Fusion Markets Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Aus Broker Runner Up 2025 - DayTrading.com

Pros

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

Fusion Markets Review

In this review of Fusion Markets, we evaluate the broker in all the areas prospective traders should consider before opening an account. We share our key findings following our hands-on tests and many hours using the platforms and tools.

Regulation & Trust

Fusion Markets is a trusted broker with oversight from a top-tier regulator; the Australian Securities and Investments Commission (ASIC).

This means the broker must follow measures to protect retail investors in Australia, including providing negative balance protection, which ensures you can’t lose more than your balance while trading leveraged products like CFDs.

The company also segregates client money in accounts with respected financial institutions like HSBC and National Australia Bank, preventing the broker from using traders’ money for overheads and other purposes.

On the downside, Fusion Markets operates with limited regulatory oversight outside of Australia. It is registered with the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority of Seychelles (FSA). Both are weak regulators.

This means global traders won’t receive the same protections afforded to clients who trade with the ASIC-regulated entity. Notably, negative balance protection is not provided. Also, investor protection is not available to any clients in the event the broker becomes insolvent.

To improve its trust rating, I would like to see Fusion pursue licenses from other respected regulators and provide negative balance protection to all retail traders.

Accounts & Banking

Fusion Markets offers two live accounts:

- Classic: Commission-free trading with spreads from 0.9 pips. Best for beginners looking for simple pricing.

- ZERO: Tight spreads from 0.0 with $4.50 commissions. Best for experienced traders looking for the best spreads.

Importantly, both accounts provide access to all instruments and there are no strategy restrictions.

The other bonus is the $0 minimum deposit, making the broker affordable for all types of traders.

There is also a swap-free account for Muslim traders, with 50 instruments and an administrative fee charged for open positions once every seven days.

Serious day traders can also apply for a Pro account and, if they meet the broker’s criteria, will get higher leverage, a dedicated account manager and a queue jump if they need support.

I can’t fault the sign-up process. It took me less than 10 minutes through a simple, user-friendly registration process that comes with an automated client dashboard tour to show newcomers the ropes.

Deposits & Withdrawals

Fusion Markets outshines many rivals with its range of international deposit options including bank cards, cryptocurrencies, local banking and e-wallets.

The 10 deposit currencies, including USD, AUD and EUR, will also suit global traders and should negate many conversion fees.

My biggest complaint is the expensive deposit fee for international wire transfers, which can reach $20 to $30. This is a frustrating charge as many rivals offer all deposits free.

Another negative is that there are fewer withdrawal methods available than deposits, and popular e-wallets Skrill and Neteller are not accepted for withdrawals.

You can compare the payment methods and base currencies with suitable alternatives below.

| Fusion Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Payment Methods | AstroPay, Bitcoin Payments, Credit Card, Debit Card, Doku Wallet, Dragonpay, Ethereum Payments, FasaPay, Interac, JetonCash, Mastercard, Neteller, PayID, PayPal, Perfect Money, Skrill, Sticpay, TransferWise, Visa, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Bonuses

When I opened a Fusion Markets live account I was not offered a welcome bonus. That said, I don’t consider a financial incentive an important factor when deciding which broker to trade with.

Two alternative promotions are, however, available for live account holders:

- Reduced Fees: 5-10% commission reduction for 5 to 10 successful referrals who trade >5 FX lots

- One Off Referral Bonus: $50 reward for a successful referral that deposits $1000 and trades >5 FX lots

Demo Account

Fusion Markets offers a free demo account to practice trading risk-free on each of the broker’s platforms with unlimited virtual funds.

I always make use of demo accounts to test-drive a broker’s services before signing up, and they’re great tools you can use to get to grips with the platform and test new strategies even when you have a live account.

The only thing to keep in mind is that the demo account expires after 30 days.

Assets & Markets

Fusion Markets has an average investment offering that’s redeemed by a huge selection of currency pairs. With over 90 major, minor and exotics, Fusion far exceeds the 55+ currency pairs at Vantage or 50+ currency pairs at AvaTrade.

On the downside, its suite of shares trails both alternatives with exposure to US stocks only.

Outside of forex, you can trade:

- Commodities: 9 metals, 3 energies, and 11 soft commodities such as corn, cocoa, oil, gold, and palladium

- US Stock CFDs: 110+ US company shares including Tesla, Apple and Microsoft

- Indices: 15 stock indices including the NASDAQ 100 and IBEX 35

- Cryptocurrency: 13 cryptos including Bitcoin and Ethereum

Fusion Markets is an excellent option for serious forex traders with more currency pairs than the vast majority of brokers.

However, I would like to see it introduce more stock CFDs, especially shares on the Australian Stock Exchange given its customer base.

Leverage

Fusion offers high leverage up to 1:500, though tighter restrictions apply under the ASIC entity with a maximum of 1:30.

Beginners should approach margin trading with caution. This is especially important for global traders who won’t receive negative balance protection – you can lose more than your deposit.

If this is important to you, we recommend a broker like AvaTrade. Not only do they offer negative balance protection, but AvaProtect provides an additional safety net that can be activated in one click.

Fees & Costs

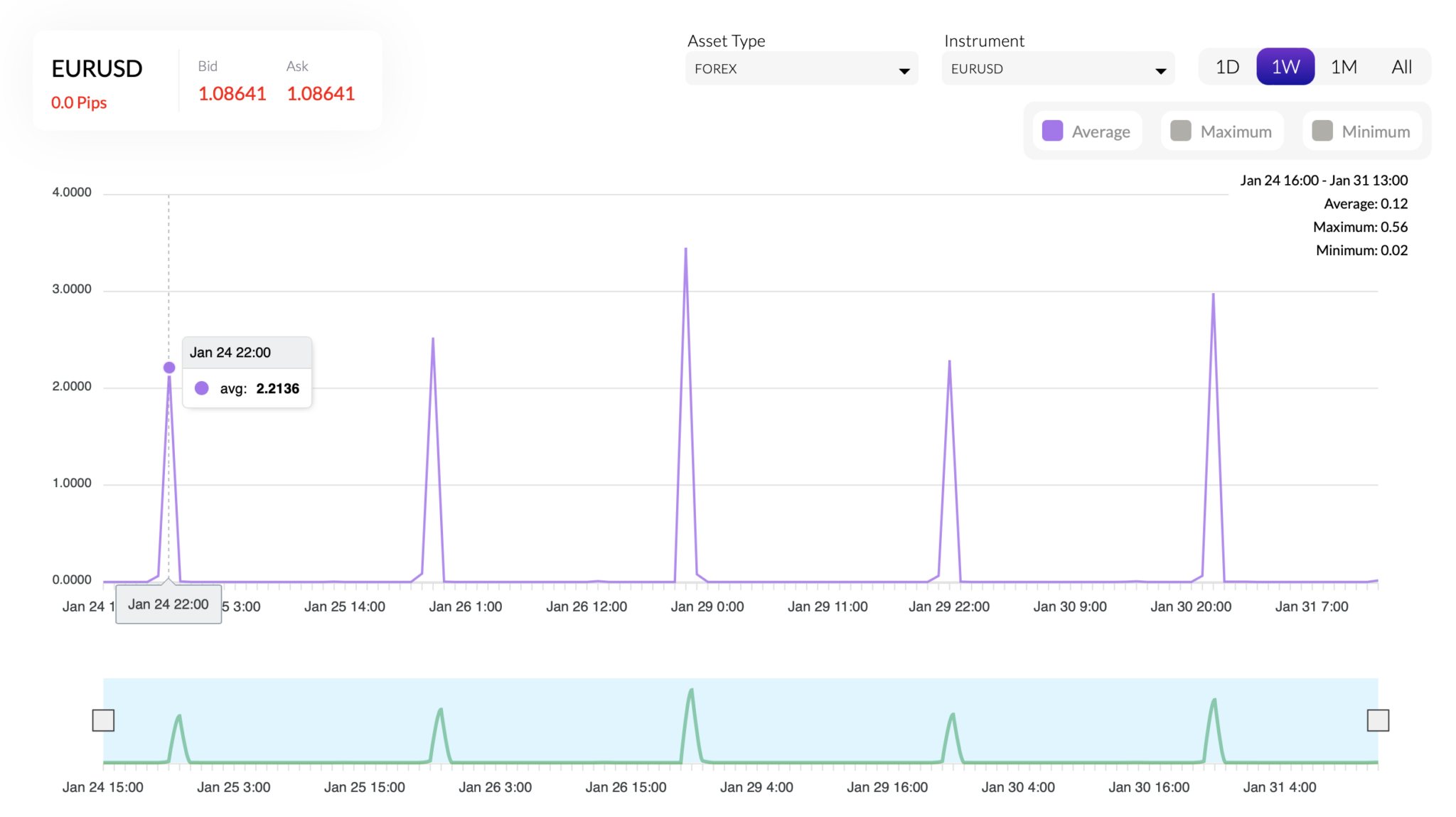

Fusion Markets advertises itself as the ‘#1 lowest cost broker in Australia’, and after testing the platform I can say that the broker might just live up to this promise, depending on what you trade.

Costs vary between account types and products, but they remain competitive throughout and make the brokerage a particularly good destination for Australian forex traders seeking raw spreads.

While using Fusion Markets I got an average spread of 0.05 pips on EUR/USD and 0.08 pips on USD/JPY. Spreads on indices did come in slightly higher, though not considerably more than competitors. This includes a 1-point spread on the FTSE 100 and 0.8 points on the NASDAQ 100.

In the ZERO account, a USD 2.25 (or equivalent in other currencies) commission applies per side, which maintains the broker’s low-cost stance. In comparison, Vantage charges $3.00 in its Raw ECN account while Skilling charges $3.50.

Fusion Markets charges a swap fee on positions held overnight. This is standard practice, and I found the broker’s trading calculators useful for estimating these costs.

There is no inactivity fee to catch out casual investors.

You can see how the trading fees at Fusion Markets compare to suitable alternatives below.

| Fusion Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Cost Rating | |||

| EUR/USD Spread | 0.05 | 0.1 | 0.08-0.20 bps x trade value |

| FTSE Spread | 1.0 | 100 | 0.005% (£1 Min) |

| Oil Spread | 2.0 | 0.1 | 0.25-0.85 |

| Stock Spread | 0.01 | 0.1 | 0.003 |

| Inactivity Fee | $0 | CHF 100 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

Fusion Markets offers four trading platforms: MetaTrader 4, MetaTrader 5, cTrader and TradingView (2024 addition).

Although it’s slightly disappointing there is no proprietary software designed with new traders in mind, the third-party options provide feature-rich trading environments, with customizable interfaces and powerful tools.

From my experience testing all four, the MetaTrader suite is great for traders familiar with the MetaQuotes software and who want access to a vast library of custom indicators, analysis features and algo trading tools.

MT4 was built specifically for forex trading and MT5 for multi-asset trading, though MT5 also boasts a stronger charting package, more order types, and an integrated calendar, amongst other features.

Where cTrader excels is its sleek design which I love. Beyond the cosmetics, the MetaTrader platforms also have more limitations in terms of charting with just three types (bar, line, and candlestick) and 9 timeframes (MT4) or 21 timeframes (MT5), while cTrader has eight chart types, plus 26 timeframes, catering to a range of trading strategies.

Fusion Markets has also enhanced its platform offering by introducing TradingView. This first-rate charting solution offers an intuitive design, however where it stands out is its extensive library of custom tools, notably over 10 million bespoke indicators and more than 8 million custom scripts.

Its social trading network, which now hosts over 50 million users, is also great for finding trading ideas spanning the broker’s full suite of instruments, from equities and currencies to indices and commodities.

Fusion also added capabilities to integrate your trading account directly in the TradingView app in July 2024, creating a comprehensive and seamless mobile experience for active traders.

Mobile App

Again, I was disappointed Fusion doesn’t have its own app, especially when AvaTrade offers a fantastic app that’s got a really slick design and all the tools you need to ensure an enjoyable mobile trading experience.

However, you can access all of the third-party platforms at Fusion Markets on mobile devices using their iOS or Android app iterations. My preference for mobile trading would be MT4 as I find it the most user-friendly on iOS, yet with all the powerful features integrated.

Copy Trading

Fusion Markets offers a native copy trading platform, Fusion+, created for clients who wish to duplicate the positions of more experienced traders in real time. For me, this is a good option for beginners or intermediate traders with limited time.

The service is free as long as you trade at least 2.5 lots of forex or metals per month. When this condition is not met, you’ll need to pay a $10 per month fee to cover Fusion’s hosting costs, though this is still reasonable.

Experienced traders can register to be a Fusion+ Master and earn a performance fee from followers’ profits that may climb as high as 30%.

I found Fusion Markets’ copy trading terminal to work satisfactorily, though it’s not quite up to the standards of best-in-class social trading brokers like eToro; the performance history of master investors is not as readily available and must be requested, making it harder to choose traders to mirror.

DupliTrade, which is also offered to clients, can be integrated directly into your MT4 terminal. I find the intuitive auto-execution software to be a good option for copy trading, providing access to fully audited signal providers while providing traders full control over positions.

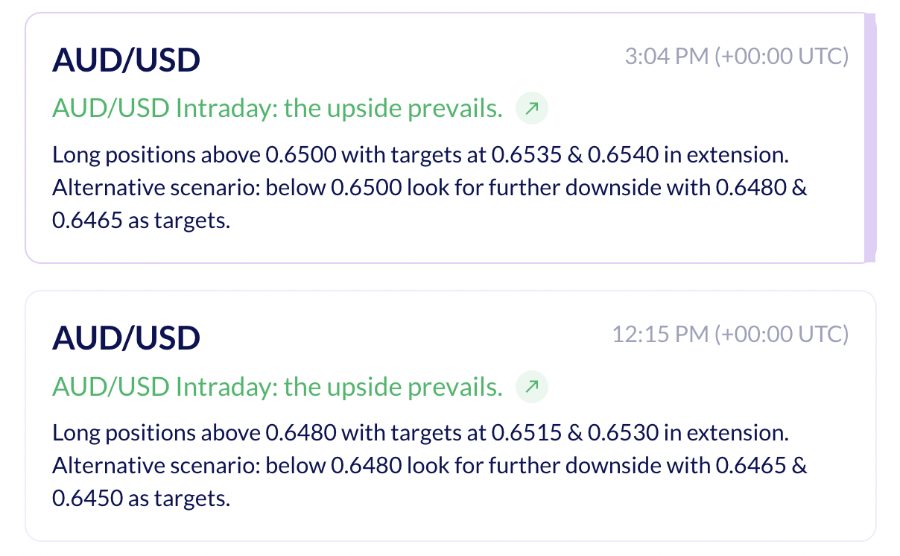

Research

I was generally impressed by the research tools available at Fusion, which can make it easier to find and develop trading ideas.

Tools include an economic calendar and trading calculator, as well as news coverage, quick market roundups and support with technical analysis.

But while these research tools are useful, I find Market Buzz the stand out thanks to its automatic event detection tool and digestible summaries of news announcements and price shifts. This makes it quick and enjoyable to glean key market updates.

On the downside, Fusion Markets doesn’t quite match leaders in the research field because it lacks in-depth market insights and third-party tools apart from bulletins via Trading Central.

In contrast, best-in-class brokers like IG offer IGTV – a super interesting video channel with live videos three times a day with pre-open bulletins, charting analysis, and future insights. It also supports Autochartist, which is excellent for technical summaries.

Education

One area where Fusion Markets really lags behind other brokers is educational content. This won’t be an issue for advanced day traders but for beginners, education is an area where online brokers can really enhance the trading experience.

There are some blogs, which I read, but the topics are a bit hit-and-miss (despite categorization) and there’s no structured learning path. Out of frustration, I actually contacted Fusion Markets to find out if they offer anything else, and they did email some links to useful third-party resources, but not enough to move the dial in this area.

In contrast, category leaders like eToro and IG have dedicated academies with beginner-friendly resources available via articles, videos, webinars, courses and more. Alongside their free demo accounts and low minimum deposits, it’s hard not to find them better options for new traders.

Customer Support

I can’t fault the customer service. I contacted them countless times on live chat and found the team extremely polite and knowledgeable about their accounts and trading products.

It’s also a breath of fresh air to get through to a customer service representative in under two minutes almost every time, and without going through a time-consuming and frustrating chatbot.

You can also reach the team by email (help@fusionmarkets.com) and telephone (+61 3 8376 2706).

The customer support at Fusion Markets is among the best I’ve experienced. Fast, friendly and helpful.

Should You Trade With Fusion Markets?

If you are based in Australia and want to trade forex – Fusion Markets is an excellent choice. There is a huge suite of currency pairs, very low fees (especially with the ZERO account), a choice of leading trading platforms, fast and reliable execution, plus authorization from the ASIC.

For traders elsewhere, a broker with negative balance protection and more robust regulatory oversight could be a safer option.

If you want to trade stocks, especially stocks beyond the US, an alternative will also be better.

FAQ

Is Fusion Markets Legit Or A Scam?

Fusion Markets is a legitimate broker with a good reputation and oversight from a tier-one regulator in Australia.

On the downside, it doesn’t have the track record of the most trusted brokers, as it was only established in 2017.

Can I Trust Fusion Markets?

Fusion Markets can be trusted, especially if you are based in Australia where it’s authorized by the ASIC – a top-tier financial regulator with strong investor protections, including negative balance protection.

Is Fusion Markets A Regulated Broker?

Yes, Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Services Authority of Seychelles (FSA) and the Vanuatu Financial Services Commission (VFSC).

Is Fusion Markets A Good Broker For Day Trading?

Fusion Markets is a great broker for day trading. It has superb charting platforms, fast execution speeds, and very tight spreads in the ZERO account.

Is Fusion Markets Good For Beginners?

Fusion Markets is an average broker for beginners. On the plus side, there is no minimum deposit, a free demo and commission-free trading in the Standard account that keeps pricing straightforward. However, the threadbare educational tools will be a big downside for many aspiring traders.

Does Fusion Markets Offer Low Fees?

Fusion Markets offers low trading fees based on our evaluation. Its spreads on major currency pairs are particularly tight, averaging 0.05 pips on the EUR/USD and 0.02 on the AUD/USD during tests, while its $2.25 commission per side is noticeably lower than many rivals.

Does Fusion Markets Have A Mobile App?

Fusion Markets does not offer a proprietary mobile app, but all its supported platforms have app compatibility; MT4, MT5, cTrader and TradingView.

We’ve used all three applications and they are reliable solutions for mobile traders, excelling for their stability and sophisticated charting tools.

Best Alternatives to Fusion Markets

Compare Fusion Markets with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Fusion Markets Comparison Table

| Fusion Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 4.6 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | ASIC, VFSC, FSA | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | – | 100% Anniversary Bonus | – |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:500 | 1:200 | 1:50 |

| Payment Methods | 20 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Fusion Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Fusion Markets | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | No |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

Fusion Markets vs Other Brokers

Compare Fusion Markets with any other broker by selecting the other broker below.

The most popular Fusion Markets comparisons:

- Fusion Markets vs FP Markets

- Fusion Markets vs MultiBank FX

- Fusion Markets vs Global Prime

- Fusion Markets vs XTB

- Fusion Markets vs Pepperstone

- Fusion Markets vs AvaTrade

- Fusion Markets vs RoboForex

- FXTM vs Fusion Markets

- Fusion Markets vs Exness

- IC Markets vs Fusion Markets

Customer Reviews

3.6 / 5This average customer rating is based on 5 Fusion Markets customer reviews submitted by our visitors.

If you have traded with Fusion Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Fusion Markets

Article Sources

- Fusion Markets Website

- Fusion Markets PTY Ltd - ASIC License

- Fusion Markets International Ltd - FSA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I have traded on and off with Fusion Markets for three years now. I actually tried a coiuple of other CFD brokers but came back because their fees are just the lowest I’ve found. Where else can you get $2.25 commissions. Dont bother with the Classic account if you day trade like me – stick to their Zero account and fire up their cTrader software (much better than their MetaQuotes options).

I’ve traded with four brokers in the last five years and Fusion Markets is by far the best and most importantly, cheapest. $2.25 per side commission – where else can you get that? Also has JPY accounts which is great for me swerving FX fees. I’ve mainly traded derivatives on their cTrader software but they’ve added spot crypto trading so dabbling in that now too.

Fusion markets system froze on ctrader mt4 and mt5 on market opening on 16th 02.2025 for 2 hours they admit this and apologized by e mail, but i had a position i wanted to close and others i wanted to change, i could do nothing.

They have said sorry admitted the system failure and offered a tiny recompense, DO NOT TRUST this broker to keep your deposit capital safe, this is not the first time this happened and i was lucky i did not have any major positions open.

Their response has been pathetic and stink’s of a dodgey broker, there sre so many positive reviews for this broker which i suspect have been paid for by fusion.

For active day traders like me Fusion Markets ticks most of the boxes. I get ultra-tight spreads during key trading sessions whilst order execution is fast. My only gripe is the lack of education – I use IG’s Academy instead.

Fusion Markets is one of the lowest cost brokers I’ve used. Signing up was also quick and easy. Weak points for me are the limited educational tools and narrow suite of shares.