Options Carry Trades

A carry trade involves profiting from yield or premium differentials between assets.

The classic example is currency carry (borrowing low-yield, long high-yield), and essentially betting on the yield differential.

This same logic applies to volatility markets through options, which intrinsically have implied volatility baked into them.

Options carry trades involve the concept of harvesting the volatility risk premium (VRP), where you’re selling options with high implied volatility and going long options with lower implied volatility to hedge out the direct price risk.

Key Takeaways – Options Carry Trades

- Carry trades profit from differences in yield or premium.

- They earn income from one side while funding it from another.

- In options markets, this means harvesting the volatility risk premium (VRP): the gap where implied volatility usually exceeds realized volatility.

- Short volatility carry earns steady income by selling options, collecting time decay (theta), and profiting if markets stay calm.

- Long volatility carry uses spreads to generate positive theta and vega. They maintain exposure to volatility spikes.

- While some traders stick to certain rules – e.g., “never be short gamma” (i.e., don’t short options) – many sophisticated portfolios blend both short and long vol.

- This balances steady income with convex protection.

- Key drivers: Theta (time decay), Vega (vol sensitivity), and Gamma (price movement sensitivity).

- Performance relies on vol-adjusted returns, capital efficiency, and rolling positions as options expires.

- Risks include regime shifts, crowding, and event shocks.

- As a source of return, carry from volatility isn’t consistent, so it may be more of a tactical return stream.

Summary – Short Vol vs. Long Vol Carry

| Feature | Short Volatility Carry | Long Volatility Carry |

| Primary Goal | Harvest premium from time decay, betting that realized vol < implied vol. | Create a positive-theta position that also profits from a volatility event. |

| Mechanism | Selling options (e.g., puts, calls, strangles, condors). | Structuring spreads across expirations (e.g., calendars, diagonals). |

| View on Volatility | Bets on low or decreasing volatility. Convergence trades as well. Time decay. | Bets on a large price move or an increase in overall volatility. |

| Role of Time (Theta) | Directly positive. The entire position profits from time decay. | Net positive. The position is structured so that short-term decay outpaces long-term decay. |

| Risk Profile | High probability of small gains; low probability of large/unlimited losses. | Lower probability of profit, but gains can be large. Max loss is usually defined and paid upfront. |

| Ideal Environment | Sideways, range-bound, or slowly trending markets. | A static market followed by a sharp, explosive price move. |

Core Mechanics of Options Premium

Options might seem complicated, but at their heart, they’re simple contracts built from two ingredients: intrinsic value and extrinsic value.

Understanding these two pieces is the key to seeing where the “carry” lives in options – why some traders can earn steady returns simply by waiting.

Decomposition of Option Value

Every option’s price (or premium) reflects both what it’s worth right now and what it might be worth in the future.

Intrinsic value is straightforward. It’s the amount of money you’d make if you exercised the option immediately.

For example, if you hold a call option that lets you buy a stock at $100 when it’s trading at $110, the intrinsic value is $10. It’s real, tangible, and exists today.

Extrinsic value, on the other hand, is more interesting. It’s the layer of price built on hope and uncertainty – i.e., the chance that the option becomes more valuable before it expires.

This portion is shaped by time and implied volatility (IV), the market’s estimate of how wild price swings might be. The more time left or the more volatile the market, the higher this “time value” tends to be.

Here’s the key insight: extrinsic value is where the carry lives. Time slowly erodes it, a process measured by theta, the rate of time decay.

- Option sellers earn carry by collecting this decay each day the market stays quiet. They’re effectively selling time and taking the risk for buyers.

- Option buyers, in contrast, are paying for potential, handing over premium for the chance that volatility or price moves will work in their favor before time runs out.

This quiet tug-of-war between theta decay and volatility movement defines the gist of every options carry trade.

It’s not about guessing direction like most trading strategies. Ultimately, it’s about understanding how time and uncertainty are priced.

The Volatility Risk Premium (VRP)

At the core of every options carry trade sits a quiet, persistent gap between what people expect will happen and what actually does.

That gap is called the Volatility Risk Premium, or VRP, and it’s one of the most consistent sources of return in modern markets.

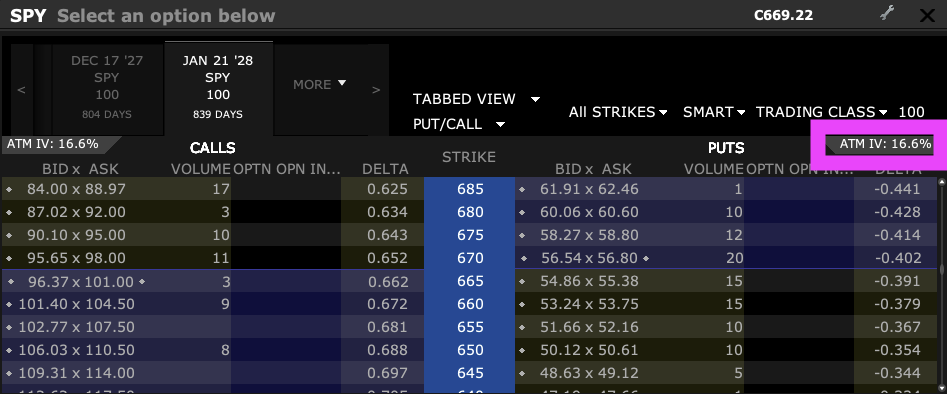

Implied volatility is what the market thinks future price swings will look like. It’s not measured; it’s inferred from option prices, typically using classic formulas like Black-Scholes.

You might see it referred to inside your broker when you see options chains.

When traders bid up the price of options, holding price constant, they’re saying, “We expect a bumpy ride ahead.”

On the other side, realized volatility (RV) is what actually happens. It’s the historical record of how much the asset truly moved over time.

Here’s the pattern: implied volatility tends to run higher than realized volatility. In other words, markets usually overestimate how wild things will get.

Think of it like insurance… people consistently pay more for protection than the risks often warrant.

The invested premiums minus claims payouts is the basis of how insurance businesses make money.

Why does this gap persist?

Two reasons.

- First, risk aversion. Investors/traders hate sudden crashes, so they’re willing to overpay for protection.

- Second, there’s a structural supply of volatility, institutions and funds that regularly sell options to earn steady income, effectively supplying “insurance” to the market.

This consistent imbalance creates a carry trade opportunity. From selling options, essentially going short implied volatility, traders collect the premium difference between IV and RV.

As long as markets behave roughly as expected, that premium generally turns into profit. It’s just the monetization of “fear” (an overused term in markets, but for the lack of a better word) versus reality.

The Short Volatility Carry Trade

The short volatility carry trade is the bread and butter of most volatility-based income strategies.

It’s simple in concept but dangerous in execution.

The idea is straightforward: sell fear, collect time decay, and hope the world stays calm long enough for you to keep the premium.

1. Structure and Objective

At its core, this trade is built around one mechanism:

- sell options, collect premium, and profit if realized volatility (RV) comes in below implied volatility (IV)

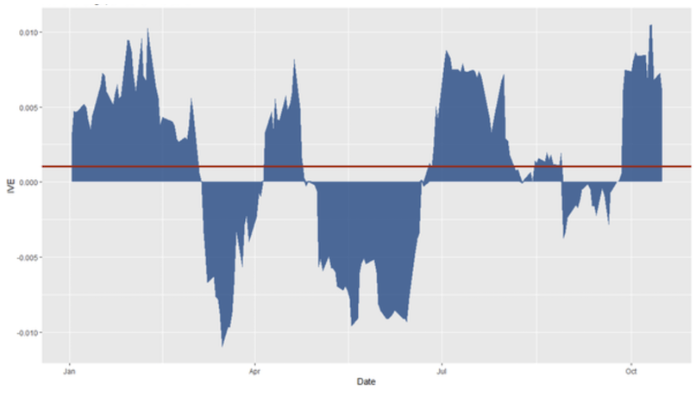

RV does come in below IV – i.e., the volatility risk premium (VRP) – most of the time. Below shows the VRP of Apple stock over a specific time horizon.

Option sellers take the other side of the market’s anxiety, earning a steady drip of income as long as markets stay normal.

These positions are positive theta (they make money as time passes) but negative vega (they lose if volatility spikes).

In quiet markets, this dynamic works well. Each passing day erodes the option’s extrinsic value, and that decay becomes profit.

The payoff profile looks like a slow, consistent grind upward, punctuated by the occasional plunge when volatility surges.

2. Strategy Variants

There are many ways to express a short-vol view:

- Short Straddle / Strangle – You sell both calls and puts, betting that the asset stays within a range. Great in calm markets, disastrous in chaos.

- Iron Condor – A risk-defined version that buys “wings” (further out-of-the-money options) to cap losses. It earns less premium but offers defined downside.

- Put-Write – Selling cash-secured puts, essentially being paid to buy the stock at a lower price if it falls.

3. Risk Characteristics

This trade’s defining feature is asymmetry. You win small and often, but lose big and rarely.

A volatility spike (driven by panic, news, or a sudden liquidity shock) can wipe out months of slow gains.

This is what people mean when they call it “picking up pennies in front of a steamroller.”

Quantitatively, it’s about gamma risk (price accelerating against you) and vega expansion (volatility exploding higher).

History offers plenty of reminders. The February 2018 “Volmageddon” crash saw the XIV volatility ETN collapse in a single day. That erased years of steady short-vol gains in hours.

4. Risk Management

Smart practitioners respect the steamroller.

They diversify across maturities and assets, hedge dynamically when volatility starts rising, and often overlay tail protection – e.g., cheap long options that kick in during crises.

Many use volatility targeting frameworks to scale positions.

This means traders adjust how much money they put into positions based on current market volatility – more when volatility is low and less when it’s high to maintain consistent risk levels.

The Long Volatility Carry Trade

The idea of a long volatility carry trade sounds contradictory at first.

How can a trader be long volatility, which usually costs money, and still earn a positive carry?

The answer lies in using the structure of the volatility market itself, specifically the term structure and skew of implied volatility.

Conceptual Paradox

Traditional long volatility positions, like buying puts or calls, lose time value as time passes.

But by selling short-dated options and buying longer-dated ones, a trader can reverse that equation.

The shorter options decay faster, while the longer ones better hold their value. Theta decay is fastest at the very end of an option’s life.

This creates a position that earns time decay while still benefiting from rising volatility.

Structural Mechanics

A typical setup might involve selling front-month options and buying back-month options on the same underlying.

The result is positive theta (carry income from faster decay) and positive vega (profit when volatility rises).

Two common ways to structure it are:

- Calendar Spread – Sell a near-term option and buy a longer-term one at the same strike. The shorter one has more time decay.*

- Diagonal Spread – Similar idea, but with different strikes to add a directional tilt.

*A short weekly/long annual calendar spread strategy typically might generate 5-15% annualized returns depending on the underlying asset’s volatility levels, with higher returns during periods of elevated short-term implied volatility relative to long-term volatility. But this can vary significantly and involves material risk if volatility spikes sharply.

Market Contexts Where It Works

This trade shines when the volatility term structure is steep, meaning short-term options are rich and long-term ones are relatively cheap.

It also works well in calm markets ahead of potential catalysts like earnings or economic announcements, when long-dated volatility is underpriced.

Risk and Reward Profile

The downside is limited to gradual carry erosion if nothing happens, while the upside is convex during volatility spikes.

It may lag in quiet periods but serves as a valuable, balanced exposure for volatility-neutral portfolios looking for both income and protection.

Volatility Surfaces

The volatility surface is a map showing how implied volatility changes across both time and strike prices.

The term structure plots volatility against time to maturity, while the skew (or smile) shows how volatility varies across different strike prices.

Together, they reveal how the market prices uncertainty over time and across directions.

Professional traders study these surfaces to uncover edges. When the term structure is steep, they might sell short-term options, which decay quickly, and buy longer-dated ones, which hold value longer.

When skew is pronounced, they can sell expensive downside insurance and buy cheaper upside convexity to asymmetric exposure.

These carry portfolios aren’t static. As volatility surfaces shift with market sentiment, traders often rebalance dynamically, adjusting positions to maintain positive carry while keeping risk contained.

Example

For example, if the S&P 500’s short-term options show high implied volatility while longer-dated options are calmer, a trader might sell a one-month put and buy a three-month put at the same strike.

This calendar spread earns carry as the front option decays faster, while keeping exposure to rising volatility.

When the short put expires, they can roll to a new one.

One of the big risks is the price moving up a lot, causing the 3-month put to lose most of its value, swamping the premium received from the short-term put.

Other Examples…

Term Structure Trade:

- Sell 10 contracts of the 1-week 500 put at 18% IV (collect ~$3,000 premium)

- Buy 10 contracts of the 3-month 500 put at 14% IV (pay ~$7,000)

- Net debit: ~$4,000 for calendar spread

Skew Trade:

- Sell 5 contracts of the 1-week 450 put at 25% IV (expensive downside insurance, collect ~$1,200)

- Buy 5 contracts of the 1-week 550 call at 16% IV (cheap upside convexity, pay ~$800)

- Net credit: ~$400

Practical Considerations and Metrics

Even the best options carry strategy depends on execution and risk measurement.

Understanding the moving parts: the Greeks, capital dynamics, and volatility signals are all important.

Key Greeks and Their Interactions

Three Greeks dominate carry trades: Theta, Vega, and Gamma.

Theta measures time decay, the steady drip of income for short-vol traders.

Vega tracks sensitivity to changes in implied volatility; short-vega positions lose when volatility spikes, while long-vega positions gain.

Gamma measures how fast profits or losses change as the underlying price moves.

A portfolio that’s short gamma earns carry during quiet periods but pays dearly when markets move fast.

| Metric | Definition | Implication for Carry |

| Theta | Rate of time decay | Source of positive carry |

| Vega | Sensitivity to volatility changes | Short vega = harvest VRP |

| Gamma | Sensitivity to price change | Short gamma = tail risk |

| IV/RV Ratio | Implied ÷ Realized vol | Determines expected edge |

Return Metrics and Capital Use

Because carry trades earn small, steady gains, performance is best viewed through volatility-adjusted returns, such as the Sharpe ratio.

Margin and capital efficiency also matter, a strategy that looks attractive on paper may be less attractive once collateral requirements are considered.

Rolling, Rebalancing, and Live Signals

Carry fades as expiration nears, so rolling and rebalancing are essential to maintain consistent exposure.

Traders often monitor the realized-to-implied volatility ratio as a real-time gauge of opportunity:

- When implied volatility sits well above realized volatility, carry potential is rich.

- When the spread narrows, it’s time to scale back.

Ultimately, the success of an options carry strategy lies in the details.

Structural Risks and Limitations

The success of this strategy depends on the market regime. The same dynamics that generate steady profits in calm markets can turn when volatility regimes shift.

Regime Dependence

Carry trades thrive in stable, low-volatility environments, where implied volatility stays above realized volatility and time decay flows steadily.

But in turbulent periods, that relationship can flip, leaving traders short volatility right as it surges.

Crowding and Liquidity Risk

Because the volatility risk premium is so well-known, it attracts competition.

When too many players chase the same edge, the premium compresses, and the strategy becomes fragile.

In a liquidity crunch, options markets can gap violently, making it costly (or impossible) to adjust positions.

Event and Diversification Considerations

Unexpected macro shocks, earnings surprises, or geopolitical events can erase months of carry income in hours.

To survive, professional managers rely on dynamic hedging and cross-asset diversification, spreading exposure across timeframes, markets, and strategies.

The goal isn’t to eliminate risk, but to ensure no single volatility event wipes the slate clean.

Specific Trade-Level Risks

In terms of specific risks, let’s go through them individually:

Volatility Risk

If short-term implied volatility decreases, the short weekly options may not decay as expected.

In turn, this reduces the strategy’s profitability.

Conversely, a sudden spike in short-term volatility can cause large losses on the short leg.

Directional Risk

Although calendar spreads are generally delta-neutral (neutral to price direction), large moves in the underlying asset can cause losses – especially if the short-term option moves deep in or out of the money.

Time Decay Mismatch

The strategy relies on the faster time decay of short-term options relative to long-term options.

If this relationship changes, the expected carry can diminish or reverse.

Liquidity and Execution Risk

Rolling short weekly options continuously requires frequent trading, which can incur transaction costs and slippage, impacting net returns.

Assignment Risk

Early exercise of short options, especially if they become in-the-money, can force unwanted stock delivery or position adjustments.

Model and Pricing Risk

Changes in the volatility surface, skew, or term structure can change option pricing and other dynamics (e.g., other Greeks/sensitivities).

This can potentially leading to losses if the spread isn’t managed or rebalanced properly.

Margin and Capital Risk

The strategy may require margin to maintain short positions.

Moves against can lead to margin calls or forced liquidation.

Conclusion

Options carry trades offer a steady stream of income by harvesting small, consistent premia, but always at the cost of being exposed to rare, violent moves.

Like global macro carry strategies – e.g., the popular FX carry trade – the payoff is patience rewarded, until it isn’t.

Long-term success comes down to not applying it indiscriminately, understanding the strategy at a deeper level, and – even then – diversifying.

If anything, it can be a market signal or more tactical return source.

It tells traders when the market is calm, when it’s uneasy, and when fear is creeping back in.

In that sense, carry isn’t just a return stream but a window into market psychology.