Sheer Markets Review 2024

Pros

- Supports end of month or spot CFDs on Non-Deliverable Forwards (NDFs) including USD/BRL and USD/TWD

- Automated portfolio diversification available to retail traders with minimum deposits of €3000

- Competitive pricing model with commission-free trading on 'Classic' accounts with average 1 pip spreads

Cons

- Subpar market research and additional tools

- Weak education compared to alternatives

- Only USD or EUR accounts support

Sheer Markets Review

Sheer Markets (Cyprus) Ltd. is a forex and CFD broker registered with the Cyprus Securities and Exchange Commission (CySEC) and Labuan Financial Services Authority (LFSA), offering a range of financial instruments and markets for traders to speculate upon. This review will explain the key features of Sheer Markets, the available account types, how to get started and how secure the broker is.

Sheer Markets Headlines

Established in 2019, Sheer Markets is a relatively new entry into the online trading platform market. The broker is based in Limassol, Cyprus. The CEO and chief commercial officer are Howard Carr and Gareth Thomas, respectively.

In Sheer Market’s quest to stand out from its rivals, the Cyprus-based broker offers a competitive product range that includes foreign exchange, commodities CFDs, stocks, indices and cryptocurrencies markets.

The headline products offered by Sheer Markets are non-deliverable forwards (NDFs) and emerging markets forex (EMFX) CFDs, which extend its appeal beyond traditional currency pairs.

Trading Platforms

Sheer Markets uses the MT4 and MT5 trading platforms to allow users to open and close positions, access the latest financial news, manage their accounts and exposure and much more. These platforms are available on Windows, Mac and as a mobile app for iOS and Android (APK) devices.

MetaTrader 4

- 6 order types

- 9 time frames

- Forex trading only

- 30 graphical objects

- Financial news alerts

- Signals integration support

- Automated trading support

- 30 in-built technical indicators

- Customisable technical indicators

MetaTrader 5

- 10 order types

- 21 timeframes

- 44 graphical objects

- Multi-asset functionality

- Faster and more efficient

- In-built economic calendar

- Signals integration support

- Automated trading support

- 38 in-built technical indicators

- Customisable technical indicators

MetaTrader 5 Web Platform

Sheer Markets clients that do not want to download a dedicated client can access their account and trade through the MT5 web platform. This option maintains most of the functionality of the desktop platform, though losing some of the advanced customisation and algorithmic trading support.

Products

Sheer Markets clients can trade more than 1,000 financial instruments:

- Stock CFDs: Global equities

- Commodities CFDs: Gold, silver & oil

- NDF CFDs: 10 USD-based forex pairs

- Indices CFDs: 11 global equity indices

- Crypto CFDs: Bitcoin, Ethereum, Bitcoin Cash & Litecoin

- Forex: 80 major, minor, exotic and emerging markets currency pairs

Spreads & Fees

Sheer Markets accounts have two pricing structures. Classic accounts have no commissions and primarily charge spreads, whereas Prime accounts show raw spreads but will charge commissions.

Sheer Classic

- Commission-free (excl. equities)

- Spreads from 1.2 pips

Sheer Classic Plus

- Commission-free (excl. equities)

- Spreads from 1.0 pips

Sheer Prime

- Commission-free for commodities and indices

- USD 4 per lot per side for forex CFDs

- USD 5 per lot per side for NDF CFDs

- Raw spreads from 0.0 pips for equities, indices, commodities and cryptocurrency CFDs

Sheer Prime Plus

- Commission-free for commodities and indices

- USD 3.5 per lot per side for forex CFDs

- USD 4.5 per lot per side for NDF CFDs

- Raw spreads from 0.0 pips for equities, indices, commodities and cryptocurrency CFDs

Be aware of ‘per side’ fees; these are charged for both opening and closing trade, so the stated fee may not represent the true total cost.

The competitiveness of Sheer Markets’ fees relative to other brokers depends on which account traders choose. The Prime accounts offer competitive, ECN-style spreads but those for the Classic accounts are not as competitive. On balance, most commission rates and spreads appear to not be markedly dissimilar from other brokers.

Other Fees

Stocks trading with Sheer Markets is handled slightly differently. Positions in European and UK equities markets carry a 15 basis point execution fee, while US instruments have a USD 0.05 per share commission (USD 10 minimum).

Cryptocurrency CFDs are charged a variety of financing fees. Long positions on Bitcoin and Ethereum CFDs require a 45% finance to be paid, while Litecoin and Bitcoin Cash only require 37.5%. Short positions on Ethereum receive 12.5% finance, though the other three currencies receive 0%.

Sheer Markets also charges a EUR 10 inactivity fee for accounts that lie dormant for six months or more. Clients looking to leave their capital in the hands of the broker’s diversification portfolios must pay a 30% performance fee on any profits.

Leverage

Leverage on Sheer Markets varies considerably depending on whether traders are investing in shares, cryptocurrencies, major currencies or NDFs. Per European regulation, the maximum leverage rate available is 1:30. A full breakdown of maximum rates is provided below:

- Major Currency Pairs – 1:30

- Minor, Exotic & EM Currency Pairs, Gold & Major Indices – 1:20

- Silver, Oil & Minor Indices – 1:10

- Shares – 1:5

- Cryptocurrencies – 1:1.333

Professional clients are not so limited by government regulation and can access higher rates, up to 1:100.

Mobile App

The MetaTrader 4 & 5 platforms are available on iOS and Android as mobile apps, allowing investors to trade flexibly and on the move by simply connecting to the broker on their phones. The app includes features that allow traders to review their trading history, make use of interactive charts, get financial news and more.

Payment Methods

Deposits

Sheer Markets requires a minimum first deposit of EUR/USD 200 for its Classic and Prime accounts and EUR/USD 10,000 for its Classic Plus and Prime Plus accounts. This can be made using a range of payment methods, including Visa, Mastercard and bank wire transfer, as well as Neteller and Skrill. Sheer Markets does not impose its own fees for deposits.

Processing times range from instant for Neteller and Skrill up to 2 hours for Visa and Mastercard and 2-5 working days for wire transfers.

Withdrawals

Withdrawal requests can be made from the “Transfers” section in the client portal. Sheer Markets will process withdrawal requests within 24 hours (Monday to Friday, excluding public holidays), followed by additional processing time depending on the payment option chosen.

For example, withdrawals using Visa, Mastercard and wire transfer take 2-5 business days, while Skrill and Neteller are instant. As with deposits, Sheer Markets does not impose its own withdrawals fees, though fees may be imposed by the payment processor.

Demo Account

Sheer Markets does offer a demo account for its existing and prospective clients, though access to this is dependent on the jurisdiction the user is in. Demo accounts are a great way to trial a new broker, explore new markets and practise different strategies in a realistic environment without risking real money.

Deals & Promotions

CySEC regulation prohibits brokers from offering financial incentives and promotional deals like cash rewards.

Regulation & Licensing

Sheer Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 395/20. The broker also complies with the EU’s Markets in Financial Instruments Directive II (MiFID II).

Sheer Markets client funds are held in separate accounts to reduce risk. Retail clients are also protected by the Investor Compensation Fund scheme, which insures clients against broker insolvency or malpractice.

It is also licenced by the Labuan Financial Services Authority (LFSA) for global clients.

Additional Features

- Sheer Strategies: managed portfolio diversification options with 70% of profits going to investors

- Market Updates: frequent market insights into stocks, commodities and forex markets

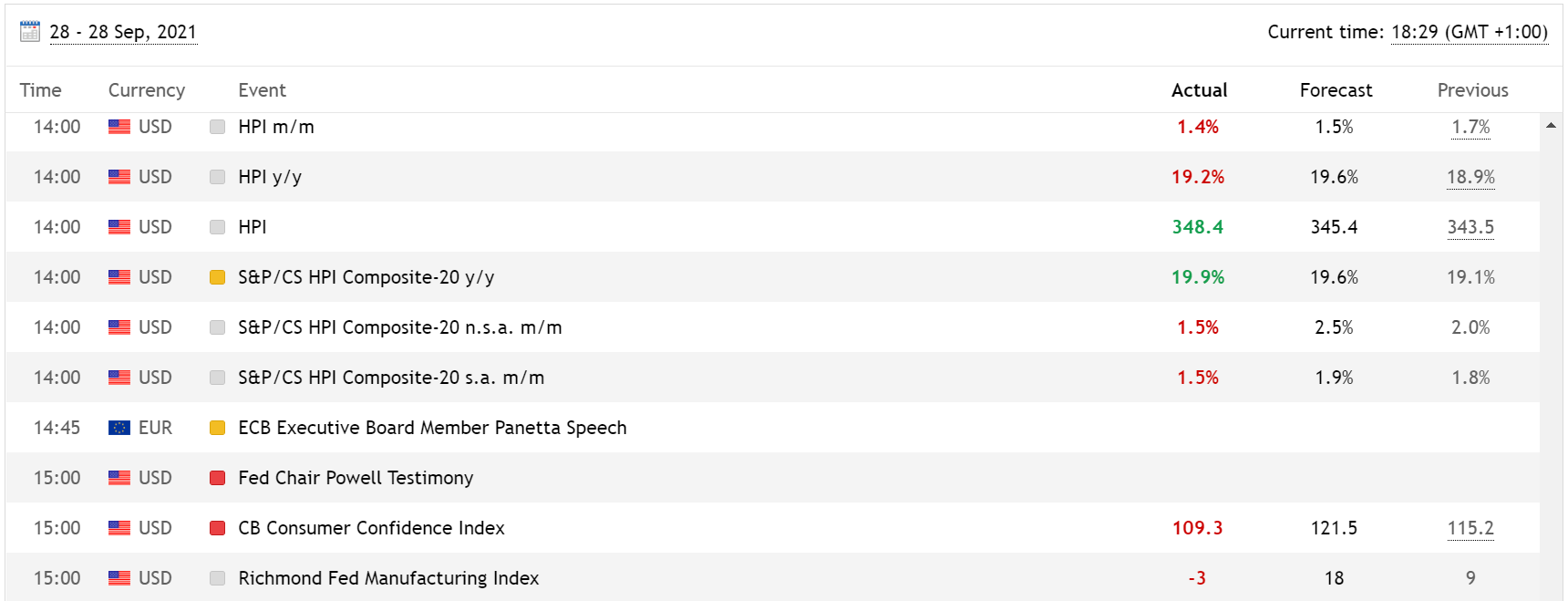

- Economic Calendar: comprehensive planning tool that allows clients to plan for upcoming news releases and events

- Educational Material: short list of key trading terms defined and explained on the Sheer Markets website

- Tailored Management: one-to-one portfolio and asset management for high capital investors (USD 250,000 plus)

Account Types

Sheer Markets clients can open one of four trading accounts:

Sheer Classic

- MT4 & MT5

- Spread markups (excl. equities)

- Commission-free (excl. equities)

- USD/EUR 200 minimum deposit

Sheer Classic Plus

- MT4 & MT5

- Phone dealing

- Spread markups (excl. equities)

- Commission-free (excl. equities)

- Free VPS hosting

- Account manager

- Market analysis & commentary

- USD/EUR 10,000 minimum deposit

Sheer Prime

- MT5 only

- USD/EUR 200 minimum deposit

- Raw spreads (excl. indices & commodities)

- Commissions (excl. indices & commodities)

Sheer Prime Plus

- MT5 only

- Phone dealing

- Free VPS hosting

- Account manager

- Market analysis & commentary

- USD/EUR 10,000 minimum deposit

- Raw spreads (excl. indices & commodities)

- Commissions (excl. indices & commodities)

Professional-grade clients can open dedicated accounts with higher leverage limits (1:100), though minimum deposits are USD/EUR 500,000. Corporate trading accounts are also available.

How To Get Started

- Choose a Sheer Markets trading account

- Validate the account – traders will need to complete a selection of questions and provide identification documents (a colour copy of a valid ID or documents like passport, driver’s license or residence permit, plus a utility bill dated within the last six months as proof of address)

- Receive login details by email

- Make a deposit

- Select a platform

Accounts can only be opened in USD or EUR.

Trading Hours

Trading hours vary depending on the market. For example, the hours for the UK equities market are Monday 09:01 – Friday 17:25 (GMT+2), while cryptocurrencies can be traded 24/7.

Customer Support

Sheer Markets clients can contact the customer service team via email, phone number and online form. The broker also has social media presence on Facebook, Twitter and LinkedIn.

- Phone: +357 25 25 40 43

- Email Address: support@sheermarkets.com

Security

Sheer Markets is regulated by CySEC, a reputable financial watchdog, which means that it must uphold strong security standards. Moreover, the MetaTrader 4 & 5 trading platforms are quite secure, encrypting all data and supporting two-factor authentication (2FA) logins. Sheer Markets also takes measures to protect personal data using encryption and access management procedures.

Sheer Markets Verdict

Sheer Markets (Cyprus) Ltd offers a wide range of financial instruments in various capital markets, from mainstream stocks to exotic currency pairs, as well as DNFs and emerging markets forex. The scale of the broker’s product range provides exciting opportunities for traders, though some of its products will be more appropriate for professional traders than amateur ones and some of the deposit requirements may put off more casual traders.

FAQs

Who Regulates Sheer Markets?

Sheer Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), a reputable EU broker. Plus, for global clients, it is licenced by the Labuan Financial Services Authority (LFSA).

What Is A CFD?

A CFD is a contract for difference, which is an agreement between an investor and a broker to exchange the difference in the value of an asset between the time of a contract opening and closing, without the investor owning the underlying asset. CFDs are banned in some countries, including in the US.

What Is An NDF?

NDF is an abbreviation for non-deliverable forward and refers to two parties contractually agreeing to exchange the difference in currency between the agreed-upon rate and the spot rate. The notional amount is never exchanged. They are a useful financial instrument to speculate upon illiquid currencies.

What Are Sheer Markets' Initial Deposit Requirements?

These depend on the account you choose. For the Sheer Classic and Sheer Prime accounts, the minimum deposit is a relatively modest EUR/USD 200. However, for the Sheer Classic Plus and Sheer Prime Plus account, the deposit requirement is a more sizeable EUR/USD 10,000.

Is Sheer Markets Commission-Based?

Sheer Markets clients can either pick a spread-based or commission-based account type, with the pricing structure varying amongst asset classifications.

Top 3 Alternatives to Sheer Markets

Compare Sheer Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Sheer Markets Comparison Table

| Sheer Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (EU), 1:100 (Pro) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Sheer Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Sheer Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Sheer Markets vs Other Brokers

Compare Sheer Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Sheer Markets yet, will you be the first to help fellow traders decide if they should trade with Sheer Markets or not?