Seasonal Trading

Seasonal trading refers to the tendency of financial markets to exhibit patterns or trends at specific times of the year.

These recurring patterns provide opportunities for traders to take advantage of price fluctuations by adjusting their trading strategies accordingly.

In this article, we’ll explore seasonal spread trading, stock market seasonality, and the reasons behind the occurrence of seasonality in markets.

Key Takeaways – Seasonal Trading

- Seasonal trading involves taking advantage of the patterns and trends that occur in financial markets at specific times of the year. Traders may choose to adjust their strategies to profit from price fluctuations during these periods.

- Seasonal spread trading focuses on the relative performance of two related assets over a specific period. By analyzing historical price movements and identifying strong seasonal relationships, traders can exploit price differences for potential profits.

- Stock market seasonality refers to the recurring patterns and trends in stock performance during specific periods. Examples include the “January Effect” and the “Sell in May and Go Away” adage.

- However, historical trends are not guaranteed to repeat in the future and other traders expect them when relevant (leading to them being discounted into markets), and traders should also consider other factors when making investment or trading decisions.

Seasonal Spread Trading

Seasonal spread trading involves taking advantage of the differences in price movements between two related assets over a specific period.

In this strategy, traders aim to profit from the relative performance of these assets rather than their absolute performance.

The underlying rationale is that the historical price movements of these assets are likely to repeat themselves during the same period in future years due to similar cause-effect mechanics.

Example of Seasonal Spread Trading in Energy Markets

For instance, in the energy sector, seasonal spread trading might involve going long on natural gas futures while going short on heating oil futures during the winter months.

This is because demand for natural gas typically rises as people use more heating, while demand for heating oil tends to decline as its prices increase.

Applied Across Markets

Seasonal spread trading can be applied across various financial instruments such as stocks, commodities, and currencies.

(Bonds, too, though fixed income often doesn’t have the same level of liquidity outside major government bond markets like US Treasuries.)

The key is to identify assets with a strong seasonal relationship and to carefully monitor the timing of the trades.

At the same time, everything that’s known about markets is already discounted in the price, so when other traders expect the same thing it can be difficult to exploit for trading profits.

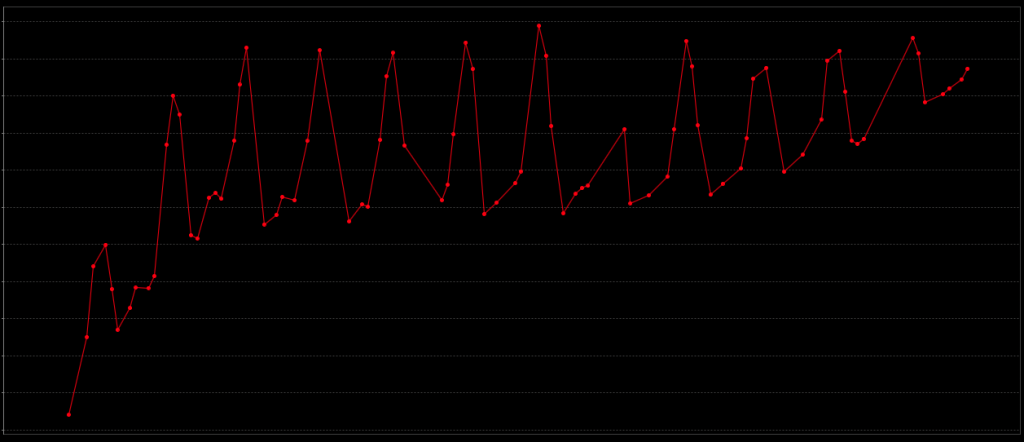

For example, the chart below shows the discounted path of natural gas futures out 10 years. As you might surmise, the peaks occur during the (Northern Hemisphere) winter months – when there’s more natural gas demand – and the troughs occur during the summer months.

Natural Gas Future Exhibiting Seasonal Patterns

Accordingly, as these show the discounted prices, having a winning seasonal trading strategy is hard because other traders expect the same.

Stock Market Seasonality

Stock market seasonality refers to the recurring patterns and trends in the performance of stocks or indices during specific periods.

These trends have been observed in various markets around the world and are often influenced by factors such as macroeconomic events, corporate earnings releases, and investor sentiment.

One of the most well-known examples of stock market seasonality is the “January Effect,” which suggests that stocks tend to perform better in January compared to other months.

This phenomenon is attributed to factors such as increased investment due to year-end bonuses, tax-loss selling in the previous year is over, and renewed optimism among investors.

Another example is the “Sell in May and Go Away” adage, which suggests that investors should sell their stocks in May and re-enter the market later in the early fall.

This is based on the historical underperformance of stocks during the summer months compared to the winter months. “Sell in May and Go Away” is more tongue-in-cheek and not to be mistaken as serious investment advice.

It is essential to note that while these seasonal trends have been observed historically, they are not guaranteed to occur in the future.

Traders must consider other factors such as market conditions, economic indicators, company fundamentals, and their own risk tolerance (among other factors) when making investment decisions.

Why Does Seasonality in Markets Occur?

Seasonality in financial markets occurs due to various reasons, some of which include:

Cyclical Economic Factors

Seasonal patterns can be influenced by cyclical economic factors such as consumer spending habits, agricultural production cycles, and tourism trends.

For example, retail stocks may perform well during the holiday season due to increased consumer spending, while agricultural commodities may exhibit seasonal price fluctuations based on planting and harvesting cycles.

Fiscal Policies and Regulations

Government fiscal policies and regulations can also contribute to seasonality in markets.

For instance, tax deadlines and incentives can impact investment decisions, leading to increased trading activity during specific periods.

Corporate Earnings Releases

Companies often release their quarterly earnings reports at predictable intervals, which can lead to increased trading activity and price fluctuations as investors react to the news.

Investor Behavior and Sentiment

Investor behavior and sentiment can also play a significant role in the occurrence of seasonality in markets.

Seasonal patterns may arise as investors anticipate and react to events such as the beginning of a new year, major holidays, or historical trends.

Examples of Market Seasonalities Across Timeframes (Daily, Weekly, Monthly, Quarterly, Annually)

Daily

There may be daily nuances in buying and selling behavior that some traders may exploit. It could be due to a specific market participant or another reason.

Weekly

There may be weekly seasonality due to options behavior. As options get near expiry, traders switch positions and market makers are forced to buy or sell the underlying to maintain their hedging arrangements.

This is known as delta and gamma hedging (and can include other Greeks).

Monthly

A lot of data is released on a monthly timeframe, creating changes in price at this interval.

Quarterly

Companies report earnings once per quarter. Certain companies may also change their activities late in a quarter to make a final sales push.

Annual

There are many forms of annual seasonality.

For example, a ski resort or Christmas tree business has inherent seasonality.

An internet resource on baseball is likely to see a high number of visitors during the April to October months when baseball season is in full swing in the US and see visitors dry up in other months.

Advertising-based businesses are cyclical. Ad spending is highest during Q4 due to the holidays, and tends to drop off a lot once the new year hits.

FAQs – Seasonal Trading

How can I identify seasonal patterns in the market?

Identifying seasonal patterns requires a combination of historical data analysis, understanding of the factors affecting the market, and ongoing monitoring.

Analyzing historical price data can help uncover recurring trends during specific periods.

Additionally, staying informed about macroeconomic events, sector-specific factors, and investor sentiment (i.e., what’s discounted into markets) can provide valuable insights into potential seasonal patterns.

Can seasonal trading strategies be applied to all financial instruments?

Seasonal trading strategies can be applied broadly across various asset classes, including equities, commodities, and FX.

However, how well these strategies do vary depending on the specific market and the underlying factors driving seasonality.

It’s important to research and understand the unique characteristics of each market before implementing seasonal trading strategies.

How reliable are seasonal patterns in predicting future market performance?

Although historical seasonal patterns can provide valuable insights into potential market trends, they are not guaranteed to recur in the future.

Seasonal trading strategies should be used in conjunction with other forms of analysis, such as technical, fundamental, and sentiment analysis, to make well-informed investment decisions.

Are there any risks associated with seasonal trading strategies?

Seasonal trading strategies, like any other trading approach, come with inherent risks.

These risks include the possibility of historical patterns not repeating, unexpected market events disrupting seasonal trends, the impact of broader market conditions, and other variables that aren’t accounted for.

Traders should always manage their risk by using proper position sizing, stop-loss orders or options to limit tail risk, and diversifying their trading or investment portfolios.

Can I use seasonal trading strategies for long-term investments?

While seasonal trading strategies are often associated with short-term trading, they can also be applied to long-term investments by adjusting the investment horizon and considering the broader market context.

Long-term investors may use seasonal trends to identify optimal entry and exit points or to strategically rebalance their portfolios.

Conclusion

Seasonal trading offers intriguing opportunities for traders who can accurately identify and capitalize on recurring market patterns.

By identifying and capitalizing on these seasonal fluctuations, traders can adjust their strategies and potentially profit from price movements.

Whether it’s through seasonal spread trading or taking advantage of stock market seasonality, understanding historical patterns and considering other market factors can be important for making informed investment decisions.

While seasonal trends are not foolproof and carry inherent risks, combining them with other forms of analysis can enhance trading strategies.