Olymp Trade Review 2026

See the best Olymp Trade alternatives in your location.

Awards

- Best Online Trading and Investment Platform MENA 2023

- Most Trusted Financial Broker LATAM 2023

- Best Mobile Trading Platform - World Finance Awards 2021

- Best Investment Broker - The Forex Awards 2021

Pros

- Commission discounts up to 20% for experienced investors

- Beginner-friendly blog section with analytics, trading education and market news

- Over 10 flexible payment methods available including bank cards and Bitcoin deposits

Cons

- Research and education trails most alternatives

- Commissions charged on all assets - up to 15% on standard trades and up to 10% on FTT

- Limited transparency on the website

Olymp Trade Review

Olymptrade is a forex and CFD broker founded in 2014. The firm offers a compelling bespoke trading solution, with access to forex, stocks and binary options. In this review of Olymptrade, I reveal my findings after testing the broker’s day trading features, including fees and account types.

Regulation & Trust

We’ve given Olymptrade an average regulation and trust rating of 2.5 out of 5.

The broker is licensed offshore by the Vanuatu Financial Services Commission (VFSC). (Number 40131)

The VFSC isn’t well known for offering the same level of financial protection as Green Tier authorities like the UK’s Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC) in the US.

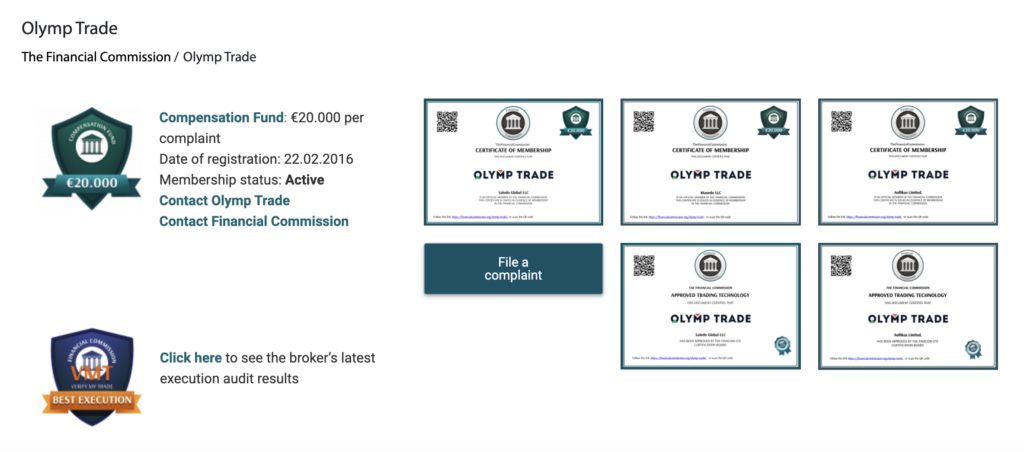

With that said, the broker does claim to offer compensation of up to €20,000 in the case of insolvency, through its membership with the International Financial Commission (FinaCom).

Additionally, the broker has been operational for 10+ years, making it more established than many brands that we test.

Accounts & Banking

Live Accounts

Olymptrade offers a promising range of account types and payment methods, catering to different levels of trader.

The broker offers 3 account statuses: Starter, Advanced and Expert.

Each upgrade allows you to unlock additional features by making larger deposits and collecting experience points (‘XP’).

You only need $10 to get started in the first tier, making the broker accessible to beginners. The firm also offer a range of currency account types, including USDT, BRL and EGP.

Traders can progress through the account types via ‘Traders Way’, or alternatively with larger deposits. Key benefits of these tiers include commission discounts of up to 20%, digital payouts of up to 93%, priority same-day withdrawals, and access to signals and education.

Whilst these benefits are enticing, traders should note that each status is subject to a time limit of only 30 days, after which your status risks being downgraded. This kind of pressure may only rush traders into reckless trading decisions, rather than offering worthwhile benefits.

As such, I strongly urge caution and recommend only trading what you can afford to lose.

Deposits & Withdrawals

Olymptrade offers over 90 payment methods, spanning bank transfers, card payments, e-wallets such as Skrill and Neteller, plus cryptocurrency payments.

Some methods may not be available in all regions, so bear that in mind if you are looking to use a specific method to fund an account.

The minimum deposit is an accessible $10 and most methods are processed instantly. There are also no deposit fees, though your bank may charge its own transaction fees.

Withdrawals must be done via the same method used to deposit. These are typically processed within 24 hours for Starter account holders, though this reduces to a few hours for Expert status.

Again, the broker doesn’t charge any withdrawal fees but there may be third-party fees for some methods.

Demo Account

Olymp Trade offers a free demo account, which comes pre-loaded with a refillable virtual balance of $10,000.

A demo is an excellent way for newcomers to gain an understanding of how trading works and to test out the platform’s tools and features.

To activate a demo account, users simply need to register with an email address, with no proof of identity required.

Assets & Markets

Olymptrade provide a fair range of markets to trade.

While the broker’s range of 250+ assets trails alternatives like Eightcap (1000+), I was impressed with the breadth and variety of asset classes.

Alongside traditional markets such as forex and stocks, I was pleased to find CFDs on some lesser-known ETFs and composite indices available for those seeking more volatile opportunities.

Here’s a breakdown of the available markets at the time of evaluation:

- Forex – 100+ major, minor and exotic pairs including EUR/USD, CHF/JPY and USD/MXN

- OTC assets – You can also try out 29 over-the-counter (OTC) currency pairs, as well as gold

- Stocks – Trade 35+ major stocks from global exchanges, including Tesla, Alibaba and BMW

- ETFs – Speculate on 6 popular ETFs, including the iShares Bitcoin Trust and SPDR S&P 500 ETF Trust

- Commodities – Speculate on precious metals gold, silver, copper and platinum, plus natural gas and brent oil

- Composite indexes – 20 lesser-known products available, including the Crypto Composite, LATAM Index and Cricket ‘23 Index

- Indices – Go long or short on 18 indices, from popular options like the S&P 500, to more interesting opportunities like the Arabian General Index

- Cryptocurrencies – The broker offers 20+ coins including major players like Bitcoin and Ethereum, as well as low-cap altcoins like Moonbeam and Tezos

Leverage

Leverage is available at Olymptrade via CFDs, though specifics vary by region, and the market traded. The brand have also noted this as an area of expansion as they grow their offering.

Fees & Costs

During our tests, the benchmark EUR/USD spread levelled at approximately 1.1 pips, which trails category leaders like AvaTrade and OANDA:

| Olymp Trade | AvaTrade | OANDA | |

|---|---|---|---|

| EUR/USD Standard Spread | 1.1 | 0.9 | 0.8 |

Forex and CFD positions will see a commission charged, and Stocks attract a Success Fee.

Overnight fees are debited at 22:00 UTC on weekdays and are limited to 15% of the total investment amount.

There’s also a $10 monthly activity fee which kicks in after only 180 days of no trading activity in your account. This isn’t as generous as brokers like eToro who start charging after 12 months.

Platforms & Tools

Olymptrade offers a fairly intuitive platform with a decent range of tools, getting it a solid platform and tools rating.

Firstly, I was impressed with the accessibility of the Olymptrade platform. It can be accessed via the web, a dedicated desktop application (available for Windows and Mac) and a smartphone/tablet app.

The terminal is easy to navigate and there’s a real focus on user experience. Charts can be customized to a certain level, including chart type and color, which will appeal to beginners looking for simplicity.

I was able to trade using 10 different timeframes during tests, from 15 seconds to 1 month, making the platform a good environment for short-term day trading strategies like scalping.

Disappointingly, though, the range of technical indicators is low. Starter account holders only get access to 10, whilst Expert account holders can use 14. I was pleased to find popular options like Bollinger Bands, Simple Moving Averages, and Pivot Points, but experienced traders will likely miss the range offered at top platforms like MetaTrader 4 (MT5) or TradingView:

| Olymp Trade Platform | MetaTrader 5 | TradingView | |

|---|---|---|---|

| Technical Indicators | 14 | 38 | 100+ |

| Time Intervals | 10 | 21 | 20 |

Research

Olymptrade provide sentiment analysis – collating the ‘wisdom of the crowd’, and also signals based on a range of data, from news to technical analysis.

Traders can also use a broad range of technical indicators to identify trends and price movements.

One drawback is that some research tools are only available to Expert account holders.

Education

The broker scores well when it comes to education.

Traders can access a decent blog with some technical and fundamental educational articles, money management tips, video tutorials and market information.

That said, the content is not the most comprehensive and doesn’t cover the same breadth of materials for all experience levels as award-winners like IG.

Customer Support

With 24/7 customer support available via multiple channels, Olymptrade gets a strong customer support rating.

During tests, the live chat service was particularly responsive and helpful. I only waited a few seconds before being connected to an agent, who was then able to answer all my queries quickly and professionally.

Multilingual help is also available via email, WhatsApp, Telegram and social media profiles. There’s also a telephone hotline based in Malta, though it’s a shame that more local telephone numbers are not available.

Should You Trade With Olymptrade?

Olymptrade offers a compelling option for beginners looking for digital trades alongside traditional CFDs.

The native platform is user-friendly and delivers a commendable range of technical tools and charting features, requiring only $10 to get started. There’s a diverse range of products to explore.

On the negative side, experienced traders will be unsatisfied by the lack of advanced analysis tools and research. Fees are also high compared to alternatives, and the lack of top-tier licensing is a concern.

FAQ

Is Olymptrade Legit Or A Scam?

Olymptrade is a legitimate broker registered offshore in Vanuatu and St Vincent and the Grenadines. However, the lack of credible licensing is a notable concern, so traders should consider the risks before registering.

Is Olymptrade Regulated?

Olymptrade is regulated offshore by the Vanuatu Financial Services Commission (VFSC). This is not a highly regarded financial authority so you will not have access to the same level of safeguarding as leading brokerages.

Is Olymptrade A Good Or Bad Broker?

Olymp trade is a middle-of-the-road brokerage based on tests. The broker’s bespoke platform is easy to navigate and delivers a fairly intuitive charting experience. That said, the asset line-up is not as wide as competing brands and fees are not the most competitive.

Is Olymptrade Good For Day Trading?

Olymp trade is a decent option for day traders. You execute short-term strategies with timeframes as low as 15 seconds, making it particularly suitable for scalpers. Fees are not ultra-low, but multipliers are available alongside a stable charting platform.

Does Olymptrade Offer Low Fees?

No, Olymp trade does not stand out against top firms when it comes to fees. Average spreads on EUR/USD came in at around 1.1 pips during tests and commissions are charged up to 15% on normal trading contracts. On the plus side, it’s cheap to get started with just $10 and there are no deposit fees.

Best Alternatives to Olymp Trade

Compare Olymp Trade with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Capitalcore – Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from multiple accounts with better pricing as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees on CFDs, though these don’t compensate for the weak oversight and paltry education and research.

Olymp Trade Comparison Table

| Olymp Trade | Dukascopy | Capitalcore | |

|---|---|---|---|

| Rating | 4 | 3.6 | 3.9 |

| Markets | Forex, CFD, Stocks, Indices, Commodities, Crypto, ETFs, OTC, Fixed Time Trades | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $10 | $100 | $10 |

| Minimum Trade | $1 | $1 (Binaries), 0.01 Lots (Forex/CFD) | 0.01 Lots (CFD/Forex), $1 (Binaries) |

| Regulators | VFSC | FINMA, JFSA, FCMC | – |

| Bonus | 100% Deposit Bonus | 100% Anniversary Bonus | 40% Deposit Bonus |

| Platforms | Olymptrade Platform | JForex, MT4, MT5 | WebTrader, Pro |

| Leverage | – | 1:200 | 1:2000 |

| Payment Methods | 12 | 10 | 4 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Capitalcore Review |

Compare Trading Instruments

Compare the markets and instruments offered by Olymp Trade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Olymp Trade | Dukascopy | Capitalcore | |

|---|---|---|---|

| Binary Options | Yes | Yes | Yes |

| Expiry Times | 5 seconds – 23 hours | 3 minutes – 1 day | 1 minute – 1 hour |

| Ladder Options | No | No | No |

| Boundary Options | No | No | No |

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | No |

| ETFs | Yes | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

Olymp Trade vs Other Brokers

Compare Olymp Trade with any other broker by selecting the other broker below.

The most popular Olymp Trade comparisons:

- Expert Option vs Olymp Trade

- Olymp Trade vs Exness

- Deriv.com vs Olymp Trade

- Quotex vs Olymp Trade

- Olymp Trade vs eToro

- XM vs Olymp Trade

- Olymp Trade vs IQ Option

- Olymp Trade vs 4xCube

- Olymp Trade vs Pocket Option

Customer Reviews

4 / 5This average customer rating is based on 8 Olymp Trade customer reviews submitted by our visitors.

If you have traded with Olymp Trade we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Olymp Trade

Article Sources

- Olymp Trade Website

- Vanuatu Financial Services Commission (VFSC) License

- International Financial Commission (FinaCom) Registration

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

My first experience was bad. All money deposited was eroded trading with the robot option. I watched as the robot traded making losses and gains and eventually making more losses and depleted the account.

Olymptrade is not trustworthy. My withdrawal is stuck for weeks now. They make false transfers which does not reach recipient account. Whether hackers are doing it or they themselves, we don’t know but results are the same. Their useless customer service will not take any complaint until 5 business days past a stated IMPS transfer. IMPS transfer means Immediate transfer by the way. Post that they ask for bank statement to prove you are not lying and so on. There are huge numbers of such incidence in various feedback website. Don’t live in happy moments. On fine day they will just take your money and you will have nothing to do.

First I just tried their deposit system with only $20, usdt (bep20). I liked the platform and now using it for my everyday trading, made a bigger depo, it’sgoing fine 🙂

OlympTrade is a game-changer! I’ve learned so much and managed to grow my trading skills with their excellent features

I’ve had an excellent experience with Olymp Trade! The platform is intuitive and easy to navigate, making it perfect for both beginners and experienced traders. The variety of tools, like customizable charts, technical indicators, and trading signals, really help to make informed decisions.

One of the standout features is their demo account, which allowed me to practice and build confidence before trading with real funds. Deposits and withdrawals are smooth and hassle-free, which is a big plus for me.

Their educational resources, including webinars and tutorials, are top-notch and really helped me sharpen my trading skills. On top of that, the customer support team is responsive and always ready to assist with any issues.

Overall, Olymp Trade is a reliable and supportive platform that has made my trading journey both enjoyable and rewarding. Highly recommend to anyone looking to get started or take their trading to the next level! 🚀📈

Easy to get the hang of, and I’ve withdrawn a few times without any issues. I’ve been using Olymp Trade for a while. Nothing crazy to say, deposits and withdrawals have worked fine for me, and the platform’s easy to use. Does the job.

Olymptrade has truly transformed my trading journey in ways I never anticipated! I have found it to be an invaluable platform, and I highly recommend it to others who are looking to improve their trading experience.

I love the simplicity of Olymptrade. The interface is so clean, and the customer support is always available to help. It’s a perfect platform for beginners and experienced traders alike.