Agency Mortgage Options – How Traders and Investors Monetize Mortgage Volatility and Prepayment Risk

Agency mortgage-backed securities (MBS), issued by Fannie Mae, Freddie Mac, and Ginnie Mae, are a multi-trillion-dollar market backed by pools of residential loans with implicit or explicit government guarantees.

Options on these securities allow traders to express views on interest rate volatility and prepayment behavior (i.e., two critical variables that drive mortgage pricing and convexity risk).

Sophisticated traders and hedge funds are drawn to this niche for its complexity, liquidity, and the asymmetric return potential created by structural inefficiencies and mispricings.

Key Takeaways – Agency Mortgage Options

- Agency MBS are government-backed bonds with embedded prepayment options, which makes them highly sensitive to interest rates.

- Mortgage options let traders express views on rate volatility, convexity, and borrower refinancing behavior.

- Strategies include directional rate plays, volatility trades, relative value arb, and path-dependent positioning.

- Pricing depends on volatility, prepayment speeds, spreads, and housing fundamentals.

- Risks include liquidity limits, model errors, regulatory shifts, and basis volatility.

- Used by REITs, hedge funds, institutional traders, banks, and insurers for profit and hedging.

Agency Mortgage Options: The Basics

Agency mortgage-backed securities (MBS) are bonds created from pools of residential mortgages guaranteed by Fannie Mae, Freddie Mac, or Ginnie Mae.

These securities carry either an implicit or explicit government guarantee, which makes them safer from a credit perspective compared to non-agency mortgages.

Investors receive monthly “pass-through” payments of principal and interest, meaning the cash flow from homeowners’ mortgage payments is passed directly to bondholders.

A large portion of trading occurs in the TBA (or “To-Be-Announced”) market. This is where buyers and sellers agree on key terms such as:

- coupon

- issuer, and

- settlement date…

…but the specific mortgage pools are not delivered until just before settlement.

This structure provides deep liquidity and standardization and allows investors to manage exposure efficiently across mortgage coupons and maturities.

Mortgage options are derivatives that provide exposure to the prepayment and interest rate dynamics embedded in MBS.

Options can be written on TBAs themselves or on specified pools of mortgages with unique characteristics, such as low loan balances or geographic concentration.

Calls give the right to buy an MBS or TBA at a set price, while puts give the right to sell.

These instruments trade over-the-counter (OTC), primarily through major dealers like Bank of America, JPMorgan, and Citigroup.

Broker-dealers provide liquidity, facilitate custom strikes and maturities, and publish indicative pricing. Transparency is nonetheless limited compared to exchange-traded options.

Unique Characteristics of Mortgage Options

Path Dependency and Convexity

Mortgage options are path dependent, meaning their value depends not just on where interest rates end up but on how they move along the way.

Convexity is central: as rates fall, homeowners refinance faster, shortening duration; when rates rise, duration extends.

This “negative convexity” makes mortgage options behave differently from standard bond options.

Prepayment Behavior and Rate Volatility

Option values hinge on borrower prepayment decisions, which accelerate in low-rate environments and slow when refinancing becomes unattractive.

Volatility in Treasury yields amplifies this effect, creating uncertainty in future cash flows and driving demand for hedging with mortgage options.

Embedded vs. Explicit Optionality

Every agency MBS already contains embedded options since borrowers can repay mortgages early without penalty.

Mortgage options are layered on top, giving traders explicit ways to express views on this embedded behavior or to hedge exposures tied to it.

Implied Volatility and Market Skew

Pricing also reflects implied volatility, often moving in tandem with the MOVE index and Treasury market volatility.

Mortgage option markets show a persistent “receiver skew,” where options sensitive to falling rates trade richer due to the ever-present risk of a refinancing wave.

Visualizing Agency Options

Let’s visualize what we just covered.

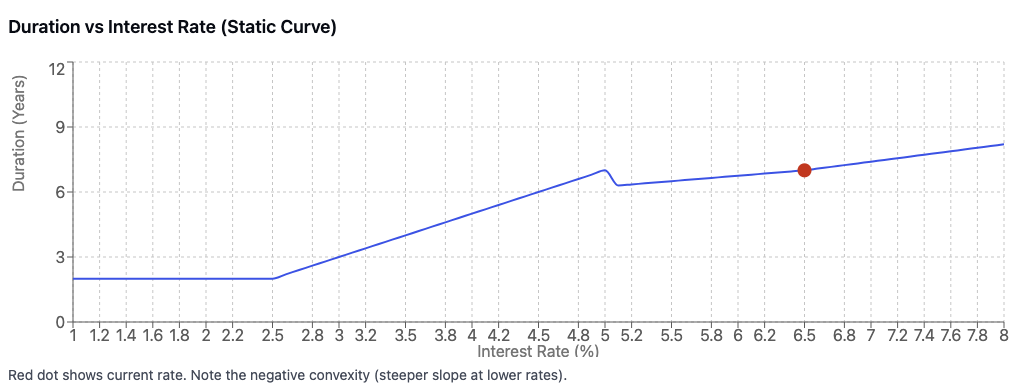

Here’s what each parameter controls in this model:

- Current Rate (6.5%) – The baseline interest rate used as the reference point for calculating how duration changes when rates move up or down.

- Base Duration (7 years) – The starting duration of the mortgage security when interest rates are at the current rate level.

- Convexity Factor (1) – Controls how dramatically the duration changes in response to interest rate movements. Higher values make the mortgage more sensitive to rate changes.

- Refinance Threshold (1.5%) – The amount interest rates must fall below the current rate before homeowners start refinancing in significant numbers.

- Max Duration (12.5 years) – The ceiling for how long the mortgage duration can extend when interest rates rise and refinancing stops.

- Min Duration (2 years) – The floor for how short the mortgage duration can get when rates fall a lot and refinancing accelerates.

The curve below demonstrates negative convexity in mortgage securities.

As interest rates fall below the current rate (red dot at 6.5%), the duration drops sharply due to increased refinancing activity, while rising rates cause duration to extend more gradually as refinancing stops.

And let’s look at some path-dependent scenarios:

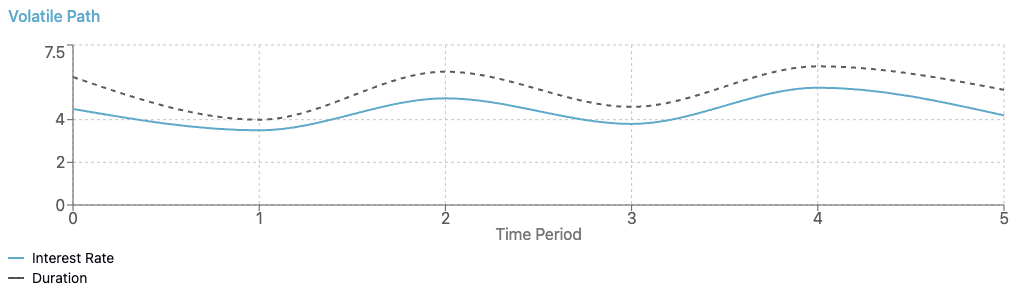

Volatile Path

The interest rate fluctuates up and down over time, causing the duration to inversely mirror these movements.

When rates spike up, duration drops, and when rates fall, duration increases, demonstrating how mortgage securities constantly adjust to rate volatility.

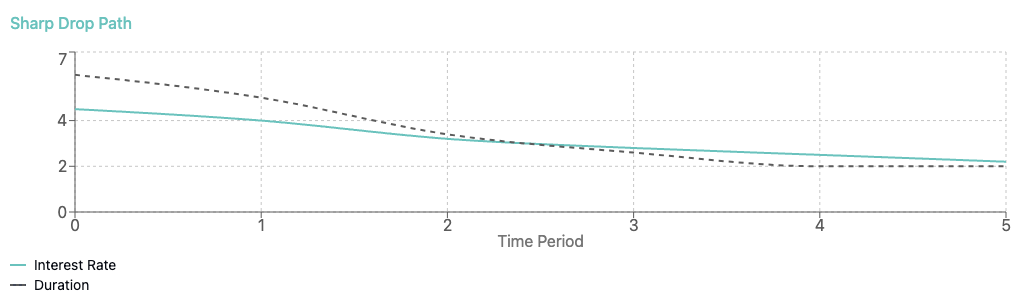

Sharp Drop Path

Interest rates fall dramatically and stay low, causing the duration to steadily decline as widespread refinancing activity shortens the mortgage pool’s average life throughout the entire period.

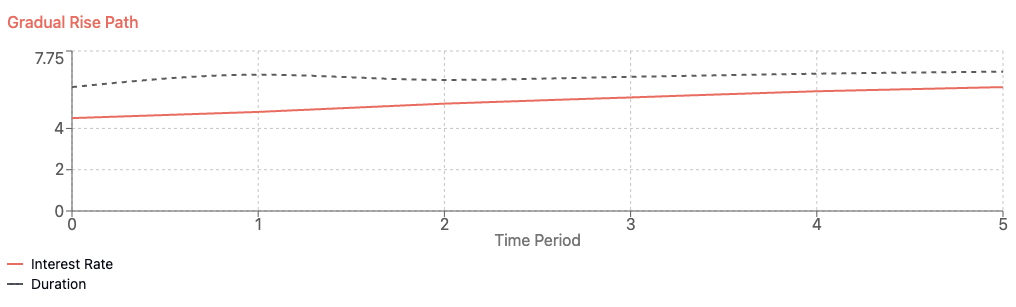

Gradual Rise Path

Interest rates slowly increase over time, causing the duration to steadily extend as refinancing activity diminishes and homeowners hold onto their existing low-rate mortgages longer.

MBS Options Trade Ideas

So, off of what we just covered, what kind of trade ideas could you come up with?

Let’s go through some examples

Directional Rate Trades

Short MBS when rates are near refinancing thresholds – If/when current rates are only slightly above historical lows, MBS face maximum negative convexity risk.

Long MBS during rate spikes – After sharp rate increases, MBS duration has already extended and refinancing risk is minimal, so they behave more like traditional bonds with positive convexity.

Receiver swaptions vs. MBS puts – Instead of shorting MBS directly in anticipation of falling rates, take the other side by buying receiver swaptions and selling MBS puts. This way, you gain from the convexity gap between more liquid swaption markets and relatively mispriced MBS downside protection.

Volatility Trades

Short MBS volatility – Since mortgage holders have a “free” refinancing option, high volatility hurts MBS holders. Homeowners exercise their option when rates drop but MBS holders can’t benefit equally when rates rise due to extension risk.

Convexity hedging – Buy interest rate caps/floors when holding large MBS positions to hedge against the asymmetric risk profile.

Relative Value Strategies

MBS vs Treasury curve trades – When the yield curve steepens, longer-duration Treasuries underperform, but MBS duration may actually shorten due to refinancing expectations, creating relative outperformance opportunities.

Specified pool vs. TBA basis trade – Buy specified pools with favorable prepayment characteristics (e.g., low loan balance pools, geographic concentration in states with slower refinancing laws) while shorting generic TBA. This arbitrages mispricing between collateral-specific behavior and standardized TBA pricing.

New issue vs seasoned MBS – Newly issued MBS at current rates have less refinancing risk than seasoned MBS with coupons well above current rates.

Path-Dependent Strategies

Fade sharp rate moves in MBS – If rates drop sharply (like the “Sharp Drop” scenario mentioned above), the immediate refinancing wave may be overdiscounted. This creates opportunities as the refinancing pace normalizes.

Position for Fed policy paths – Front-run anticipated Fed policy changes. If gradual rate hikes are expected, positioning for extension risk early can be profitable as duration extends predictably.

Forward-starting options on UMBS – Enter forward-starting receiver options that only become active after a set horizon. These align with expected Fed easing cycles and let you cheaply capture refinancing waves without paying today for near-term noise. (Related: Future-start options)

The Key Insight

MBS trading requires thinking about not just where rates are going, but how they get there and the timing of those moves.

Key Variables That Drive Agency MBS Options Pricing

Interest Rate Volatility

The single most important driver of agency MBS option pricing is interest rate volatility.

Mortgage cash flows are highly sensitive to changes in rates because they alter both refinancing incentives and borrower behavior.

Traders distinguish between:

- realized volatility, which measures how much Treasury yields have actually moved, and

- implied volatility, which reflects the market’s expectations for future swings

When implied volatility rises, the cost of mortgage options increases, as traders pay a premium to protect against rate shocks.

Prepayment Models and Speed

Prepayment risk is central to valuing mortgage options.

Prepayment models use borrower behavior to estimate how quickly mortgages are likely to be refinanced or paid down.

The S-curve captures the relationship between refinancing incentives and prepayment speed, steepening as mortgage rates fall below borrowers’ existing rates.

Over time, a phenomenon known as burnout reduces refinancing activity as those most sensitive to rates have already refinanced, dampening future option value.

Mortgage Rate Spreads

Another key input is the spread between mortgage yields and comparable Treasuries.

The option-adjusted spread (OAS) accounts for the value of embedded prepayment options within MBS, adjusting expected cash flows for option risk.

Wider spreads suggest higher compensation for risk, while tighter spreads indicate rich valuations.

These shifts directly influence the hedging and speculative demand for mortgage options.

Housing Market Fundamentals

Finally, housing market conditions shape option pricing.

Rising home prices increase borrower equity, making refinancing or moving more likely, while falling prices can trap borrowers, reducing prepayments.

Turnover rates, driven by job mobility and demographics, also feed into expected mortgage cash flows.

Credit availability, lending standards, and policy changes further impact prepayment behavior.

In turn, this reinforces the connection between housing fundamentals and option value.

How Traders Use Agency MBS Options to Profit

Volatility Trading

One of the most common uses of agency MBS options is volatility trading.

When traders expect interest rate swings or policy surprises, they buy calls or straddles to gain from higher implied volatility.

Conversely, when rates stabilize and realized volatility drops, selling options becomes attractive, which enables traders to capture premium from overvalued volatility levels.

Prepayment Speculation

Mortgage options also serve as tools to speculate on borrower prepayment speeds.

Deep out-of-the-money options can be used to bet on sudden refinancing waves when the Fed cuts rates or mortgage spreads compress.

On the other side, investors may wager on slower prepayment speeds if they anticipate tighter credit conditions, weaker housing turnover, or limited refinancing incentives.

Relative Value Arbitrage

More advanced traders frequently use relative value strategies across rate products.

Mortgage option skew, where receiver options trade richer due to refinancing risk, creates opportunities for payer vs. receiver asymmetry trades.

Others focus on dislocations between mortgage volatility and Treasury volatility, which exploits misalignments when one market reprices faster than the other.

Some traders arbitrage agency vs. non-agency convexity spreads, expressing views on structural risk premia.

Directional Rate Views

Mortgage options also allow investors to express directional views on interest rates through tailored exposures.

In a rally, calls on lower-coupon pools benefit most from increased refinancing activity.

During rate sell-offs, puts on higher-coupon pools provide leveraged downside exposure.

This flexibility makes MBS options valuable for combining directional rate bets with optionality-driven payoffs.

Hedging Mortgage Basis Trades

Finally, many traders use mortgage options to manage risks from holding MBS cash positions.

Options hedge convexity mismatches that occur when duration shortens in rallies or extends in sell-offs.

Traders also use them for tail-risk hedging, protecting against sudden shocks in mortgage-Treasury basis spreads or unexpected prepayment surges.

Instruments and Trade Structures

Some more color on instruments and possible trade structures that you see with agency options.

TBA Options vs. Spec Pool Options

TBA options are the most liquid and widely used, offering standardized exposure to large pools of mortgages with unknown specific collateral until settlement.

In contrast, specified pool options target particular mortgage characteristics, such as low loan balances or geographic concentration. This allows traders to fine-tune exposure to prepayment risk.

Options on UMBS 30yr vs. 15yr

The Unified Mortgage-Backed Security (UMBS) allows trading in both 30-year and 15-year maturities.

Thirty-year UMBS options carry greater convexity and prepayment uncertainty, while 15-year options exhibit shorter duration and more predictable cash flows.

Traders select between them depending on rate outlook and hedging needs.

Calendar Spreads and Butterflies on Coupons

Options on different mortgage coupons can be structured into calendar spreads or butterflies to capture relative value.

Calendar spreads involve buying and selling options with the same strike but different expiries, while butterflies use multiple strikes to profit from implied volatility curvature.

These structures let traders monetize subtle shifts in market pricing.

Straddles and Strangles Around Fed Events

Ahead of major policy announcements, traders often employ straddles or strangles on TBAs, positioning for heightened volatility.

These strategies profit from outsized rate moves, regardless of direction, and are most effective when implied volatility is underpriced.

Hedging Mortgage Servicing Rights (MSRs)

Mortgage servicing rights are highly sensitive to prepayment speeds.

Options on TBAs provide a liquid hedge, offsetting MSR value erosion when refinancing surges.

This makes them essential tools for servicers and REITs managing convexity exposure.

Examples of High-Convexity Payoff Setups

Volatility Spike Post-Fed Surprise

After unexpected Federal Reserve announcements, implied volatility often surges.

Traders holding long call or straddle positions on TBAs benefit from sharp repricing.

Accordingly, they can capture convex payoffs.

Hedging Against Taper Tantrum

During the 2013 taper tantrum, mortgage durations extended rapidly as rates rose.

Options provided important downside protection, allowing investors to offset losses on cash MBS holdings.

Cheap Receiver Skew Before Prepayment Wave

At times, receiver options price cheaply relative to payer options despite looming refinancing risks.

Traders positioned long receivers ahead of prepayment waves can profit as option values spike.

This demonstrates how convex payoffs emerge when market pricing underestimates behavioral risks.

Risks and Other Considerations

Liquidity Risks

Agency mortgage options trade over-the-counter, and liquidity can vary across strikes and maturities.

While on-the-run TBA options are fairly active, tail options or deep out-of-the-money strikes often face wide bid-ask spreads.

This makes it harder for traders to enter or exit positions efficiently, increasing transaction costs and slippage.

Model Risk

Valuation heavily depends on prepayment models and option-adjusted spread (OAS) simulations.

Small errors in estimating borrower behavior, refinancing incentives, or burnout can lead to errors and pricing discrepancies.

Since these models drive both hedging and speculative strategies, miscalibration exposes traders to unexpected losses.

Regulatory Changes

The Federal Reserve’s role in the agency MBS market has been transformative, from large-scale purchases to gradual balance sheet runoff.

Such interventions alter spreads, volatility, and prepayment dynamics.

All of this directly impacts option values.

Policy shifts or new regulations can reprice risk quickly and catch unhedged traders off guard.

Basis Volatility

Mortgage options are also sensitive to the spread (or basis) between agency MBS and Treasuries.

When this basis becomes volatile, option values may diverge from rate market expectations.

Traders relying solely on Treasury volatility as a proxy may misprice risk.

So it’s important to monitor basis dynamics alongside interest rate moves.

Who Uses These Options?

Mortgage REITs

Mortgage REITs such as AGNC and NLY rely on agency MBS options to manage convexity exposure from highly leveraged portfolios.

They also use them to hedge mortgage servicing rights (MSRs), which lose value when refinancing accelerates.

Macro Hedge Funds and Volatility Traders

Hedge funds and specialized volatility desks view mortgage options as a way to trade rate volatility and prepayment risk with asymmetric payoffs.

These investors often exploit relative value opportunities, such as skew dislocations between mortgage and Treasury vol.

Banks Managing Pipelines

Large banks originate mortgages and hold them in pipelines or warehouse facilities before securitization.

Options provide a hedge against rate swings that could alter loan values.

In turn, this protects profitability during rate rallies or sell-offs.

Insurance Firms

Insurance companies with long-dated liabilities use agency MBS options to stabilize portfolio duration.

By hedging rate risk and prepayment uncertainty, they align asset cash flows with obligations to improve balance sheet resilience.

Resources for Traders

Professional mortgage option traders rely on specialized software to price and manage risk.

The Bloomberg TBA Option Monitor provides real-time data on implied volatility and option surfaces.

Analytics from Volcube, the JPM MBS volatility desk, and BAML prepayment research offer market color and modeling insights.

For detailed valuation, traders use OAS model suites from Intex and YieldBook to simulate prepayment behavior and cash flows.

Finally, the MOVE Index and Treasury volatility surfaces serve as benchmarks for cross-market correlation and relative value opportunities.

Of course, many traders and institutions build their own proprietary models to have an edge over other market participants.

Conclusion

Agency MBS options arguably remain underutilized, even among institutions, due to their complexity and reliance on specialized modeling.

Traders who grasp prepayment behavior and rate volatility can uncover asymmetric payoffs overlooked by broader markets.

When integrated into macro or rates portfolios, these instruments provide ways for both hedging and opportunistic positioning.

Overall, it provides a unique convexity exposure that complements traditional fixed-income and volatility strategies.