Best Forex Brokers And Trading Platforms In Eswatini 2026

Explore our selection of the best forex brokers in Eswatini. The Central Bank of Eswatini (CBE) oversees forex trading in the country, formerly Swaziland, however it doesn’t actively regulate online brokers. As a result, many traders in Eswatini choose to sign up with established, global brokerages that offer excellent trading tools, low forex fees and strong regulatory credentials.

Top 6 Forex Brokers in Eswatini

We have reviewed dozens of brokers active in the country and compared crucial factors to produce our list of the best forex trading platforms in Eswatini:

-

1

XM

XM -

2

Vantage

Vantage -

3

IC Markets

IC Markets -

4

AvaTrade

AvaTrade -

5

FOREX.com

FOREX.com -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Here is a summary of why we recommend these brokers in February 2026:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

Best Forex Brokers And Trading Platforms In Eswatini 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| FOREX.com | 84 | 1.2 | / 5 | $100 | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- It’s quick and easy to open a live account – taking less than 5 minutes

- The ECN accounts are very competitive with spreads from 0.0 pips and a $1.50 commission per side

Cons

- Unfortunately, cryptos are only available for Australian clients

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

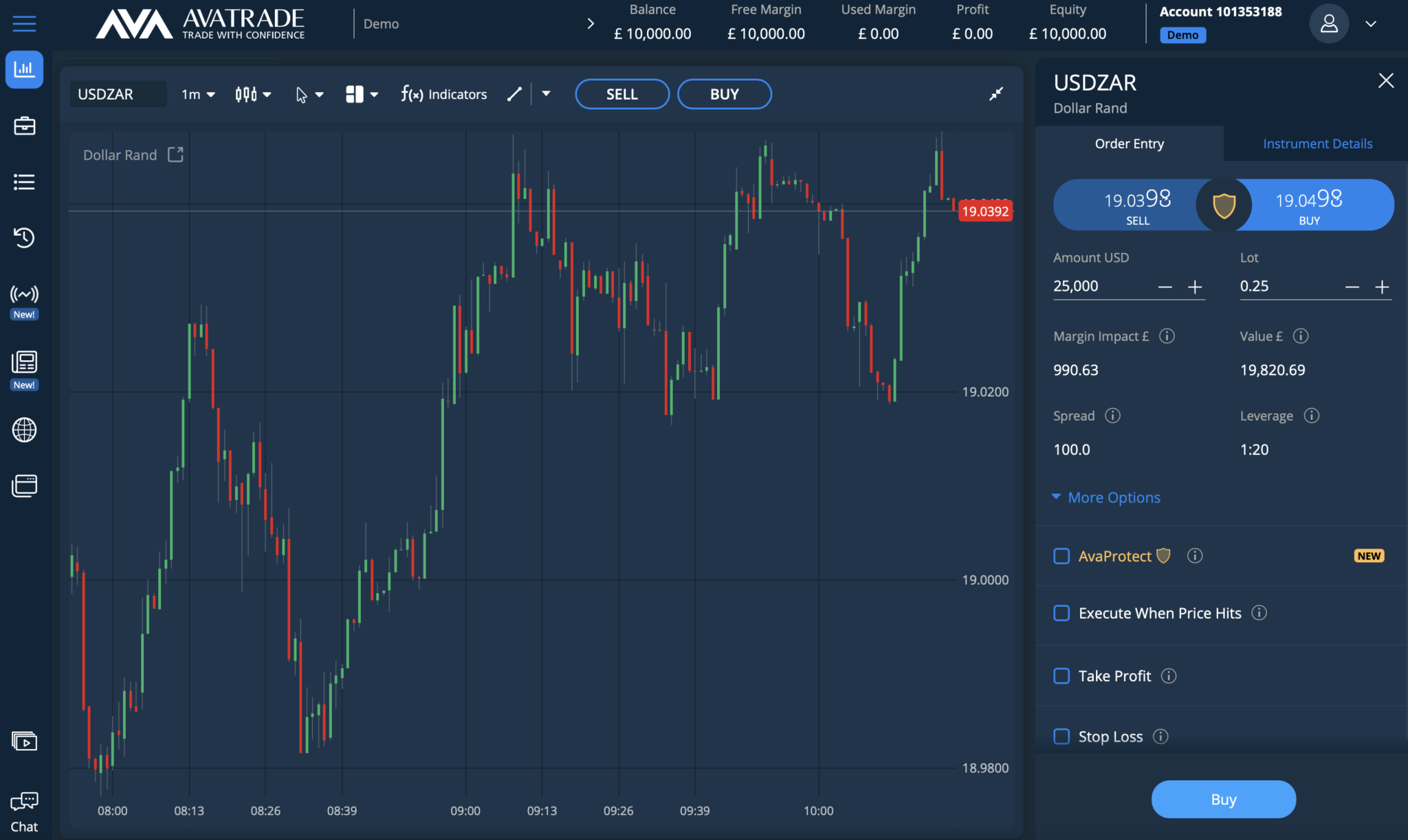

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:400 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

How We Rate Forex Brokers In Eswaitini

We rate forex trading platforms in Eswatini by considering the following factors that we recommend you also consider:

Trust

Choosing a trusted forex broker is paramount to safeguard your trading experience.

This is especially important given the danger of forex scams, which have targeted traders in Eswatini in recent years.

The Central Bank of Eswatini is not a particularly active or well-regarded regulator. However, residents of Eswatini should still choose a forex broker regulated by another respected body, as long as they continue to follow tax rules in Eswatini. South Africa’s Financial Conduct Authority (FSCA) is a particularly attractive option given Eswatini’s close ties with the country.

Importantly, we only recommend forex brokers we trust, an assessment we make by weighing their regulatory credentials, years in the industry and reputation.

- Vantage is highly trusted, with authorization from the FSCA, FCA and ASIC, 15+ years in the industry, and a long row of industry awards.

Currency Pairs

It pays to have access to a good selection of currency pairs, as it will help provide you with a range of trading opportunities.

Our research shows that the Swazi Lilangeni (SZL) is not traded in large volumes or widely available at online brokers. However, the ZAR, which is pegged 1:1 with the SZL, normally features on the top forex platforms and presents trading opportunities for traders in Africa.

We only recommend forex trading platforms that offer a large suite of forex assets, as well as alternative assets like stocks and commodities, helping traders build a diverse portfolio.

- Of our top forex brokers in Eswatini, Pepperstone stands out with the most currency pairs, offering over 90 assets, with several featuring the ZAR.

Pricing

Selecting a forex broker with low fees is a key consideration, ensuring you won’t pay more SZL than you need to while maximizing returns.

That’s why we aim to provide a full picture of pricing by checking brokers’ average as well as minimum spreads, where possible, across popular currency pairs.

To find low-cost forex trading platforms, we also factor in any commissions, plus non-trading fees like deposit charges, which Eswatini traders may need to pay when making wire transfers to international brokerages.

- IC Markets continues to deliver excellent pricing, notably for serious day traders with spreads from 0.0 pips on forex and and rebates up to $2.50 per lot. After trading at IC Markets using real money we’ve also found it offers a flexible environment for traders at all levels.

Forex Platforms

You need a fast, responsive platform with the right tools to effectively analyze charts and set up short-term trades.

That’s why we recommend forex brokers with user-friendly in-house software that provides strong charting packages and flexible layouts. Beginners may also want to consider a broker with social trading, allowing you to learn from and copy the positions of experienced forex traders.

We also favor firms that offer access to popular third-party platforms like MetaTrader 4 and cTrader. Not only do these offer sophisticated charting tools for intermediate and advanced traders, but they also cater to automated forex strategies.

- AvaTrade excels with its web platform that sports a modern design that we really like. It’s quick to learn and offers a fairly unique risk management feature called AvaProtect. Alternatively, forex traders have access to the ever-popular MT4 and MT5 platforms.

Payment Methods

You should look for convenient account funding, especially if you are day trading and making a large volume of trades and payments.

For forex traders in Eswatini, important considerations are fees for wire transfers if you use an international brokerage. Electronic wallets can help keep costs down here, with Wise supporting SZL transactions with a transparent, percentage fee.

We recommend forex trading platforms that provide a good selection of deposit and withdrawal methods that make it hassle-free to fund your forex trading account.

- XM stands out as a good option for forex traders from Eswatini, with a strong choice of funding options, an account denominated in ZAR, plus a low deposit of $5, approximately 100 SZL.

Methodology

To make our list of the best forex brokers and trading platforms in Eswatini, firms had to meet several criteria:

- They had to accept forex traders from Eswatini.

- They had to earn the trust of our trading experts.

- They had to provide a good choice of currency pairs.

- They had to have a transparent fee schedule with competitive forex spreads.

- They had to offer strong charting platforms for short-term traders.

- They had to provide convenient deposits and withdrawals that work in Eswatini.

FAQ

Is Forex Trading Legal In Eswatini?

There are no legal restrictions banning forex trading, so traders in Eswatini can sign up with online brokers and trade currencies.

Who Regulates Forex Trading In Eswatini?

The Financial Regulation Department of the Central Bank of Eswatini (CBE) is the body that oversees forex trading in the country. However, it’s not widely known or particularly active, so residents may choose to sign up with a forex broker that’s regulated by South Africa’s FSCA or another respected international body. That said, it’s still important to check your tax obligations in Eswatini.

How Much Money Do I Need To Start Forex Trading In Eswatini?

The account minimums vary between forex trading platforms in Eswatini, with some requiring an initial deposit of at least $200, around 4000 SZL, and others like Pepperstone not requiring any minimum before you can sign up for a forex trading account.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com