Options Strategies for High Volatility

In periods of high market volatility, options strategies can be used to take advantage of or hedge against large price movements.

We cover several such strategies in this article.

Key Takeaways – Options Strategies for High Volatility

- Options Strategies for High Volatility

- Long Straddle

- Long Strangle

- Inverse Iron Condor

- Modified Butterfly Spread

- OTM Options

- Customized Exposures

- Plus, strategic considerations.

Here are some strategies suitable for high volatility conditions:

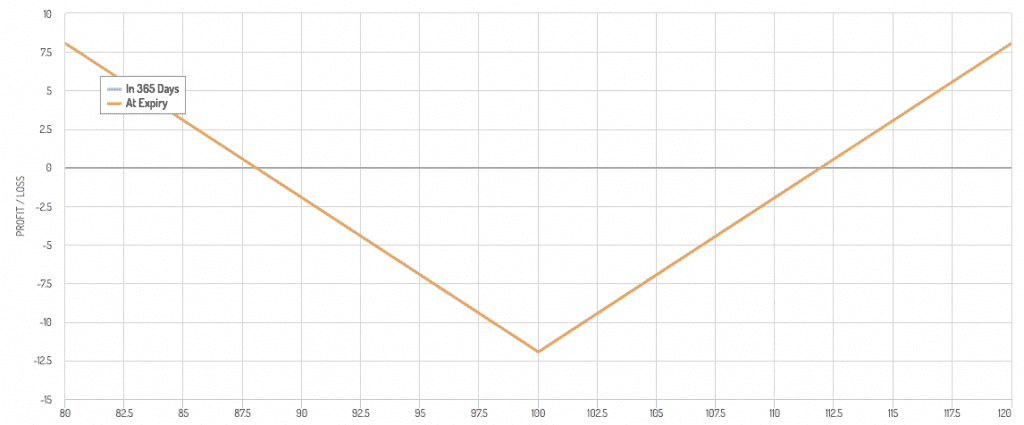

1. Long Straddle

Involves buying both a call and a put option at the same strike price and expiration date.

Rationale

Benefits from large moves in either direction.

High volatility increases the potential for significant price swings.

Risk/Reward

Unlimited potential profit with the risk limited to the premium paid for the options.

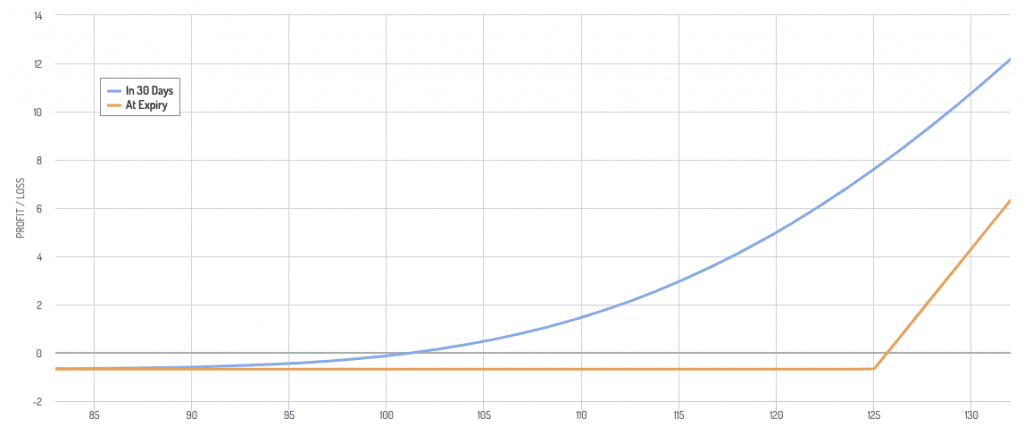

Payoff Diagram

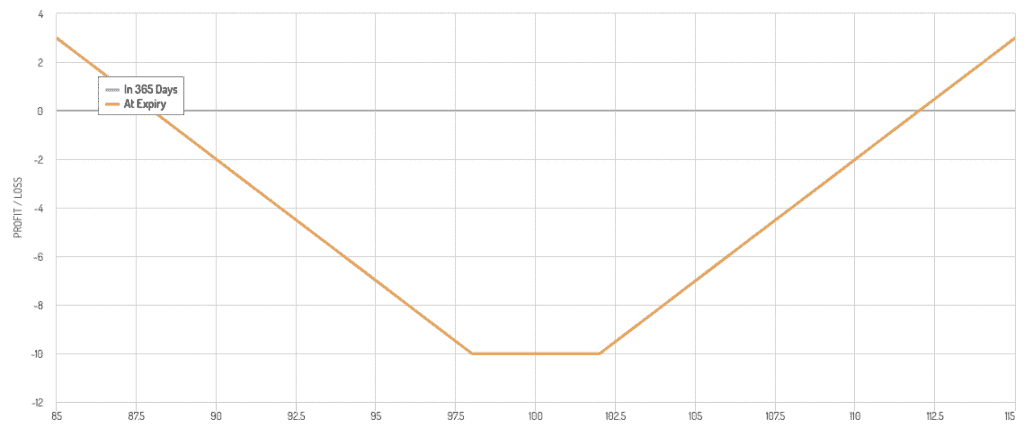

2. Long Strangle

Similar to a straddle but the call and put options have different strike prices, both out of the money.

Rationale

A cheaper alternative to a straddle with potential for profit in large price movements.

Risk/Reward

Like the straddle, the maximum risk is the premium paid, with potentially unlimited upside.

Payoff Diagram

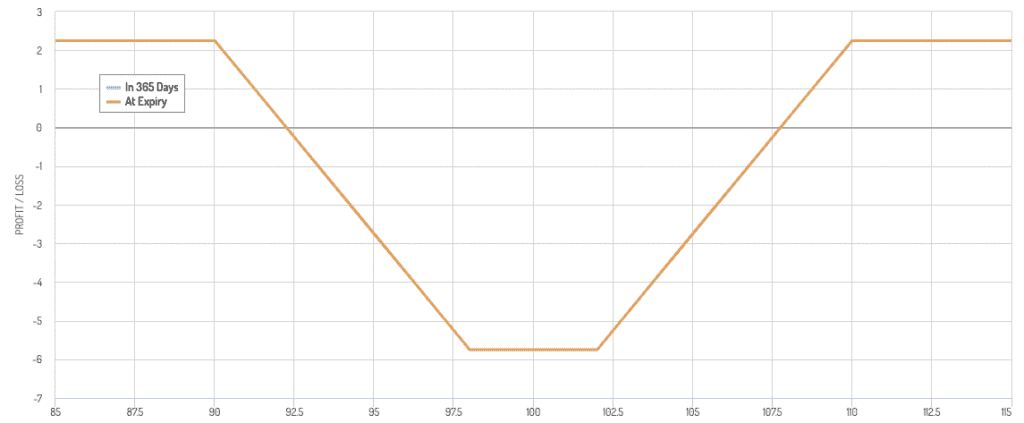

3. Inverse Iron Condor

A combination of a bull put spread and a bear call spread, typically using out-of-the-money options.

Rationale

The normal iron condor capitalizes on low volatility, but can be adjusted for high volatility by widening the distance between strike prices.

Risk/Reward

Limited profit potential and defined risk.

Profitable if the underlying stays between the two spreads.

Payoff Diagram

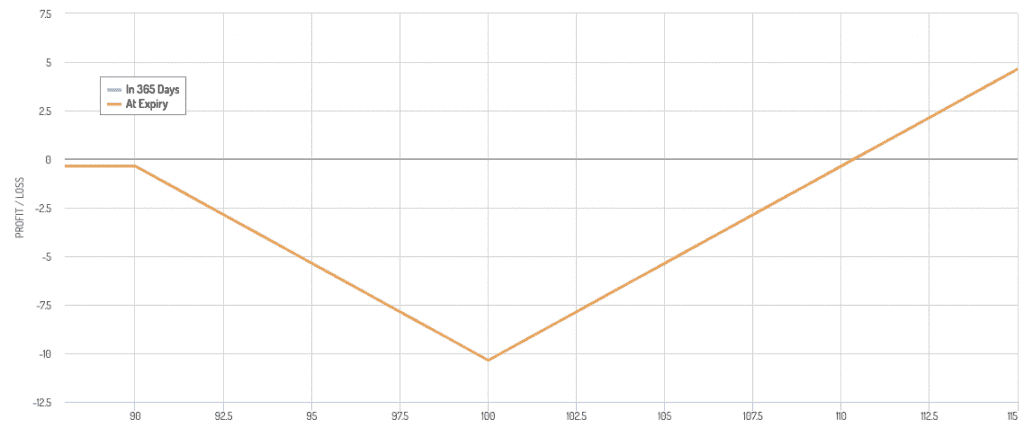

4. Modified Butterfly Spread

Involves buying and selling options at three different strike prices..

Rationale

Can be structured to profit from volatility by adjusting strike prices.

Risk/Reward

Limited risk (the net premium paid) and potentially high profit.

Payoff Diagram

This is structured using:

- Sell 90 Put

- Buy 100 Put

- Buy 100 Call

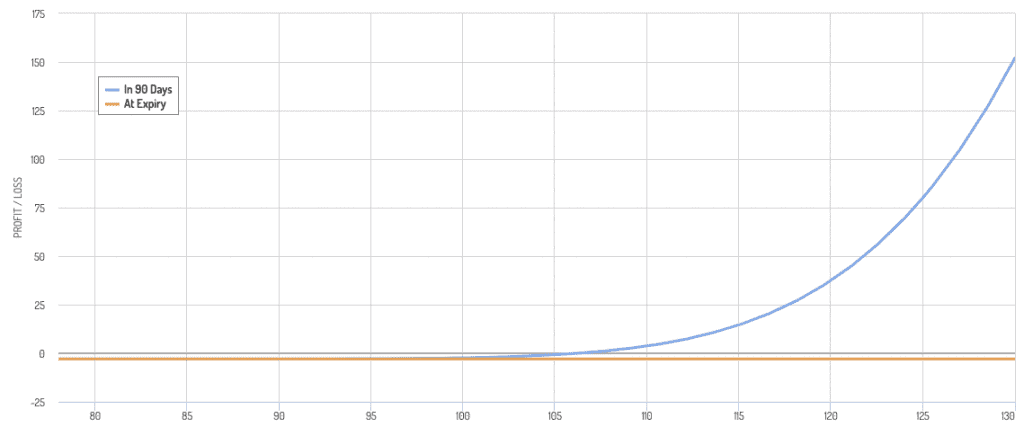

5. OTM Options

Out-of-the-money (OTM) options enable you to pay a little for a lot of upside.

Rationale

Doesn’t risk too much capital and can potentially pay out a lot.

Risk/Reward

Your probability of making a lot is small, but the trade-off is that you don’t lose much.

You also don’t need the options to land in-the-money, just move in that direction within a reasonable timeframe.

Payoff Diagram

Of course, the larger the convexity, the more the potential pay out at the trade-off of a lower chance of making money.

For someone who needs consistent income from the market, this is unlikely to be a desirable strategy.

For day traders, it can be attractive because they can buy more as prices fall and trim as prices rise.

It can also be used in the context of the barbell trading strategy, where 70%-85%+ is kept in safe/safe-haven assets (e.g., Treasury bonds, inflation-linked bonds, safe corporate credit, gold) and the other portion is put into high-risk/high-reward strategies like OTM options, startups, etc.

6. Customized Exposures

When you first start out in options trading, you learn the basic structures.

Then you can get creative and start designing your own for better customization.

Rationale

Standard structures may not fit your goals and you’ll need to tailor them.

Risk/Reward

Depends on the design.

Everything has trade-offs.

Strategic Considerations

Volatility Measurement

Usee metrics like the implied volatility (IV) to gauge market expectations of future volatility.

High IV typically indicates expected large price movements.

Market Analysis

Beyond volatility, consider the underlying markets and economic indicators to inform strategy choice.

Risk Management

High volatility strategies often come with significant risk.

Accordingly, position sizing, diversification, and prudent use of options should be used to manage potential losses.

Implementation

Timing

Entry and exit timing are important in high volatility environments as conditions can change rapidly.

Adjustments

Be prepared to adjust or close positions as market conditions evolve to manage risks and lock in profits.

In using these strategies, traders should be cognizant of the cost of options (premiums), which tend to be higher in volatile markets due to the increased risk of large price movements.

Diversification and Options in Portfolio Management

Principle of Diversification

Spreading investments across various asset classes, sectors, and geographies reduces the risk of significant loss from a single investment’s poor performance.

Volatility Offset

Assets with low or negative correlations can counterbalance each other’s price movements.

This can lead to more stable overall portfolio performance.

Integrating Options for Better Portfolio Management

Ways to use options for high volatility environments:

1. Options for Risk Management

Hedging with Options

Options can be used to hedge against potential losses in the portfolio.

For instance, purchasing put options on stocks or indices can protect against downside risk.

Strategic Use

Options can be tailored to the specific risk profile and objectives of the portfolio.

They can provide flexibility in managing exposure to market movements.

2. Creating Synthetic Positions

Synthetic Exposure

Options can replicate the payoff of a stock position while potentially using less capital.

For example, a synthetic long position can be created by buying a call option and selling a put option with the same strike price and expiration.

Adjusting Portfolio Balance

Synthetic positions through options allow for adjusting the risk and return profile without altering the underlying asset composition significantly.

Portfolio Diversification with Options

How to use options for improve return-to-risk.

Incorporating Options in a Diversified Portfolio

Options and Volatility as a Separate Asset Class

Options and volatility can be considered a distinct asset class within a diversified portfolio.

This is because they can add extra layers of risk management and return potential that can be uncorrelated to other things (when designed appropriately).

Related: Volatility Risk Premium (VRP)

Enhancing Diversification

Options strategies like writing covered calls or selling cash-secured puts can generate income and effectively reduce the portfolio’s overall volatility.

Options for Strategic Allocation

Dynamic Allocation

Using options, traders can dynamically adjust their market exposure without the need to significantly rebalance the core holdings.

Tail Risk Hedging

Options are useful for hedging against extreme market movements (tail risks), and can protect the diversified portfolio against unexpected significant downturns.

Implementation & Considerations

Consistency with Your Goals

The use of options should align with your broader financial objectives, risk tolerance, and time horizon.

Skill and Knowledge Requirements

Effective implementation of options strategies requires a good understanding of these instruments and their risks.

Monitoring and Rebalancing

Active Management

Options strategies often require more active management compared to traditional buy-and-hold strategies, including monitoring markets and adjusting positions as necessary.

This makes them a better fit for day traders than those following longer-term styles like position trading or investing.

Cost and Complexity

Options can add value to a diversified portfolio, but they also introduce additional costs (like premiums and wider spreads) and complexity (e.g., knowledge of Greeks).