Calendar Spread

A calendar spread is an options trading strategy that involves taking simultaneous long and short positions in options of the same underlying asset but with different expiration dates.

The primary goal of a calendar spread is to capitalize on the time decay of options premium, also known as theta decay.

A calendar spread can also be used in the case of futures, where a trader will go long or short one contract date and long or short a separate one.

The goal of calendar spread trading in the case of the future is typically convergence or betting on changes in the shape of the futures curve.

Key Takeaways – Calendar Spread

- Time Decay Advantage

- A calendar spread takes advantage of the faster time decay of the short-dated option compared to the longer-dated one.

- Tries to profit as the near-term option expires.

- Directional Flexibility

- This strategy offers traders a way to benefit from both sideways and modestly bullish market conditions.

- Volatility Play

- Traders use calendar spreads to exploit expected increases in volatility, as the value of the longer-dated option can increase disproportionately and enhance profits.

How a Calendar Spread Is Constructed

Here’s how a calendar spread is structured:

- Long Option: The trader buys an option with a longer expiration date, usually several months out.

- Short Option: The trader sells an option with a shorter expiration date, typically the front-month option.

Both options must have the same underlying asset and the same strike price.

The long option has a higher premium due to its longer time to expiration, while the short option has a lower premium due to its shorter time to expiration.

The trader collects a net credit from the spread, which represents the maximum potential profit.

This credit is the difference between the premium received from selling the short option and the premium paid for buying the long option.

As time passes, the short option will lose value faster due to accelerated time decay as it approaches expiration.

If the underlying asset’s price remains relatively stable, the long option’s premium will decrease at a slower rate.

This difference in time decay creates the potential for profit in the calendar spread.

Variations of the Calendar Spread

Calendar spreads can also entail various other trading strategies involving trading the same asset but at different expirations/maturities.

For example, a trader might go long a shorter-term expiration and short a longer-term expiration.

There are also hybrids of the calendar spread strategy where a trader will have different strike prices and different expiration dates.

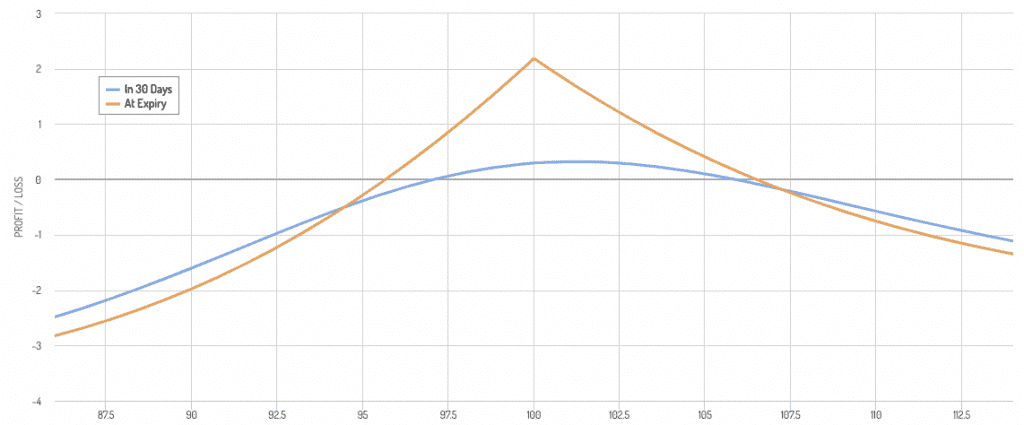

Calendar Spread Payoff Diagram

The calendar spread payoff diagram is a useful way to visualize the potential risk and reward profile of the strategy and for identifying the underlying asset price ranges where the position is most profitable or loss-making.

A calendar spread payoff diagram is a visual representation of the potential profit or loss of a calendar spread options strategy at different underlying asset prices and at expiration.

The x-axis of the payoff diagram represents the underlying asset’s price at expiration, while the y-axis represents the profit or loss of the calendar spread position.

- From the payoff diagram, you can see that this is more of a neutral strategy.

- The underlying falling is the worst scenario for the calendar spread.

The payoff diagram assumes that the position is held until expiration.

In practice, traders may choose to exit the position before expiration, depending on market conditions and their trading strategy.

Day traders often don’t hold positions overnight.

Factors to Consider with Calendar Spreads

There are a few main considerations with calendar spreads:

Time Decay

The trader benefits from the faster time decay of the short option compared to the long option.

This is what maximizes the profitability of the strategy.

Expiration Risk

If the underlying asset’s price moves significantly, the short option may expire in-the-money and expose the trader to assignment risk.

Volatility

Changes in implied volatility can impact the premiums of the long and short options differently and affect the spread’s profitability.

Margin Requirements

While a calendar spread is a defined-risk strategy (assuming you keep rolling the call), it still requires margin to maintain the positions.

Who Calendar Spreads Are For

Calendar spreads are often used by traders who have a neutral to perhaps slightly bullish view on the underlying asset and want to take advantage of time decay while limiting risk.

Nevertheless, it’s essential to manage the risks associated with this strategy, which we’ll cover in more depth below.

Calendar Spread Isn’t Arbitrage (Calendar Spread Risks)

Let’s say we’re doing a calendar spread variation where we’re seeing the following:

- the current period’s futures contract is trading at $240

- the futures contract trading one year from now is trading at $260.

Some traders will look at this and think if they go long the $240 contract and short the $260 contract, and keep rolling the forward contract, they will pocket the $20 difference.

Unfortunately, it doesn’t work this cleanly.

While this type of calendar spread can potentially profit from the price difference between the two contracts, it isn’t risk-free.

There are several factors to consider:

Basis Risk

The difference between the prices of the two contracts doesn’t represent a pure arbitrage opportunity.

The difference partially reflects carrying costs like storage, interest, and insurance, but it’s also influenced by the unstable relationship between the spot price of the asset and its futures contracts.

The basis, which is the difference between the spot price and the futures price, can change over time.

As the contracts approach expiration, the basis typically converges, but the convergence may not be perfect.

This basis risk can impact the profitability of the calendar spread.

Volatility Risk

The prices of the two futures contracts can fluctuate independently, depending on market conditions, supply and demand dynamics for the specific contracts, and other factors.

Increased volatility in either contract can lead to adverse price movements and affect the spread’s profitability.

Interest Rate Risk

Changes in interest rates can impact the carrying costs associated with holding the long and short positions and impact the overall profitability of the spread.

Liquidity Risk

The two futures contracts may have different levels of liquidity, especially those further out in time.

This can make it difficult to enter or exit the positions at desired prices, leading to slippage and potential losses.

Economic Factors

Changes in economic indicators, geopolitical events, or market sentiment (money and credit flows independent of technical or fundamental factors) can lead to price adjustments in the futures market.

Roll Risk

When you need to roll over the positions to different contracts (if the strategy involves holding positions beyond the nearest expiration), the market conditions at the time of rolling could impact the costs and potential profitability.

Transaction Costs

Every trade has commissions and potential exchange fees.

These transaction costs eat into any potential profit.

Margin Requirements

Futures trading involves margin.

Even if you anticipate the prices converging, there’s always a risk of adverse price movements that trigger margin calls.

This could force you to either deposit more funds or potentially liquidate your positions prematurely at a loss.

Convergence, but Not Guaranteed

Futures prices generally converge toward the spot price of the underlying asset as the expiration date approaches.

Nonetheless, convergence isn’t guaranteed, and market conditions could lead the basis to widen rather than narrow.

Reducing These Risks

To reduce these risks, traders typically use risk management strategies, such as setting stop-loss orders, adjusting position sizes, and monitoring the spread’s performance closely.

While calendar spreads can be used to capitalize on the price difference between different contract months, they aren’t risk-free strategies.

Analysis, risk management, and understanding the underlying market are important for the successful execution of these types of spread trades.