Woxa Review 2025

Pros

- It is really easy to open a Woxa account – taking less than 5 minutes

- TradingView's charting package is excellent with 100+ indicators and drawing tools

- The trading platform is very easy to use thanks to its modern design and intuitive navigation

Cons

- Woxa is still relatively new with weak regulatory credentials and limited safeguards

- Woxa seriously lags behind top brokers when it comes to market research tools

- Investors can only deposit with wire transfer and there is a fee for non-USD transfers

Woxa Review

In this Woxa review, I weigh the pros and cons of opening an account. I will break down the ratings I have given Woxa in each area, based on my own first-hand experience using the platform. I also compare Woxa to suitable alternatives and highlight where I think the broker could improve.

Regulation & Trust

1.5 / 5The first question I always ask, and you should too, is can I trust this broker and will my funds be safe?

Unfortunately, I have given Woxa a low trust score. The company is regulated offshore by the Financial Services Commission (FSC) in Mauritius. The broker is also registered in Saint Vincent and the Grenadines. These are not well-respected regulatory jurisdictions with limited trader safeguards. For example, you may not have access to an investor compensation scheme in the event the broker goes bankrupt.

Woxa also has a relatively short history – it was only launched in 2019. This means the trading firm doesn’t have the track record or reputation enjoyed by more established brokers.

Considering the positives, I was pleased to find that the broker uses segregated accounts to separate client and company funds. This will help protect your money in case Woxa faces financial difficulties.

I was also reassured to find that the broker offers negative balance protection. I consider this a key safety measure, especially when trading with leverage. It means you cannot lose more than your account balance should the markets move against you.

However, these benefits do not outweigh the broker’s poor regulatory credentials for me, hence its low overall trust score. Also, as you can see from my comparison of alternatives below, you can find tightly regulated brokers that still offer important safeguards.

| Woxa | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulators | FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Negative Balance Protection | Yes | Yes | Yes |

| Segregated Accounts | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

1.5 / 5Live Account

Woxa offers one live account to retail investors, with an accessible starting deposit of $25. A swap-free solution is also available for Islamic traders.

The good news is that this keeps things straightforward for beginners, as everyone gets access to all tools and instruments with the same trading conditions. On the negative side, it means there aren’t accounts specially designed for different types of strategies, skill levels and budgets.

As a comparison, Pepperstone offers a Standard and Razor account. The Standard account is good for beginners with spread-only pricing while the Razor account is suitable for active traders looking for ultra-tight spreads with a low commission. You don’t get the option of a Razor account or similar at Woxa.

I think Woxa could better serve a wider range of traders, including day traders, with a raw spread account.

How To Open A Woxa Account

There is nothing bad to report about the registration process at Woxa. It took me 2 minutes and required a few basic contact details. To get started:

- In the registration form provide your username, email, password and country of residence. Alternatively, my tip is to sign up with a Google or Facebook account (this is quicker)

- Click on the verification link sent to your email address

- Sign in with your login credentials

Importantly, you won’t be able to trade with real money until you verify your identity by submitting the requested documents.

Deposits & Withdrawals

Something that really frustrated me when I opened a Woxa account was finding out that this broker only accepts local wire transfers from Indonesia, Vietnam and Malaysia.

As you can see from my comparison of similar brokers below, most top firms also accept bank cards and popular e-wallets, ensuring you can fund your account quickly using a convenient solution.

Instead, I learned that you will have to wait 3 to 5 days for funds to be available at Woxa after depositing by bank transfer.

My other major complaint, which I explain in more detail below, is that you may have to pay a conversion fee to transfer your funds into USD, as Woxa accounts are only denominated in USD. Again this adds to the inconvenience of depositing with this broker.

| Woxa | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Payment Methods | Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Welcome Bonus

When I opened a Woxa account I was offered a $50 joining bonus.

This is essentially free trading credit that is available after you verify your identity and bank account. You then just need to switch to ‘Credit Account’ in the client area to trade with the bonus funds.

I found that the bonus does not expire, but once you withdraw any profit the Credit account will be automatically closed.

Importantly, I do not recommend choosing a broker because of its welcome bonus. For me, there are more important considerations, including its regulatory credentials and reputation, the competitiveness of its accounts and fees, plus the quality of trading tools.

Demo Account

Woxa also offers a free demo account so you can practice trading risk-free. This is a useful tool, especially for new traders. I also think this is particularly helpful given that Woxa uses a proprietary platform, as it gives you the freedom to learn and try the different features.

I signed up to test the practice account and found that $100,000 in virtual funds are available. This was enough for me to explore different markets – I traded forex, stocks and commodities with no restrictions.

The only thing to keep in mind is that I discovered the demo account will permanently close when you withdraw money from Woxa.

Assets & Markets

3.3 / 5It is important to choose a broker that offers access to the products and markets you are interested in. With this in mind, I investigated the instruments in the trading platform to see what is available, and what isn’t.

I found that Woxa offers a decent range of around 2000 CFDs spanning 6 asset classes; forex, stocks, indices, commodities and ETFs. This will provide plenty of opportunities to speculate on popular global markets, especially for new traders.

Looking at the downsides, the 29 currency pairs and 352 shares do not rival the depth of product portfolios at many alternatives I have evaluated. As a result, I wouldn’t recommend Woxa for serious stock and forex traders.

It is also worth noting that you can only trade using contracts for difference (CFDs). This is a popular derivative with short-term traders that allows you to speculate on rising and falling prices, however you won’t own the underlying asset.

To give you the full picture of what you can trade on the Woxa platform, I have listed the different markets:

- Commodities – 8 energies and metals including oil, gold and silver

- Indices – 10 stock indices including the NASDAQ, FTSE and DAX

- Stocks – 352 shares including Apple, Amazon and Google

- Forex – 29 currency pairs including the EUR/USD, GBP/USD, and AUD/USD

- Cryptocurrencies – 10 digital tokens including Bitcoin, Litecoin and Ethereum

- ETFs – 40 exchange-traded funds across several sectors and markets

I think Woxa could broaden its appeal for serious traders by expanding the number of assets available, especially currencies and stocks.

Additional investing vehicles, such as share dealing, would also make the broker a better fit for longer-term traders.

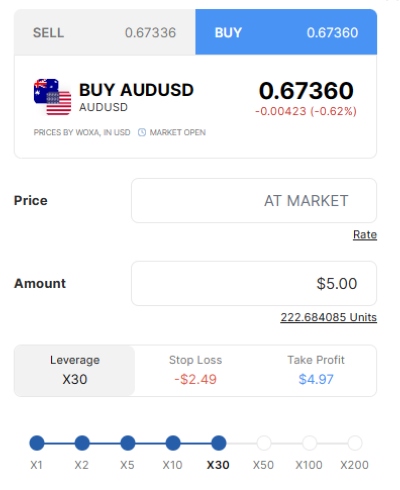

Leverage

Woxa offers high leverage on CFDs up to 1:400. This is significantly higher than the 1:30 cap imposed by many regulators, including in the EU, UK and Australia.

As a result, I recommend that beginners in particular be careful. High leverage can not only magnify returns, it can also lead to large losses. With this in mind, I recommend making use of the risk management tools available in the platform, especially the stop-loss function.

One useful feature I did like about margin trading at Woxa is the flexibility to amend the leverage on each trade using a straightforward slider at the bottom of the order widget. This is a nice touch and makes it easier to manage your exposure depending on market conditions.

| Woxa | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:400 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

2.9 / 5Although Woxa advertises commission-free trading, after using the platform, I found that you will pay:

- Spreads – the difference between the bid and ask prices of assets

- Overnight fees – if you hold CFD positions overnight

- Conversion fees – if you deposit and withdraw in non-USD

I evaluate the fees in more detail below, but my conclusion: Woxa is not the cheapest broker, especially if you want to trade forex, commodities or stocks.

Trading Fees

When I compared Woxa’s spreads to other brokers, I found them to be average to high.

I recorded and analyzed Woxa’s spreads on the 26 October 2023 following the US open. During my tests, I got a 2.0 pip spread on the EUR/USD. Spreads on commodities and shares also came in on the high side, while spreads on cryptos like Bitcoin were more competitive at 25.

| Woxa | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| EUR/USD Spread | 2.0 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 5.38 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.06 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.53 (Tesla) | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

As you can see in my detailed comparison with alternatives, spreads at Woxa are noticeably wider on most popular assets. As a result, it wouldn’t be my pick if you want a low-cost trading platform.

Like most brokers, Woxa also charges a swap fee on CFD positions held overnight. I found that you can view this fee at the bottom of the trade widget within the platform.

Non-Trading Fees

Woxa scores better when it comes to non-trading fees.

I was pleased to find no inactivity fees, which makes this broker more attractive to casual traders. For comparison, the majority of brokers I have evaluated, including AvaTrade and Plus500, charge accounts a monthly fee in excess of $10 after several months of no trading,

The only cost you will need to take into account is the conversion fee if you deposit or withdraw in a currency other than the USD. This is because Woxa automatically converts any payments to USD.

After investigation, I found that the size of the conversion fee will depend on the exchange rate at the time and the payment provider.

Platforms & Tools

2.8 / 5Woxa Platform

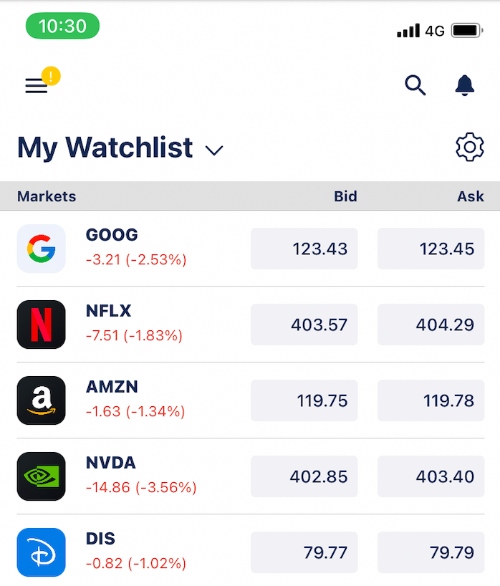

I thoroughly tested Woxa’s in-house platform, creating my own watchlist, trading from charts and managing my portfolio to understand what works well, what could be improved, and what is missing compared to popular alternatives.

I have explained my findings in detail below, but my conclusion: the in-house platform is best for beginners looking for a smooth trading experience with basic analysis features. However, it lacks advanced functions such as automated trading capabilities for seasoned traders.

Design & Usability

I don’t have any complaints about the design and usability of the platform. The look and feel are more modern than alternatives I have tried like MetaTrader 4.

It is also streamlined. While some platforms I use are packed with widgets, making for a cluttered interface, the Woxa layout features a single chart, from which you can overlay indicators and drawing tools and place trades. In addition, you can conveniently track open and closed orders in the panel underneath the chart.

You can also access different features by selecting the relevant icon at the top of the screen. These include a ‘Watchlist’, which I find useful but expect from any decent trading platform, and ‘Portfolio’, where I can view account metrics, including my trading history, profits, fees and account equity.

This all makes for an enjoyable trading experience that I think will appeal to new traders, in particular, who should be able to quickly get to grips with the terminal.

I think the fact it is accessible directly through browsers is also a plus, as it means you don’t have to download any software.

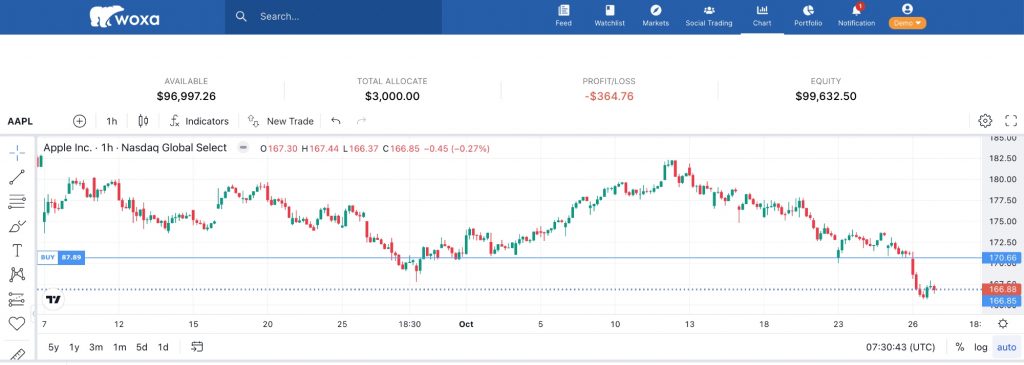

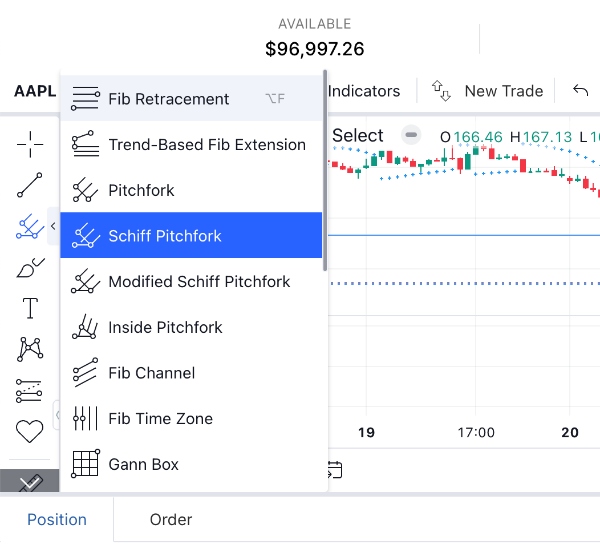

Charting Tools

Charting is where the Woxa platform really stands out for me. This is because it uses a package from TradingView – an industry frontrunner in the charting department.

I have access to 9 timeframes (1 minute to 1 month), 9 charting styles (including bars, candles and lines), close to 30 drawing tools (including Fibonacci Retracement and Gann Box) and around 100 technical indicators (including Bollinger Bands and Moving Averages).

I also find it very straightforward to work on my charts and add indicators using the control bar at the top of the interface. Ultimately, it has everything you need for technical analysis.

Order Types

After placing multiple trades on the Woxa platform, orders are where I found the platform falls short. You cannot place a limit order to specify the price you will buy or sell an asset. This is a drawback compared to alternatives like MetaTrader 5 and cTrader, where you can.

Instead, you can place market orders which will buy or sell an asset at the best available price. This means your order will be filled, but there could be a difference between the requested price and the actual price when the order is filled.

On a positive note, I was pleased to find risk management tools like stop-loss and take-profit orders.

How To Place A Trade

I didn’t run into any issues placing trades on the Woxa platform. I traded US shares and major currency pairs with no problems. You have a couple of straightforward options:

- Click on the ‘Markets’ tab, choose an asset, click ‘Trade’ and enter the order details

- Click on the ‘Chart’ tab, choose an asset, click ‘New Trade’ and enter the order details

Mobile App

I enjoyed using the Woxa app during my review. My watchlists and charting parameters translated well to the mobile application and I had no issues managing my account, especially once I enabled notifications.

I didn’t experience any technical glitches during testing either. The charts loaded quickly and no delays moving between widgets.

The other positive is the strong user security. I set up two-factor authentication with a PIN code in the account settings, giving me important peace of mind.

My only criticism is that really drilling down into technical analysis is hard, even with mobile-optimized charts. However, this is true of all mobile trading apps, so I haven’t marked Woxa down for this.

I used the iOS app, but you can also download the application from Google Play for Android devices.

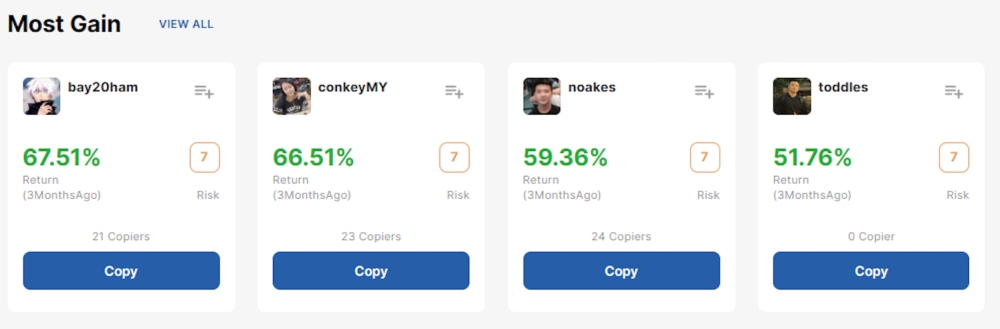

CopyTrade

Woxa offers a social trading service – CopyTrade.This allows you to find, follow and copy the strategies of experienced traders.

There were a few things I rated about this tool. Firstly, Woxa has designed the social trading feed so you can quickly view the most important metrics about signal providers, including their returns, number of copiers and risk rating.

The fact they have also created lists of the best master traders in different categories is also useful, including ‘Most Gain’, ‘Low Risk’ and ‘Long-Term Traders’

This all makes it much easier to find strategy providers that align with your investment goals and risk appetite.

However, when I compared the solution to best-in-class brokers, I found several drawbacks. Firstly, Woxa offers a very limited pool of traders to choose between. Also, many of the traders don’t have performance data beyond a few months.

Even more frustratingly, I discovered that several signal providers I investigated choose not to publish trading data, which doesn’t inspire trust. I discarded these immediately.

Overall, Woxa’s copy trading service is easy to use and has potential, but if you want a large suite of high-quality master traders to choose from, I’d use an alternative like eToro.

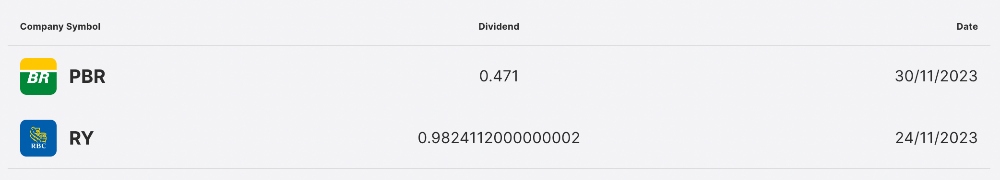

Research

1.8 / 5After thoroughly evaluating Woxa and using its trading platform, one area where the broker really lags behind alternatives is market research tools. There is no commentary from in-house analysts or access to extra tools to help analyze markets and inform trading decisions.

This shortfall is especially evident when I compare Woxa to brokers like FOREX.com, which offers access to Trading Central that scans the markets for opportunities, plus daily analyst insights, and financial news with market commentary. These all seriously bolster the trading experience in my view, and save me from having to turn to third-party resources.

The only tool I found somewhat useful at Woxa was the Stocks Calendar which provides basic information on dividend dates, stock splits and symbol changes. But while convenient to have, I don’t think it will provide much value to traders.

Education

2 / 5I found some useful learning resources in the Woxa Academy, with articles on different investments and videos.

However, they are only good if you want to learn the basics, such as understanding major, minor and exotic currency pairs or what the difference is between stocks and forex.

Importantly, after comparing the materials to alternatives like XM, I concluded that Woxa offers little for experienced traders looking to learn new strategies or understand different indicators, for example.

I think Woxa could improve its education by introducing content on more advanced topics and providing more engaging ways to learn, such as live trading sessions and interactive quizzes.

Customer Support

2 / 5Finding a broker with customer support you can count on is important, especially when you are new to a brand or new to online trading. That is why I tested the speed and quality of Woxa’s customer support on more than 10 occasions. Unfortunately, I wasn’t impressed.

While the broker claims to be available every day from 03.00 to 07.00 (UTC+0), there were occasions during this window when I couldn’t get through to anyone because they were too busy – not great when you need urgent assistance.

There are also very few contact options. You can reach the team by email (support@woxa.com) and live chat (bottom right-hand side of the broker’s website), but there is no telephone number or social media support, which I see at most top brokers.

Finally, while the support staff were polite during testing, my questions were sometimes misunderstood often leaving me more confused. A good example of this is when one customer service representative I spoke to did not know what automated trading was.

Ultimately, I don’t have confidence that they can adequately resolve platform queries or withdrawal issues.

I think Woxa could improve its customer support by bringing in more knowledgeable support staff who are always available during important trading sessions.

Should You Trade With Woxa?

Woxa does not get my vote based on my first-hand experience using the platform.

Looking at the positives, it is easy to open an account, the $25 minimum deposit is accessible and the platform is beginner-friendly with an excellent charting package from TradingView. The broker also offers a decent product portfolio with access to popular global markets.

However, my assessment shows that Woxa falls short in too many areas. Most importantly, its weak regulatory credentials and short history result in a low trust score. My analysis shows fees are also on the high side and you can only load your account by wire transfer.

Finally, it doesn’t rival other brokers I have reviewed when it comes to education, market research, customer support or copy trading.

Overall, it offers a basic trading solution for new investors in Vietnam, Malaysia and Indonesia. But it wouldn’t be my first pick…

FAQ

What Is Woxa?

Woxa is an online broker established in 2019. Woxa Ltd is based in Mauritius, though the group is also registered in Saint Vincent and the Grenadines (26740 BC 2022). The brokerage claims to have over 100,000 users spanning Vietnam, Malaysia and the Philippines.

Is Woxa Legit Or A Scam?

Woxa appears to be a legitimate broker. I opened an account, used the trading platform and tested the various features, all of which worked as advertised.

With that said, it does not operate with the same reputation, regulatory oversight and safeguards as leading brokers, which makes it higher risk in my view.

Can I Trust Woxa?

I gave Woxa a low trust score. This is because the broker is not authorized by a trusted regulator and it has a relatively short history – it was only established in 2019.

Is Woxa A Regulated Broker?

Woxa is regulated by the Financial Services Commission (FSC) of Mauritius. However, this is not a well-regarded regulator. You may not get access to investor compensation should the company run into financial difficulties.

Is Woxa Good For Beginners?

My testing shows that Woxa is an average broker for beginners. The $25 minimum investment lowers the entry barrier, plus there is a free demo account and a social trading service where you can learn from more experienced traders.

However, the educational materials and customer support fall below many alternatives I have used, and I consider these important for new traders. As a result, I think beginners will have a better trading experience with other online brokers.

Does Woxa Offer Low Fees?

Woxa offers above-average fees. I compared the spreads I got while using Woxa with alternatives and found they were significantly higher on currency pairs, stocks and commodities. Spreads on crypto assets like Bitcoin were more competitive, however.

Is Woxa A Good Broker For Day Trading?

Woxa is not great for day trading. There is no raw spread account, fees are on the high side and automated trading isn’t supported.

Does Woxa Have A Mobile App?

Yes, Woxa offers a mobile trading app. It can be downloaded to Android and Apple devices from the relevant app store. The app performed well during my testing, offering full account management features, mobile-optimized charts and on-the-go trading functionality.

What Are The Trading Hours At Woxa?

Like most brokers, trading hours vary depending on the market. For example, cryptocurrencies can be traded 24/7, forex can be traded 24/5 and stocks follow the opening times of the respective exchange.

Helpfully, the broker’s website has included a list of trading times and events that affect market opening. You can also filter it by your local time zone.

Top 3 Alternatives to Woxa

Compare Woxa with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Videforex – Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

Woxa Comparison Table

| Woxa | Interactive Brokers | Dukascopy | Videforex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 3.6 | 3.5 |

| Markets | CFDs on Forex, Commodities, Stocks, Indices, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $25 | $0 | $100 | $250 |

| Minimum Trade | 0.01 | $100 | 0.01 Lots | $0.01 |

| Regulators | FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | – |

| Bonus | $50 Welcome Bonus | – | 10% Equity Bonus | 20% to 200% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Woxa Platform, App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | TradingView |

| Leverage | 1:400 | 1:50 | 1:200 | 1:500 |

| Payment Methods | 1 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Videforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Woxa and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Woxa | Interactive Brokers | Dukascopy | Videforex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Woxa vs Other Brokers

Compare Woxa with any other broker by selecting the other broker below.

Customer Reviews

3.3 / 5This average customer rating is based on 6 Woxa customer reviews submitted by our visitors.

If you have traded with Woxa we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Woxa

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I am finding Woxa pretty good for stock trading. There are no commissions and loads of US shares, though a stock screener would be a welcome addition.

Don’t choose Woxa if you want low fees. Spreads are too wide on forex. Cheaper brokers elsewhere. Won’t use again.

I’ve been happy with Woxa so far. I’m new to online trading so wanted a broker with a simple app and quick sign-up. I haven’t tried to withdraw my profits yet, but hopefuly that won’t be an issue.

Decent broker if you want to trade CFDs. I’ve been using the platform for a few weeks and haven’t had any major issues. Higher leverage than lots of firms and quick to get started with the app. My only gripe is that the spreads are pretty wide on currencies.

Woxa has worked well for me for several weeks now, but I do wish they had MT4 support and more educational articles and technical tools. Customer support is also a bit hit and miss.

I think Woxa is a great broker. I found it super easy to open an account and the platform is user-friendly.