Fixed-Income Attribution (Components & Example)

Fixed-Income Attribution is a process used to analyze the performance of a fixed-income portfolio relative to a benchmark.

This technique decomposes the returns from a bond portfolio into different sources to understand what factors contributed to its performance.

It’s a tool for portfolio managers, analysts, and traders/investors to assess the effectiveness of trading and investment strategies in the fixed-income market.

Key Takeaways – Fixed-Income Attribution

- Fixed-income attribution analyzes a bond portfolio’s performance by decomposing returns into sources – e.g., interest rate changes, credit spread movements, and active management decisions.

- It helps identify which strategies and market factors contribute most to the portfolio’s gains or losses (improves decision-making and risk management).

- This model helps understand the impact of market dynamics on fixed-income investments.

- Helps with portfolio adjustments and strategy formulation.

- We do an example of a fixed-income attribution model in Python.

Components of Fixed-Income Attribution

1. Interest Rate Decision

This component analyzes the impact of changes in interest rates on portfolio returns.

It involves assessing the portfolio’s duration and convexity relative to the benchmark.

2. Yield Curve Movements

This aspect focuses on the returns generated due to changes in the shape of the yield curve (steepening or flattening).

Different parts of the yield curve can behave differently, affecting various securities in the portfolio.

3. Sector Allocation

This part examines the impact of the portfolio manager’s decisions to allocate funds to different sectors (such as corporate, government, or municipal bonds) compared to the benchmark.

4. Security Selection

Security selection attribution measures the impact of choosing specific securities within a sector, as opposed to the sector allocation itself.

5. Currency Decisions

For global fixed-income portfolios, currency matters.

For example, if you’re a US-based trader (your currency is USD), having non-USD bonds (i.e., foreign bonds aka FX bonds) brings currency movements into it.

This component analyzes the effect of foreign exchange rate movements on the portfolio’s returns.

Significance of Fixed-Income Attribution in Portfolio Management

Performance Analysis

Fixed-income attribution provides a detailed understanding of why a portfolio performed the way it did.

By breaking down the sources of return, portfolio managers can evaluate the effectiveness of their trading or investment strategies.

Risk Management

Understanding the contributions to returns allows managers to assess the risk taken to achieve those returns.

It’s important for managing risk and aligning the portfolio with risk tolerance.

Strategy Adjustment

By identifying which strategies worked and which did not, managers can make informed decisions about future portfolio adjustments, whether it’s in interest rate positioning, sector allocation, or specific security selections.

Challenges in Fixed-Income Attribution

Complexity

The complexity of the fixed-income market, with its variety of instruments and sensitivity to multiple factors like interest rates and credit spreads, makes attribution analysis challenging.

Model Specification

The choice of the attribution model and its assumptions can significantly impact the analysis.

Different models may yield different interpretations of the same portfolio’s performance.

Data Quality

High-quality, accurate data is important for effective attribution analysis.

Inaccuracies in pricing, yield curves, or other relevant data can lead to misleading attribution results.

Fixed-Income Attribution in Python

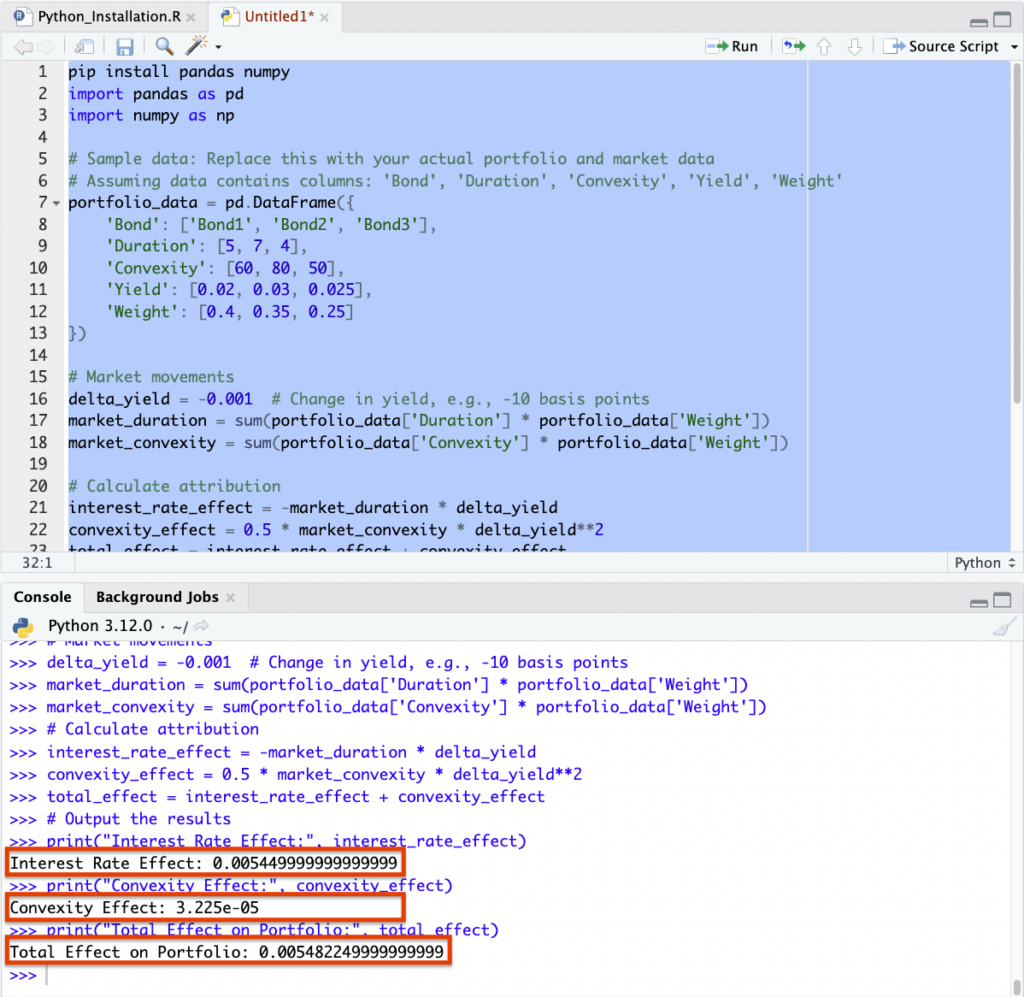

Developing a fixed-income attribution model in Python involves several steps: data acquisition, yield curve modeling, and attribution analysis.

Below is a simplified example to demonstrate the basic concept using Python.

This example assumes you have a fixed-income portfolio and market data, including bond prices, yields, durations, and convexities.

You’ll need libraries like pandas and numpy for data handling and calculations.

pip install pandas numpy

So, let’s write a basic Python script for Fixed-Income Attribution:

import pandas as pd import numpy as np # Sample data: Replace this with your actual portfolio and market data # Assuming data contains columns: 'Bond', 'Duration', 'Convexity', 'Yield', 'Weight' portfolio_data = pd.DataFrame({ 'Bond': ['Bond1', 'Bond2', 'Bond3'], 'Duration': [5, 7, 4], 'Convexity': [60, 80, 50], 'Yield': [0.02, 0.03, 0.025], 'Weight': [0.4, 0.35, 0.25] }) # Market movements delta_yield = -0.001 # Change in yield, e.g., -10 basis points market_duration = sum(portfolio_data['Duration'] * portfolio_data['Weight']) market_convexity = sum(portfolio_data['Convexity'] * portfolio_data['Weight']) # Calculate attribution interest_rate_effect = -market_duration * delta_yield convexity_effect = 0.5 * market_convexity * delta_yield**2 total_effect = interest_rate_effect + convexity_effect # Output the results print("Interest Rate Effect:", interest_rate_effect) print("Convexity Effect:", convexity_effect) print("Total Effect on Portfolio:", total_effect) # Extend this model to include other factors like credit spread movements, sector allocation effects, and active management decisions

Just plug this into your favorite IDE and you’ll get the results:

Related

Conclusion

Fixed-income attribution is used for understanding the performance of bond portfolios.

It enables portfolio managers to dissect and analyze various factors contributing to performance.

It helps with informed decision-making and strategy refinement.

But its effectiveness depends on the chosen attribution model, the quality of underlying data, and an understanding of the fixed-income market dynamics.