets

In spread betting, you do not own the underlying assets. You are speculating on the price movement of the asset without owning it.

CFD trading also does not involve ownership of the underlying asset. It is a contract between you and the CFD provider to exchange the difference in price between the asset’s opening and closing prices.

Trading Mechanics

In spread betting, you bet a certain amount per point move in the asset’s price, and the profit or loss is determined by the number of points the price moves in your favor or against you.

In CFD trading, you enter into a contract with a CFD provider to exchange the difference in the price of the underlying asset between the contract’s opening and closing. Profit or loss is calculated based on the change in price.

Taxation

In some countries, spread betting is treated as a form of gambling and is typically tax-exempt. Profits made from spread betting are not generally subject to capital gains tax or stamp duty. However, it may not be available in all countries.

CFD trading is generally subject to capital gains tax or other relevant taxes, depending on your jurisdiction.

Regulation

Both spread betting and CFD trading are subject to regulation in many countries. Regulatory standards are in place to protect traders and ensure fair trading practices.

Spread Betting Vs Stock Trading

The choice between spread betting and stock trading depends on your financial goals, risk tolerance, and the specific tax and regulatory environment in your jurisdiction.

Spread betting is often favored for its tax advantages and flexibility in trading various markets, while stock trading provides ownership of assets and potential dividends but may come with tax implications.

Spread betting and stock trading differ in several key ways:

Ownership Of Assets

In spread betting, you do not own the underlying assets (e.g., stocks). Instead, you are placing a bet on the price movement of shares.

In stock trading, when you buy shares of a company, you own a portion of that company, with the associated rights and responsibilities, such as voting rights and dividend eligibility.

Tax Treatment

In some regions, spread betting is considered a form of gambling, and any profits made from spread betting are typically tax-exempt. This can make it a tax-efficient option for certain traders.

In stock trading, profits are often subject to capital gains tax, and you may also incur other taxes and fees depending on your jurisdiction.

Leverage

Spread betting often involves the use of leverage, which allows you to control larger positions with a relatively small amount of capital. This leverage can amplify both gains and losses.

Stock trading typically does not involve the same level of leverage. You usually need to invest the full amount to purchase shares, although some brokers do allow the purchasing of fractional shares.

Regulation

Spread betting is regulated in many countries, with rules and standards set by relevant financial authorities.

Stock trading is also highly regulated, with rules and regulations set by stock exchanges and government agencies.

Market Access

Spread betting allows you to speculate on a wide range of financial markets, including stocks, indices, currencies, commodities, and more.

Stock trading involves buying and selling shares of individual companies listed on stock exchanges.

Dividends And Voting Rights

In stock trading, as a shareholder, you may be entitled to receive dividends and have a say in company decisions through voting rights.

In spread betting, you do not have such rights because you do not own the underlying stocks.

Pros & Cons Of Spread Betting

Pros

- Tax Efficiency: In some regions, spread betting is considered a form of gambling, and any profits made from spread betting are typically tax-exempt. This can provide a tax-efficient way to speculate on financial markets, as gains are not subject to capital gains tax or stamp duty.

- Leverage: Spread betting allows you to use leverage, so you can control larger positions with a relatively small initial investment. This leverage can amplify potential profits, but it also magnifies losses.

- Diverse Market Access: Spread betting provides access to a wide range of financial markets, including stocks, indices, currencies, commodities, and more. You can diversify your portfolios and trade multiple asset classes from a single account.

- Short Selling: Spread betting lets you profit from falling markets by taking short positions. This flexibility enables you to make gains in both rising and falling market conditions.

- No Ownership Of Assets: When you spread bet, you do not own the underlying assets. This means you can speculate on price movements without the need to buy and hold physical assets, making it a more cost-effective and accessible way to trade a variety of markets.

Cons

- Tax And Regulatory Changes: Tax laws and regulations regarding spread betting can change over time and vary by jurisdiction. What is currently tax-efficient may not remain so in the future. You should stay informed about the latest tax and regulatory developments in your region.

- Costs And Spreads: Spread betting involves costs in the form of spreads (the difference between the buying and selling price), overnight financing charges, and, sometimes, platform fees. These costs can eat into profits, and you need to consider them when making trading decisions.

- Market Volatility: Financial markets can be highly volatile, and this volatility can lead to rapid and significant price movements. You need to be prepared for market swings and have risk management measures in place to protect your capital.

- Limited Risk Management Tools: While spread betting platforms offer some risk management tools like stop-loss orders, they may not provide the same level of control as other trading platforms. Additionally, during extreme market conditions, stop-loss orders may not guarantee execution at the desired price, potentially leading to larger losses than anticipated.

- Complexity And Learning Curve: Spread betting can be complex, especially if you are new to online trading. Understanding the mechanics, risk management strategies, and various markets can take time and effort. Beginner traders may find it overwhelming, leading to potential losses due to lack of experience.

How To Start Spread Betting

Let’s go through a detailed example of making a spread bet on oil. Note that this is a simplified illustration, and actual trading involves more complexities and risks.

Step 1: Research And Analysis

Before making a spread bet, conduct thorough research and analysis to understand the market and asset you want to trade. This includes studying the market trends, news, and any other relevant information.

In this example, you believe that oil’s price is going to increase.

Step 2: Choose A Broker

Select a top spread betting platform that offers access to the financial markets you want to speculate on.

You can then create an account with the spread betting provider. This involves providing personal information, verifying your identity, and depositing funds into your trading account.

Step 3: Place The Bet

Considering that you have a bullish outlook on the price of oil and expect it to rise, you initiate a ‘Buy’ trade with a stake of £2 per point. Under this arrangement, for every point that the price of oil climbs, you’ll gain £2. Conversely, if the price of oil drops, you’ll incur a £2 loss for every point of descent.

The ultimate determination of your profit or loss occurs when you decide to close your position. For example, if the price of oil has surged by 50 points since your initial purchase, your profit would amount to (£2 per point x 50 points) £100. Conversely, if the price had declined by 50 points, you would face a loss of £100.

After closing the position, review your spread bet trade, and assess what went well and what could have been done differently. This analysis can help you improve your trading strategy for future spread betting trading.

Taxes

The tax treatment of spread betting depends on the country and its tax laws. In some countries, such as the UK, spread betting is considered a form of gambling, and any profits made from spread betting are normally tax-exempt. This can make spread betting a tax-efficient option.

Capital Gains Tax

The most obvious potential charge is perhaps capital gains tax, known as ‘CGT’. But qualifying returns made from financial betting are not liable for this tax, which in some cases, can be over 20%.

So is spread betting tax free when it comes to capital gains? Yes.

Stamp Duty Tax

Those who have become land owners and bought and sold properties will be familiar with stamp duty tax. Stamp duty generally applies to more assets than just property, and some aspects of stock trading fall into its sphere of liability, especially under stamp duty reserve tax (SDRT). However, spread betting profits generally do not.

This is because spread betting products are derivatives that track the asset in question, and do not confer any ownership of the underlying asset. So while it might appear that you’re trading Meta stock, for example, what you’re actually doing is trading a financial product that tracks the stock’s value and delivers profit or loss based on how the share price performs.

So is spread betting tax free when it comes to stamp duty? Yes.

Income Tax

It is also important to consider any income tax implications when spread betting. This is where the exact definition of ‘betting’ comes into play.

Spread betting is, for income tax purposes, treated as gambling – which means that profits do not give rise to a liability.

The Money Advice Service does, however, caution that this might change in the event that a person relies on their income from spread betting to earn a living. In that case, it could be re-categorized as ‘trading’, which could mean there is income tax to be paid.

For that reason, it is worth consulting a tax professional if you execute a higher number of spread bets versus lower volume investors as this might push you into the ‘trading’ category, especially if your profits are high.

Your tax percentage will also depend on the income zone you are in. A high earner will need to pay more depending on the total value of their received (liquid) income.

So is spread betting tax free when it comes to income tax? Yes – unless spread betting profits are your primary source of income.

It is not, however, the case that spread betting losses can be used in this way. So while tax efficiency is the order of the day when it comes to profitable returns, a trader can’t bank on their spread betting losses being used to reduce the overall amount of tax they owe.

Terminology

Below is a spread betting glossary, where you will find a breakdown of all the essential jargon.

- Bet size – This decides how much you will stand to make or lose for every point of movement in the price of your market. It is also known as stake size.

- Spread/Bid/Offer spread – The financial spread is the difference between the buy and sell price for a particular bet. The spread will usually be based on live market data.

- Controlled risk bet – This is when you limit your maximum loss through a guaranteed stop. This could be triggered by a major news event, for example. This will prevent you from suffering a much larger than expected loss. You will normally pay a premium to place a controlled risk bet.

- Down bet – This is when you place a spread bet with the anticipation a price will fall for a financial instrument. For example, if you believe the price of aluminium is going to plummet, you’d place a sell bet at the bid price.

- Up bet – You’ll place an up bet on a market when you think the price will climb. For example, you’d place an up bet in the UK FTSE 100 or 250 market if you think the FTSE price will rise. You will buy at the ‘ask’ price, which is the higher price of the quoted spread.

- Expiration – The expiry date is when the bet will close. On expiration, your bets will be settled at the relevant closing price and specified time.

- NMS (Normal Market Size) – Today it is more commonly known as Exchange Market Size and represents the exchange-specified quantity of shares that a spread betting market maker is compelled to quote a two on, in a certain underlying market.

- Slippage – This represents the difference between the level of a stop order and the actual price it is executed. Slippage can take place during periods of high volatility. A guaranteed stop is an effective way to prevent slippage.

Bottom Line

Spread betting effectively reduces the financial entry barrier for beginner traders and provides a diverse alternative market. While the allure and risks of excessive leverage remain a prominent concern in spread betting, the modest initial capital requirement, the availability of risk management tools, and tax advantages render it an attractive option for speculators.

Use our rankings of the best spread betting brokers to get started.

FAQ

How Does Spread Betting Trading Work?

Spread betting is a trading product where you speculate on the price movement of various assets, such as stocks, commodities, or currencies, without owning the underlying assets.

It involves making bets on whether the price of an asset will rise or fall, with profits or losses determined by the accuracy of the prediction.

What Is The Difference Between Spread Betting And CFDs?

Spread betting and CFDs are leveraged financial instruments that allow you to speculate on the price fluctuations of financial markets, but they employ distinct mechanisms.

In spread betting, you place a wager by staking a specific amount per point based on your market prediction, while CFDs involve trading contracts that entail exchanging the price difference of an asset from the moment you initiate the position to when you terminate it.

What Countries Allow Spread Betting?

The UK and Ireland are well-known for offering spread betting, and it is a popular form of trading in these countries. However, spread betting is also available in some other countries, including Australia and South Africa, where it is regulated.

The availability and regulation of spread betting can vary, and it is not currently permitted in the United States.

Is Spread Betting More Profitable Than Stock Trading?

The profitability of spread betting versus stock trading depends on individual trading strategies, market conditions, and risk management.

While spread betting offers tax advantages and the potential for leverage, it also carries higher risks.

Is Spread Betting Tax Free?

Spread betting profits are usually treated as gambling returns and therefore do not incur a tax liability. Spread bets are exempt from capital gains tax in the UK, for example, which means you’re not liable for tax on your profits, unlike in traditional share dealing. Additionally, there’s no stamp duty to be paid.

With that said, the circumstances of each individual make it prudent to check with a professional tax advisor early on. Also, there is no guarantee that tax laws won’t change in the future.

Recommended Reading

Article Sources

- The Financial Spread Betting Handbook, 3rd Edition, Malcolm Pryor, 2017

- Financial Spread Betting For Dummies, Vanya Dragomanovich, David Land, 2013

- The Beginner's Guide to Financial Spread Betting, Michelle Baltazar, 2010

- Pepperstone - Spread Betting Trading

- OANDA - Spread Betting Trading

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com