Can Cryptocurrency Be The World’s Currency?

With cryptocurrency’s popularity, there’s natural speculation over just how popular it can get. Can cryptocurrency become a type of global currency that could complement or even substitute for sovereign currencies?

We believe it’s unlikely for a couple reasons, but first let’s look at the nuts and bolts of cryptocurrency and go from there.

Cryptocurrency as a normal currency

A cryptocurrency is a digital asset designed to work as a store of value or medium of exchange using cryptography, which helps secure transactions, control creation, and verifies transactions.

Cryptocurrencies are a type of alternative currency and digital currency (of which virtual currency is also a subset).

Bitcoin became the first decentralized cryptocurrency in 2009 and became a market leader in the space. Since then, numerous cryptocurrencies have been created. These are frequently called altcoins, as a type of bitcoin alternative.

Cryptocurrencies typically feature decentralized control (different from a centralized electronic money system) and a public ledger (such as blockchain) that records transactions.

Each cryptocurrency’s decentralized control works through distributed ledger technology (normally a blockchain), which serves as a financial transaction database.

Blockchain is a database used in cryptocurrency transactions that is shared and continuously reconciled. This enables complete information about user transactions and their corresponding values such as purchase amounts and the time of the transaction.

Cryptocurrencies use various timestamping techniques to obviate the need for a third party to timestamp the transactions that are added to the blockchain ledger. Some crypto systems require entries that contain recent proof-of-work from coin owners to be included in the blockchain ledger before they can be spent. This type of cryptocurrency system requires owners of it to keep a full copy of the blockchain, which contains the history of all crypto transactions.

The cryptocurrency system is a peer-to-peer one. Transactions take place between users directly, without a traditional intermediary. Since the system works without the need for a central repository or administrator, cryptocurrency is considered decentralized.

Cryptocurrency and central authorities

In cryptocurrency systems, there is not the same level of trust in central authorities as when transacting in normal currency. So it’s up to individual users to ensure that their coins are genuine/not counterfeit.

One cryptocurrency security method involves exchanging the secret private keys that are used to cryptocurrency units between two users.

A cryptocurrency wallet stores the public and private “keys” or “addresses” which can be used to receive or spend cryptocurrency units. A cryptocurrency unit is a digital token issued by an individual, organization, or other entity to users as a means of payment for goods, services, or assets. The term cryptocurrency system is also applied to transactions involving payment systems that operate without a central bank, such as merchant systems that have only peer-to-peer links between customers and vendors.

Cryptocurrency address is where cryptocurrency units are sent or received from. Cryptocurrencies are created using software that generates these addresses through cryptography (called mining), along with validating transactions.

The cryptocurrency address is used to identify the receiver of cryptocurrency, much like how a bank account number identifies where money is going to and from.

With these characteristics, do cryptocurrencies make sense outside a form of peer-to-peer payments or as a store of value? Can they become a type of national currency?

Why countries don’t want cryptocurrency

Governments use monetary policy and fiscal policy to control the flow of money and credit in an economy.

For this purpose, they need their own national currency, which allows them to make policy adjustments in light of their own conditions.

Naturally, this means they have the need to have control.

One of the great powers of a government is the ability to have influence over all money and credit within their borders.

Central banks became an important mechanism for doing this starting in the 1600s (with Sweden in 1668) and later other European countries.

The US, given its founding off skepticism of centralized control, lacked a central bank until 1913 when a series of bad economic downturns – then called “panics” – forced them to establish one to act as a lender of last resort for any subsequent recessions.

Policymakers don’t want other forms of money competing with their own that can undermine their ability to carry out their policy objectives.

This includes other national currencies as well as forms of private money.

Gold has been banned by governments because people used it as a type of alternative asset that undermined the use of the internal money and credit that’s used to control policy.

Can cryptocurrency become world’s currency?

Cryptocurrency may be part of the next step in the evolution of money. And the evolution in what’s considered a store of value in a world where those assets have been lacking (especially as governments lower their interest rates and depreciate their currencies to evade debt and funding problems).

Governments have used the concept of turning their own currency into a type of digital form (e.g., digital yuan). This is a type of spin on the private versions of money where money is virtual but controlled by the central bank.

However, once governments get into cryptocurrency they will likely try to take more control over it, do what they did with other sovereign currencies and private money and try to stamp it out.

China has already done so. Western economies are less strict but will veer in that direction if it becomes too material that it start undercutting policy efforts or creates a common loophole (e.g., tax evasion).

And the need for a regulatory environment is important. This will likely lead to some type of global agreement and multilateral coordination because if there’s an “out” it’ll be taken advantage of.

A big issues is that given cryptocurrency units are not backed by any government or central bank, there’s a lack of a methodology for being used in tax collection.

Governments can simply prohibit cryptocurrency use if they don’t want it or encourage other entities under their oversight (e.g., commercial banks) to crack down. The easiest way of doing this is by controlling the flows of money into cryptocurrency exchanges.

Many governments will be okay with cryptocurrency existing alongside their own currency as long as it’s regulated and doesn’t impede policy goals. Most likely, cryptocurrency will change from a decentralized currency system to an increasingly centralized one under the oversight of governments that allow them to exist in some form alongside their own currency.

However, cryptocurrency might still remain outside of governmental control as it has the potential to be used in various schemes for which cryptocurrency is well-suited given it’s anonymous, divisible, and can successfully hold its value (or increase in value) over time.

Some analysts think cryptocurrency’s most important long-term feature will be as an international sovereign currency, kind of like a type of digital gold.

However, any type of formal integration of bitcoin (the current market leader) or cryptocurrency into a country’s economy would make cryptocurrency subject to economic policy set by different countries with different conditions (such as exchange rates).

It’ll become more likely that cryptocurrency will find niches where it is useful and can continue without inhibiting government control over policymaking.

Global non-fiat reserve assets

There can be some forms of globally agreed-upon reserve assets (like gold and to a lesser extent silver and other things that have intrinsic value).

But national currencies serve the vital purpose of giving each country autonomy over how to control policy in light of their own conditions.

Having more countries on a digital currency would be difficult.

Some smaller countries that have a history of currency problems have adopted bitcoin (e.g., El Salvador), but that’s very different from a bigger, more stable country doing so.

El Salvador’s bitcoin imbroglio

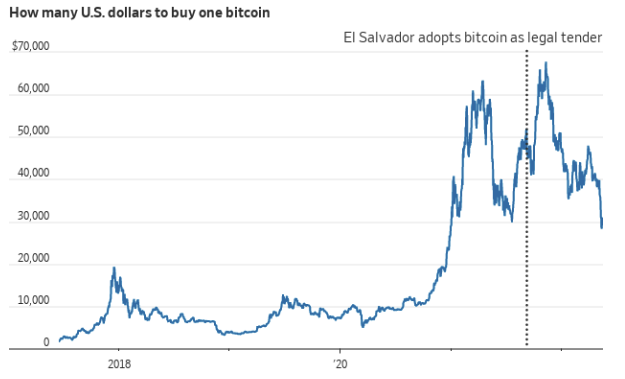

El Salvador’s president Nayib Bukele went big on bitcoin. Then it fell. Bukele had spent hundreds of millions of dollars in taxpayer money buying bitcoin and championing the cryptocurrency as a national currency.

Moreover, the country planned to issue an exotic $1 billion bond that would bet on a rise in bitcoin’s value, which was tabled after the cryptocurrency fell when most global central banks began tightening in 2022.

And the market value of El Salvador’s $100 million in bitcoin holdings dropped by about a third.

This, in turn, squeezed the country’s finances further and raised the odds that it would default on its more than $24 billion in sovereign debt.

(Source: WSJ, Coinbase)

The difficulty in getting economies on any type of common currency

Countries have their own problems when they’re linked to sovereign currencies that they can’t directly control.

For example, the euro has its own host of structural issues. Different economies with very different economic circumstances are all pegged together because of the common currency, creating distortions in some countries where the currency is too weak (e.g., large current account surpluses in Germany) and chronically weak growth conditions in the periphery (e.g., Italy, Spain, Portugal, Greece) where the currency is too strong.

The most social and political conflict in Europe occurs in the periphery, which is partially attributed to the strain of being under the currency union and lacking the autonomy to control and direct policy in a way suitable to their own circumstances.

For example, in the Greek debt crisis in 2012, in normal circumstances, they would have simply devalued their currency in order to cover their debt burdens. They would have spread their debt problems externally by paying back the debts in depreciated currency.

Devaluing a currency is always the easy way out.

But because Greece left the drachma for the euro several years before, they didn’t have the capacity to devalue and had to suffer a massive ~40 percent drop in incomes.

If a country can’t devalue its currency – or doesn’t have control over its currency in general – it ends up taking the problem by lowering its incomes, which causes lots of pain and often sets back economic progress by a decade or more.

On the other hand, when a country devalues, internal wages remain the same.

It’s also a way to close balance of payments imbalances because exports become cheaper relative to other currencies and imports become more expensive because the currency no longer goes as far.

This type of pegged structure makes Europe the most vulnerable of developed market economies. Individual countries lack the tools to combat their problems. Pegged currency systems become strained when they become divorced from their economic fundamentals. In these circumstances, exchange rate breakups become more likely.

This would be a similar problem if countries adopted cryptocurrency as a type of national currency.

They don’t have the capacity to control the currency or credit denominated in it. If one country runs into debt problems, how do they go about creating more?

Even within countries there are different subsets of governments given the set of conditions in one area are going to be different in several respects from others.

In the US, there’s the constant debate over how much power the federal government should have versus what policy choices should be left to the states, and what matters should be left to municipalities (counties and individual cities and towns).

Crypto’s own evolution

In the crypto world, that will go through its own evolution, much like countries, empires, companies, and sovereign currencies.

Bitcoin may be the most popular right now, but that’ll work through its own evolutionary process in terms of what has demand.

Crypto is another one of those things that has imputed value, but they don’t have intrinsic value (being useful in and of themselves).

That’s why things like gold have stood the test of time while financial assets come and go. That’s because it has widely accepted intrinsic value, unlike debt assets or other financial things that require an enforceable contract, or a law to ensure the other side will deliver on its promise to deliver whatever it said it would.

Monetary history and cryptocurrency in context

Of the roughly 750 currencies that have existed since 1700, only about 150 remain, and of those that remain all have been significantly devalued.

If you go back to the mid-1800s the world’s major currencies wouldn’t look anything like the currencies we see today.

The US dollar, British pound, and Swiss franc existed back then, but most others were different and have since been taken out of circulation.

Back then, in what is now Germany, you would have used the thaler or gulden. The yen didn’t exist in Japan yet, so you might have had to use the ryo or koban.

Italy had six different currencies in circulation. China and most other countries had different currencies relative to what they use now.

Many were wiped out entirely. This was often due to losing wars and being saddled with large war debts. Others had hyperinflation that ruined their currencies and had to be replaced by new ones.

When the new currency was phased in, this wiped out the old debt, and the new currencies typically had a “hard” backing to them (for example, a gold, silver, or bimetallic standard). This helped them regain trust.

For this reason, it could make sense in a limited number of cases for countries with a history of currency problems to enable or even encourage the use of cryptocurrency in their economy.

For example, Ecuador and El Salvador have dollarized their economies. In other words, they use a more stable, foreign currency to carry out transactions. But they lack control over it, which carries its own host of issues.

A hard backing prevents total freedom over monetary policy, so countries eventually break that link down the line when it impedes the ability to create money to relieve debt problems. That cycle repeats over and over again and has gone on for centuries.

Some currencies have been merged into currencies that replaced them. For example, most of the individual European currencies were merged into the euro.

And some currencies still remain in existence, such as the dollar, pound, and Swiss franc.

But they’ve been significantly devalued over time relative to gold and relative to goods and services inflation.

How currencies devalue

And how currencies devalue is another matter.

The last two leading global empires before the US were the Dutch and British.

The Dutch crashed and burned from the Fourth Anglo-Dutch War that gave them enormous debts and led to the bankruptcy of the Bank of Amsterdam.

The decline of the British was much more gradual and came from their debts exceeding their assets (debts mostly accumulated from the two World Wars) and reduced competitiveness as the US and other countries caught up to them.

The US situation

The US dollar was installed as the world’s leading reserve currency in 1944 as part of the Bretton Woods Agreement. It was tied to gold.

So long as the US kept gold convertibility, it wasn’t devalued much in terms of price inflation. The dollar moved up and down against other currencies but it didn’t lose value relative to gold over time, which was pegged at $35 per ounce.

During this period, there were also two notable deflationary periods in post-war history when the US increased its participation in world trade to help rebuild Europe after WWII.

The first was during this reconstruction period from 1945 to 1947 under President Truman, which coincided with a mild recession.

The second was during the mid-1960s until the early 1970s under Johnson’s administration, which advocated for entitlement reform across federal programs, including Social Security and new medical programs.

Because of the debt buildup from the Vietnam War and entitlement expansion, the USD’s peg to gold was untethered in August 1971, 27 years into the new currency regime.

This was necessary to get more money in the system.

But it also contributed to the stagflation of the 1970s and got worse in the late 1970s under President Carter.

Questions began to build around the dollar as a reserve currency going forward given its significant devaluation relative to gold and relative to goods and services (i.e., the high inflation rate).

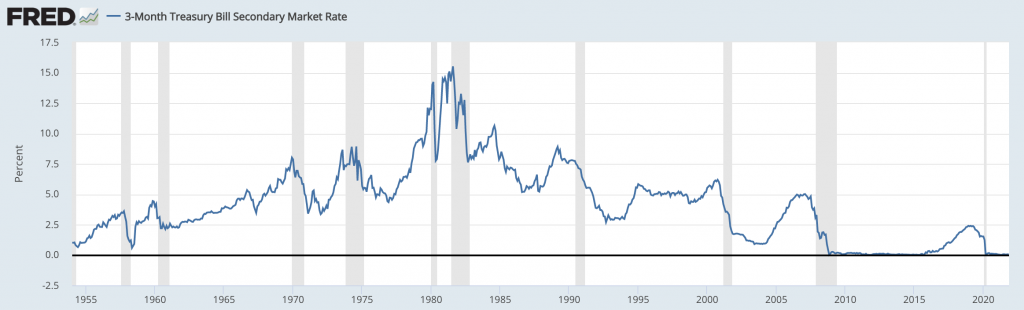

Inflation was eventually corraled in 1981 when Fed Chairman Paul Volcker raised interest rates to their highest in the country’s more than 200-year history (the peak in the graph below).

Raising interest rates had the impact of slowing credit creation and getting inflows into the dollar (because the interest paid on it was higher).

When money is flowing into a country you can get more growth per unit of inflation.

As the dollar goes up, this produces deflationary pressures, which would allow the Fed to ease interest rates going forward without raising inflation.

During the 1980s, global payments imbalances began to build up. The US was exporting capital and other countries were increasing their reserves of dollars because they wanted to save in it as the world’s top reserve currency. This led to a large amount of US dollar liquidity in non-American hands that wasn’t put back into the system because it didn’t need more credit.

Instead, the money stayed abroad while various currencies increasingly floated against each other based on supply and demand as normal.

With the dollar back to indisputably being the world’s top reserve currency, it created a situation where the US could continue expanding its credit at an increasingly faster pace than the rest of the world could grow theirs, giving it enormous spending and borrowing power.

It also meant that interest rates would be lower than they otherwise would have been.

This ended up fueling a boom in US investment markets that carried for around the next 20 years before ending with the dot-com crash.

Crypto the dominant currency?

All of this works to illustrate the importance of countries having their own national currency so they can adjust policy in light of their own conditions.

Having a reserve currency is the most tremendous privilege a country can have because it allows them to borrow and spend heavily.

It also gives the power to produce sanctions by preventing other countries from transacting in the “world’s money”.

Sanctions aren’t perfect but they are pretty effective.

But that’s not to say that other countries will work to disrupt this.

Russia is a good example of this today.

For a long time, they have had difficulty managing their economy because of sanctions against them.

This means it’s very difficult for them to borrow internationally to finance investments domestically, which will ultimately create the conditions for growth.

It also makes it difficult for them to compete on world markets because their currency isn’t as strong as it could be if they had more access to credit that wasn’t under international control.

China has gone through similar changes in the last decade with its own economy being increasingly controlled by outside forces. This creates problems for Chinese politicians who have long campaigned on lower unemployment and higher standards of living (“Common Prosperity”), which will require the development of their capital markets and development of their currency. Both of these will include increasing confrontation with the US.

We can already see this playing out with the US putting tariffs on Chinese goods that will make it even harder for them to compete in the world market. Increasing competition will exist on economics, capital, technology, military armament, and geopolitics.

This is a delicate dance between the world’s two major powers.

A limited alternative

Cryptocurrencies, to a limited extent, can provide alternative decentralized markets to transact in when going through the global banking system is hard to do.

If bigger entities participate in the crypto market, as they are, it will also helped to further legitimize the space as an investable market – not simply something that’s primarily been used as a conduit for speculative activity.

This would give traders and investors more options when they go looking for yield because cryptocurrency won’t just be limited in scope like most investments today (stocks, real estate, debt instruments domestically denominated in USD).

Conclusion

Can cryptocurrency be the world’s currency?

The main benefit of national currencies is the power for governments to adjust policy in accordance with their own set of economic conditions.

If other national currencies, cryptocurrency, and other forms of private money interfere with that process, they will take steps to prevent that by regulating or even prohibiting their use.

It’s unlikely that central banks will want to hold cryptocurrency as a reserve asset, unlike the top sovereign currencies and gold, because of the volatility component.

For cryptocurrency to become a true reserve currency in some form it will need to be used for more than speculation and people will actually need to use cryptocurrency to buy things.

The biggest risk of cryptocurrency becoming dominant is the element of control for central banks. These entities, like many others, struggle with the concept of decentralization because it puts them at risk of losing control over how money moves and who has access to credit (which is the very essence of what banking is).

If cryptocurrency is going to evolve into more of a world currency, the first biggest shift in thinking that will have to take place won’t come from governments or banks.

It will come from cryptocurrency traders and institutional investors who are willing to support cryptocurrency as a reserve asset against fiat currencies.

In order for this shift to happen people with money will need to be comfortable holding cryptocurrency in lieu of other assets, which many currently aren’t.

They’ll be especially reluctant during risk-off and less frothy periods for markets.

The most speculative assets are some of the first to be sold, which doesn’t help their case as reserve assets (i.e., grow and become part of the system), unlike things like US Treasuries and gold.

In order for cryptocurrency to become a world currency it will need to be used as money first, not just the next big speculative thing.

If cryptocurrency does start being used as money, then cryptocurrency can evolve into a potential source of savings – i.e., a reserve asset – against fiat currencies and other assets that will help cryptocurrency markets stabilize through negative market sentiment.

Presently cryptocurrency is not widely accepted enough for people to buy much with cryptocurrency, nor are people sufficiently capitalized with cryptocurrency to make these purchases even if they were more broadly accepted.