Moneta Markets Review 2025

Awards

- 10 Best Companies To Watch 2021

- Best Forex Broker For Beginners 2021

- Best Forex Broker For Professionals 2021

- Most Advanced CFD Trading Platform 2020

Pros

- Registering for an account with Moneta Markets is quick and easy through the digital sign-up process, taking just a few minutes with an accessible $50 minimum deposit.

- Moneta Markets makes account funding a breeze, with plenty of account currencies, zero transfer fees and a wide selection of traditional, digital and now crypto-backed payment methods.

- The broker offers competitive leverage rates of up to 1:1000, allowing experienced day traders to amplify their positions and potentially increase their returns.

Cons

- While trading costs are generally competitive, index CFDs feature fairly high spreads especially on US products like the S&P 500, trailing IC Markets during testing.

- Clients need an account balance of at least $500 to access educational materials, a serious drawback for beginners who can get free materials from brokers like IG and eToro.

- The best pricing is reserved for traders who deposit $20,000 for the ECN Ultra account, putting it out of reach for most retail investors.

Moneta Markets Review

This Moneta Markets review provides an in-depth exploration of the day trading journey, informed by firsthand testing and comparisons with alternatives drawn from our database of 500 brokers.

Regulation & Trust

3.5 / 5Moneta Markets operates under three distinct entities, each subject to varying regulatory oversight. Depending on your country of residence, you will trade with the corresponding subsidiary.

- Moneta Markets International Pty Ltd acts as a corporate authorized representative of AGC Capital Securities Pty Ltd, regulated by the Australian Securities & Investments Commission (ASIC) – a ‘green-tier’ regulator.

- Moneta Markets South Africa (Pty) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) of South Africa – a ‘yellow-tier’ regulator.

- Moneta Markets Ltd is regulated by the Financial Services Authority (FSA) of the Seychelles and registered under the Saint Lucia Registry of International Business Companies – a ‘red-tier’ regulator.

While less stringent regulation allows traders to access higher leverage and deposit bonuses, it comes with the trade-off of reduced client fund protection schemes and less robust regulatory oversight.

However, Moneta Markets takes measures to ensure maximum security for client funds. Traders’ capital is held in segregated accounts with NAB (National Australian Bank) and negative balance protection is guaranteed to prevent losses resulting from trade abuse.

Moneta Markets

Dukascopy

Interactive Brokers

Regulation & Trust Rating

Regulators

ASIC, FSCA, FSA

FINMA, JFSA, FCMC

FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Accounts & Banking

3.5 / 5Live Accounts

Moneta Markets offers STP and ECN accounts:

- The STP Direct account offers direct access to the interbank market, with the advantage of zero-commission trading. The broker marks up the spread, which starts at 1.2 pips. With a minimum deposit of just $50 and no deposit fees, this option is geared towards beginners and traders with lower net worth.

- The ECN Prime account offers spreads starting as low as 0.0 pips on major assets, thanks to the network’s automatic sourcing of the best deals from multiple liquidity providers. This setup should appeal to scalpers, day traders, and those utilizing expert advisors. Moneta Markets charges a $3 commission per lot per side for ECN trades, coupled with a minimum deposit requirement of $50.

- The ECN Ultra account offers equally tighter spreads but with industry-low commissions of $1. The catch is the steep $20,000 minimum deposit, making it only viable for high-volume day traders and professional investors.

There is also a swap-free account, specifically tailored for clients whose religious beliefs prohibit interest payments. Instead of accruing overnight interest charges, traders with this account incur a daily administration fee based on their account balance.

Moneta Markets has also introduced a solution known as PAMM (Percentage Allocation Management Module), which caters to money managers, allowing for an unlimited number of managed accounts.

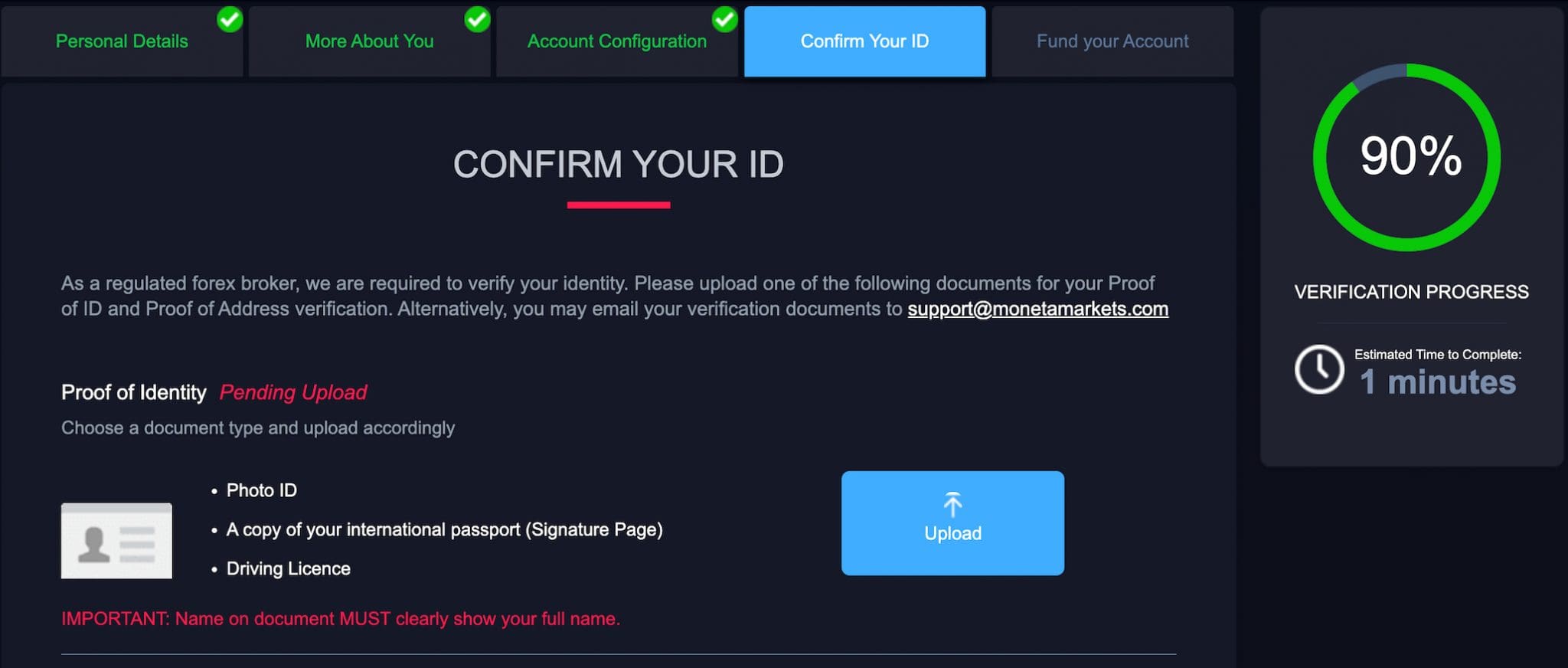

One aspect that stands out during my hands-on experience with Moneta Markets is the swift and entirely digital account opening process.

Living up to its commitment to rapid sign-up, I found that the account opening took less than 5 minutes, streamlining the setup phase.

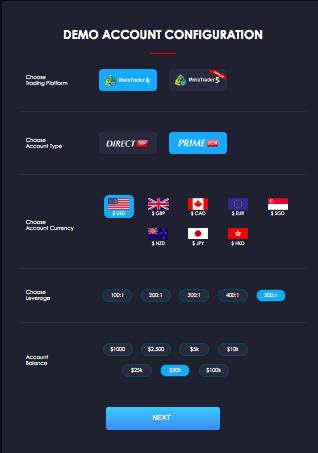

Demo Accounts

Moneta Markets offers a risk-free demo account compatible with both the MetaTrader 4 and Pro Trader platforms.

However, it’s only available for 30 days – not long enough to thoroughly test strategies before risking real capital. As a comparison, alternatives Vantage and AvaTrade offer unlimited demo accounts.

Deposits & Withdrawals

Moneta Markets provides an excellent range of options for deposits, including wire transfers, credit and debit cards, FasaPay, JCB, and SticPay, all at no cost. There’s even an option to deposit with crypto.

It also offers the convenience of being able to transact in 9 base currencies – USD, EUR, GBP, JPY, SGD, CAD, HKD, NZD, and BRL – with wire transfers clearing within 2-5 business days, while other methods offer instant deposits.

When it comes to withdrawals, international wire transfers incur a minimum fee of $20. Processing times typically take up to one business day for most methods, although wire transfers experience slightly longer wait times.

Trading Promotions

Depositing between $500 and $1,000 into your Moneta Markets trading account entitles you to a 50% deposit bonus. Deposits exceeding $1,000 qualify for an additional 10% bonus, capped at a total bonus credit of $20,000.

However, I quickly learned that bonus credits can’t be withdrawn, and any profits earned will be reflected in your account balance, while losses will first be deducted from your real deposited funds, followed by the trading credit.

Additionally, a free VPS is available for traders who deposit $500 and trade 5 forex lots per month. This is a great perk if you want to run Expert Advisors (EAs) 24/7 with faster execution speeds and no downtime.

Moneta Markets

Dukascopy

Interactive Brokers

Accounts & Banking Rating

Payment Methods

Bitcoin Payments, Credit Card, FasaPay, JCB Card, Mastercard, Sticpay, Visa, Wire Transfer

Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer

ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer

Minimum Deposit

$50

$100

$0

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Assets & Markets

3.5 / 5Moneta Markets offers fairly extensive market coverage of over 1,000 instruments. Their selection of stocks, forex, and commodities is particularly robust.

- You can trade 56 currency and metal pairs, including popular pairs like EUR/USD, AUD/USD, GBP/USD, USD/JPY, etc, and XAU/USD, which is about half the amount on offer at Fusion Markets.

- Additionally, there are opportunities to speculate on over 15 commodities, such as natural gas, oil, and coffee, which again is about half the amount compared to Fusion Markets.

- Traders can also engage with 43 cryptos, including Bitcoin, Ethereum, and Ripple. However, cryptocurrency trading is solely accessible through CFDs, so trading the underlying asset is presently not feasible.

- You can also take positions on some of the largest global stock index CFDs including the SP500, FTSE, DAX, NIKKEI, HANG SENG and more. Moneta Markets also provides access to over 844 global stock CFDs, which is an excellent choice.

- Moreover, traders can access over 50 popular ETFs including VanEck Gold Miners, and iShares Global Clean Energy.

- Traders can also speculate on 6 bond CFDs, including UK Long Gilt Futures and the US 10-year T-Note Futures.

On a more critical note, Moneta Markets lacks passive income options such as earning interest on unused account balances, a feature available with competitors like eToro, offering up to 5.3% on cash balances.

Leverage

Retail clients are offered leverage rates of up to 1:1000. While the highest leverage is available on most major forex pairs and several notable minor swaps, some minor and exotic pairs are capped at levels as low as 1:10. For indices CFDs futures, leverage of 1:500 is supported, while cash indices are limited to 1:33.

European and UK stock CFDs are leveraged up to 1:20, while US companies can be traded with leverage of 1:33. In the case of commodities, leverage rates are capped at 1:500 for gold, 1:100 for silver, and 1:30 for copper.

Soft commodities, on the other hand, can be traded with leverage of 1:50, while energies are limited to 1:33.

Moneta Markets

Dukascopy

Interactive Brokers

Assets & Markets Rating

Trading Instruments

CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto

CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options

Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies

Margin Trading

Yes

Yes

Yes

Leverage

1:1000

1:200

1:50

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Fees & Costs

3.8 / 5Moneta Markets offers competitive fees across their trading accounts, with costs varying depending on the account type and instrument. One notable aspect is the absence of account, inactivity, or deposit fees, which is a refreshing change from many platforms.

For ECN accounts, Moneta Markets provides the most competitive fees, with spreads starting from 0.0 pips and a low round-turn fee per lot on most assets.

During testing, I observed that the EUR/USD currency pair could be traded from 0.0 pips with a $3 commission per lot, per trade. While slightly more expensive than Fusion Markets’ $2.25 commission per lot per trade with a zero spread, the competitive fees offered by Moneta Markets are still appealing.

Traders opting for the STP account may encounter higher spreads. For example, the EUR/USD currency pair typically has an average spread of 1.56 pips. However, since there are no commission fees associated with this account, the overall cost structure differs, making it a viable option for certain trading strategies.

Trading US stock CFDs incurs no charges, and there are no minimum commissions on UK and EU stocks, which are set at 0.1% of the nominal value on all trades. This affordability makes it an attractive option for stock trading.

On the downside, spreads on indices are less favorable, with a typical spread of 3.0 for the S&P 500, considerably higher than the typical spread of 0.2 at IC Markets.

| Moneta Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.26 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 13.33 | 100 | 0.005% (£1 Min) |

| Oil Spread | 2.90 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.3 | 0.1 | 0.003 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4.3 / 5Moneta Markets offers a few platform choices – their proprietary ProTrader and MT4/5. The broker caters to the diverse needs of day traders by providing support for web trading, mobile apps, and standalone programs.

ProTrader

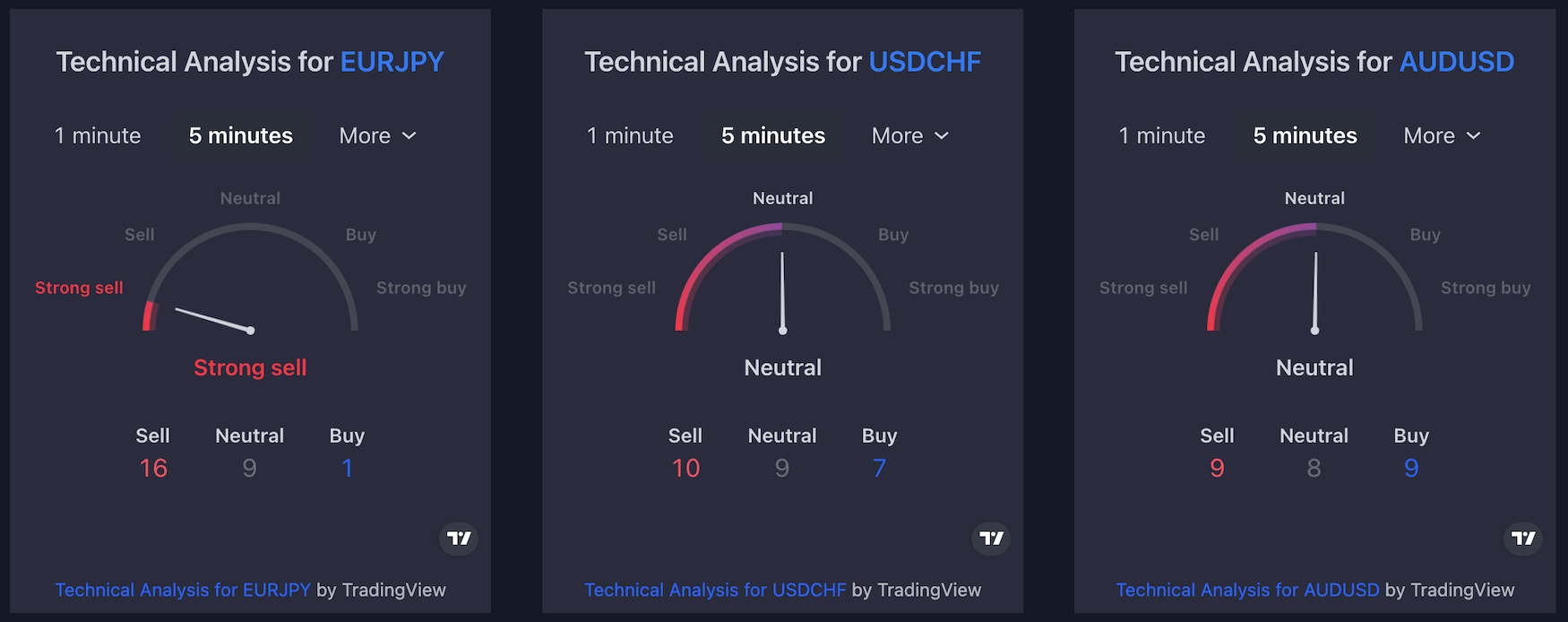

Moneta Markets’ ProTrader, a web-based system powered by TradingView, offers access to over 300 CFD products.

While it provides comprehensive charting tools and indicators, including advanced order functionalities like preset stop loss and take profit levels, I’ve noticed some limitations compared to the full TradingView version. For instance, time frames lack seconds or ranges, and community scripts (indicators) cannot be added.

Despite these drawbacks, the platform’s user-friendly interface integrates account management tools seamlessly, allowing me to monitor profit and loss, deposit funds, and execute trades with ease.

MetaTrader

The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are a familiar choice for experienced traders, renowned for their reliability and extensive features.

With ultrafast execution speeds as quick as 1 ms, MetaTrader helps ensure short-term traders don’t miss trading opportunities.

Integration of user-designed indicators and expert advisors (EAs) through the extensive MQL4 marketplace further enhances its appeal. Available for download on Windows, Mac, and Linux, MetaTrader offers accessibility and functionality across multiple devices.

CopyTrader

For beginner traders, Moneta Markets offers social trading through the CopyTrader app, providing access to hundreds of strategy providers whose trades can be automatically replicated.

With a minimum account balance requirement of $100 or equivalent, traders can copy signal providers or become signal providers themselves.

Additionally, access to ZuluTrade, a popular third-party social and copy trading platform, further enhances the social trading experience offered by Moneta Markets.

Moneta Markets

Dukascopy

Interactive Brokers

Platforms & Tools Rating

Platforms

AppTrader, ProTrader, MT4, MT5, TradingCentral

JForex, MT4, MT5

Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

Mobile App

iOS & Android

iOS & Android

iOS & Android

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Research

4 / 5Third-party research content is accessible on the Moneta Markets’ platform, complemented by daily in-house articles, trade ideas, and video content from the Moneta TV series.

Moneta Markets users have access to a wide range of third-party research tools, including Trading Central. Available exclusively to live account holders, it offers third-party research aimed at identifying trading opportunities by continuously monitoring financial markets.

It provides real-time alerts for both opportunities and risks and can be accessed conveniently through the client portal or supported trading platforms including MetaTrader.

My favorite features are the Market Sentiment, which enables me to gauge other traders’ sentiments by showing me the percentage of traders going long or short, as well as the Economic Calendar which updates me with news and events impacting the global markets.

There’s also a Market Buzz tool that can help pinpoint what drives the global market through real-time news coverage and media content.

This comprehensive data can assist in identifying entry and exit points, formulating trade scenarios, and validating strategies using indicators.

| Moneta Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.3 / 5Clients with an account balance surpassing $500 are rewarded with complimentary access to the Markets Masters course, a comprehensive resource comprising over 100 trading tutorials.

Delving into the course content, I’ve found it to be well-presented and easy to grasp, covering essential topics such as trading fundamentals, technical analysis, and various trading techniques.

The video-based format makes learning convenient and engaging, providing beginner traders with a solid foundation to elevate their trading knowledge and skills.

| Moneta Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4 / 5Top-tier brokers cater to diverse client needs by offering various support options. Moneta Markets exemplifies this by providing multiple channels for queries and complaints.

Their support team is available round-the-clock during the 24/5 forex and CFD markets’ operating hours, reachable via email, phone, as well as a live chat feature.

Moneta Markets

Dukascopy

Interactive Brokers

Customer Support Rating

Visit

Visit

Visit

Visit

Review

Review

Review

Review

Should You Trade With Moneta Markets?

Moneta Markets offers extensive forex and CFD trading opportunities globally, with benefits including a 50% deposit bonus and high leverage for all clients.

It offers competitive fees, particularly with its ECN account and it is well-suited for intraday trading. Additionally, traders can access two copy trading platforms for potentially lucrative passive income.

FAQ

Is Moneta Markets Legit Or A Scam?

With over 70,000+ active clients and monthly trade volumes of over $100 billion, Moneta Markets is not considered a scam and can be considered a legitimate online broker. Its entities ensure the segregation of client funds and offer negative balance protection.

Is Moneta Markets A Regulated Broker?

Moneta Markets operates under various regulatory authorities depending on the jurisdiction, ensuring compliance with financial regulations. These include the ASIC in Australia, the FSCA in South Africa and the FSA in Seychelles.

Is Moneta Markets Suitable For Beginners?

Moneta Markets is suitable for beginners due to its choice of trading platforms, demo accounts for practice and a range of educational materials to help beginners learn the basics of trading.

Additionally, their excellent customer support team is available to assist with any questions or concerns.

Is Moneta Markets A Good Broker For Day Trading?

Moneta Markets is a suitable broker for day trading due to its terrific charting platforms, ECN pricing, and access to leveraged derivatives.

The trading platforms offer good reliability and excellent execution speeds, but there’s no support for trading using the popular TradingView and cTrader platforms.

Top 3 Alternatives to Moneta Markets

Compare Moneta Markets with the top 3 similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Moneta Markets Comparison Table

| Moneta Markets | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 4.4 | 3.6 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $100 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, FSCA, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | 50% Cashback Bonus, Free VPS | 10% Equity Bonus | – | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | AppTrader, ProTrader, MT4, MT5, TradingCentral | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:200 | 1:50 | 1:1000 |

| Payment Methods | 8 | 11 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Moneta Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Moneta Markets | Dukascopy | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | Yes | No | No |

Moneta Markets vs Other Brokers

Compare Moneta Markets with any other broker by selecting the other broker below.

Customer Reviews

4.5 / 5This average customer rating is based on 2 Moneta Markets customer reviews submitted by our visitors.

If you have traded with Moneta Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Moneta Markets

Article Sources

- Moneta Markets Website

- Moneta Markets International Pty Ltd - ASIC License

- Moneta Markets South Africa (Pty) Ltd - FSCA License

- Moneta Markets Ltd - FSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m a long tiome user and fan of Moneta Markets. Their Pro Trader platform is about as good I think it gets for short-term trading. You get over 100 TIs and over 20 chart layouts. You can also have 12 charts open at same time which works well with my three screen setup. Because they deliver real-time news in the software too you’re not jumping between various sites and programs all the time like I did back in the day. I’ve learned quite a lot from their Market Masters series too where there;’s loads of videos on pro trading strategies.

Eu tive e tenho uma ótima percepção da corretora. Ela é rápida e segura, e apenas eu posso sacar o meu dinheiro com o meu CPF, o que me deixa mais tranquilo. Os saques são praticamente instantâneos, o que me transmite uma grande segurança. Não tenho nada a reclamar da corretora e estou muito feliz com os seus produtos e com o que ela entrega.

I had and have a great impression of the brokerage. It is fast and secure, and only I can withdraw my money with my CPF, which makes me feel more at ease. Withdrawals are practically instantaneous, which gives me great security. I have nothing to complain about the broker and I am very happy with its products and what it delivers.