Best Brokers For Trading Space Stocks 2026

Space stocks have shifted from being a niche curiosity to a sector traders actively pursue. Companies like SpaceX, Virgin Galactic, Boeing, and Lockheed Martin have pushed the narrative beyond science fiction; it’s now a growing industry tied to satellite launches, defense, exploration, and even space tourism.

For us traders, that means opportunities but also more complexity. Space stocks don’t move like traditional tech or energy names. They can be volatile, headline-driven, and tied to government contracts or regulatory changes.

That makes broker choice even more important. If execution is slow, spreads are wide, or the trading platform doesn’t list the right companies, you’ll feel it straight away in your P&L. Fortunately, we’ve extensively tested brokers with access to space-related equities and ETFs to find the very best.

Top 3 Brokers For Space Stocks & ETFs

Based on our hands-on testing, scoring, and personal experience, these clear leaders stand out if you want to trade satellite stocks, rocket launch companies, and space-themed ETFs:

Why Are These Brokers The Best For Space Trading?

Here's a quick breakdown of why we rate these platforms as the top brokers for space stocks and ETFs:

- Interactive Brokers is the best broker for space stocks & ETFs in 2026 - Interactive Brokers is an excellent option for trading space stocks, especially for advanced traders. Execution speed, access to both large-cap and speculative names in the space industry, and superb research tools make it the go-to platform if you want complete control and flexibility. Fees also stayed tight during testing, even on smaller-cap names like AST SpaceMobile.

- Plus500 - In our dedicated space trading tests, Plus500 scored best in regulation and safety, but also performed well in pricing and trading tools. It offers space stocks and ETFs through CFDs only, making in attractive option for short-term traders looking to take leveraged positions on big names like Virgin Galactic.

- Saxo - Saxo has some of the best access to space-related stocks and ETFs. But what we loved during testing was how it combines execution speed with reliable tools like custom indicators, multiple timeframes, and real-time data for volatile stocks such as Rocket Lab or AST SpaceMobile. We found these features helped us identify entry and exit points in space securities more confidently.

How Reliable Are The Best Space Trading Brokers?

Space traders need secure accounts. Here’s how our top brokers ensure compliant access to global space equities and ETFs:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | |

| Saxo | ✘ | ✘ | ✔ |

Are The Best Space Brokers Good For Beginners?

New to space ETFs and satellite stocks? We assessed education, demo accounts, and support to find which brokers best support beginners:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| Plus500 | ✔ | $100 | Variable | ||

| Saxo | ✔ | - | Vary by asset |

Are The Top Space Brokers Good For Experienced Traders?

Active traders need options on space names, advanced order types, and global pre/post-market access. Here’s where our leaders excelled:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| Saxo | - | ✘ | ✘ | ✘ | 1:30 | ✘ | ✔ |

Compare Detailed Ratings Of Top Space Investing Brokers

See how the leading space investing platforms performed in each core testing area:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| Plus500 | |||||||||

| Saxo |

Compare Trading Fees

Costs matter for space trading, especially for active traders. Compare pricing across our top trading platforms based on our latest round of tests:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| Plus500 | ✘ | $10 | |

| Saxo | ✘ | - |

How Popular Are The Top Space Investing Platforms?

Space investing is surging. We looked at user numbers to see which brokers attract the most traders:

| Broker | Popularity |

|---|---|

| Plus500 | |

| Interactive Brokers | |

| Saxo |

Why Use Interactive Brokers To Trade Space Stocks?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

Why Use Plus500 To Trade Space Stocks?

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- The customer support team continue to provide reliable 24/7 support via email, live chat and WhatsApp

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

- Plus500 has recently bolstered its suite of short-term trading products, including introducing VIX options with enhanced volatility and extended hours trading on 7 stock CFDs

Cons

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

- Educational resources are limited compared to best-in-class brokers like eToro, impacting the learning curve for beginners

Why Use Saxo To Trade Space Stocks?

"Saxo is best for active traders and high-volume investors with an unrivalled selection of instruments alongside premium market research and fee rebates. The 190 currency pairs with tight spreads also make Saxo great for forex traders."

Tobias Robinson, Reviewer

Saxo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Regulator | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Platforms | TradingView, ProRealTime |

| Minimum Trade | Vary by asset |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF |

Pros

- Low fees with premium account tiers

- Excellent educational resources including podcasts, webinars and expert-led video insights

- High-level research hub with curated market research, plus unique insights with 'Outrageous Predictions'

Cons

- Access to Level 2 pricing requires a subscription

- Clients from some jurisdictions not accepted including the US and Belgium

- High funding requirements for the trading accounts

How DayTrading.com Chose The Best Brokers for Space Stock Trading

When it comes to trading space stocks, broker choice isn’t just about costs; it’s mainly about access because it’s still relatively novel.

Some providers let you trade the big names like Boeing or Lockheed Martin, but don’t touch the smaller, high-growth space plays like Rocket Lab or AST SpaceMobile.

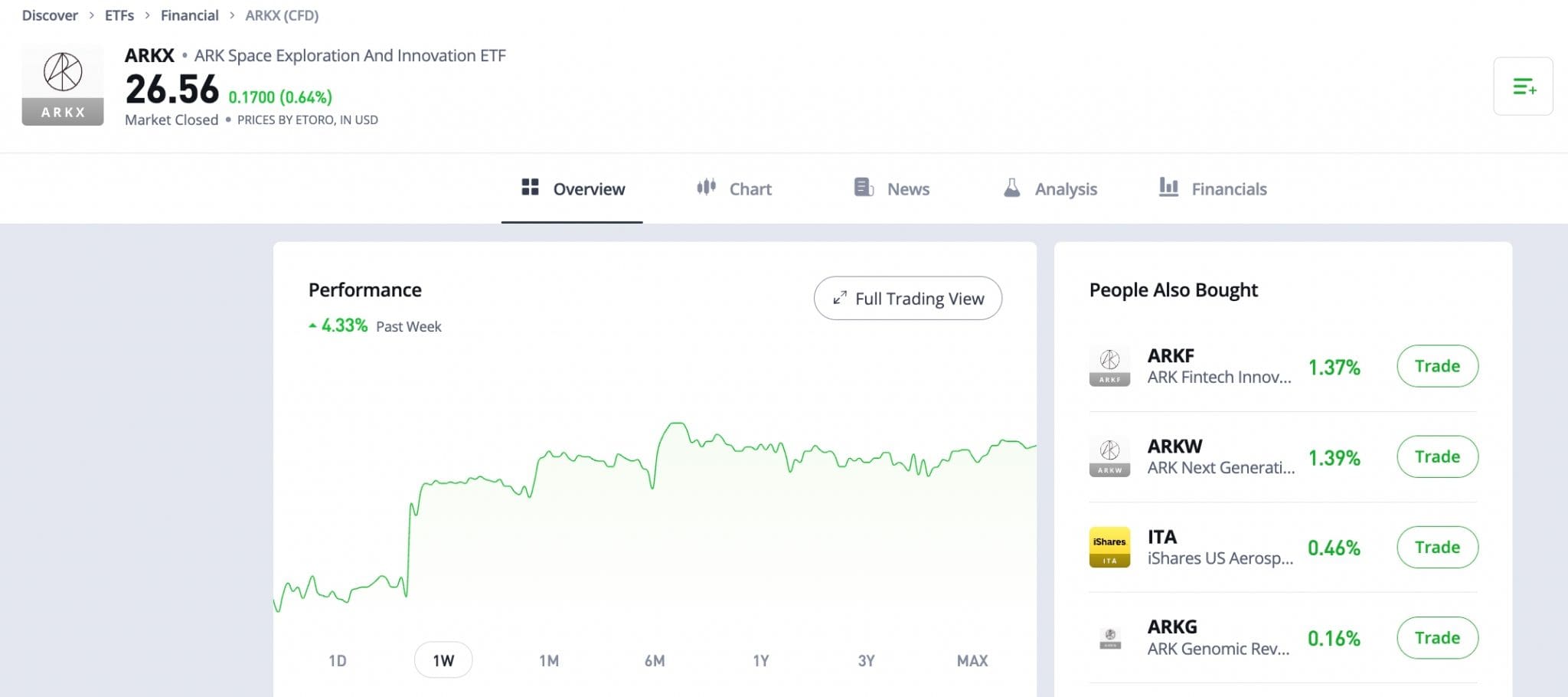

Others offer space-focused exchange-traded funds (ETFs) such as ARKX, which give you instant diversification but can feel too broad if you want direct exposure to one company or shorter-term trading opportunities with strong price action.

To test brokers properly, we set up accounts and looked at:

- Execution speed: How quickly orders went through, especially in volatile names like Virgin Galactic.

- Spreads and commissions: Which brokers quietly padded costs versus those that kept them tight.

- Market access: Whether you can buy both the giants (Boeing, Lockheed Martin) and the newer entrants (AST SpaceMobile, Rocket Lab).

- Platform tools: Charting, watchlists, and screeners that help identify unusual moves in niche sectors like space.

We scored each broker based on these criteria.

What To Look At When Picking A Broker To Trade Space Stocks

Trading space stocks is different from sticking with big, liquid names like Apple or Microsoft. Execution, access, and fees matter more when you’re dealing with stocks that can move 10% in a single session.

Based on our tests, here are the five key factors you’ll want to weigh up before picking a broker:

- Execution Speed: Volatility spikes with news – a successful launch, a government contract, or even a regulatory announcement can send stocks like AST SpaceMobile or Rocket Lab soaring or plunging in minutes. We measured execution speed by placing market and limit orders during high-volume U.S. sessions. The faster the broker got us filled, the tighter our slippage stayed.

- Liquidity and Market Access: Some brokers give you access to all U.S. listings plus smaller international names, while others only cover the big defense contractors. If you want to trade newer space plays like AST SpaceMobile or ETFs like ARKX, make sure your broker lists them. Big names like Boeing or Lockheed Martin are liquid, so even smaller brokers can handle orders well. The newer entrants – Virgin Galactic, Rocket Lab, AST SpaceMobile – can be trickier. We found that brokers offering broader market access consistently delivered better fills on these names, while some platforms struggled to match the orders during high-volume periods.

- Fees, Spreads, and Commission Structures: We compared both headline spreads and the hidden extras. Space stocks often trade on wider spreads than blue-chip tech, so a broker with a fractionally lower commission can make a big difference over multiple trades – a vital consideration for day traders. That said, a broker with low headline fees isn’t automatically the cheapest. Look for consistent execution, fair spreads on volatile names, and transparency on all costs – that combination protects your capital while trading the high-risk world of space stocks.

- Platforms and Research Tools: Trading a niche sector like space benefits from strong screeners, watchlists, and alerts. In our testing, we found big differences between platforms – some gave us detailed sector breakdowns and real-time news, others made it harder to track movements. In particular, screeners that filter by sector, market cap, and volatility are invaluable. In our hands-on tests, brokers with built-in research tools gave us real-time insights into company announcements, upcoming launches, and ETF composition – all of which influenced our trading decisions.

- Regulation and Safety: Space stocks are high risk, but your broker shouldn’t be. We only scored brokers regulated by major financial authorities like the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or the Australian Securities and Investments Commission (ASIC) – all ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating.

How to Trade Space: ETFs or Single Stocks?

One of the first decisions you’ll face is whether to trade stocks directly or through an exchange-traded fund (ETF). Both approaches have pros and cons:

- Single stocks: Higher risk and higher reward. You can pick companies like Rocket Lab or AST SpaceMobile and ride the volatility, but you’re exposed to company-specific risks. Execution quality from your broker is key here, since spreads can widen quickly.

- ETFs: Funds like ARKX (ARK Space Exploration ETF) or UFO (Procure Space ETF) let you spread your risk across dozens of space-related companies in one trade. It’s a smoother way to trade the theme, but you’ll miss out on the outsized moves of individual stocks.

| Broker | Direct U.S. Space Stocks | Space-Focused ETFs | Notes |

|---|---|---|---|

| Interactive Brokers | Full access | Wide ETF Range | Strongest global access, but the platform can be heavy |

| eToro | Popular space stocks | ARKX, UFO | Easy access, good for beginners |

| IG | U.S. and UK listings | Some ETFs | Wide coverage, competitive spreads |

| Saxo | Global stock markets | ETFs across regions | Strong research tools, higher deposit barrier |

| Plus500 | Limited CFDs only | ETF CFDs | Speculative exposure only, not real stock trading |

As you can see from the above, we found not all brokers offer both. Some lean heavily on direct U.S. stock access, while others focus on ETFs listed in the U.S. and Europe. Only a handful stood out by offering both full stock trading and space-themed ETFs on the same platform, which gives you flexibility to mix approaches.

Top Space Stocks To Trade in 2026

Here are some of the top stocks to keep an eye on based on their market capitalization, price action, and innovations in the space industry:

| Company | Sector Focus | Notes |

|---|---|---|

| Boeing (BA) | Aerospace & Defense | NASA and satellite launch contracts |

| Lockheed Martin (LMT) | Defense & Space Systems | Heavy involvement in space systems |

| Iridium Communications | Satellite Communications | Global satellite phone and data network |

| Rocket Lab USA (RKLB) | Launch Services | Frequent small satellite launches |

| AST SpaceMobile (ASTS) | Satellite Broadband | Ambitious direct-to-smartphone satellite |

| Virgin Galactic (SPCE) | Space Tourism | Pure-play speculative space tourism stock |

| Garmin (GRMN) | GPS & Navigation Systems | Dual exposure: consumer GPS + aerospace use |

“Where is SpaceX?”, I hear you ask? Well, it’s not a quoted firm, but estimates suggest it would be a spectacular IPO, one of the biggest ever on the NASDAQ. Maybe one to log for the future.

Pros and Cons of Trading Space Stocks

Pros

- Access to Growth Names: Trade both giants like Boeing and Lockheed Martin, and high-growth names like AST SpaceMobile and Rocket Lab.

- ETF Diversification: Space-themed ETFs like ARKX and UFO let you spread risk across multiple companies.

- Advanced Tools: Charting, alerts, and screeners are getting better at helping traders track volatile moves in the sector.

- Flexible Account Options: Low minimum deposits and multiple funding methods make it easy for beginners, while margin accounts offer more leverage for experienced traders.

Cons

- High Volatility: Prices can swing dramatically, and some brokers widen spreads during peak volatility.

- Limited Access on Some Platforms: Not all brokers list smaller space companies or ETFs from our tests.

- Learning Curve: Advanced platforms can feel overwhelming initially, so beginners need to go slow.

- Hidden Costs: Overnight financing, inactivity fees, or withdrawal charges can add up if overlooked.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com