5 Self-Financing Hedging Strategies

In trading and investing, hedging is a common strategy employed to manage risks and reduce potential losses.

What stops people from hedging their portfolios?

A big part of it is simply the cost.

Among various hedging techniques, self-financing strategies are about as close to ideal as getting what you want without having to pay significantly for it.

These are strategies where the cost of hedging is financed by the potential profits coming from elsewhere.

We look into the nuts and bolts of self-financing hedging strategies with a specific focus on collar strategy and its variants.

Key Takeaways – Self-Financing Hedging Strategies

- The cost of hedging can be a significant barrier for many investors when considering hedging their portfolios.

- Self-financing strategies, where the potential profits from investments cover the hedging costs (or at least partially), provide a way to mitigate this issue.

- Self-financing hedging strategies, like the collar strategy and put spread, offer protection against market volatility while still allowing for potential upside gains.

- While self-financing hedging strategies have their advantages, it’s important to understand their limitations. These strategies often cap the upside potential and may not be suitable for all traders/investors or investment types. A solid understanding of options and market dynamics is necessary to implement them well.

Hedging Basics

Before diving into self-financing hedging strategies, let’s first cover the basics of hedging.

Hedging is a risk management strategy used in limiting or offsetting the probability of loss from fluctuations in the prices of commodities, currencies, or securities.

In effect, hedging is a transfer of risk, but it comes at a cost. Therefore, the goal of hedging should not be to make money but to protect from losses.

Self-Financing Hedging Strategies

Self-financing hedging strategies are those that cover their own costs.

In other words, these strategies do not require an initial outlay or ongoing costs from the investor.

The potential profit of the investment is used to finance the hedging strategy.

This has the advantage of not eroding the initial investment, as any hedging costs are covered by the possible upside of the investment.

Benefits of Self-Financing Hedging Strategies

Self-financing hedging strategies like the collar strategy offer a number of benefits.

They provide a level of protection against market volatility, limiting the potential downside risk while still allowing for some upside potential.

These strategies can be particularly beneficial for long-term investors who have a bullish view on the market but still want to protect themselves against unexpected downturns.

Limitations of Self-Financing Hedging Strategies

Despite their benefits, self-financing hedging strategies also have limitations.

One of the main limitations is that the upside potential is capped.

Once the sold call option is exercised by the buyer, the investor is obliged to sell the asset, thereby capping their profit.

Moreover, these strategies might not be suitable for all investors or all types of investments. It requires an understanding of options markets.

#1 Collar Strategy

The collar strategy is a type of self-financing hedging strategy.

It is often used by investors/traders who have a long position in a stock and want to protect their investment against market volatility.

The collar strategy involves two parts: buying a put option and selling a call option.

Selling Calls

In a collar strategy, the investor sells a call option.

A call option gives the buyer the right to buy the underlying asset at a predetermined price within a specific time frame.

When the investor sells a call, they are obligated to sell the asset if the buyer chooses to exercise the option.

The income received from selling the call helps finance the purchase of the put, making it a self-financing strategy.

Buying Puts

The other side of a collar strategy involves buying a put option.

A put option gives the owner the right to sell a specific amount of the underlying asset at a predetermined price within a specified time frame.

If the price of the asset falls, the put option will increase in value, helping to offset the loss in the underlying asset.

The purchase of the put is financed by the selling of the call option, which makes the strategy self-financing.

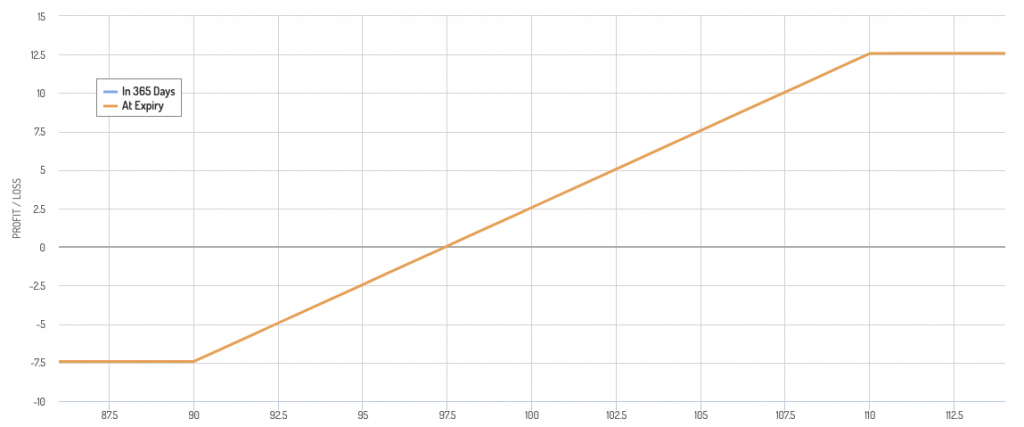

Collar Diagram

A collar looks something like this:

#2 Put Spread

A put spread hedging strategy involves the simultaneous purchase and sale of put options with different strike prices but the same expiration date.

To implement a put spread hedge, a trader initially buys a put option with a higher strike price (the long put) and simultaneously sells a put option with a lower strike price (the short put).

The long put provides downside protection, while the short put generates income to offset the cost of the long put.

The difference in strike prices between the long put and short put is known as the “spread.”

The wider the spread, the higher the initial cost of the hedge, but it also provides a greater level of protection.

However, a narrower spread reduces the upfront cost but offers less protection.

The put spread hedge strategy is designed to limit potential losses while still allowing for potential gains.

If the price of the underlying asset decreases significantly, the long put option will increase in value, offsetting the losses in the portfolio. Meanwhile, the short put option, which is sold, generates premium income that helps mitigate the cost of the long put.

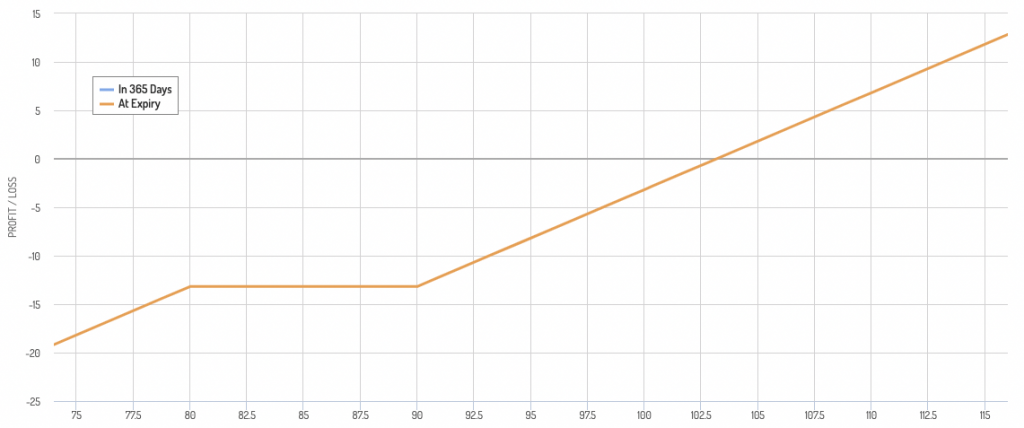

Example of a Put Spread as a Hedging Strategy

- Buy stock at $100

- Buy put option at 90 strike

- Sell put option at 80 strike

It would appear as the following:

Limitations of the Put Spread as a Hedging Strategy

However, the put spread strategy also has limitations:

- If the price of the underlying asset increases significantly, the gains in the portfolio may be limited due to the hedge.

- The put spread will always cost some amount, which can be a drag on long-run returns.

- The put spread also offers only finite protection.

Put Spread vs. Collar as a Hedging Strategy

The main advantage of the put spread over the collar is that the put spread retains unlimited upside.

The collar provides limits downside but also limits the upside.

#3 Fence (Dutch Rudder)

A “fence” or “Dutch rudder” is a combination of a collar and a put spread.

Another way to think of it is a collar with an OTM put option being sold for some extra income.

So, it forms a partial hedge.

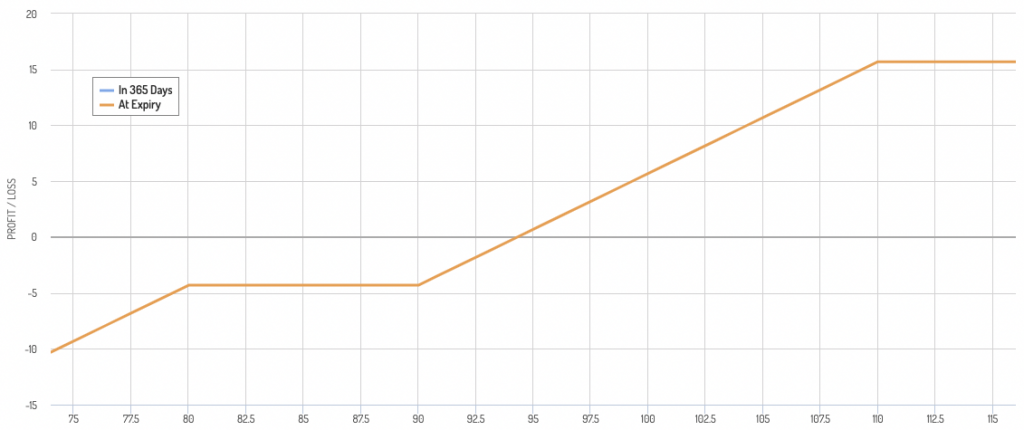

Example of a Fence (aka Dutch Rudder) as a Hedging Strategy

- Buy stock at $100

- Sell call option at 110 strike

- Buy put option at 90 strike

- Sell put option at 80 strike

It looks like this:

#4 Overweighted Call Hedging Strategies

There are many variations of this strategy, but overweighting the call portion of the trade can yield extra income and fund the put side of the trade that hedges your losses.

What are these best suited for?

These might be suited for assets with limited upside.

An example would be higher dividend stocks with low growth rates.

With these types of companies, you don’t generally have to worry about lots of capital appreciation. It can happen, it just isn’t very likely.

It’s still a good idea to limit to close off your tail risk on the upside (from selling excess call options) for risk management purposes.

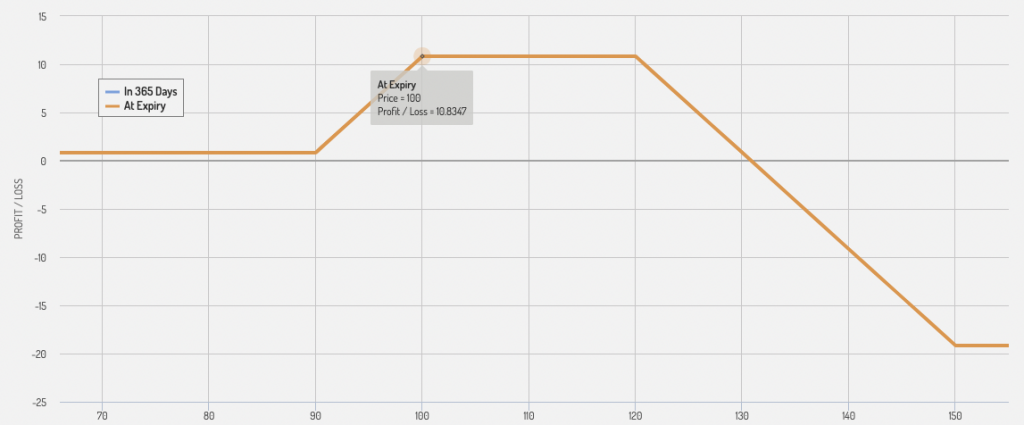

Example of this strategy

- Buy stock at $100

- Buy call option at 150 strike

- Sell call option at 120 strike

- Sell call option at 100 strike

- Buy put option at 90 strike

#5 Diversification and Portfolio Balance

Diversification is a strategic investment approach that involves spreading your investment capital across various types of assets and investment opportunities.

This strategy helps to reduce exposure to any single type of asset or risk.

The principle is that different asset classes, such as equities, fixed-income securities, real estate, commodities, and alternative investments, will perform differently under different market conditions.

Here’s how diversification can be considered a self-financing hedging strategy:

Lower Downside Risk

By spreading investments across a broad range of asset classes, sectors, and geographical regions, the potential losses from any one investment are less likely to significantly impact the overall portfolio.

If one asset or sector performs poorly, others may perform well and compensate for the losses.

It doesn’t necessarily prevent losses, but it can help mitigate them.

Increase Return to Risk Ratio

This is also known as the Sharpe ratio, which is a measure of risk-adjusted return.

Diversification can increase this ratio by potentially improving portfolio returns and reducing portfolio volatility (risk).

Even if the portfolio return remains the same, the Sharpe ratio can still improve if risk is reduced through diversification.

Lower Volatility

The volatility of a portfolio is directly linked to the correlations of the underlying assets.

If the assets are perfectly positively correlated (they move in sync), the portfolio volatility will be high.

However, in a diversified portfolio, the assets often have varying degrees of correlation, which can reduce the overall volatility.

Assets that are negatively correlated can provide a stabilizing effect because when one decreases in value, the other may increase.

Why Diversification Can Be Considered “Self-Financing”

The concept of diversification being a “self-financing hedging strategy” is based on the premise that it does not necessarily require additional capital to achieve these benefits.

Instead, it’s about how you allocate your existing capital. It doesn’t require purchasing a separate financial instrument (like an options contract for hedging).

Therefore, it doesn’t have an additional direct financial cost, making it a form of self-financing risk management strategy.

But while diversification does not require additional capital, it does require careful planning, research, and ongoing monitoring to maintain a balanced portfolio that aligns with your investment goals and risk tolerance.

There can also be transaction costs associated with establishing and rebalancing a diversified portfolio, which should be taken into account.

Furthermore, diversification can’t entirely eliminate risk or guarantee profits – it’s a strategy to manage and mitigate risk.

Conclusion

Self-financing hedging strategies such as the collar strategy can be effective tools for investors looking to protect their investments from market volatility without incurring additional costs.

They offer a way to limit downside risk while retaining some upside potential.

We also have other articles dedicated to the idea of diversification and how to build a good overall portfolio.