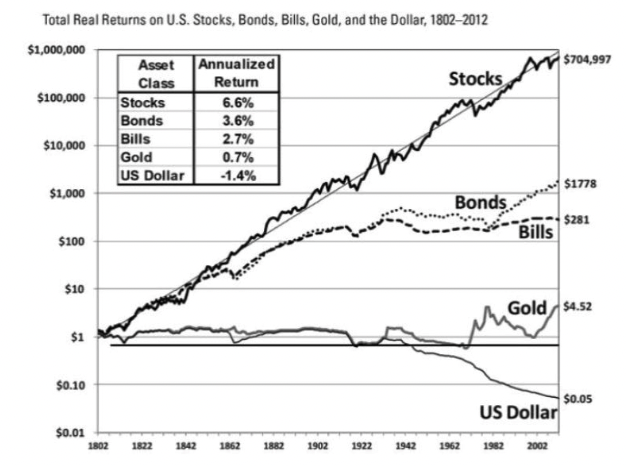

What Are the Long-Term Returns of Asset Classes?

In the US, from 1802-2012, the real (inflation-adjusted) returns of stocks have been between 6 and 7 percent.

Bonds have returned between 3 and 4 percent.

Bills – which are safe government bond securities and have a duration of less than one year – have a return between 2 and 3 percent. Some might also call this cash.

Gold is between 0 and 1 percent. (All of these percentages hold true even though the last decade-plus of returns are missing from the below graph.)

Takeaways

This illustrates a few things:

Stocks > bonds > cash

Over enough time, stocks can be expected to outperform bonds and cash.

Risk premiums

Stocks will outperform bonds, and bonds will outperform cash and by the appropriate risk premiums.

Stocks return about 3 percent better than bonds, and bonds return about a percent better than cash over the long term.

Gold in a portfolio

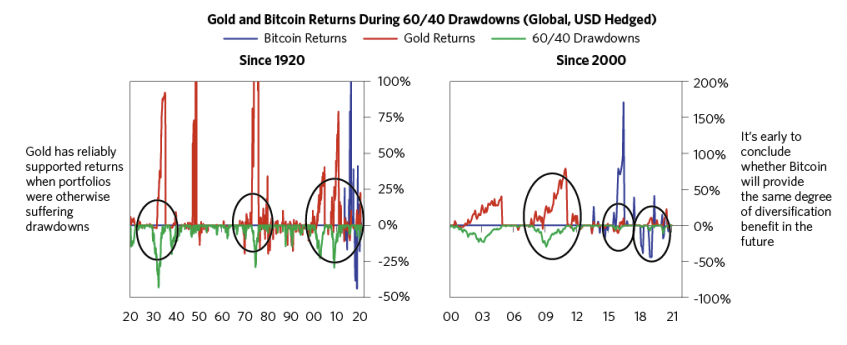

Gold has large swings in price as a long-duration asset, but is a type of currency alternative that can serve as a store of value over time.

It’s not the best investment but it essentially functions as an alternative form of cash.

Gold also does a reasonable job of offsetting falls in financial wealth over time. Other proposed stores of value like bitcoin haven’t shown the same effects.

It is like an inverse money type of asset, meaning its price is simply reflective of the value of the currency used to buy it.

Other currency alternatives

It is not the only currency alternative. Commodities can fulfill a similar role.

Owning assets denominated in other national currencies can also provide geographic and currency diversification.

These returns show how things have transpired through most of the US’s history.

But now, 96 percent of the world’s population and 80 percent of the world’s output now comes from outside the United States.

This means to only own US assets (which is a typical American’s portfolio) would be to miss out on the growth, output, and diversification potential that can be found elsewhere.

History has shown that one cannot just sit on a business that looks good today. The world is always changing and evolving. What’s considered a good business today may not be a good business in 20-30 years.

If we look at the makeup of the Dow Jones Industrial Average (DJIA) or the top companies by market cap each decade, we can see how fast things change.

The top companies today will be challenged by new ones and entirely different types of companies will come up to supplant them.

Related: Emerging Technology Trends & the Next Generation of New Markets

Conclusion

The long-term returns of asset classes can vary, but over time, stocks have outperformed bonds and cash.

Gold has also served as a store of value (i.e., its return have offset inflation), even if its returns have been lower.

Other currency alternatives include commodities and assets denominated in other national currencies. It is also important to diversify one’s portfolio to take advantage of growth potential outside the United States or developed markets more broadly.