Best Forex Trading Platforms In Somalia 2026

The Somali Shilling (SOS) typically experiences low trading volumes, but interest in forex trading is on the rise in Somalia. Despite this, the Central Bank of Somalia doesn’t actively regulate forex trading platforms, so many residents turn to global brokers.

Our experts have identified the best forex brokers in Somalia through personal testing and thorough analysis. Our recommended forex platforms accept traders from Somalia and offer first-rate platforms, excellent pricing, convenient deposits, and a great selection of currency pairs.

5 Top Forex Trading Platforms In Somalia

Following years of exhaustive tests, these 6 forex platforms continue to shine as the best for currency traders in Somalia:

-

1

XM

XM -

2

Vantage

Vantage -

3

IC Markets

IC Markets -

4

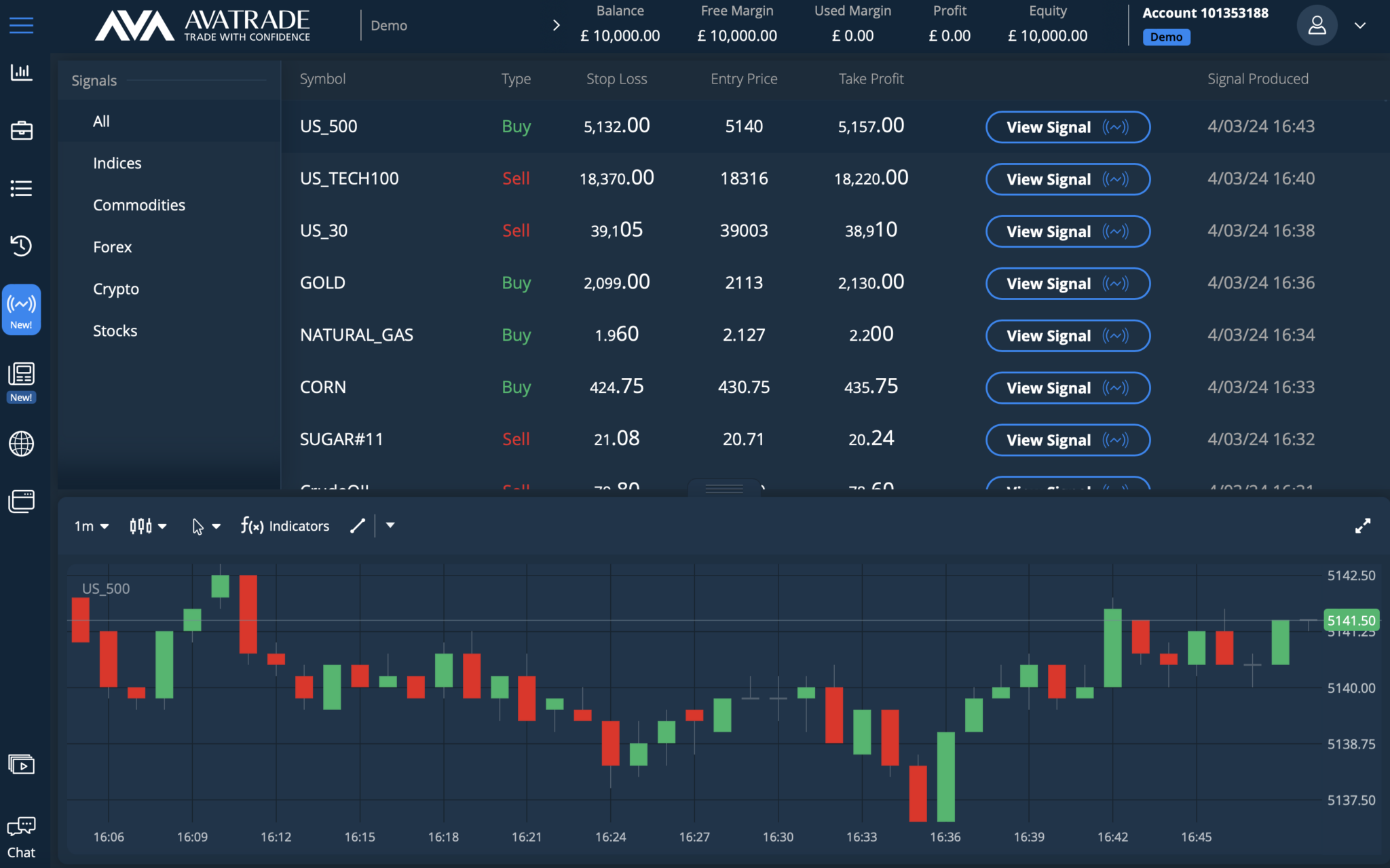

AvaTrade

AvaTrade -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

This is why we think these brokers are the best in this category in 2026:

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

Best Forex Trading Platforms In Somalia 2026 Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| XM | 55+ | 0.8 | / 5 | $5 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Vantage | 55+ | 0.0 | / 5 | $50 | FCA, ASIC, FSCA, VFSC |

| IC Markets | 75 | 0.02 | / 5 | $200 | ASIC, CySEC, CMA, FSA |

| AvaTrade | 50+ | 0.9 | / 5 | $100 | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | 100+ | 0.1 | / 5 | $0 | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Eightcap | 50+ | 0.0 | / 5 | $100 | ASIC, FCA, CySEC, SCB |

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- There’s an excellent suite of day trading software, including the award-winning platforms MT4 and MT5

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- Unfortunately, cryptos are only available for Australian clients

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

How We Rate Forex Trading Platforms In Somalia

To identify the top forex brokers for Somalia, we first pinpointed all the platforms that accept Somalian traders and then ordered them by their overall rating, which takes into account these areas:

Trust

Only trusted forex trading platforms make our top list for Somalian investors. This is to protect traders from forex scams, which MENAFN reported are targeting Somalians through social media platforms and promising “everyday is payday”.

Since the Central Bank of Somalia does not have a robust regulatory framework for actively overseeing and authorizing forex brokers, we recommend platforms that are licensed by ‘Green-Tier’ regulators, such as the UK Financial Conduct Authority (FCA). This is the best sign a brokerage is legitimate with fair operating practices.

I’ve found that even when you trade from Somalia with a forex broker that’s licensed by a trusted regulator, you may not get the same protections as you would in its home jurisdiction. As such, only risk what you can afford to lose.

- FOREX.com is one of the most trusted forex trading platforms with an excellent 20+ year track record since 2001 and oversight from 9 ‘Green-Tier’ regulators. Its parent organization is also listed on the NASDAQ, ensuring financial transparency.

Forex Markets

We analyzed our database of 139 brokers and found that retail trading on the USD/SOS or other pairs with the Somali Shilling is rare.

As a result, only forex trading platforms that provide at least 50 currency pairs make our shortlist for Somalian traders, providing diverse trading opportunities on other currencies from around the world.

We also favor brokers with forex contracts for difference (CFDs), as this derivative is popular with short-term traders and provides the opportunity to speculate on up and down price movements in currencies from one product.

- Pepperstone offers the most forex assets of our 15 highest-rated FX brokers in Somalia, with over 100 currency pairs, plus currency indices, catering to a range of day trading strategies.

Fees

Forex trading platforms make their money from bid-ask spreads and, sometimes, commissions or charges when you deposit Somali Shillings to an account in another currency.

These all represent a barrier to profits so we regularly evaluate trading and non-trading fees to identify forex platforms that consistently deliver excellent pricing.

Crucially, we record and analyze spreads on the most widely traded currency pairs, including the EUR/USD, EUR/GBP and GBP/USD. Then we balance these with the quality of the platforms, tools and trading features to find firms that deliver great value.

- IC Markets continues to impress with its superior pricing, providing Somalian forex traders with average spreads of just 0.1 pips on popular pairs like the EUR/USD, plus rebates of up to $2.50 per lot for high-volume traders.

Forex Platforms

Finding a forex broker with a reliable and easy-to-use charting platform that offers the tools your forex day trading strategy requires is essential. That’s why we make it a priority when rating forex brokers for Somalia.

Importantly, our thousands of hours annually testing forex brokers shows not all platforms are created equally, and they can be targeted at specific groups of traders or strategies.

MetaTrader 4, for example, remains the most widely used third-party platform for forex trading, but is geared towards experienced traders and algo traders.

We believe newer traders may prefer the slick and intuitive interfaces available in many proprietary forex platforms, which are often optimized for more casual traders.

- AvaTrade continues to excel with its superb forex platforms, including its easy-to-learn WebTrader, alongside MT4 and MT5, plus auto-trading platforms AvaSocial and DupliTrade.

Account Funding

We scoured our extensive directory of forex trading platforms and there are limited options for accounts denominated in SOS. Fortunately, the vast majority of forex platforms have USD accounts, a currency that is still widely used in Somalia, ensuring convenient deposits and account management.

We also check that forex trading platforms support a range of secure, low-cost and convenient deposit options, helping Somalians reduce fees and maximize profits.

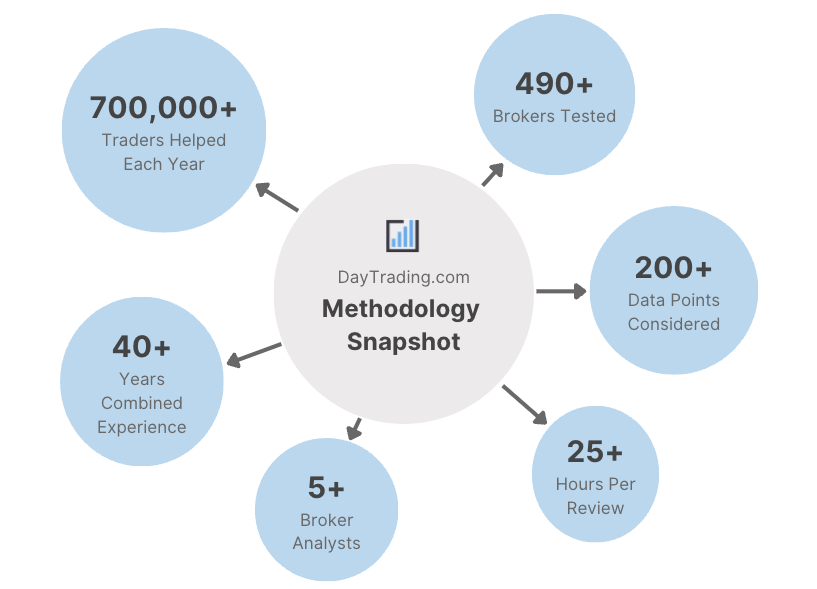

Methodology

To list the best trading platforms in Somalia, we evaluated all those offering forex trading products and accepting day traders from Somalia. We then ranked them by their total rating, using extensive hands-on tests and drawing on over 100 data points.

With this data, we were able to focus on several key areas:

- Ensuring that licensing by a credible regulatory authority is present.

- Checking for a wide range of popular currency pairs for Somali forex traders.

- Identifying platforms that deliver competitive pricing, especially low spreads on forex pairs.

- Prioritizing brokers that offer a range of forex charting platforms and analysis tools.

FAQ

Is Forex Trading Legal In Somalia?

Somalia’s laws do not prohibit forex trading. Still, we recommend keeping abreast of the latest developments from the Central Bank of Somalia.

It’s also important to adhere to tax obligations from the Somalia Revenue Directorate when trading currencies online.

Who Regulates Forex Trading In Somalia?

The Central Bank of Somalia is responsible for overseeing the country’s financial sector, but it’s an underdeveloped regulator that doesn’t take an active interest in overseeing retail forex trading.

As a result, we recommend Somalians sign up with an international forex broker that’s regulated in a tier-one jurisdiction, such as the UK, US, Australia and Europe.

How Much Does It Cost To Start Trading Forex In Somalia?

The minimum outlay to start trading forex in Somalia will depend on the broker you sign up with. That said, after years of extensively reviewing forex trading platforms accepting Somalians, we’ve found that you normally need between 0 to 250 USD, equivalent to around 0 to 140,000 SOS.

Although, some leading forex trading platforms accept Somalian traders with significantly less – Pepperstone, for example, has no minimum deposit.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com