FOREX.com Review 2025

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

FOREX.com Review

This FOREX.com review examines the advantages and drawbacks of trading with one of the leading forex and CFD brokers. We’ve analyzed the elements prospective day traders should consider before opening an account, including thoroughly testing the platform and highlighting the standout features.

Note, the products and services available to you at FOREX.com will depend on your location, and on which of its regulated entities holds your account.

CFDs and equities are not available to trade for US clients.This is an independent review and has not been influenced by the broker. FOREX.com has only provided general information about its services and offerings to ensure factual accuracy. All opinions expressed in this review are solely those of the reviewer.

Regulation & Trust

4.9 / 5FOREX.com is one of the most trusted brokers. It’s authorized by 10+ regulators, 9 of which are ‘Green Tier’ (NFA, CFTC, CIRO, FCA, CySEC, ASIC, SFC, FSA, and MAS), demonstrating a commitment to high standards of investor safeguarding.

FOREX.com is regulated by the following financial bodies:

- US National Futures Association (NFA) and US Commodities Futures Trading Commission (CFTC)

- Canadian Investment Regulatory Organization (CIRO)

- UK Financial Conduct Authority (FCA)

- Cyprus Securities & Exchange Commission (CySEC)

- Australian Securities and Investments Commission (ASIC)

- Hong Kong Securities and Futures Commission (SFC)

- Japan Financial Services Agency (FSA)

- Monetary Authority of Singapore (MAS)

- Cayman Islands Monetary Authority (CIMA)

The CIMA regulation, in particular, has led to huge growth for the brand in the Middle East, across Africa, South and Central America and South Asia.

Its parent company, StoneX Group Inc, is also listed on the Nasdaq stock exchange (NASDAQ: SNEX), underscoring its legitimacy.

Client funds are held separately from the company’s capital, ensuring protection in case of financial difficulties in the case of the brokerage. Additionally, UK clients benefit from asset protection through the Financial Services Compensation Scheme (FSCS), offering coverage up to £85,000, while Canadian clients enjoy protection up to $1,000,000 through the Canadian Investor Protection Fund (CIPF).

FOREX.com provides negative balance protection, a requirement under ESMA regulations implemented in 2018, for its UK/EU clients.

Unlike other brokers that offer ‘just’ two-factor authentication (2FA), FOREX.com provides both 2FA and biometric authentication options for its mobile application, ensuring a secure environment.

On the downside, US clients do not receive negative balance protection to safeguard their funds. While fairly common, this means that US traders facing negative account balances may find themselves owing more money than their initial deposits, increasing the level of risk.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | NFA, CFTC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Accounts

For US traders, there are three live accounts to choose from; ‘Standard’, ‘Raw Pricing’, and ‘MetaTrader 4’.I recommend the ‘Standard’ profile for users looking to trade forex with traditional spread pricing from 1.0 pip. There are zero commissions and a good selection of extra features not found at many alternatives, including signals, technical insights, Reuters news, and integrated calendars.

The ‘MetaTrader 4’ account will serve traders familiar with the MT4 download. It offers the same variable spreads from 1.0 pip, along with technical insights, market research, analyst views, and more.

The ‘Raw Pricing’ solution is a better fit for day traders seeking very low spreads from 0.0 pips with a $7 per 100k fixed commission. This essentially provides all the same perks as the Standard account but with tighter spreads.

Although the minimum deposit requirement is relatively low at $100, making this forex broker an appealing choice for beginners, some other competing brokers, notably Pepperstone and OANDA, have no minimum deposit.

I found setting up an account straightforward, and the entirely digital process can be completed in just a few minutes. The only potential delay lies in awaiting approval, which may take up to 48 hours depending on your time zone.

Before depositing, I recommend trying a demo account. One is accessible through the proprietary FOREX.com platform, while the other is an MT4 demo account. These accounts come preloaded with $10,000 in virtual funds but are frustratingly limited to 90 days.

Deposits & Withdrawals

FOREX.com lags behind many brokers in terms of deposit options. Payment solutions are dependent on your jurisdiction and are limited to credit/debit cards, a few e-wallets like PayPal, or wire transfers. US traders only have access to debit cards, ACH transfers and wire transfers.

Cards and PayPal deposits should appear in your account within seconds, while a wire transfer can take up to 2 business days.

FOREX.com doesn’t charge for deposits, but your card-issuing bank may charge you a cash transaction fee if it treats your transaction as a cash transaction.

Live accounts can be funded with 8 base currencies depending on your account jurisdiction, including USD, EUR, and GBP. This is better than most brokers, but not as accommodating as IG, which supports 12 different currencies.

Opening an account using your preferred base currency offers a significant advantage: you can avoid conversion fees when funding your trading account in the same currency as your bank account, or when trading assets denominated in the same currency as your trading account’s base currency.

You can fund your account quickly via the FOREX.com client portal. Simply select ‘Funding’ and then ‘Deposit’. Then just follow the on-screen instructions to complete the payment.

Similar to other brokers, the withdrawal process can be slower. Withdrawals can only be made to accounts under your name, and initially, you must use the same methods for withdrawals as for deposits.

Disappointingly, US and Canadian customers are charged a withdrawal fee (from $25) if their withdrawal is under $10,000.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $100 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Bonuses & Promotions

FOREX.com has introduced its VIP program with up to 10k+ in rebates to reward high-volume traders.To qualify, you will need to deposit at least $10,000 or trade $50 million in a calendar month.

This is a great loyalty program for serious day traders who want a personalized experience with highly competitive account conditions.

Assets & Markets

4.3 / 5FOREX.com specializes in forex and CFDs, which means that certain popular asset classes like real stocks, real ETFs, or options are not included.

Also be aware that the products and services are contingent upon your location and the regulated entity that oversees your account. For instance, CFD trading is prohibited in the US.

However, with a wide selection of instruments available, including currency pairs (80), stock index CFDs (17), stock CFDs (5,500), ETF CFDs (20), commodity CFDs (26), bond CFDs (12) and crypto CFDs (8), the brokerage provides excellent trading opportunities.

In particular, FOREX.com stands out for its extensive selection of currencies and shares, which surpass that of the vast majority of the almost 500 brokers we’ve tested, making the broker an excellent option for forex and stock traders.

FOREX.com also scores well in the investment offering department after enhancing its range of products in recent years, including bolstering its suite of stock CFDs in 2022 for Canadian clients.

Leverage

Leverage of up to 1:200 is offered (subject to regulatory limitations, capped at 1:30 in Europe and 1:50 in the US on forex, though you cannot take leveraged positions on spot gold and silver), with lot sizes starting from just 0.01.

I found the default leverage setting on the FOREX.com platform remains fixed at 1:50 and cannot be altered. However, MetaTrader 4 accounts allow for adjustments to leverage settings, with options ranging from 1:10 to 1:20.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Forex, Stock CFDs, Futures, Futures Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:50 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

4.6 / 5FOREX.com offers excellent pricing, particularly for active day traders.

Spreads on the EUR/USD start from just 0.0 pips alongside a competitive commission of $7 per $100k on the Raw Pricing account. This is a great option for active traders.The Standard and MetaTrader 4 accounts also offer tight variable spreads from 1.0 pips.

It is also worth noting that if you are part of the VIP program and deposit at least $10,000 while trading 30 standard lots per month, you can receive up to 10k+ in rebates.

Overall, when comparing FOREX.com to FXCM, OANDA, and other competitors, live pip spreads are comparable or better, particularly for major pairs like the EUR/USD.

Additionally, a currency conversion fee may be applicable for trades settled in a currency different from your account base, typically around +/-0.5% from the prevailing market price. Rollover rates apply for positions held overnight, commencing from 5PM (ET). Thankfully for day traders, this cost should be easily manageable.

In terms of non-trading fees, FOREX.com imposes a $15 (or base currency equivalent) inactivity fee after one year of no activity, although you can temporarily disable your account to avoid this penalty.

I would like to see FOREX.com introduce interest payments on cash balances. This is available at alternatives like eToro and Interactive Brokers, and provides a way to make money on idle funds.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 1.2 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.0 | 0.005% (£1 Min) | 100 |

| Oil Spread | 2.5 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.14 | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4.6 / 5FOREX.com provides a superb range of software, tailored to diverse trading styles and requirements.

My only criticism is that there is no copy trading service, an increasingly popular tool among aspiring traders, provided by alternatives like eToro.

Web Trader

Its proprietary web platform (also available as a desktop) stands out. It offers a user-friendly and customizable experience, making it a solid choice for those seeking convenience over technicality. The desktop platform has the same functionality as the web trading platform, but I do think the design feels outdated.

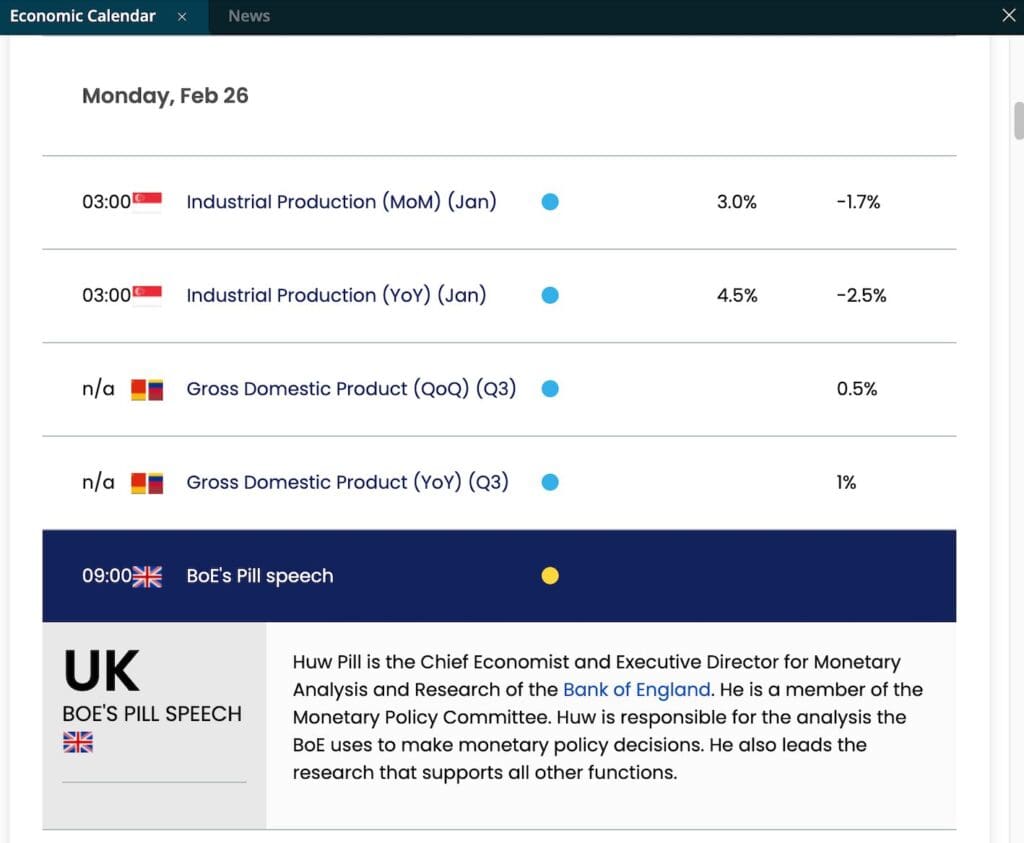

With 10 chart types and over 80 technical indicators, the platform is well-equipped for in-depth technical analysis, catering to day traders. Moreover, I appreciated the integrated economic calendar and account management features, which helped to streamline my trading activities within a single terminal.

Ultimately, the FOREX.com Web Trader is one of the best proprietary platforms that I’ve tested, especially if you are looking for a quick and easy-to-use platform.

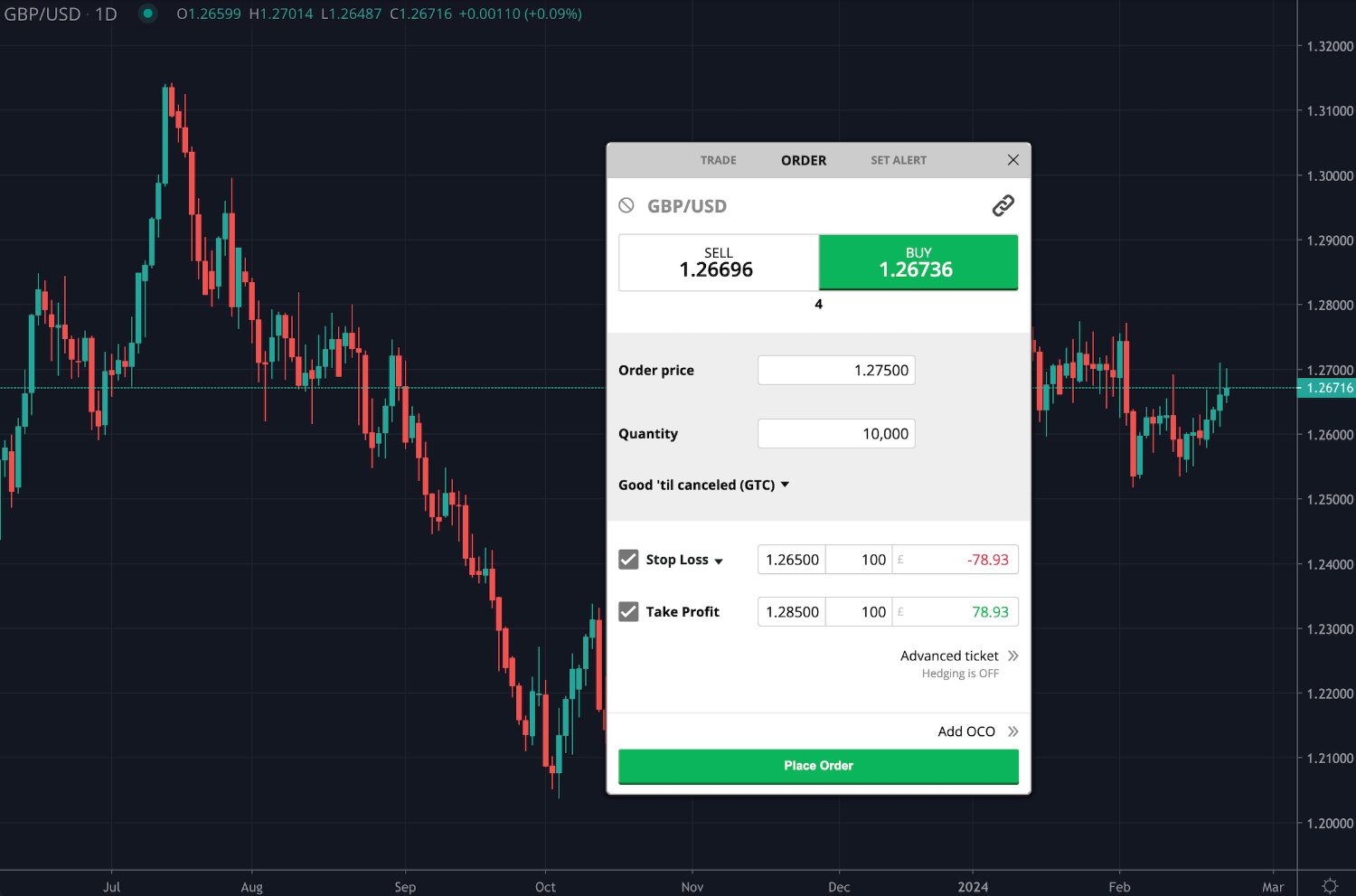

TradingView

FOREX.com also lets you trade directly from the superb TradingView platform, so you’ve got intuitive charting tools and visualization features with a high degree of customizability.

Among TradingView’s most notable features are financial market screening for identifying trading opportunities, dynamic alerts and notifications customizable for various factors, access to over 80 technical indicators, and the option to create custom solutions using PineScript.

Additionally, you can benefit from a community forum for discovering new ideas, receiving strategy feedback, and gaining insights, making it a great network for aspiring traders.

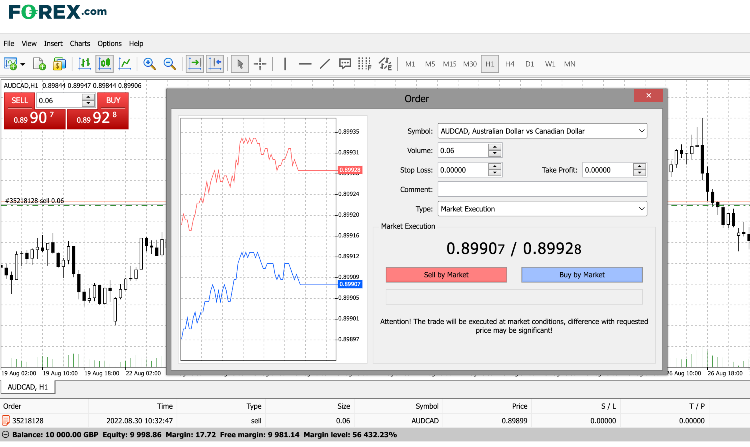

MetaTrader

Although my least favorite platforms due to their clunky and retro design, MetaTrader (MT4 and MT5) are extremely popular due to their extensive tools, customization options, and support for automated trading.

The software offers a comprehensive array of features, including heat maps, security screeners, built-in technical indicators, historical data, and more. A standout feature is the Expert Advisors (EAs), particularly favored by experienced traders seeking automated trading solutions.

FOREX.com offers the largest number of servers for hosting MetaTrader, surpassing other brokers globally. It provides MetaTrader Web and MetaTrader mobile platforms, along with various add-ons, establishing itself as a leading MetaTrader broker for software integration.

Another advantage of opting for MetaTrader is the abundance of online tutorials available, facilitating you in maximizing your utilization of the platform.

Apps

Once you open a FOREX.com account you will also be able to download their apps for Android and iOS devices.

While using FOREX.com’s app, I’m always pleasantly surprised by the full trading capabilities, advanced charts and integrated tools offered. You can set up alerts, access an economic calendar and utilize integrated Reuters news.

All apps have 26 indicators and 13 drawing tools. On top of that, scrolling between live quotes, charts and current positions is quick and easy.

The newest version of the app includes ‘dynamic trade ticket’ with risk management updated in real-time, orders set by price, pips and PnL and powerful new charting (including templates) provided by TradingView.

Upon testing, I found that on the side of the app, you can access support via phone or live chat. You will also find training videos within the application to help you make the most of the platform.

I particularly like the iPhone and iPad apps, where the sleek user interface really comes into its own.

You can easily view rates, market analysis and change your leverage from within the app. Depositing and withdrawals can also be made from within the application.

US traders can take advantage of a mobile app that FOREX.com have created alongside software developers FX Blue. The app is a single-click download, and offers extensive EA add-ons for the MT4 integration. Some of the best features include:

- Correlation Trader – Use correlation information to monitor markets and trigger trades

- Market Manager – Displays current portfolio, with PnL for each. Place new trades and order

- Trade Terminal – Pop-up dealing form enabling full access trading including the use of templates

- Correlation Matrix – Highlight your own correlations between markets, or assess hypothetical scenarios

- Sentiment Trader – Sentiment data from FXBlue.com. Judge current trader sentiment across markets

- Tick Chart Trader – Advanced tick charts including multiple configurable elements and volume/activity trackers

- Alarm Manager – Set up user-configurable alarms for your balance, margin, profit or loss, consecutive wins or losses, and many more. Ensure you are always up to date

- Mini Terminal – Set up orders ‘per pip’, set open positions, organize templates, risk calculators, and other trading tools

- Session Map – Shows the current active session with the user’s local time as a reference point. It also includes an integrated economic calendar and key market changes

Available across most mobile platforms, the EA can be downloaded here.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

4.8 / 5FOREX.com’s market analysis and insights exceed industry standards. It effectively consolidates its research resources within its own platform, ensuring easy access and organization.

You can access multiple news channels, automated pattern-recognition modules from Trading Central, and blog updates from FOREX.com’s global research team.

Reuters headlines stream continuously, and a Trading Central-powered economic calendar, Market Buzz, and Technical Insight are integrated.

What I really like is that FOREX.com also delivers high-quality written content daily, encompassing various markets and sector themes.

This includes weekly features such as the ‘Week Ahead’ series, as well as daily articles authored by in-house analysts and integrated resources from third-party providers. The result is a wealth of research tools to help you discover trading opportunities.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

4.5 / 5FOREX.com provides a superb variety of interactive courses, including training videos designed to enhance understanding of chart patterns and risk management.

What I find particularly useful about the educational material is that the courses can be filtered based on your experience (beginner, intermediate and advanced) and include progress tracking so you can conveniently continue your learning at a time that suits.

In addition to courses, lessons, Q&As and quizzes, the ‘Foundations of Forex Trading’ live webinar series covers useful topics such as market outlooks and trading Nonfarm payroll (NFP).

You can also benefit from quarterly outlooks, economic calendars, NinjaTrader access, Trading Central access, live daily market updates, comprehensive technical reports, and weekly insights on major financial events on the broker’s YouTube channel.

Expert analysis and insights into assets within the new markets pages are also provided. You can navigate to the ‘Pivot Points’ section for daily, weekly, and monthly support and resistance levels, while an alphabetized glossary of financial terms is available within the technical section.

I continue to be very impressed with the educational materials at FOREX.com and it’s definitely one of the best resources I’ve seen from a broker. The only drawback is that content, apart from technical analysis topics available, can only be accessed via the main website.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

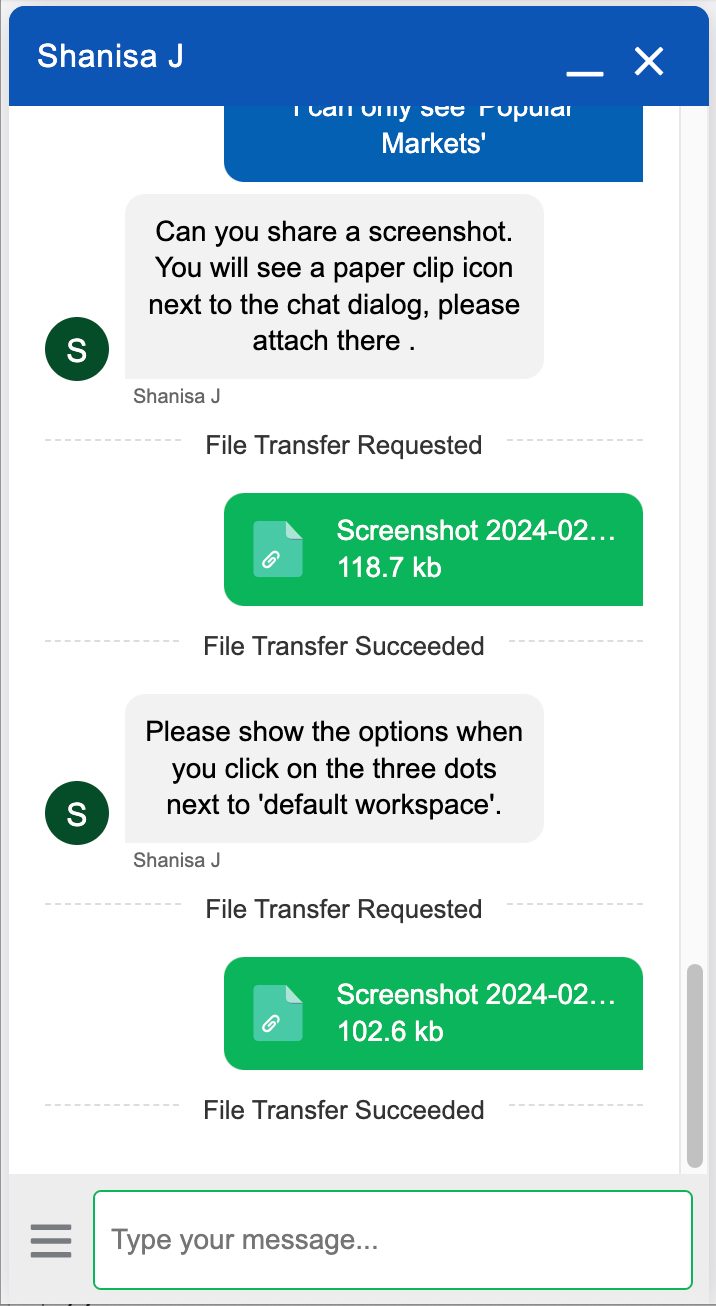

FOREX.com’s customer support services are outstanding and are offered 24 hours a day from Sunday 10am to Friday 5pm via telephone, email, or live chat.

Personally, I always head straight to live chat first to try and get issues resolved as quickly as possible. In my experience, engaging with FOREX.com’s online chat function has been commendable, although I have had to wait a few minutes for an agent to respond. My queries are always resolved, however, without having to send an email.

The broker’s customer service team is capable of addressing various issues, ranging from inquiries about minimum and maximum lot sizes to withdrawal concerns and leverage calculators. Additionally, they can assist with general complaints, questions about interest rates, operating hours, or web login problems.

The comprehensive FAQ page on the website, which is organized into major categories covering topics such as managing funds, opening an account, and trading with margin, is well written and is a great help.

| FOREX.com | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With FOREX.com?

FOREX.com is a reputable broker with a strong regulatory framework, a wide range of tradable assets, competitive pricing, and a user-friendly platform suitable for traders of all levels. It’s also made strides to widen its appeal globally, expanding into the Latin American market in recent years.

FOREX.com continues to rank among the best brokers, regularly enhancing its suite of instruments and trading tools.

FAQ

Is FOREX.com Legit Or A Scam?

FOREX.com is a legitimate and reputable brokerage firm. It has been in operation for over two decades, is regulated by multiple authorities in various jurisdictions, and has garnered a strong reputation within the industry.

While no brokerage is without its shortcomings, FOREX.com is widely recognized as a trustworthy platform for trading forex and other financial instruments.

Is FOREX.com A Regulated Broker?

Yes, FOREX.com is a regulated broker. It is registered with and overseen by multiple regulatory bodies across different jurisdictions, including the NFA and CFTC in the United States, the FCA in the United Kingdom, CySEC in the European Union, IIROC in Canada, ASIC in Australia, and FSA in Japan.

Is FOREX.com Suitable For Beginners?

FOREX.com is suitable for beginners due to its user-friendly proprietary platform (stay away from MetaTrader), educational resources, and access to demo accounts for practice. The broker also offers a relatively low minimum deposit requirement, allowing beginners to start trading with a smaller initial investment.

Does FOREX.com Offer Low Fees?

While specific fees may vary depending on the type of account and instruments, FOREX.com generally provides narrow spreads on currency pairs and low commissions. The absence of deposit and withdrawal fees, along with transparent pricing, also contributes to a cost-effective trading experience.

Is FOREX.com A Good Broker For Day Trading?

FOREX.com is a suitable broker for day trading due to its robust platforms, great range of tradable instruments, and competitive pricing. Its proprietary platform offers fast execution speeds, multiple order types, and a customizable workspace, catering to the needs of active traders.

However, more experienced day traders looking to scalp might need a broker with higher leverage to amplify potential profits.

Does FOREX.com Have A Mobile App?

FOREX.com’s proprietary apps, MetaTrader and TradingView are all available for both iOS and Android devices. FOREX.com’s app in particular lets you access your accounts, monitor market movements, place trades, and manage your positions from anywhere with an internet connection, while TradingView is the best option for charting and backtesting.

What Type Of Broker Is Forex.com?

Forex.com is an online broker offering CFDs and forex to retail investors around the world. Whilst it caters to a range of trading styles, based on our first-hand experience, we’ve found it’s best for serious day traders looking for fast, reliable execution.

Top 3 Alternatives to FOREX.com

Compare FOREX.com with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

FOREX.com Comparison Table

| FOREX.com | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 3.6 | 3.4 |

| Markets | Forex, Stock CFDs, Futures, Futures Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.0001 Lots |

| Regulators | NFA, CFTC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | GLOFSA |

| Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. | – | 10% Equity Bonus | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

| Education | Yes | Yes | Yes | No |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | Mobius Trader 7 |

| Leverage | 1:50 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 8 | 6 | 11 | 14 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

AZAforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by FOREX.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FOREX.com | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

FOREX.com vs Other Brokers

Compare FOREX.com with any other broker by selecting the other broker below.

The most popular FOREX.com comparisons:

- IQ Option vs Forex.com

- Binance vs FOREX.com

- Webull vs FOREX.com

- NinjaTrader vs Forex.com

- ActivTrades vs FOREX.com

- FXChoice vs FOREX.com

- FOREX.com vs Wealthsimple

- Pepperstone vs FOREX.com

- IG vs FOREX.com

- FOREX.com vs Easy Markets

- FOREX.com vs OANDA

- Libertex vs FOREX.com

- Quotex vs FOREX.com

- IC Markets vs Forex.com

- FOREX.com vs Bybit

- FOREX.com vs Exness

- Forex.com vs OANDA US

- Forex.com vs Coinbase

- Vantage vs FOREX.com

- LiteFinance vs FOREX.com

Customer Reviews

4.8 / 5This average customer rating is based on 4 FOREX.com customer reviews submitted by our visitors.

If you have traded with FOREX.com we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FOREX.com

Article Sources

- FOREX.com Website

- FOREX.com YouTube Channel

- NASDAQ: SNEX Listing

- US National Futures Association (NFA) License

- US Commodities Futures Trading Commission (CFTC) License

- Canadian Investment Regulatory Organization (CIRO) License

- UK Financial Conduct Authority (FCA) License

- Cyprus Securities & Exchange Commission (CySEC) License

- Australian Securities and Investments Commission (ASIC) License

- Hong Kong Securities and Futures Commission (SFC) License

- Japan Financial Services Agency (FSA) License

- Monetary Authority of Singapore (MAS) License

- Cayman Islands Monetary Authority (CIMA) License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

During my time day trading FX at forex.com over 5 years I’ve developed a scalping strategy around the London/New York session overlap, using M1 EUR/USD charts and relying heavily on DOM data and the broker’s OCO brackets for tight risk control. I learned to time trades around the biggie data releases (especially NFP and CPI) by monitoring the platform’s calendar and setting up pre-release limit orders based on historical volatility profiles and market positioning. They’ve supported me every step of the way with the right tools and support when I’ve needed it.

Forex.com is the best broker I’ve used, period. Reliable, low trading fees and excellent analysis tools.

For me Forex.com has proven to be a reliable broker. The Smart Signals are really useful for analyzing currency markets while the trading platform itself is responsive with dozens of indicators and a slick design. I would like to see a copy trading service though, I’ve seen lots of brokers offer that these days.

I can’t fault Forex.com for trading currencies. The web platform is excellent with all the charts and tools I need. Spreads are also very tight. If you want a forex broker you can trust, it’s a great option.