Forex Trading in Eswatini

Forex trading in Eswatini has seen a surge in popularity, driven by the country’s steady economic progress and the exciting potential for profit in this growing financial market.

As one of Africa’s smaller nations, Eswatini’s economy, with a GDP of approximately $5 billion, relies heavily on the financial sector while its Swazi lilangeni is pegged to the South African rand for stability.

Want to start forex trading in Eswatini? This guide for beginners has you covered, unpacking the country’s regulatory and tax stance, optimal forex trading times, and practical tips to help you make informed decisions.

Quick Introduction

- The Swazi Lilangeni (SZL), pegged 1:1 to the South African rand, is Eswatini’s national currency. While used only in Eswatini, it’s less traded than major currencies. Its liquidity is low and it is primarily traded against the ZAR due to its fixed exchange rate.

- Forex trading in Eswatini is regulated by the Financial Services Regulatory Authority (FSRA), which oversees non-bank financial services. The Central Bank of Eswatini also influences the forex market through its role in monetary policy and economic stability.

- In Eswatini, forex trading profits are generally taxable between 20% and 33%. The Eswatini Revenue Service (ERS) collects these taxes with returns due by June of the following year.

Top 4 Forex Brokers in Eswatini

After our latest in-depth tests, these 4 platforms came out on top for forex traders in Eswatini:

How Does Forex Trading Work?

Forex trading entails buying and selling currency pairs to profit from price fluctuations.

An online broker will provide you with a platform to do this, either through a desktop client, web terminal or increasingly, a forex trading app.

In Eswatini, the local currency, the Lilangeni (SZL), is primarily traded against other major currencies such as SZL/ZAR and SZL/USD, given the country’s economic connections with South Africa and global markets.

Let’s imagine you expect the Lilangeni to strengthen against the US Dollar (USD) due to increased foreign investment, you might decide to sell the USD/SZL currency pair.

If the exchange rate declines (meaning the SZL strengthens against the USD), you could potentially profit from this trade, after accounting for any trading fees.

Our research indicates that the SZL is not widely traded or readily available at brokers.However, the ZAR is typically featured on leading forex platforms, offering opportunities for Eswatini traders.

Is Forex Trading Legal In Eswatini?

Forex trading is legal in Eswatini and overseen by the FSRA and the Central Bank of Eswatini.

Established to regulate and supervise non-bank financial institutions, the FSRA ensures that all entities involved in forex trading – whether they are brokers, investment firms, or individual traders – adhere to the rules and guidelines set forth to maintain market integrity and protect investors.

The Central Bank of Eswatini also plays an important role in maintaining monetary stability, indirectly impacting the forex market through its handle on interest rates, inflation and foreign exchange reserves.

Is Forex Trading Taxed In Eswatini?

Forex trading profits are generally taxable in Eswatini, with rates ranging from 20% to 33%. These taxes are paid to the Eswatini Revenue Service (ERS).

However, the specific tax rate and regulations can vary based on factors such as your overall income, the type of forex trading account, and whether you are classified as an individual or a business.

Given Eswatini’s developing tax regime and limited oversight of forex trading activities, I recommend consulting a local tax professional who can advise on your circumstances and ensure you meet your obligations.

When Is The Best Time To Trade Forex In Eswatini?

The best time to trade forex in Eswatini depends on your trading strategy, risk tolerance, and market conditions.

Generally, trading during overlapping hours with major financial centers like London and New York offers the most movement and potential for profit due to increased liquidity and volatility. Eswatini’s Central Africa Time Zone allows for such overlaps.

- During the London-New York overlap, active traders may choose to focus on global currency pairs that feature the US Dollar (USD), such as EUR/USD and GBP/USD.

- The Asian market hours (early morning in Eswatini) could be suitable if you prefer lower volatility. Although quieter than the London and New York overlap there remain opportunities, particularly in currency pairs featuring the Japanese Yen (JPY), such as USD/JPY and EUR/JPY.

Example Forex Trade

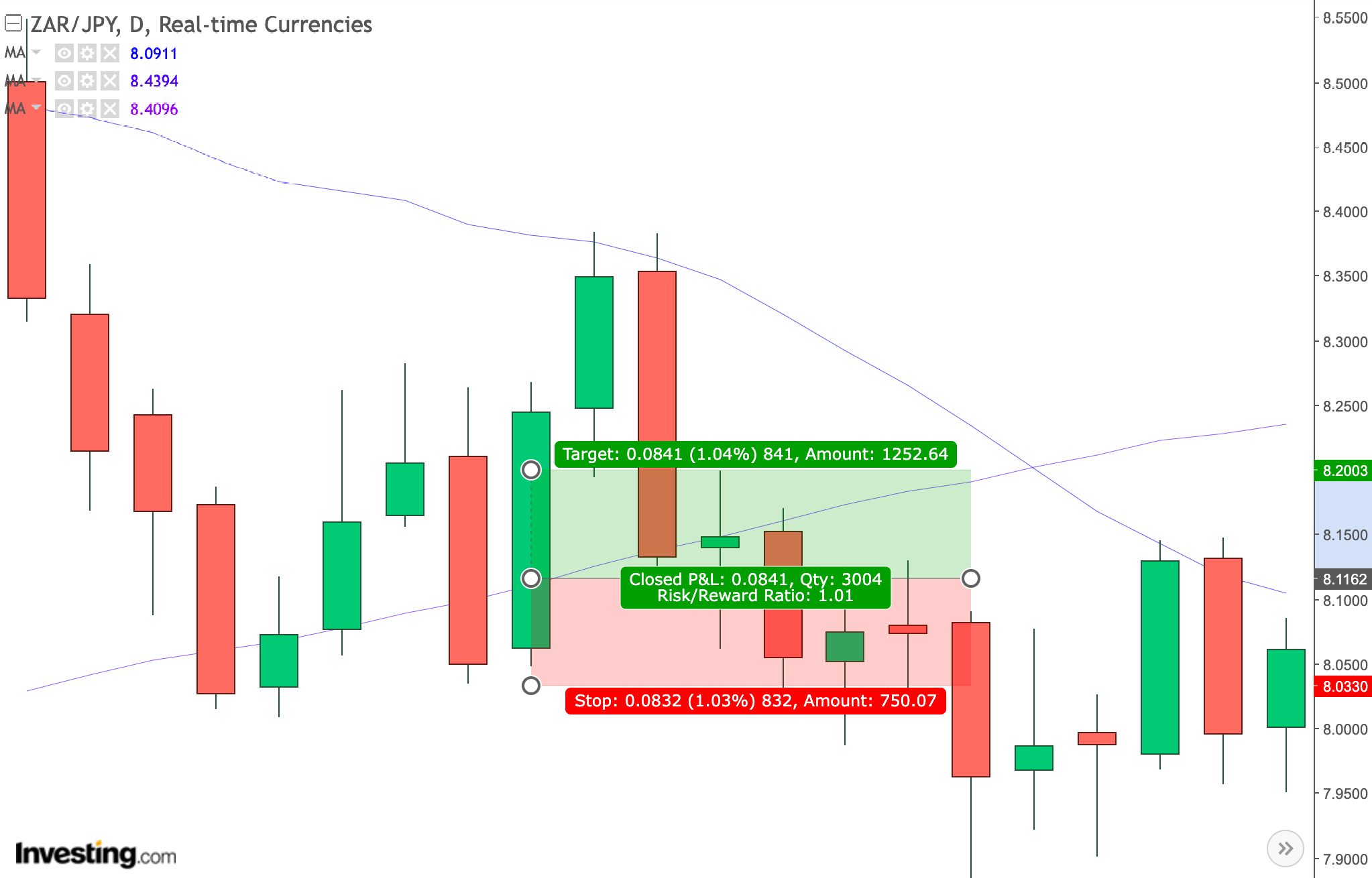

Let’s explore a hypothetical scenario where I trade the South African rand (ZAR) against the Japanese yen (JPY).

I have chosen this pair because the Lilangeni is less suitable for short-term trading because of its limited liquidity and availability.

Event Background

I observed an economic announcement from South Africa regarding a significant increase in the country’s GDP growth rate.

This announcement was unexpected and had the potential to impact the ZAR positively against other currencies.

Given the economic context, I decided to focus on trading the ZAR/JPY currency pair, which reflects the rand’s value relative to the Japanese yen.

Trade Entry & Exit

At the time of the announcement, I noticed a sharp rise in the value of the ZAR as the news was released, which was quickly reflected in the forex market.

I entered a long position on the ZAR/JPY pair right after the news broke, and the market began reacting.

I chose a conservative entry point just slightly above the current market price of JPY 8.1162 to ensure I was capitalizing on the initial momentum without getting too caught up in any short-term volatility.

I set my exit strategy by monitoring the price movement and the subsequent reactions to the announcement.

I placed a take-profit order at a level that represented a reasonable 1.04% gain, given the expected short-term impact of the announcement. To minimize losses in the event my analysis was wrong, I set a stop-loss order at the previous day’s low.

As the ZAR strengthened, I observed a steady increase in the currency pair.

I decided to exit the trade when the ZAR/JPY reached a point that had shown resistance in previous market trends, securing a profit before any potential reversal.

Trade Analysis

After the positive news was released, I capitalized on a recent South African economic announcement by entering a long position on the ZAR/JPY pair.

I carefully timed my entry to take advantage of the initial market reaction and strategically set my exit to secure profits while avoiding excessive risk.

The trade was executed successfully, demonstrating the importance of aligning trading decisions with timely economic events and maintaining disciplined trade management.

Bottom Line

Forex trading in Eswatini is legal and operates under a structured regulatory framework overseen by the FSRA, which ensures compliance and market integrity.

The Central Bank of Eswatini also plays a role in maintaining monetary stability, influencing the local currency, the Swazi lilangeni, and its relationship with other currencies.

To ensure your activities remain lawful and transparent, you must work with licensed brokers and adhere to financial regulations, including tax obligations.

To get started, turn to DayTrading.com’s selection of the best forex trading platforms in Eswatini.

Recommended Reading

Article Sources

- Eswatini Revenue Service (ERS)

- Financial Services Regulatory Authority (FSRA)

- Central Bank of Eswatini

- Eswatini GDP - IMF

- Eswatini Taxes on Personal Income - PWC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com