Binance Review 2026

Please see the list of similar brokers or the Best Brokers List for alternatives.

Pros

- 24/7 support is available via live chat

- There are no fees on fiat and crypto deposits

- The account opening process is straightforward

Cons

- Some regulatory investigations

- The crypto exchange has been hacked

- No contact support number

Binance Review

Binance is a leading cryptocurrency exchange that offers trading on the likes of Bitcoin. Our review looks at the login procedure, fees, API offering, and its decentralised exchange service (DEX). We’ll also unpack the range of Binance markets, from crypto futures and options to leveraged tokens.

What Is Binance?

Customers buy, sell and manage crypto assets for investment on the Binance exchange. The secure online platform offers multiple crypto trading products while holding licenses with several regulatory agencies. The firm has an average daily trading volume of over $2 billion and its owner – Changpeng Zhao, has a personal net worth of more than $2 billion.

Access

The company’s services are available in many jurisdictions including in the UK, Uganda, Nigeria, and the US. Binance Europe Services Limited is based in Malta and serves as the organisation’s headquarters.

Binance Markets Limited is the trading name of the UK operation which follows regulations from the Financial Conduct Authority (FCA) and has an office address in London. Potential UK customers should note that individuals dealing in crypto assets may be subject to income and capital gains tax.

The firm recently announced the closure of its local branch, Binance Jersey (Binance.je), as its services are now available with the global entity. Customers with this branch should sign in with their login credentials to withdraw any funds from their accounts before the website is shutdown.

Markets & Derivatives

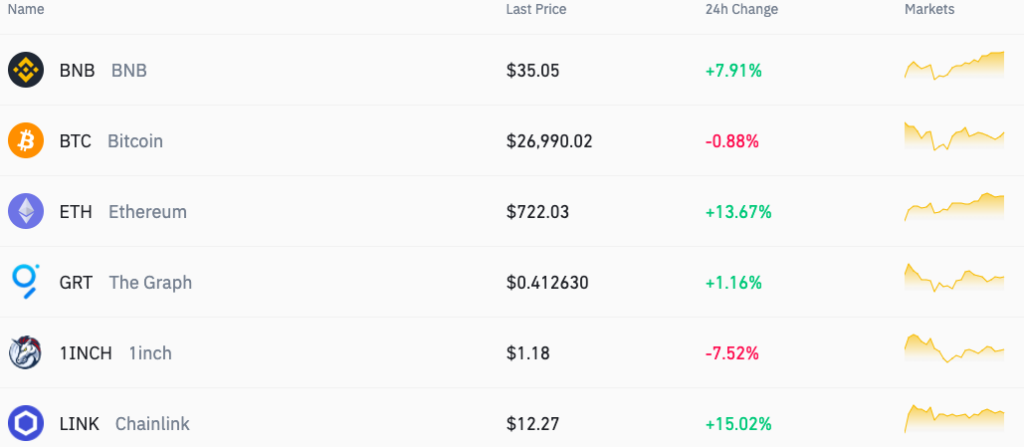

The spot offering encompasses the following markets, which amounts to over 150 different coins:

- BTC – Bitcoin

- ETFs – All traded against Tether, USDT

- Alts – Cryptocurrencies other than Bitcoin

- BNB – Binance coin, the firm’s own cryptocurrency

- Fiat – Government-backed currencies such as the Euro

The spot market also includes leveraged tokens. These instruments represent a number of perpetual contract positions, with variable leverage between 1:1.25 and 1:4.

The futures markets available are:

- USDT-margined – perpetual futures, e.g. XRP/USDT

- USD Coin-margined – perpetual and quarterly futures, e.g. BTCUSD Quaterly1225

The firm also offers options, which follows the Binance Futures BTCUSDT perpetual contract asset.

Clients can navigate the cryptocurrencies offered using the Zones group. This listing contains all currencies offered by the firm, including Monero, Neo, and XRP. Quant and Nano do not appear to be available at Binance, however new coins/crypto listings are announced regularly. The Zones group also contains the Innovation Zone, which allows customers to trade new and potentially higher risk tokens, and DeFi (decentralised finance) listings like Sushi Swap.

Trading

Customers can improve their strategies by using historical trading data on futures, which is available upon application. Clients should also be aware of the funding rate for futures, which is determined using the premium (the variation between a perpetual contract price and its mark price) and the interest rate. The concept of open interest, which quantifies the number of open positions held by clients, may also be of use to new traders as it can convey market sentiment.

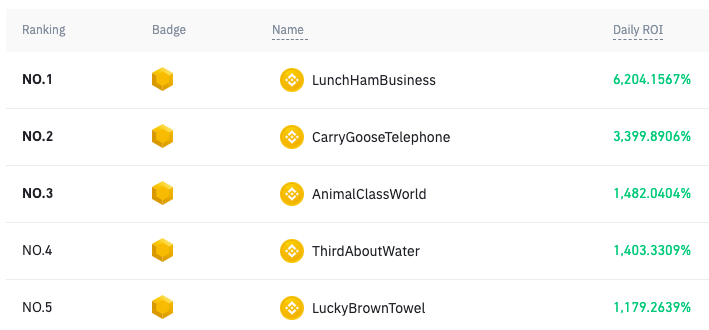

Binance maintains an insurance fund for futures which pools the collateral from trader fees to cover bankrupt clients’ positions. It also runs a Futures Leaderboard, which displays the performance of the top 500 traders based on daily ROI.

Binance offers five ways to trade crypto assets unlike many traditional brokers:

Convert & OTC Desk

As the most basic trading method, the ‘Convert’ feature enables clients to convert one coin type into another, based on a real-time exchange rate. The website also recently added an over-the-counter (OTC) trading desk, which allows users to exchange larger quantities of cryptocurrencies in one transaction with settlement directly into a chosen Binance account.

Classic & Advanced

These trading interfaces give users access to data that will inform their order strategy. The Classic platform contains less technical information and may be more suited to beginners, whereas the Advanced view includes a wealth of market data and price charts.

Margin

Clients can trade with up to 1:125 leverage. Customers can calculate initial margin, profit, and loss using the P&L (or PnL) analysis tab provided on the Futures calculator. Traders may also use the Isolated Margin mode, a feature that allocates only a percentage of the users’ total margin balance to a single position to modulate risk.

P2P

Binance offers a supporting escrow service for its fee-free peer-to-peer (P2P) trading market. Traders place orders to buy or sell crypto in local currency, and the exchange holds the asset until payment has been delivered and both parties finalise the deal.

A wide range of payment methods are available on this platform, including PayPal and Western Union.

Order Information

Binance offers several order types: limit order, stop-limit order, market order, stop-market order, and trailing-stop order. Limit orders are placed on the order book and are not executed until the limit price is reached. Customers can view up to three months of trade history using the Orders tab.

Finance

Binance Earn

This set of financial products is similar to a savings account and is not related to trading. It includes products like Flexible Savings, where customers can earn interest on deposited funds, and Dual Savings, in which clients can get greater returns if the value of funds increases over time.

Binance offers staking, which entails keeping cryptocurrency (specifically Proof of Stake coins) in the appropriate wallet for a certain period of time to gain rewards. The firm recently added Ethereum 2.0 staking to its portfolio and supports yield farming.

The company also hosts Launchpool, which allows clients to farm new token rewards in exchange for tokens like BNB.

Other Financial Services

- Binance Pool – Supplies mining services, with an emphasis on Proof of Work and Proof of Stake

- Binance Visa Card – Available to customers in select countries, including the UK, and works similarly to a debit card but utilising crypto funds

- Crypto Loans – Clients can apply for loans using their crypto assets as collateral, with loan terms from 7 to 90 days

- Liquid Swap – A liquidity pool that traders can either contribute to or use to swap two tokens/fiat assets

Binance Fees

A client’s 30-day exchange trading volume and BNB balance determine their VIP level. Fees are reduced as the VIP level increases, and begin at a maximum of 0.1%. Fees are generally lower for “maker” trades (those that are placed on the order book) than “taker” trades. The company offers a discount when clients pay using BNB, which is currently 25% off trading fees and 10% off USDT-margined futures, but the rate varies.

Other fees include:

- Margin fees – The daily interest rate for margin borrowing also reduces with VIP level and varies widely between currencies.

- Futures fees – USDT-margined futures fees start from 0.04% and reach 0% for clients executing maker trades at VIP level 9. Quarterly and perpetual USD coin-margined futures also start at 0.04% but VIP level 5-9 clients enjoy a negative interest rate on maker trades.

Note with the referral program, clients who invite friends using their referral code can get rewards from completed trades in the form of commission or ‘kickback’.

Deposits & Withdrawals

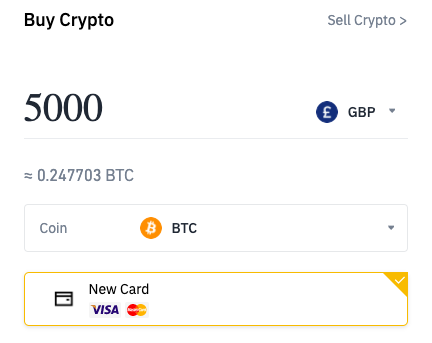

Binance offers an extensive range of coins/tokens for deposit and withdrawal, including GBP, BTC, and XRP. Fiat and crypto deposit fees are zero and there is no limit on the amount traders can add to their account.

For many fiat currencies, including GBP and Euro, the withdrawal fee and minimum limit are also zero. This is not the case for cryptocurrencies, and clients can expect to pay 0.0005 for BTC withdrawal, with a minimum limit of 0.001. Users should check the broker’s Q&As for a walk-through on how to deposit and withdraw revenue, e.g. to a UK bank account.

Binance also offers zero deposit fees to clients using the Faster Payments Bank Transfer service for buying crypto directly with local fiat currency, although a withdrawal fee of £1.50 is charged. The processing time for this transaction is quoted as a few minutes. Customers in the US and elsewhere can also purchase crypto using a credit card.

Binance Chain

Binance Chain is a blockchain software system for the trading of digital assets, which users can interact with via the Explorer function, and DEX is the decentralised exchange feature built on top of the Chain. The Smart Chain is a parallel blockchain that allows smart contracts to be created. Customers can choose either the Trust Wallet or Binance Chain wallet to safeguard their trading funds.

Binance regularly utilises the Testnet, a blockchain used by developers for testing. The company also offers a Futures Testnet specifically for paper trading, as a form of demo environment.

Binance API

Clients can use the API to automatically trade futures and other instruments via languages like Python. Users must create an API key on Binance, and can view all official documentation on Github.

It is also possible to access historical data on cryptocurrencies using the API. Customers should note, however, that it is not possible even with this technology to use popular platforms like MetaTrader 4 (MT4) within the Binance transfer network.

Mobile App

The Binance app is available for iPhone and as an Android / APK file type either from the website or by scanning the QR code on the webpage. The desktop app for macOS, Windows, and Linux can also be downloaded directly from the firm’s website.

Additional Features

The broker operates other initiatives in addition to the crypto exchange:

- Market Maker Program – Fee reductions and higher API limits for high liquidity providers

- Academy – Educational resources and research on cryptocurrency and blockchain technology

- Launchpad – Exclusive token launch platform

- Industry Recovery Initiative – Binance has launched a co-investment opportunity to support web3 projects and companies. The firm pledged $1b in 2022 and is attracting funding from other brands and investors too. If succesful, the IRI could help rebuild trust in the industry following the FTX collapse.

Customer Support

For help with queries like how to delete an account or a forgotten password, clients can contact the Support Centre which is accessible 24/7. A contact phone number is not available but customers can submit a ticket request using an online form.

Binance publishes frequent announcement articles, runs an active blog, and maintains a YouTube channel with trading tutorial videos. The company can also be found on Twitter (@binance) and Telegram (@BinanceExchange) for up-to-date news and notifications.

Security

The exchange and broker uses the Google Authenticator security feature for login and withdrawals. This 2-factor authentication (2FA) process improves security but can be reset if clients get a new phone or if it’s not working. Different verification tiers exist (Levels 1 and 2), where supplying more information allows customers to withdraw greater quantities from their Binance accounts. For other transactions, such as buying crypto directly with fiat currency, clients using Visa bank cards must also have 3D-secure validated.

Fund Safety

The Secure Asset Fund for Users (SAFU) is an emergency insurance fund that was established by Binance in July 2018 to protect clients’ funds. When it was first established in 2018, Binance began allocating 10% of all trading fees to provide insurance for potential security breaches. Moving forward, Binance continues to monitor the size of the SAFU to ensure the size of the fund adequately protects clients’ account balances.

In April 2019, Binance customers were victims of a major hack, which saw around $40 million worth of crypto assets stolen. The theft occurred within the organization’s ’hot wallet’, which at the time, was holding around 2% of total Bitcoin assets. Binance covered all losses thanks to their SAFU, though two-factor authentication codes and API tokens were also breached.

The Secure Asset Fund was valued at US$1 billion on January 29th 2022.

Proof Of Reserves

Following the collapse of FTX, Binance founder and CEO Changpeng Zhao tweeted that the crypto exchange would begin to issue “proof of reserves”. A proof-of-reserve audit is typically conducted by an independent third party to ensure the custodian’s assets are owned as claimed. This pledge, together with fund safety protocol, has the chance to reform the digital currency landscape, providing a new level of transparency.

December 2022 saw Binance publish the results of its Bitcoin proof of reserves. The audit, conducted by Mazars, confirmed that the crypto exchange had enough collateral at the time to cover potential losses in the event of default.

Binance has also stated that it will publish proof of reserves for other tokens.

How To Open A Binance Account

Clients can register on the website, then open an account after identity verification – this is part of the Know Your Customer (KYC) process. Personal account holders can also create a business account by applying with their corporate documents. The registration process is quick and easy, taking just a few minutes.

Binance vs Coinbase

Binance is often compared with other crypto exchanges like Coinbase Pro or Kraken. Binance certainly offers a wider range of assets for trading, though Coinbase may be the more established exchange. Kraken is considered to be a solution better suited to beginner traders.

Pros Of Trading With Binance

The popular exchange offers multiple benefits:

- Five trading methods to suit experience level and strategy

- Largest crypto exchange currently in operation

- Expansive selection of coins and derivatives

- API offering for automated trading

Cons Of Trading With Binance

The company was hacked in 2019 and its services have recently been under investigation as part of a money-laundering scandal. As a result, we do have some concerns around user security. Fortunately, customer reviews remain positive about the company and its trading services.

Final Word

Binance is a crypto asset exchange that offers a wide range of instruments and derivatives such as futures with low fees. Clients can utilise the API service in addition to Binance DEX, alongside other products such as the Flexible Savings crypto account. Binance has much to offer beginners and advanced traders, and many investors interested in crypto will be satisfied with the service.

Best Alternatives to Binance

Compare Binance with the best similar brokers that accept traders from your location.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Binance Comparison Table

| Binance | Kraken | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.5 | 3.9 | 4.3 |

| Markets | Cryptos | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $10 | $0 |

| Minimum Trade | $10 | Variable | $100 |

| Regulators | – | FCA, FinCEN, FINTRAC, AUSTRAC, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | Lower fees when trading volume exceeds $50,000 in 30 days | – |

| Platforms | AlgoTrader, Quantower | AlgoTrader, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | – | – | 1:50 |

| Payment Methods | 20 | 6 | 6 |

| Visit | Visit | Visit | Visit |

| Review | – | Kraken Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Binance and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Binance | Kraken | Interactive Brokers | |

|---|---|---|---|

| CFD | No | No | Yes |

| Forex | No | No | Yes |

| Stocks | No | No | Yes |

| Commodities | No | No | Yes |

| Oil | No | No | No |

| Gold | No | No | Yes |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | Yes |

| Options | No | No | Yes |

| ETFs | No | No | Yes |

| Bonds | No | No | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Binance vs Other Brokers

Compare Binance with any other broker by selecting the other broker below.

The most popular Binance comparisons:

- StormGain vs Binance

- Binance vs Binarium

- Revolut vs Binance

- Pionex vs Binance

- XTB vs Binance

- Expert Option vs Binance

- Binance vs AvaTrade

- Nexo vs Binance

- OKEx vs Binance

- Deriv.com vs Binance

- Binance vs Libertex

- IC Markets vs Binance

- RoboForex vs Binance

- Binance vs Exness

- Pocket Option vs Binance

- Binance vs FOREX.com

- Moomoo vs Binance

- Plus500 vs Binance

- Binance vs Quotex

- IQ Option vs Binance

FAQ

Is Binance a wallet?

Binance is an exchange for crypto assets. The exchange supports two wallets for holding cryptocurrency – Trust Wallet and Binance Chain wallet.

How do I deposit on Binance?

From the customer profile page, select Deposit and then pick a coin to deposit – clients can choose from over 150 cryptocurrencies.

How do I create an API?

Users should navigate to API Management after login, create an API key (i.e. name) and then perform secondary verification by phone or email. The key must be stored securely to prevent unauthorised access.

How can I buy cryptocurrency with Binance P2P?

Registered clients can click P2P under the Trade tab on the Binance homepage. Check ‘Buy’ is selected on the top ribbon, and choose the currency of interest then input the desired amount (in fiat or crypto).

How do I start leveraged trading on Binance?

Customers should launch the trading interface and choose either Isolated or Cross Margin mode to open a margin account. After transferring collateral to the margin wallet, borrowing can be calculated automatically and repayment can be performed by selling assets.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Binance yet, will you be the first to help fellow traders decide if they should trade with Binance or not?