Pass-Through Securities

Pass-through securities are a key component of the fixed-income market and are influential in both institutional and individual investing.

They allow traders/investors to receive payments that are directly “passed through” from a pool of underlying assets, such as mortgages or loans.

We look at what pass-through securities are, how they work, their types, advantages and risks, and their influence in modern finance.

Key Takeaways – Pass-Through Securities

- Pass-through securities are fixed-income investments backed by pools of loans (e.g., mortgages, auto loans).

- Provides monthly payments that include both interest and principal.

- Major issuers include Ginnie Mae, Fannie Mae, and Freddie Mac.

- Offer steady income, portfolio diversification, and liquidity.

- Risks include prepayment, interest rate sensitivity, and credit risk (especially for private-label securities).

- Correlate positively with Treasuries, moderately with corporates (less with investment-grade, more with high-yield), and weakly with stocks. This makes them useful for diversification.

- Best suited for institutional or experienced investors due to structural complexity and market sensitivity.

What Are Pass-Through Securities?

Pass-through securities are fixed-income investments that are backed by a pool of financial assets, typically mortgages, auto loans, student loans, receivables, or credit card debt.

These securities are structured such that the payments made by borrowers on the underlying assets are passed directly to the security holders.

How Pass-Through Securities Function

Pass-through securities work by pooling together similar types of debt, such as home mortgages.

A financial institution, such as a government-sponsored enterprise (GSE), then purchases these debts from lenders and securitizes them.

The institution will then issue securities to investors, who in turn receive a portion of the principal and interest payments from the borrowers.

Issuers of Pass-Through Securities

Key issuers include:

- Government National Mortgage Association (Ginnie Mae)

- Federal National Mortgage Association (Fannie Mae)

- Federal Home Loan Mortgage Corporation (Freddie Mac)

These entities provide liquidity to the housing market by buying loans from lenders and converting them into tradable securities.

Types of Pass-Through Securities

Pass-through securities vary based on the nature of their underlying assets. Here are the primary types:

Mortgage-Backed Securities (MBS)

Mortgage-backed securities are the most common form of pass-through securities, representing the vast majority of the entire securitization market, with over $11 trillion in outstanding securities in the US market alone.

These are backed by residential or commercial mortgages and are issued by institutions like Ginnie Mae, Fannie Mae, or Freddie Mac.

Residential MBS (RMBS)

These are backed by residential home loans.

Investors receive regular payments that are derived from homeowners’ mortgage payments.

Commercial MBS (CMBS)

These are backed by commercial real estate loans.

They tend to be more complex and may carry more risk compared to RMBS.

Asset-Backed Securities (ABS)

These securities are backed by pools of assets such as:

- Auto loans

- Credit card receivables

- Student loans

- Equipment leases

ABS often includes various levels of credit enhancement designed to reduce the risk to investors.

Structure and Payment Mechanism

The structure of pass-through securities is designed so that the cash flows are transmitted directly to investors.

Monthly Payments

Investors typically receive monthly payments that include:

- Interest – Based on the outstanding principal

- Principal – A portion of the original loan amount repaid

Prepayment Risk

Prepayment risk is a major risk, i.e., the possibility that borrowers may pay off their loans early (e.g., a borrower paying off their mortgage early).

This is what gives some fixed-income instruments a negative convexity.

This affects the expected cash flow and yield of the investment.

Cash Flow Structure

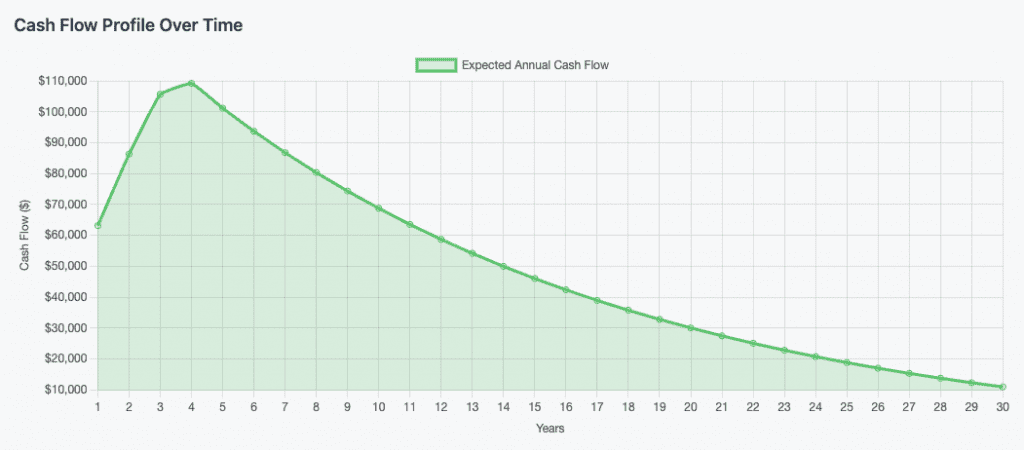

The chart below shows an example expected annual cash flow from a pass-through security over 30 years.

It shows the relationship between scheduled amortization, prepayments, and defaults.

It peaks around year 4 of the security’s life and gradually declines over time due to loan amortization and prepayments.

Advantages of Pass-Through Securities

Pass-through securities offer several benefits that make them attractive to investors.

Steady Income

They provide a consistent stream of income.

It’s typically paid monthly, making them suitable for income-focused investors.

Diversification

Pooling numerous loans, pass-through securities offer diversification to help reduce individual asset risk.

Liquidity

Many pass-through securities, especially those issued by GSEs, are actively traded and relatively liquid.

Risks Involved in Pass-Through Securities

Despite their advantages, these securities carry a number of risks.

Prepayment and Extension Risk

Prepayment risk occurs when borrowers repay their loans earlier than expected, i.e., often due to refinancing when interest rates fall.

Conversely, extension risk happens when repayments slow, typically when interest rates rise.

Interest Rate Risk

Changes in interest rates affect the value of pass-through securities.

Rising rates usually lead to a decrease in their market price.

Credit Risk

GSE-backed securities carry low credit risk due to government guarantees, but private-label securities (not backed by GSEs) can carry credit risk depending on the quality of the underlying loans.

The Role of GSEs and Government Guarantees

Ginnie Mae (GNMA)

Ginnie Mae guarantees the timely payment of principal and interest on MBS backed by federally insured or guaranteed loans.

These securities carry the full faith and credit of the US government, making them very low-risk (i.e., low credit risk, there is still duration/interest rate risk).

Fannie Mae and Freddie Mac

These institutions don’t offer direct government guarantees but are under government conservatorship.

Their securities are considered very safe, though not quite as secure as those from Ginnie Mae.

Investment Considerations

Before trading or investing in pass-through securities, consider the following:

Yield and Return Expectations

Yields on pass-through securities can be attractive but will still vary widely depending on prepayment assumptions, underlying asset quality, and interest rate movements.

Duration and Convexity

Because of the impact of prepayments, these securities have unique duration and convexity characteristics that differ from traditional bonds.

Traders/investors need to analyze how these metrics shift in different interest rate environments for risk management purposes.

Tax Implications

Interest income from most pass-through securities is taxable at the federal level.

State and local tax treatment varies, especially for Ginnie Mae, Fannie Mae, and Freddie Mac securities.

Market Trends and Evolution

Growth of the Securitization Market

The pass-through securities market has grown substantially since its inception in the 1970s.

Innovations in securitization have expanded the types of underlying assets and improved the structuring of securities.

Post-2008 Regulatory Changes

The 2008 financial crisis exposed weaknesses in the securitization process, particularly in private-label MBS.

In response, regulations such as the Dodd-Frank Act introduced stricter guidelines for asset-backed securities to increase transparency and investor protection.

Comparison with Other Fixed-Income Securities

Bonds vs. Pass-Through Securities

While both offer periodic income, traditional bonds pay fixed interest on a principal repaid at maturity.

In contrast, pass-through securities repay both principal and interest throughout the life of the security.

CDOs and CMOs

Collateralized Debt Obligations (CDOs) and Collateralized Mortgage Obligations (CMOs) are more complex offshoots of pass-through securities.

They involve tranching cash flows into different risk/return profiles, and appeal to investors with specific needs.

CDO/CMO vs. Pass-Through Security

A trader would use a CDO or CMO over a pass-through security to target a specific risk-return profile and maturity that isn’t available in a standard pass-through.

The structure of a CDO/CMO redirects cash flows into different tranches.

This allows a trader to select a security that either minimizes prepayment risk for more predictable cash flows or accepts higher risk for a greater potential yield.

Like most things in finance, it’s a matter of trade-offs and optimization based on your particular objectives.

Who Should Invest in Pass-Through Securities?

Institutional Investors

Pension funds, insurance companies, and banks often invest in pass-through securities for steady returns and portfolio diversification.

Individual Investors

While accessible, these instruments may be better suited for experienced traders/investors or those working with financial advisors due to their complexity and sensitivity to interest rate changes.

Correlations of Pass-Through Securities with Stocks and Bonds

Pass-through securities generally offer diversification benefits due to their relatively low correlation with stocks and their unique characteristics compared to other fixed-income assets.

Correlation with Stocks

Pass-through securities, particularly high-quality agency mortgage-backed securities, typically exhibit a low to negative correlation with equities.

The S&P 500’s correlation with MBB (MBS ETF) has averaged +0.21 using monthly returns.

| Name | Ticker | SPY | MBB | Annualized Return | Daily Standard Deviation | Monthly Standard Deviation | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|

| SPDR S&P 500 ETF | SPY | 1.00 | 0.21 | 10.45% | 1.26% | 4.53% | 15.68% |

| iShares MBS ETF | MBB | 0.21 | 1.00 | 2.57% | 0.29% | 1.23% | 4.26% |

| Asset correlations for time period 04/01/2007 – 06/30/2025 based on monthly returns | |||||||

When the stock market declines (a “risk-off” environment), investors often move into the perceived safety of high-quality bonds, which can include agency MBS, causing their prices to rise as stock prices fall.

This makes them relatively effective for diversifying a traditional stock portfolio.

Correlation with Government Bonds

Pass-throughs have a high positive correlation with government bonds like US Treasuries.

Both asset classes are sensitive to changes in overall interest rates.

| Name | Ticker | MBB | TLT | IEF | Annualized Return | Daily Standard Deviation | Monthly Standard Deviation | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|

| iShares MBS ETF | MBB | 1.00 | 0.72 | 0.83 | 2.57% | 0.29% | 1.23% | 4.26% |

| iShares 20+ Year Treasury Bond ETF | TLT | 0.72 | 1.00 | 0.92 | 3.09% | 0.97% | 4.14% | 14.33% |

| iShares 7-10 Year Treasury Bond ETF | IEF | 0.83 | 0.92 | 1.00 | 3.28% | 0.45% | 1.96% | 6.80% |

| Asset correlations for time period 04/01/2007 – 06/30/2025 based on monthly returns | ||||||||

Nevertheless, the correlation isn’t perfect due to the unique prepayment risk of pass-through securities.

This risk can cause MBS prices to react differently than Treasury prices during periods of interest rate volatility.

Correlation with Corporate Bonds

The correlation with corporate bonds is moderately positive, as both asset classes are sensitive to credit spreads and the overall health of the economy.

| Name | Ticker | MBB | LQD | HYG | Annualized Return | Daily Standard Deviation | Monthly Standard Deviation | Annualized Standard Deviation |

|---|---|---|---|---|---|---|---|---|

| iShares MBS ETF | MBB | 1.00 | 0.68 | 0.28 | 2.56% | 0.29% | 1.23% | 4.27% |

| iShares iBoxx $ Invmt Grade Corp Bd ETF | LQD | 0.68 | 1.00 | 0.69 | 4.09% | 0.57% | 2.43% | 8.42% |

| iShares iBoxx $ High Yield Corp Bd ETF | HYG | 0.28 | 0.69 | 1.00 | 4.90% | 0.70% | 3.03% | 10.50% |

| Asset correlations for time period 05/01/2007 – 06/30/2025 based on monthly returns | ||||||||

It has a stronger correlation with investment-grade credit than high-yield credit, as the former trades more on rates than credit risk (like MBS) relative to the latter.

When economic conditions are strong, the credit risk for both asset types is perceived as lower, and their prices tend to move in a similar direction.

However, because the underlying credit risk is different (consumer debt for pass-throughs vs. corporate debt for bonds), they still offer some diversification benefits relative to each other.

Pass-Through Securities Access for Individual Traders and Investors

While directly purchasing individual pass-through securities is often impractical for individual investors due to high minimums, the most common way to gain access is through specialized mutual funds and exchange-traded funds (ETFs).

MBB, as used in our correlation analysis above, is one example.

These funds pool together various mortgage-backed or asset-backed securities and enables traders to buy shares with a much smaller initial investment.

Investors can easily purchase shares of these MBS or ABS funds through a standard brokerage account, just like buying a stock.

Besides the iShares MBS ETF (MBB), here are some other popular ETFs and mutual funds that individual investors use to get exposure to pass-through securities:

- Vanguard Mortgage-Backed Securities ETF (VMBS) – This is one of the largest and most popular MBS ETFs, known for its very low expense ratio (like most Vanguard funds). It tracks a broad index of US agency mortgage-backed pass-through securities.

- SPDR Portfolio Mortgage Backed Bond ETF (SPMB) – Offered by State Street Global Advisors, this ETF also provides low-cost exposure to the US agency mortgage pass-through market.

- Vanguard Mortgage-Backed Securities Index Fund (VMBSX) – This is the mutual fund version of Vanguard’s ETF. It’s a good option for investors who prefer the mutual fund structure for automatic investments or retirement accounts.

- Fidelity Mortgage Securities Fund (FMSFX) – This is an actively managed mutual fund from Fidelity that invests primarily in mortgage-related securities, giving the manager flexibility to find opportunities across the sector.

Conclusion

Pass-through securities are a unique investment vehicle that connects lenders and borrowers.

From providing direct access to the cash flows of pooled assets, they offer regular income and interest payments.

Nonetheless, they come with distinctive risks, particularly related to interest rates and prepayments.

Understanding the structure, advantages, and risks of pass-through securities is important for any trader or investor considering them as part of a fixed-income strategy.