Investopedia Review 2025

Investopedia is a financial website that provides information on investment products and vehicles, reviews of brokers and trading accounts, dictionaries of key terms, and more. The New York-headquartered information hub is aimed at both beginner traders and experienced investors.

But how does Investopedia make money, and what are the pros and cons of using its information to support trading decisions? In this review of Investopedia, we explain how the financial site works, its history, plus leading alternatives.

For glossaries, news, demo accounts, and beginner-friendly education:

What Is Investopedia?

Investopedia is an online information base and publication that provides articles and services around finance, investments, and trading. It was formed in 1999 by university graduates Cory Janssen and Cory Wagner with the aim of making financial decisions and concepts easier to digest, giving people more control over their personal finances.

The founders of Investopedia sold the brand to Forbes Publishing in 2007. Their parent company was previously Dotdash, but in 2021 they acquired Meredith to become Dotdash Meridith, which is currently the top digital print company in the USA.

The content published on Investopedia is done so by a team of experienced financial writers but is not supposed to advise in the places of licensed attorneys, accountants, advisors, or other financial professionals.

The information hub has also been featured in the press by several publications including NBC News and CNBC.

How Investopedia Works

Investopedia began as an online encyclopedia that gave definitions of financial terms, but since then it has grown to be a source of various financial information as well as offering a free stock or forex simulator and a training academy.

Investopedia routinely publishes articles on a range of topics, with more than 30,000 posts on display. These articles are broken down into categories such as education, news, and money management. All articles can be read for free.

The training academy and courses cost money, as opposed to the articles, and this is partly how the website funds the free elements of its site.

Services & Products

Simulator

One service offered by Investopedia is the free stock market simulator. Much like demo accounts, the paper trading profile allows users to practice stock trading with virtual money (up to $100,000).

The simulator allows users to trade stocks, ETFs, and options. In total, there are more than 6,000 equities on the NYSE and Nasdaq exchanges.

Traders can also join a game with other investors and create some competition for who can achieve the best results.

However, we would recommend starting with one of the best demo accounts in 2026. This will give you better insights into what trading with a real-money broker is like, getting you familiar with a brand’s platforms, tools and trading conditions. You can then upgrade to a live account when you feel ready.

Best Demo Accounts

Money Management

Investopedia’s money management articles are divided into personal finance and reviews & ratings of popular brokers and accounts.

The personal finance section encompasses aspects of how individuals can manage their own money, such as taxes, wealth management, budgeting and saving, banking, credit cards, home ownership, retirement planning, and insurance.

The reviews and ratings section focuses on reviewing different aspects of personal finance and trading opportunities. This includes compiled lists of online brokers, savings accounts, home warranties, credit cards, personal loans, student loans, life insurance, and auto insurance.

On the downside, Investopedia has a smaller pool of broker reviews than other providers, which may affect those that feature in top lists. Our ranking of the best brokers in 2026 considers hundreds of brokerages and trading accounts.

Top Brokers

Academy

Academy is the section of Investopedia that requires users to pay money. It offers a set of training courses that help with investing and training, on topics from day trading to futures and personal finance advice.

Courses include Investing for Beginners, Becoming a Day Trading, Trading for Beginners, and Technical Analysis. Each course features quizzes and exams.

Users can navigate the website based on the kind of course they want to do (trading courses, investing courses, and financial professional courses), or they can browse all courses at once.

But while some of the trading courses are insightful, there are a few other providers that have particularly helpful courses, especially for beginners:

Best Trading Courses

Education

The education section is broken down into two categories: general and investing/trading.

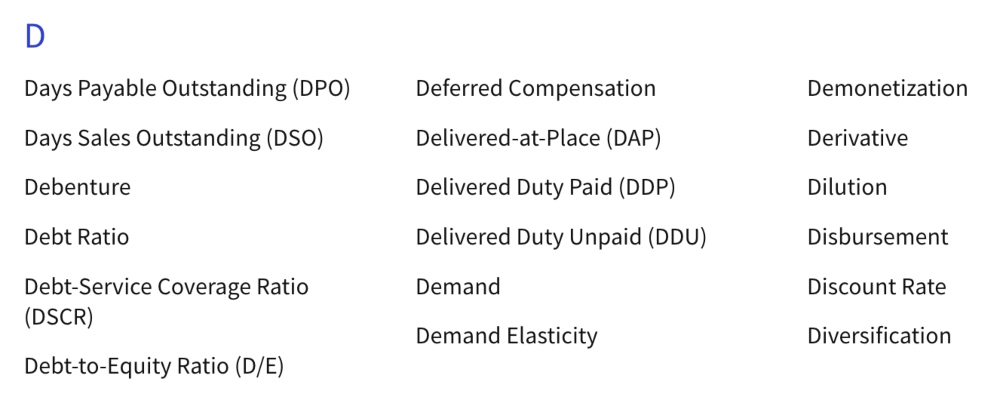

In the general section, you will find basic financial information that provides a foundation for learning more about the specific aspects of investing and trading. This includes a glossary and information on stocks, mutual funds, ETFs, economics, corporate finance, Roth IRA, and 401ks.

The second section goes over the education you need for online trading, including technical analysis, risk management, fundamental analysis, and portfolio management.

It’s worth noting, however, that some of the educational articles are short and relatively narrow in scope. They do not go into the depth and detail some beginners will need to fully understand a topic.

News

The news page is centered around different categories of financial news.

There are various subsections so that users can discern between the pages, including company news, market news, crypto news, personal finance, economic news, and government news.

Advisors

The advisors section is aimed at finance professionals who are managing their own practices, giving advice and tips on starting a firm, hiring employees, facing ethical issues and more.

There is also a section on financial career advice as well as financial planning and portfolio construction.

How Investopedia Makes Money

The majority of Investopedia’s money is made from advertising. Due to the high volume of published content, the site gets a lot of traffic and therefore its ad space receives a lot of views.

Since 2017 Investopedia has also been diversifying its earnings with the launch of its Academy service, growing the department, and adding courses most of which cost $199.

The income from subscriptions allows Investopedia to keep all of its other content free.

Pros

- Breadth of information – Investopedia has a large database of financial information, covering a range of topics for traders, investors and finance professionals.

- Cost – Aside from the training courses, all of the content on Investopedia is free.

- Clear information – Most articles are clear and concise.

Cons

- Poor support reviews – online reviews for the customer support service are mixed, with many users saying that they found it difficult to get in touch when facing a problem with a training course, for example.

- Simulator issues – user reviews also state that the stock simulator does not account for stock splits, and that traders were having trouble getting the issue fixed.

- Bank of broker reviews – the financial website has not reviewed and rated as many online brokers and platforms as other providers, giving prospective traders less choice.

- Breadth over depth – Investopedia offers a range of succinct information, but doesn’t necessarily specialize in specific trading styles, such as day trading. As a result, it is not comprehensive in some areas.

- Location – Investopedia’s training courses are not available in all locations. As a result, many budding investors will be unable to enrol.

Is Investopedia Reliable & Trustworthy?

Investopedia has several tools and processes that add credibility to its content:

- Financial Review Board – Investopedia has a review board made up of market participants to bring credibility to its content. The board reads the content and reviews the sources to reduce the likelihood that false information is published.

- Corrections – Human error can happen in any publication, and Investopedia notes when incorrect information has been published.

Investopedia Verdict

Investopedia provides some useful information for traders and finance professionals on a relatively easy-to-navigate website. However, aspiring traders should be aware when spending money on the academy that some users have encountered issues with poor customer support. The bank of brokers is also limited vs other providers.

Use our table of top brokers for in-depth reviews and ratings. Alternatively, beginners can start with the brokers with the best educational materials.

FAQs

What Is Investopedia?

Investopedia is an online information base with articles about finance, trading, and investing. Alongside free news posts and educational content, users can sign up for training courses. But head to our full review of Investopedia for leading alternatives.

Does Investopedia Cost Money?

The majority of the content on the education platform is free, including published articles and the trading simulator. The courses, on the other hand, come at a fee (typically around $199).

How Does Investopedia Make Money?

Investopedia makes most of its money from advertising. However, in recent years the company has diversified and placed more of a focus on making money from courses.

Does Investopedia Have Free Courses?

Yes, there are some free courses on offer with Investopedia Academy, but most of them require the user to pay upwards of $199.

Note, the courses are not available in all locations.

Who Is The CEO Of Investopedia?

Investopedia is currently run by the online publisher Dotdash Meredith, and the current CEO is Neil Vogel. Its headquarters are in New York.