Moomoo Review 2026

Awards

- Best Trading Platform 2022 - Fintech Breakthrough

- Best Active Trading App 2021 - Investing Simple

- Best Trading Technology 2021 - Benzinga

- Best Online Stock Brokers 2021 - Benzinga

Pros

- It is reassuring that Moomoo holds licenses with the US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS), among others

- The ‘Moomoo Token’ generates dynamic passwords for transaction security - a unique and helpful safety feature

- There are reduced options contract fees from $0.65 to $0

Cons

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

Moomoo Review

In this Moomoo review, I’ll unpack my first-hand experience and assessment of the broker, including its trading fees and platform. During my tests, I’ve compared the brand to some similar alternatives, while considering the key pros and cons for prospective clients.

Since Moomoo primarily offers US and Hong Kong stocks, there are a few factors that I like to take into account when reviewing brands like this:

- Can I trust this broker and will my funds be safe?

- Can I access a decent range of global stocks with competitive conditions?

- Are entry requirements low compared to alternatives?

- Is the platform easy to use with relevant stock trading tools?

- Are there sufficient resources available at Moomoo so I don’t have to look elsewhere?

Accounts

I’ve had the chance to explore Moomoo’s single account, the Individual Margin Account, and was pleased that there’s no minimum deposit requirement for me to get started.

The account provides access to US and international investments, including options and ETFs. It’s also good to see that there are zero commissions and platform fees, and I’m impressed that you get free access to Level 2 market data.

What I’d Like To See

I’m a little disappointed that the broker doesn’t offer any savings or retirement accounts, nor any investment portfolios or robo-advisory features. I think introducing these as part of the account offering would align Moomoo with top competitors like Webull or E*Trade.

How To Open A Live Account

When signing up, I was given the option to register using my email address or phone number, which I found very convenient.

To get started, head to the ‘Open Account’ button on the website and then:

- Select your country of residence

- Enter your personal details including name, birth date and address

- Complete your employment status and income information

- Submit your registration form. Applications are generally processed on the same day

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | $0 | $100 | $10 |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Fees & Costs

I’m pleased to see that there are no account opening fees, maintenance charges, or inactivity fees, meaning traders can calculate profits on a per-trade basis.

My tests have found that stocks, ETFs, and options trading at Moomoo are commission-free for US residents. However, there are 0.03% commissions on Hong Kong and A-Share stocks, plus platform fees.

I’ve compared some notable fees below with popular alternatives, Webull and eToro US. These comparable brokers are carefully selected by our experts based on the products offered and their fee structure.

| Moomoo | Webull | eToro US | |

|---|---|---|---|

| Options Contract Fee | $0 | $0.55 | $0.65 |

| Annual Margin Rate | 6.8% | 9.74% | 8.33% |

| US Stock/ETF Commission | $0 | $0 | $0 |

Overall, I think Moomoo is a pretty low-cost broker for US stocks and options.

That said, I do want to point out that there are also numerous other industry-standard transaction fees and regulatory charges to consider. I’ve detailed some of these in the sections below.

US Stocks & ETFs Fees

As I expected, regulatory charges are applicable, for example, the US Securities and Exchange Commission (SEC) charges a small fee for stock sell orders (0.000008 x transaction amount at the time of writing).

Other charges I found include Trading Activity Fees (TAF) of $0.000145 per share, with a minimum $0.01 trade, plus an ADR custodian fee of $0.01~0.05 per share.

US Options Fees

Options have no contract fee, which is a serious saving for active traders. As a comparison, brokers like Fidelity charge $0.65 per contract.

There is also an SEC fee at 0.000008 x transaction amount with a minimum $0.01 trade, plus a TAF of $0.00244 per contract.

Traders can also expect an Options Regulatory Fee (ORF) of $0.02905 per contract, as well as an Options Clearing Corp (OCC) fee of $0.02 per contract.

Hong Kong & A-Share Stocks

For Hong Kong stocks and China A-shares, there are some commissions and other transaction fees which are in line with other brokers I have reviewed, including Interactive Investor.

Trading commissions are charged at 0.03% or 3 HKD/3 CNH (whichever is higher).

There is also a 15 HKD/15 CNH per order platform fee and various regulatory charges including stamp duty, trading tariffs, and exchange settlement fees as follows:

- Trading tariff – HK$0.50 per transaction

- Stamp duty – 0.13% x transaction amount

- Settlement fee – 0.002% x transaction amount

- SFC transaction levy – 0.0027% x transaction amount

- FRC transaction levy – 000015% x transaction amount

- Exchange trading fee – 0.00565% x transaction amount

Margin Rates

Webull charges a 6.8% long margin interest for US and HK stocks, and 8.8% for China A-Shares. Short margin rates depend on the stocks and you can refer to the individual daily statements within your platform.

Overall, I think these rates are fairly competitive. Webull, for example, charges 9.74% for US stocks.

Assets & Markets

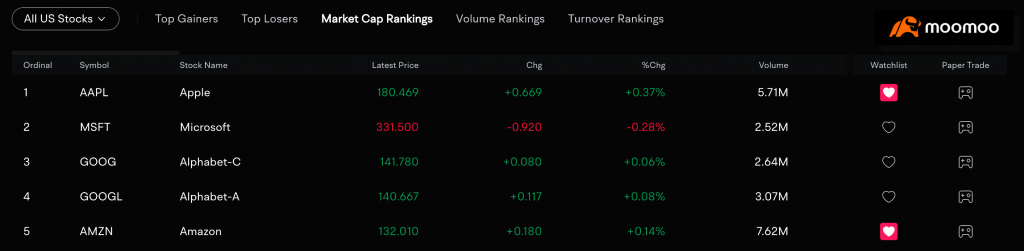

My tests turned up good results in terms of stock market availability. Moomoo offers over 5,000 shares and ETFs, which I think is highly competitive when compared with top brands like Bestinvest (3,000) and Nutmeg (1,800).

Stocks from the following markets are available:

- China – A-shares via the Hong Kong Exchange

- Hong Kong – Stocks and ETFs via the Hong Kong Exchange

- US – Stocks, options, ETFs, ADRs, OTC, and US IPOs via the NASDAQ, NYSE and Chicago Mercantile Exchange

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Instruments | Stocks, Options, ETFs, ADRs, OTCs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Deposits & Withdrawals

Deposits

Moomoo doesn’t have a minimum deposit requirement, which is ideal for new traders. I also like that you can access 4 account funding currencies depending on your jurisdiction: USD, HKD, SGD and CNH.

Similar to other stock trading brands I’ve reviewed, account funding can be done via Automated Clearing House (ACH) or bank wire transfers.

- Automated Clearing House (ACH) Transfer – US bank accounts only, no deposit fee, 5 business days settlement, maximum deposit $5,000 per transaction

- Domestic Bank Wire Transfer – $10 fee plus bank charges (no more than $50 estimated), 1-3 business days settlement

- International Bank Wire Transfer – $10 fee plus bank charges (no more than $70 estimated), 1-3 business days settlement

Instant buying power is also available interest-free on US stocks and IPOs. This essentially provides every trader with a $1,000 limit, which can be increased to $2,000 if there are adequate assets in your account. Instant buying power is available as soon as your deposit clears or within 7 days of the initial grant.

Withdrawals

Moomoo doesn’t charge a withdrawal fee for ACH transfers, however, domestic bank wires do incur a $20 fee, whilst international bank wires cost $25. I find these rates are similar to brands like Webull, though not as cheap as eToro US which only charges $5 for withdrawals.

The maximum withdrawal amount is $10,000, however, I did find that traders can initiate several transactions.

Average processing times are up to 5 business days, which is industry standard. Finally, it’s worth noting that withdrawals via bank wire transfer are only available in USD.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Payment Methods | ACH Transfer, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Debit Card, PayPal, Wire Transfer |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Platforms & Tools

Moomoo offers a proprietary trading platform which is available for download on Windows and Mac PCs. One major downside for me is that there’s no web browser compatibility which we commonly see offered at other brokers.

With that said, I do like the powerful features available within the platform, which I think will serve both new and experienced traders.

Design & Usability

I’m impressed with the customizability of Moomoo’s platform. I can easily change the design layout of the interface, displaying up to 6 charts simultaneously.

The design of the platform is also very modern, clean and feels enjoyable to use. The interface is easy to navigate and I’m able to access all the key functions directly from the main window.

Charting Tools

The range of analysis tools is excellent. I could access 63+ technical indicators and 38 drawing tools, which I think easily compares with top third-party platforms.

There’s also an impressive total of 190+ pre-set functions for customization, plus an intuitive auto-suggestion function for seamless asset searching.

Trade Orders

Moomoo offers all the usual order types you’d expect to see:

- Limit

- Market

- Auction

Plus, I was pleased to see advanced order types which can support more flexible triggers:

- Stop

- Stop Limit

- Market if Touched

- Limit if Touched

- Trailing Stop

- Trailing Stop Limit

Stock Analysis

Moomoo’s library of stock analysis features is particularly impressive. The platform is packed with analysis tools and financials, including sentiment indicators, institutional data and balance sheets.

I particularly appreciate the customizable stock screener, which allows me to filter through thousands of stocks using 100+ indicators.

What I’d Like To See

Moomoo’s platform offering could be improved by integrating some easily accessible analysis and educational tools into the interface. I would suggest an economic calendar, plus some platform tutorials and stock trading webinars for those who need a little more on-the-spot guidance.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| MetaTrader 4 | No | No | No |

| MetaTrader 5 | No | No | No |

| cTrader | No | No | No |

| TradingView | No | Yes | No |

| Auto Trading | Capitalise.ai, TWS API | No | |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Mobile App

MooMoo’s mobile app platform is available for free download to iOS and Android devices from the relevant app store. Alternatively, I like that there are QR codes on the broker’s website for easy download. I think it’s also good to see that the app is available in English or Chinese language.

The app has been optimized well and offers many of the same tools available in the desktop app. Traders can access real-time charts and full trading history.

Additionally, it provides access to all analytical functions, including economic data releases and earnings calls, so I was able to review investments whilst on the go.

Other notable features include:

- 100+ advanced indicators and charting tools

- Open up to 6 customizable charts simultaneously

- Detailed company insights and institutional tracking

- 24/7 financial news from Bloomberg, Dow Jones and more

- Instant in-app currency exchange for Hong Kong stock trading

Regulation & Trust

During testing, I had the chance to examine Moomoo’s regulatory status from all of its websites. I’m pleased to confirm that Moomoo is a tightly regulated broker-dealer, authorised in several major jurisdictions.

Moomoo Financial Inc. is regulated and authorized by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These are highly reputable regulatory bodies which enforce strict client protection rules.

Moomoo is also a member of the Securities Investor Protection Corporation (SIPC), with up to $500,000 in compensation available for clients in the case of financial failure.

In Singapore, Futu Singapore Pte Ltd, the Moomoo subsidiary, is a registered capital markets license holder with the Monetary Authority of Singapore (MAS). Moomoo’s parent company Futu Holdings Limited is also listed on the NASDAQ stock exchange, providing additional credibility.

Additionally, Futu Securities International (Hong Kong) Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong, whilst Futu Securities (Australia) Ltd is regulated by the Australian Securities and Investments Commission (ASIC).

It’s reassuring to see that the broker segregates client funds from the company’s operating capital.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Regulator | SEC, FINRA, MAS, ASIC, SFC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Segregated Accounts | Yes | Yes | Yes |

| Negative Balance Protection | No | Yes | No |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Moomoo Leverage

My tests have found that margin trading is available on US stocks up to a maximum of 1:2. However, if your net assets are less than $2,500, this option may not be available. The annual margin rate (i.e. interest on borrowed funds) is a flat rate of 6.8%.

I do want to stress that margin trading is a risky strategy. Traders can lose more than their initial deposit, so I urge beginners in particular to consider if this is right for you before trading.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Leverage | 1:2 | 1:50 | |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Demo Account

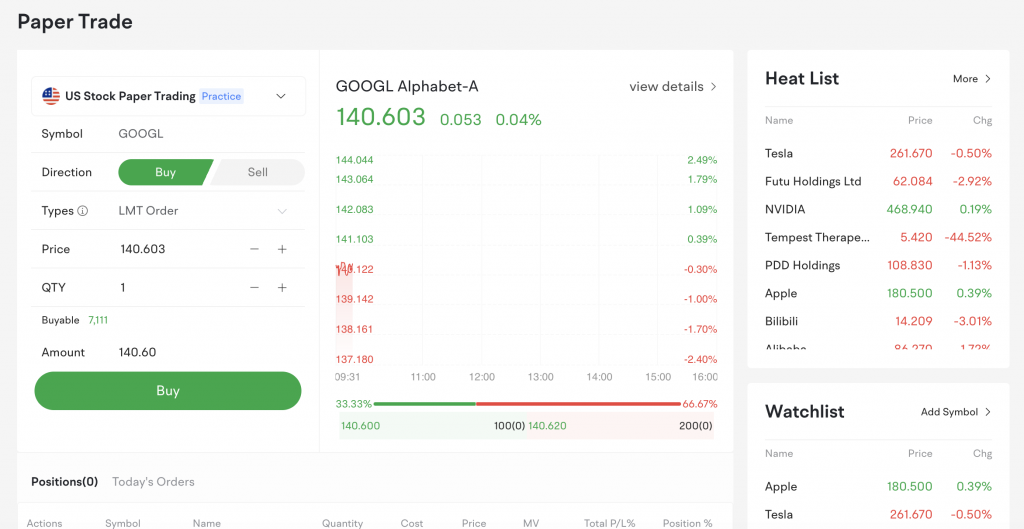

It’s good to see that Moomoo offers a free demo account across all instruments. Also known as ‘paper trading accounts’, demo solutions are a good way to familiarize yourself with the platform features and test strategies risk-free.

I’m impressed that the demo account comes with up to $1 million in virtual funds to trade stocks and options, and up to $10,000,000 to trade futures.

With that said, I have found that the demo mode is somewhat quite different to the real trading environment. You don’t get access to the real desktop platform but instead a simulated browser version with no technical analysis features.

In addition, I have found that pre-market and after-hours trading is not permitted via the demo account.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Demo Account | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

| Review | Review | Review | Review |

Bonuses & Promotions

My tests have found some decent promotions at Moomoo, depending on your jurisdiction. For example, US residents can access a sign-up promotion with up to 15 free stocks plus 1 extra share of a popular company like Tesla or Google. Each stock is valued between $2 and $2,000.

Note that the number of free stocks you receive will depend on how much you can deposit. Depositing $100 will get you 5 free stocks, whilst depositing $1,000 will get you 15. A $5,000 deposit will earn you 15 free stocks as well as an additional free share from a major firm.

The broker also offers the occasional referral and cash reward bonus.

Research

Market Analysis

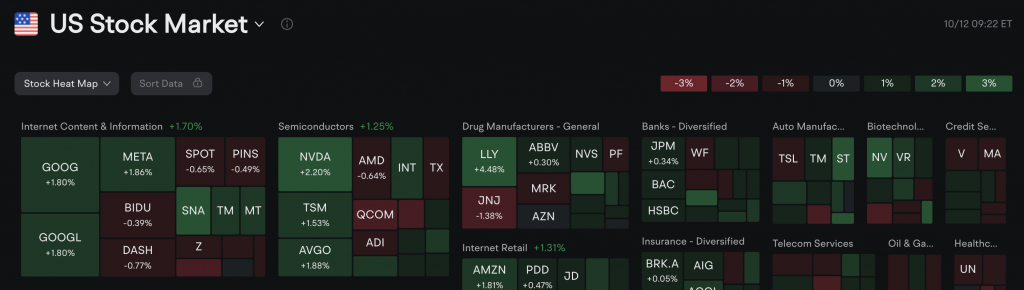

I think Moomoo’s Market Analysis section contains an excellent range of research tools. For example, you can access live global financial news 24/7 from top-tier sources like Bloomberg, as well as stock price fluctuation updates.

There are also earnings and financial calendars, a heat map, a stock screener tool with 100+ indicators, and an institutional tracker which allows me to view the performance of top firms.

I particularly like the ‘Sparks’ section, which tracks the performance of emerging, or topical dynamic industries like nuclear power, Metaverse and weight loss drugs.

What I’d Like To See

A minor change I think Moomoo could make is to implement a search function and a categorized breakdown of articles. This would refine the somewhat haphazard current setup and make it easier to navigate for those looking for specific resources.

Education

Moomoo Community

One of my favourite features at Moomoo is the global investment community which has more than 200,000 users worldwide. I like that you can share trading insights with community members and participate in discussions on the user-friendly social feed.

Learning Centre

I’m also impressed with Moomoo’s educational resources. The ‘Learn’ section features a comprehensive selection of investment courses with detailed articles, webinars and tutorial videos.

There’s also a Library which is helpfully categorized into broad topics including stocks, fundamental analysis and options.

Customer Support

However, I’m a little disappointed with Moomoo’s customer support. The broker is only available from 8:30 am to 4.30 pm ET which I don’t think is really sufficient for clients. Most competitors offer support 24/5 at least, with some even offering 24/7 help.

You can access support through the following channels:

- Email – support@moomoo.com

- Social media – Twitter and Facebook

- Address – 720 University Avenue, Suite 100, Palo Alto, CA 94301, USA

The lack of a live chat feature and telephone number is another major drawback compared to most other brokers.

Security & Safety

I’m pleased to see that the Moomoo trading platform assures encryption features and industry-standard data privacy.

However, I did note that there is only a one-step login for mobile and desktop platform access. Biometric or 2 step-login authentications would be more secure given the broker prides itself on its technology.

Despite this, I am a fan of the ‘Moomoo Token’ which can be enabled to provide an additional layer of security. It’s essentially a separate application that provides dynamic password verification, creating a new 6-digit code every 30 seconds for monetary transfers.

Company Background

Moomoo Inc. is a subsidiary of Futu Holdings Ltd and was established in March 2018.

The broker’s mission is to provide users with an intuitive and powerful investment platform backed by innovative technology. Extended trading hours and welcome bonuses have also made the firm popular with aspiring traders.

Primarily aimed at US and Chinese investors, Moomoo is regulated and authorized by several reputable agencies including the SEC, MAS and ASIC. Moomoo is also a member of the SIPC, which protects US customer funds up to $500,000.

Moomoo’s parent company, Futu, is backed by notable investors, including Tencent, Matrix, and Sequoia.

Trading Hours

Moomoo follows standard Monday-to-Friday trading hours, however, these timings may vary by instrument. I also found that pre- and after-market trading hours are available on some assets.

The following times apply to US assets:

- Pre-market hours – 4:00 am to 9:30 am (EST)

- Regular hours – 9:30 am to 4:00 pm (EST)

- After-market hours – 4:00 pm to 8:00 pm (EST)

Should You Trade With Moomoo?

I think Moomoo is a reliable, easy-to-use proprietary terminal suitable for new or experienced investors. There is no minimum deposit, making it ideal for those with lower capital requirements. A demo account is provided and sophisticated analysis tools are available.

However, the product portfolio is fairly limited for those looking to diversify outside of equities and I would like to see more customer service options. Overall, though, Moomoo is a strong contender, particularly for US investors.

FAQ

Is Moomoo A Legit Broker?

Yes, Moomoo is regulated by a credible authority – the SEC and offers a secure and reputable trading platform. Investor protection is offered by SIPC, up to a maximum of $500,000, including a $250,000 limit for cash in the case of business insolvency.

Is Moomoo Regulated?

Yes, Moomoo is regulated and authorized by the US SEC and authorized by the FINRA. In Singapore, the online brokerage is regulated by the MAS, whilst in Hong Kong and Australia, the firm is regulated by the SFC and ASIC, respectively.

Does Moomoo Charge Trading Commissions?

My tests have found that Moomoo offers US stocks with zero commissions. Regulatory charges are applied, but these are not broker-specific. International stocks do come with commissions. For example, Hong Kong stocks incur a commission of 0.03%/3 HKD/3 CNH (whichever is higher).

What Is The Moomoo Buying Power?

Moomoo provides instant interest-free ‘buying power’ up to $1,000 whilst account funding is settling. This is cleared after 7 days or after a deposit settles as withdrawable cash.

Can I Open A Moomoo Trading Account In The UK?

Moomoo trading accounts are currently targeted towards US residents and are unavailable to UK clients. This is similar to TD Ameritrade, which offers no trading options to UK or EU residents.

Moomoo Vs Futu, What Is The Difference?

Moomoo Inc. is a subsidiary of Futu Holdings Ltd, founded in March 2018. Futu is the parent company with global trading operations.

Best Alternatives to Moomoo

Compare Moomoo with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

Moomoo Comparison Table

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Rating | 4.3 | 4.3 | 3.4 |

| Markets | Stocks, Options, ETFs, ADRs, OTCs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | $0 | $100 | $10 |

| Regulators | SEC, FINRA, MAS, ASIC, SFC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | Get up to 15 free stocks worth up to $2000 | – | Invest $100 and get $10 |

| Platforms | Desktop Platform, Mobile App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader |

| Leverage | 1:2 | 1:50 | – |

| Payment Methods | 2 | 6 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

eToro USA Review |

Compare Trading Instruments

Compare the markets and instruments offered by Moomoo and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Moomoo | Interactive Brokers | eToro USA | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Moomoo vs Other Brokers

Compare Moomoo with any other broker by selecting the other broker below.

The most popular Moomoo comparisons:

- Moomoo vs SoFi Invest

- Stake vs Moomoo

- Crypto.com vs Moomoo

- Moomoo vs Interactive Brokers

- CMC Markets vs Moomoo

- Moomoo vs Binance

- NinjaTrader vs Moomoo

- Webull vs Moomoo

- Robinhood vs Moomoo

- Saxo Bank vs Moomoo

- Moomoo vs eToro

- Moomoo vs Futu

- Tiger Brokers vs Moomoo

- Moomoo vs Vanguard

- Moomoo vs M1 Finance

- Moomoo vs Fidelity

Customer Reviews

3.3 / 5This average customer rating is based on 3 Moomoo customer reviews submitted by our visitors.

If you have traded with Moomoo we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Moomoo

Article Sources

- Moomoo Website

- Moomoo Financial Inc - SEC License

- Moomoo Financial Inc - FINRA Registration

- Futu Securities (Australia) Limited - ASIC License

- Moomoo Financial Singapore Pte Ltd - MAS License

- Futu Securities International (Hong Kong) Limited - SFC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Moomoo is good if you don’t mind day trading with a Chinese owned firm. I don’t care but some might. It’s got a much better app and platform than a load of the old discounters and big names like Schwab. What I actually like about it is the trading community. Obviously there’s some rubbish and people shilling stocks but there’s some interesting traders on there too.

Moomoo is good if you want to trade stocks commission-free on an easy to use platform. But its investment offering is pretty limited – I have to go elsewhere to trade forex.

Moomoo is one of the better stock trading apps I’ve used. The fees are low and there are thousands of US and Chinese shares. Some more guides to using the platform would be helpful though. Customer support could also be better.