On-The-Run vs. Off-The-Run Bonds & Strategies

In fixed-income securities – particularly government bonds like US Treasuries – the terms “on-the-run” and “off-the-run” have important implications for traders.

- On-The-Run (OTR) Bonds – These are the most recently issued Treasury securities of a specific maturity (e.g., a 10-year Treasury note). They’re actively traded and offer the highest liquidity.

- Off-The-Run (OFFTR) Bonds – These are older Treasury securities of the same maturity that were issued prior to the current on-the-run issue. As newer issues take their place, they become less liquid.

Key Takeaways – On-The-Run vs. Off-The-Run Bonds & Strategies

- Liquidity and Trading Volume

- On-the-run (OTR) bonds – the most recent issue – offer higher liquidity and tighter bid-ask spreads.

- Preferable for traders who prioritize ease of entry and exit in their transactions.

- Yield and Pricing Differences

- Off-the-run (OFFTR) bonds may provide higher yields due to their lower liquidity and reduced demand compared to OTR bonds.

- Provide opportunities for yield-seeking traders.

- Arbitrage Opportunities

- The price/yield differential between OTR and OFFTR bonds can be exploited through basis trades (when done skillfully), where traders can potentially profit from the narrowing of spreads between these two types of bonds.

Understanding On The Run (OTR) Bonds

On-the-run bonds refer to the most recently issued US Treasury securities of a particular maturity.

These bonds are essential components of the fixed-income market and offer traders a range of benefits.

Characteristics of OTR Bonds

- Most recently issued – OTR bonds represent the newest offering of a specific Treasury security type (e.g., 2-year note, 10-year bond).

- High liquidity – As the most actively traded Treasury securities of their maturity, OTR bonds have ample buyers and sellers, making them easy to trade.

- Benchmark status – OTR bonds are often used as benchmarks for pricing other bonds and for determining interest rates in the broader market.

Why OTR Bonds are Considered More Liquid and Often Trade at a Premium

OTR bonds have greater liquidity and a slight price premium due to:

- Demand – The newest issues typically attract the most attention from traders, leading to higher demand and therefore higher prices.

- Market-making activity – Large financial institutions focus their trading activity on OTR bonds, so they have a steady flow of buy and sell orders.

Current Examples of OTR Bonds in the Market

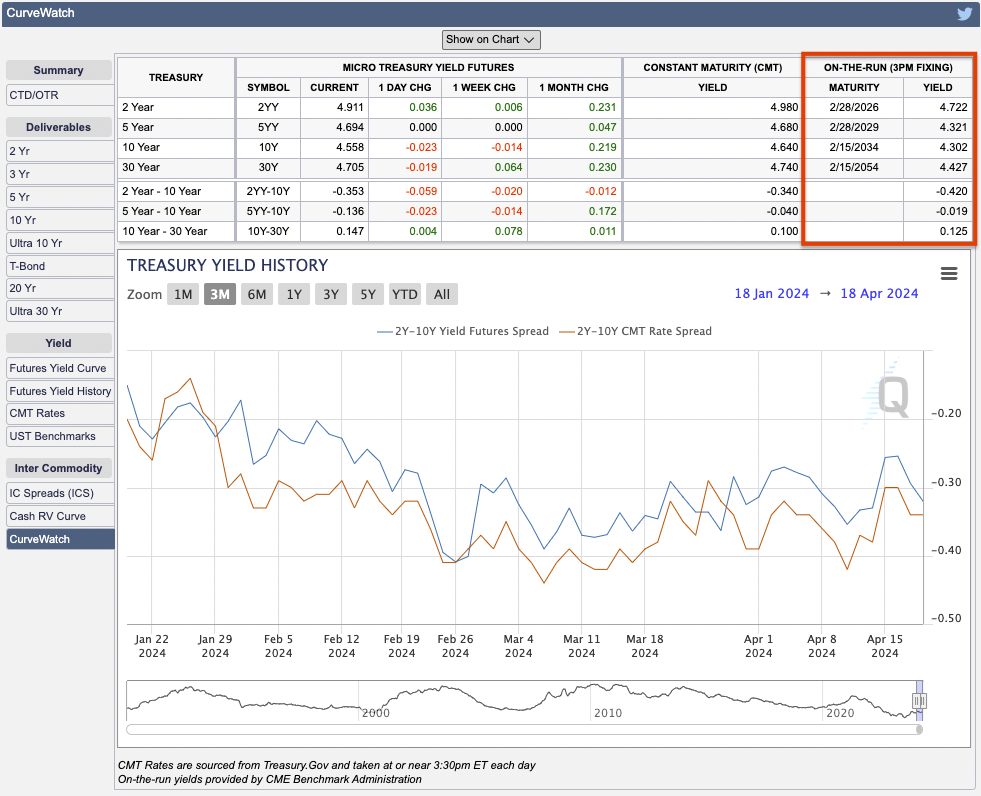

To find current examples of OTR bonds, you can visit the CME Group’s Treasury analytics dashboard.

Here, you’ll find real-time information on the latest Treasury auctions and the specific maturities of the current on-the-run bonds.

Understanding Off The Run (OFFTR) Bonds

Off-the-run (OFFTR) bonds are Treasury securities that were once on-the-run but have been superseded by newer issues of the same maturity.

Characteristics of OFFTR Bonds

- Older issues – OFFTR bonds are previous Treasury offerings that are no longer the most recent for their maturity.

- Decreased liquidity – As investor focus shifts to newer OTR bonds, OFFTR bonds often experience less trading activity, leading to lower liquidity.

- Potential for higher yields – Due to their lower liquidity, OFFTR bonds sometimes trade at slightly lower prices. They offer somewhat higher yields to compensate for the liquidity risk.

Reasons for Less Liquidity and Broader Yield Spreads Compared to OTR Bonds

- Reduced Demand – Traders/investors generally prefer the most recent OTR issues, resulting in decreased attention on OFFTR bonds.

- Less Market-Making Activity – Financial institutions often concentrate their market-making activities on OTR bonds. This leaves OFFTR bonds with less support, which can lead to wider bid-ask spreads (i.e., difference between buying and selling prices).

Why On the Run vs. Off the Run Matters for Trading Strategies

Understanding the difference between OTR and OFFTR bonds is important for several reasons:

Liquidity

OTR bonds are typically much more liquid than OFFTR bonds.

This means you can buy and sell them more easily, and with tighter bid-ask spreads (the difference between what a buyer is willing to pay and a seller is willing to accept).

Greater liquidity can be advantageous if you need to adjust your portfolio quickly.

Pricing and Yields

Due to their higher liquidity, OTR bonds often trade at a premium compared to their OFFTR counterparts.

This means their yields (the return you get) are generally slightly lower.

Trading Strategies

The price difference between OTR and OFFTR bonds creates opportunities for specific trading strategies.

Some traders may choose to short (bet against) OTR bonds while simultaneously buying OFFTR bonds of the same maturity, hoping to profit from the narrowing price difference.

Factors to Consider

When deciding whether to trade or invest in OTR or OFFTR bonds, you should consider the following:

Goals

Are you looking for stability and income with less volatility (OTR), or are you seeking slightly higher potential yields and willing to accept more price variations within your holding period (OFFTR)?

Risk Tolerance

OFFTR bonds can be more vulnerable to price swings due to lower liquidity.

Time Horizon

If you plan to hold the bonds until maturity, the liquidity difference between OTR and OFFTR becomes less important.

Basis Trade Explained: On-the-Run vs. Off-the-Run Bonds

The basis trade is an arbitrage strategy involving the purchase of one financial instrument and the simultaneous sale of a related instrument.

In the context of US Treasury securities, this often refers to the trade-off between on-the-run (OTR) and off-the-run (OTR) bonds.

Basis Trade Mechanism

Identifying the Spread

The basis trade exploits the price differences (yield spread) between OTR and OFFTR bonds.

Typically, OTR bonds have a lower yield compared to OFFTR bonds due to their higher liquidity and demand.

The spread between these yields represents an opportunity for arbitrage.

Execution of Trade

- Purchase of OFFTR Bonds – The trader buys OTR bonds, which have a higher yield (thus, they’re priced lower) expecting their price to rise or yields to fall.

- Sale of OTR Bonds – Simultaneously, the trader sells short OTR bonds, which have a lower yield (thus, they are priced higher), expecting their price to decrease or yields to rise.

Profit Mechanism

The profit from a basis trade arises when the yield spread between the OTR and OTR bonds narrows.

The trader gains on the convergence as the price of the less liquid OTR bonds rises (or their yield falls) relative to the more liquid OTR bonds.

Risk Considerations

- Liquidity Risk – OFFTR bonds, being less liquid, might be difficult to sell at the desired price.

- Market Risk – Changes in interest rates or market sentiment can affect the yield spread unpredictably and impact the profitability of the trade.

- Execution Risk – The simultaneous execution of trades in OTR and OTR bonds must be precise to avoid slippage that can erase arb profits.

Example of a Basis Trade with Cash Bonds and Futures

Step 1: Identify the Spread

- Analyze the yield spread between an on-the-run (OTR) 10-year Treasury bond and an off-the-run (OFFTR) 10-year Treasury bond.

- Suppose the OTR bond yields 3.5% and the OFFTR bond yields 3.7%.

Step 2: Execute Trades

- Purchase OFFTR Bonds – Buy $10 million in face value of the OFFTR 10-year Treasury bonds at a higher yield of 3.7%.

- Short-Sell OTR Bonds Using Futures – Instead of short selling OFFTR bonds directly, sell short $10 million in face value equivalent of 10-year Treasury futures that are priced based on the OTR bond yield of 3.5%.

Step 3: Monitor and Close the Position

- Wait for the yield spread between the OTR and OFFTR bonds to narrow.

- Close both positions when the yield spread narrows sufficiently, capturing the profit from the price/yield differential.

Step 4: Profit Calculation

- Calculate the profit from the convergence of the price/yield difference between the cash bond purchase and the futures contract based on the change in the yield spread.

This strategy uses futures for the short position to manage collateral requirements and minimize transaction costs.

Trading Strategies Involving OTR and OFFTR Bonds

The relationship between on-the-run and off-the-run bonds offers opportunities for other various trading strategies.

Here’s a look at some of those strategies:

Long/Short Strategies for Balancing Portfolios Using OTR and OFFTR Bonds

The Strategy

Traders can take a long position in OFFTR bonds (buying and holding) to potentially benefit from their slightly higher yields.

To balance the liquidity risk, they can simultaneously take a partial short position in OTR bonds, effectively hedging a portion of the portfolio.

Considerations

This approach aims to create a more balanced yield/liquidity profile.

It requires an understanding of how the OTR/OFFTR price relationship typically behaves, as well as constant rebalancing.

OTR and OFFTR Bonds in Hedging Interest Rate Risks

The Strategy

Traders can use both OTR and OFFTR bonds to hedge against interest rate fluctuations.

For example, if interest rates are expected to rise, shorting OTR bonds (which would likely drop in price) could offset potential losses in other fixed-income holdings within a portfolio.

Considerations

Hedging with bonds is a complex strategy and involves understanding how bond prices react to changing interest rates.

It’s important to assess your risk tolerance and objectives before using such techniques.

Market Impact and Trading

The dynamic between on-the-run and off-the-run bonds influences market trading and pricing.

Here’s how this works:

How the Liquidity of OTR and OFFTR Bonds Affects Market Trading and Pricing

Trading Volume and Spreads

High liquidity in OTR bonds leads to larger trading volumes and tighter bid-ask spreads (the difference between buying and selling prices).

Conversely, OFFTR bonds tend to experience lower trading volumes and wider spreads due to reduced liquidity.

Price Efficiency

The higher liquidity of OTR bonds allows information to flow more seamlessly.

This can promote more efficient price discovery in the market.

OFFTR bonds may have less accurate pricing due to the less fluid trading environment.

Benchmarking

OTR bonds serve as benchmarks for pricing other debt instruments, including corporate bonds and mortgages.

Their liquidity and active trading make them reliable reference points for market participants.

Impact of Economic Announcements and Market Conditions on OTR vs. OFFTR Bonds

Interest Rate Sensitivity

Both OTR and OFFTR bonds react to changes in interest rates.

But OTR bonds, with increased liquidity, often show faster and more pronounced price movements in response to rate shifts.

Flight-to-Safety

Traders often seek safety in highly liquid government bonds during rockier periods in the market.

This can intensify demand for OTR bonds, increasing their price and decreasing their yield compared to OFFTR bonds.

Market Volatility

In highly volatile markets, the liquidity differential between OTR and OFFTR bonds can become even more pronounced, and cause potentially wider price gaps.

Market Responses to Shifts Between OTR and OFFTR Bonds

Treasury Auctions

When a new OTR bond is issued, the previous on-the-run issue transitions to OFFTR status.

This can cause a temporary decrease in the liquidity of the newly OFFTR issue and a potential price adjustment.

Economic Surprises

Unexpected economic releases, such as inflation figures or employment data, can trigger sharp movements in the Treasury market.

The effect is likely to be more pronounced on OTR bonds due to their higher liquidity and trader attention.

But it can also affect OFFTR issues as well due to their lower liquidity and less fluid price movements.

Periods of Market Stress

During financial crises or significant market dislocations, the liquidity premium on OTR bonds may increase substantially as traders flock to the most easily traded securities.

FAQs – On-The-Run vs. Off-The-Run Bonds & Strategies

How long does it take for a basis trade to play out?

The duration for a basis trade to play out typically ranges from a few days to several months.

It depends on:

- market volatility

- liquidity conditions, and

- the speed at which the yield spread between on-the-run and off-the-run bonds converges

Conclusion

Definitions and Characteristics

- On-the-run (OTR) bonds are the most recently issued Treasury securities of a given maturity, offering high liquidity.

- Off-the-run (OFFTR) bonds are older issues with less liquidity and may provide a slight yield advantage.

Trading Strategies

Traders can exploit the price differences between OTR and OFFTR bonds through arbitrage opportunities or use them in hedging strategies to balance yield and liquidity within a portfolio.

Liquidity and Market Trading

The higher liquidity of OTR bonds leads to greater trading volume, tighter bid-ask spreads, and more efficient price discovery compared to less liquid OFFTR bonds.

Economic and Market Impacts

Interest rate changes, economic news, and market volatility can influence the price and liquidity discrepancies between OTR and OFFTR bonds, with OTR bonds generally exhibiting faster price reactions.

Future Outlook and Risks

Understanding the evolving OTR/OFFTR bond dynamics is important for traders.

Risks include the potential widening of yield spreads and reduced liquidity, especially during market stress.

Hedge fund LTCM famously blew up trying to “trade the basis” (spread between OTR and OFFTR bonds) due to the extreme leverage applied.