Factor ETFs

Factor ETFs track stocks that share specific characteristics (factors) that academic and institutional/practitioner research has shown explain differences in risk and return.

They’re often called “smart beta” ETFs because they blend passive indexing with active selection rules and tilts.

Instead of simply tracking a market-weighted index (e.g., the S&P 500), they focus on measurable traits like low volatility, size, quality, value, or momentum.

Key Takeaways – Factor ETFs

- Factor ETFs target measurable influences on asset performance, like value, quality, momentum, size, and low volatility instead of standard market-cap weighting.

- Academic/practitioner models show independent, persistent sources of return with low correlations.

- Factor ETFs give implementable, transparent, and low-cost access to those same ideas in a long-only format.

- They try to better capture risk premiums that exist due to risk compensation and behavioral inefficiencies identified in decades of research.

- Factors are fundamentally long-term drivers of performance. Short-term results can vary widely.

- Value and profitability reward patience; momentum may work on shorter timeframes.

- These ETFs help investors tilt portfolios toward proven characteristics without stock-picking.

- Common funds include VLUE (value), QUAL (quality), MTUM (momentum), USMV (low volatility), and COWZ (cash flow).

- Many combine factors for diversification and smoother returns.

- Multi-factor ETFs like LRGF or DFAC simplify this approach in one fund.

- Factor ETFs suit long-term holders looking for structured, evidence-based exposure to risk and return.

- Note that these ETFs are long-only tilts, not traditional factor positioning that involve both buying and short-selling.

Goal of Factor ETFs

Factors fundamentally exist because of risk compensation and behavioral biases that make them persist over time.

They explain why some assets earn higher returns or carry higher risks.

Factors are typically a longer influence on markets and not easy to capture on short-term time horizons.

For example, the value factor is a long-term risk premium associated with owning cheaper stocks vs. more expensive stocks, typically defined as companies with higher earnings and cash flow yields.

Momentum is typically more viable on shorter time horizons as a way to benefit from strong recent performance trends.

For traders/investors, factor ETFs are a convenient way to tilt their portfolios toward proven sources of risk premium without having to:

- pick individual stocks

- define their own way of capturing factors (e.g., how do you define value, momentum, etc.)

- manage the portfolio

Factor ETFs translate these academic and practitioner ideas into investable, long-only tilts.

Key Ideas

Think of factors as the DNA of asset performance.

Core equity factors include market, size, value, momentum, profitability, investment, and reversals.

Their correlations are low when formulated as long/short pairs, so combining them can improve diversification.

Balance offense like momentum and value with defense like quality and low volatility to smooth results.

Common Factors Explained

Value

Value factor ETFs target companies that appear undervalued based on metrics such as price-to-earnings (P/E), price-to-book (P/B), or dividend yield.

They try to exploit the market’s tendency to overreact to short-term problems, creating opportunities in solid companies trading at attractive earnings yields relative to the rest of the market.

Example ETF: iShares MSCI USA Value Factor ETF (VLUE)

Note that funds like SPYV or VTV have “value” in the name, but are not explicitly value factor ETFs.

Momentum

Momentum ETFs focus on stocks with strong recent price performance.

The idea is that trends tend to persist over short to medium timeframes because of behavioral biases and slow information diffusion in the market.

How is momentum measured?

Most momentum factors rank stocks based on their past 6-12 months of total return. Often the most recent month is excluded to avoid short-term reversals.

Stocks are compared against either peers or the market index (e.g., S&P 500). Higher relative performance gives it a stronger momentum score.

Some models also include a risk adjustment. In other words, they adjust for volatility or beta. This way, they favor stocks showing strong risk-adjusted returns rather than those that show strong raw gains.

Example ETF: iShares MSCI USA Momentum Factor ETF (MTUM)

Quality

The quality factor emphasizes companies with strong balance sheets, steady earnings, and efficient operations.

These ETFs favor firms that can maintain profitability and low debt even during downturns, appealing to investors who prioritize stability and long-term growth.

Example ETF: iShares MSCI USA Quality Factor ETF (QUAL)

Low Volatility

Low-volatility ETFs select stocks that have smaller price swings compared to the overall market.

They’re designed for investors who want smoother returns and lower drawdowns while still staying invested in equities.

Example ETF: iShares MSCI USA Min Vol Factor ETF (USMV)

Size

The size factor reflects the tendency for smaller companies (small caps) to outperform larger ones over long periods.

ETFs in this category allocate more weight to small- and mid-cap firms, which often grow faster (they’re commonly neglected by institutional investors) but also carry higher risk.

Example ETF: iShares Russell 2000 ETF (IWM) or SPDR S&P 600 Small Cap ETF (SLY)

Why Use Factor ETFs

Factor ETFs allow traders/investors to customize risk exposure without selecting individual stocks.

For example, a conservative investor may combine low-volatility and quality ETFs for stability.

At the same time, a growth-oriented investor might add momentum or small-cap exposure.

They can also serve as diversification, as factors often perform differently across market cycles when they’re isolated appropriately (i.e., a long component and short component).

Another advantage is transparency; investors know exactly what rules determine inclusion in the fund. Most factor ETFs rebalance quarterly or semiannually. This way, they have a consistent exposure to their chosen traits.

Sample Factor ETFs to Know

| ETF Ticker | Fund Name | Primary Factor | Description |

| QUAL | iShares MSCI USA Quality Factor ETF | Quality | Focuses on US companies with high profitability and low leverage. |

| MTUM | iShares MSCI USA Momentum Factor ETF | Momentum | Allocates to stocks with strong recent price trends. |

| USMV | iShares MSCI USA Min Vol Factor ETF | Low Volatility | Targets stocks expected to have lower volatility than the market. |

| VLUE | iShares MSCI USA Value Factor ETF | Value | Screens for undervalued large and mid-cap companies. |

| SMLV | SPDR SSGA US Small Cap Low Volatility ETF | Size / Low Vol | Combines small-cap growth potential with reduced volatility. |

| SIZE | iShares MSCI USA Size Factor ETF | Size | Tilts toward smaller, more agile, less-covered firms with higher growth potential. |

| QVAL | Alpha Architect US Quantitative Value ETF | Value / Quality | Selects high-quality US value stocks using quantitative models. |

| DFAC | Dimensional US Core Equity 2 ETF | Multifactor | Combines size, value, and profitability factors for diversified exposure. |

Let’s map factor ETFs to academic and practitioner research on factors.

Fama-French Factors and ETF Expressions

Market (FF-MKT-RF)

Represents the equity risk premium over cash.

Broad beta ETFs reflect this exposure, such as VTI or ITOT.

Size: Small Minus Big (FF-SMB, FF-SMB5)

The size premium has been mixed in recent decades – mostly due to multiple expansion in large caps – but small caps can add a risk premium on top of large caps equities.

ETFs: IWM or SLY.

Value: High Minus Low (FF-HML)

Owns cheaper stocks versus expensive ones.

ETFs: VLUE for a purer value tilt, QVAL for concentrated quant value.

Classic “value” index funds like VTV are broader style boxes and explicit factor constructions.

Momentum (FF-MOM)

Rewards recent winners over recent losers. Has to be rebalanced on set schedules to keep the signal fresh.

ETFs: MTUM in the US, IMTM internationally.

Profitability (FF-RMW) and Investment (FF-CMA)

Profitable firms and conservative investors tend to outperform.

ETFs: QUAL proxies profitability and balance sheet strength. Multi-factor funds like DFAC and AVUS embed profitability and investment tilts.

Reversal: Short- and Long-Term

Short-term reversal and long-term mean reversion are harder to access in long-only ETFs.

Most access comes very indirectly via multi-factor or active quant funds.

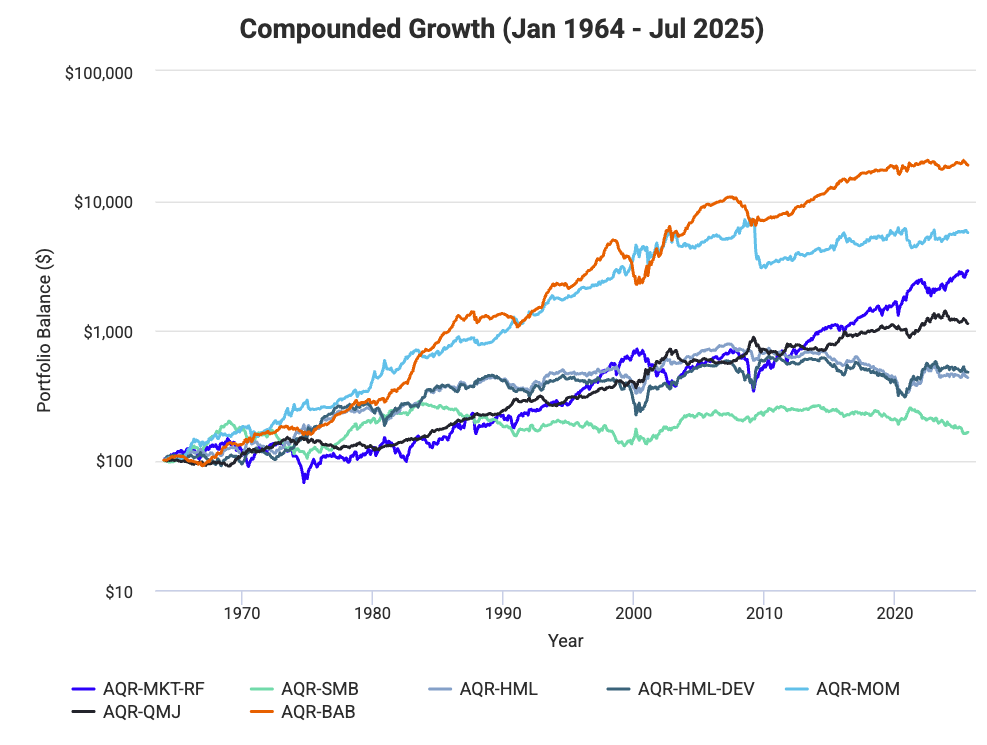

AQR Style Premia and ETF Proxies

AQR’s research highlights value, momentum, quality (QMJ), and Bet Against Beta (BAB).

Long-only proxies include VLUE for value, MTUM for momentum, QUAL for quality, and low beta or low volatility proxies such as USMV or SPLV for BAB-like behavior.

These ETFs aren’t long-short, but they capture the defensive and behavioral edges in a practical wrapper.

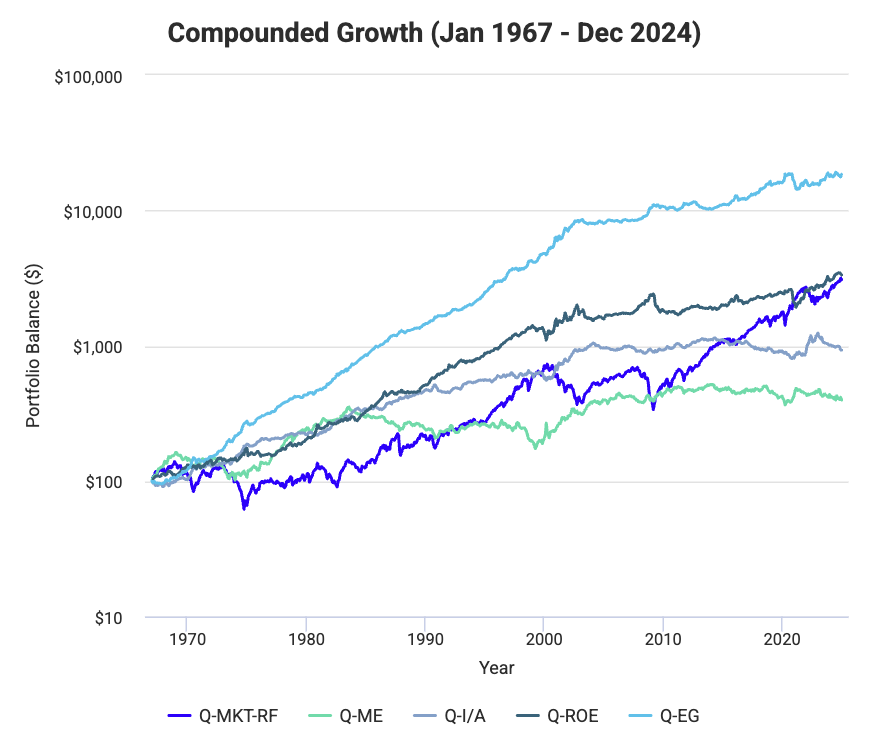

q-Factor Model and ETF Proxies

Hou–Xue–Zhang focus on investment intensity and profitability. Size and expected growth are used as complements.

In ETFs, you can approximate with QUAL for profitability, AVUS or DFUS for integrated tilts to profitability and conservative investment, and DFAC for multi-factor breadth.

International Factor Coverage: Developed and Emerging Markets

The same styles show up globally, with differences in strength by region.

ETF proxies include IVLU for international value, IQLT for international quality, and IMTM for international momentum.

These help diversify US factor cycles.

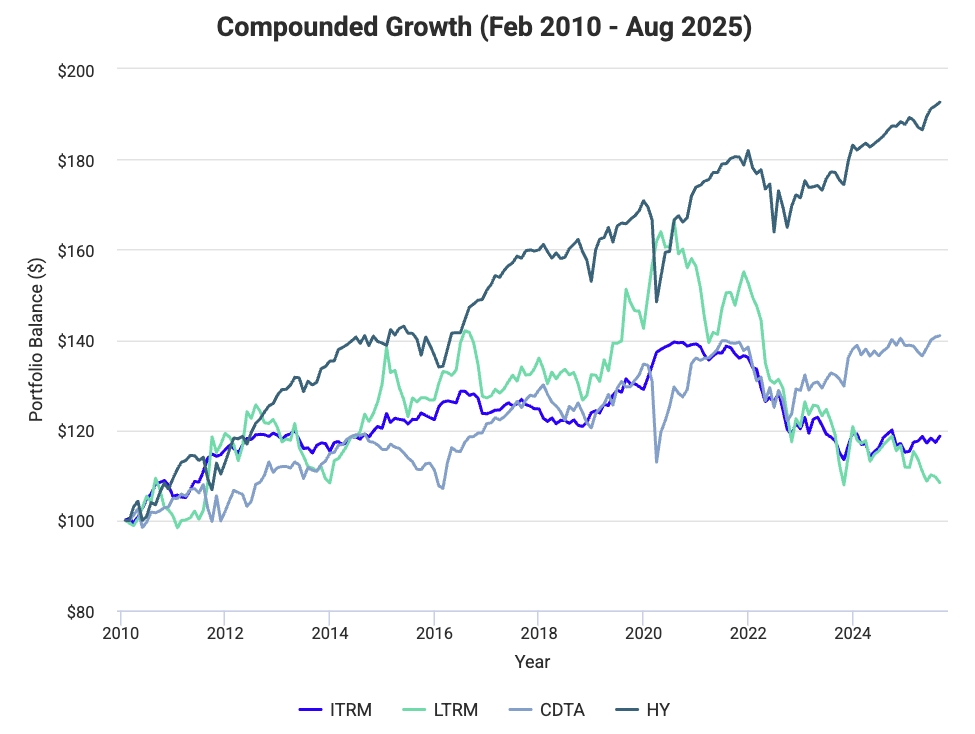

Fixed Income Factors and ETF Proxies: Rates and Credit as Bond “Factors”

Interest rate/duration risk and credit spreads explain most bond returns.

Duration proxies: IEF for intermediate Treasuries and TLT for long duration.

Credit proxies: LQD for investment-grade and HYG for high yield.

For inflation linkage, TIP, SPIP or SCHP provide TIPS exposure.

Blending Low-Correlated Premia

Combine value, momentum, quality, and a low-volatility proxy in roughly risk-balanced weights, then add core beta and bonds for stability.

Example ETFs: VLUE, MTUM, QUAL, USMV, plus VTI and a duration mix like IEF or TLT.

Rebalance quarterly, semiannually, or as needed to maintain target exposures.

The “Ideal” Stock Profile and How ETFs Approximate It

High quality, profitable, reasonably valued, low volatility, with optional consistent momentum.

You can approximate that profile by pairing QUAL and COWZ for profitability and cash flow, VLUE for valuation, USMV for risk control, and MTUM for trend confirmation.

A single-ticket alternative is DFAC or AVUS for integrated multifactor exposure, if it matches what you’re looking for.

Conclusion

Factor ETFs give investors the ability to tilt portfolios toward specific drivers of return like value, quality, or momentum.

They’re practical translations of market, size, value, momentum, profitability, investment, and low-risk effects into portfolios that you can hold.

They often have slightly higher fees than broad market ETFs but offer a more intentional strategy.

But factors will go through performance cycles. For example, value may lag growth for years before reversing.

Part of the reason they exist is because psychologically they can be difficult to pursue.

Because of this, many hold multiple factor ETFs together to smooth performance and maintain diversification.

FAQs – Factor ETFs

Note that a lot of the ETFs mentioned below are not pure factor ETFs in the way the strategy is pursued among hedge funds.

They lack a short component that offsets the market beta, unlike the ETFs we have listed below.

Instead, these are long-only constructions with specific tilts.

What Is the Best Value ETF?

iShares MSCI USA Value Factor ETF (VLUE) is a popular choice for factors specifically.

It targets large- and mid-cap US companies trading below intrinsic value based on earnings and book metrics.

It’s low-cost and transparent at an expense ratio of just 0.08%.

What Is the Best Momentum ETF?

iShares MSCI USA Momentum Factor ETF (MTUM) is the most popular here.

It captures stocks with strong recent price trends.

It updates semiannually to adjust for shifting market leadership, which helps investors stay aligned with outperforming sectors.

What Is the Best Quality ETF?

iShares MSCI USA Quality Factor ETF (QUAL) focuses on companies with high return on equity (ROE), stable earnings, and low debt.

It provides exposure to financially sound businesses that perform well through various market cycles.

Vanguard US Quality Factor ETF (VFQY) is another.

These select roughly ~15% of the companies from the Russell 3000 Index.

Also note that Quality is different from Value. Quality may still contain companies with relatively low earnings (i.e., higher P/E ratio) relative to their share prices.

What Is the Best Low Volatility ETF?

iShares MSCI USA Min Vol Factor ETF (USMV) is a popular pick.

It tries to reduce portfolio swings by emphasizing stable companies with historically low volatility.

Invesco S&P 500 Low Volatility ETF (SPLV) is another as it focuses on stable, heavily traded blue-chip stocks.

What Is the Best Size ETF?

iShares MSCI USA Size Factor ETF (SIZE) tilts toward smaller firms with higher long-term growth potential.

Smaller size companies have also tended to outperform in the early stages the business cycle and react better to domestic data.

It captures the size premium, to the extent it’s still a factor, while maintaining diversified exposure across US equities.

What Is the Best Growth ETF?

Vanguard Growth ETF (VUG) gives a broad exposure to large-cap US growth stocks with consistent revenue expansion.

It’s widely held for its low cost (0.04% expense ratio) and simple design.

What Is the Best Multifactor ETF?

iShares MSCI USA Multifactor ETF (LRGF) combines value, momentum, quality, and size within one framework.

Some more complex strategies cost more, but this one comes from a passive screen and contains an expense ratio of 0.08%.

What Are the Best International Multifactor ETFs?

iShares International Equity Factor ETF and iShares Emerging Markets Equity Factor ETF are popular international multifactor ETFs.

What Is the Best Dividend Yield ETF?

Vanguard High Dividend Yield ETF (VYM) screens for large US companies paying above-average dividends.

It still contains broad diversification (over 500 stocks) and reliable payout record make it a core holding for income investors.

Note that VYM’s dividend yield still tends to hover in just the 2-3% range.

What Is the Best Profitability ETF?

Dimensional US Equity ETF (DFUS) emphasizes firms with high operating profitability.

It has over 2,000 securities but is still weighted heavily on its top 10 (~35%).

What Is the Best Investment (Asset Growth) ETF?

Honestly, there isn’t a great fit as far as I know.

Avantis US Equity ETF (AVUS) is popular among factor-interested traders/investors as it pushes a systematic tilt toward factors associated with higher expected returns.

What Is the Best Leverage ETF?

We have an article on capital efficiency ETFs, which are the best way to get explicit leverage.

GDE (WisdomTree) combines 90% US stocks with 90% gold futures, creating 180% notional exposure with just $100 of capital.

Funds like NTSX, NTSI, NTSE overlay Treasuries on US, international, and emerging equities (leveraged 60/40-like style).

What Is the Best Cash Flow ETF?

Pacer Cash Cows 100 ETF (COWZ) screens for US companies with strong free cash flow yields.

It’s gained popularity for balancing value and profitability while avoiding overleveraged firms.

It essentially screens the Russell 1000 for the top 100 companies based on free cash flow yields.

What Is the Best Low Beta ETF?

Invesco S&P 500 Low Beta ETF (USLB) focuses on stocks less sensitive to market swings.

It’s ideal for investors wanting smoother performance during downturns.

What Is the Best Carry ETF?

The WisdomTree Enhanced Commodity Strategy Fund (GCC) looks for returns from roll yield and carry in diversified commodities.

It’s used as a tactical inflation and macro hedge.