Best Forex Brokers In South Africa

Discover our selection of the best forex brokers in South Africa. Many of our recommended forex trading platforms cater specifically to South African day traders with regulation from the Financial Sector Conduct Authority (FSCA) and ZAR accounts.

Top 6 Forex Brokers In South Africa

These 5 forex brokers accepting traders from South Africa achieved the highest ratings during our firsthand tests and evaluations:

Here is a short summary of why we think each broker belongs in this top list:

- FXCC - FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

- XM - XM offers a strong selection of currency pairs with no re-quotes or hidden charges, while spreads have come down over the years, now starting from 0.8 pips on the EUR/USD in the commission-free account.

- RoboForex - RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- IC Markets - IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

Best Forex Brokers In South Africa Comparison

| Broker | FSCA Regulated | ZAR Account | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit |

|---|---|---|---|---|---|---|

| FXCC | - | - | 70+ | 0.2 | / 5 | $0 |

| XM | ✔ | - | 55+ | 0.8 | / 5 | $5 |

| RoboForex | - | - | 30+ | 0.1 | / 5 | $10 |

| Vantage | ✔ | - | 55+ | 0.0 | / 5 | $50 |

| IC Markets | - | - | 75 | 0.02 | / 5 | $200 |

| AvaTrade | ✔ | - | 50+ | 0.9 | / 5 | $100 |

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| GBPUSD Spread | 1.0 |

|---|---|

| EURUSD Spread | 0.2 |

| EURGBP Spread | 0.5 |

| Total Assets | 70+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP |

Pros

- There are no restrictions on short-term trading strategies like day trading and scalping

- The free education section, including the 'Traders Corner' blog, offers a large selection of materials that will serve all experience levels

- Competitive and transparent ECN spreads from 0.0 pips with zero commissions, making FXCC one of the cheapest forex brokers

Cons

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- FXCC’s MetaTrader-only offering is a drawback compared to many alternatives, notably AvaTrade which provides five platforms to suit different trader preferences

- While the range of currency pairs exceeds most alternatives, the selection of additional assets is narrow, and notably, there are no stocks

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 1.5 |

| Total Assets | 55+ |

| Leverage | 1:1000 |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 30+ |

| Leverage | 1:2000 |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:500 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- The broker has recently made efforts to expand its suite of CFDs providing further trading opportunities

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

- It’s quick and easy to open a live account – taking less than 5 minutes

Cons

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| GBPUSD Spread | 0.23 |

|---|---|

| EURUSD Spread | 0.02 |

| EURGBP Spread | 0.27 |

| Total Assets | 75 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

How We Rate Forex Brokers In South Africa

Trusted Forex Brokers

Opening an account with a trusted broker is key to safeguarding your funds against forex scams. This is especially important as we’ve witnessed an increase in fraudulent platforms targeting retail investors in recent years.

Our observations are also supported by ITWeb, which reported that MyChargeBack, a fund recovery company, is receiving around 1,000 scam complaints a month from South Africans.

The best sign of a legitimate forex broker is authorization from a trusted regulator. In South Africa, this is the Financial Sector Conduct Authority (FSCA), which houses a register of all licensed firms (you can search by company name or license number).

The most proactive regulator on the African continent, the FSCA has several requirements for brokers providing forex trading services to South African residents, from segregating client funds to adequate risk warnings.

However, unlike other heavily regulated jurisdictions, such as the UK and Australia, the FSCA does not limit leverage available to forex traders, with rates of 1:1000+ available.While this will appeal to skilled traders, I recommend new investors take a strict approach to risk management to curb large losses.

- AvaTrade is a great example of a trusted forex trading platform. As one of South Africa’s largest brokers, it is regulated by the FSCA and other globally recognized authorities and boasts a long history since 2006. It’s also proven to be a secure, dependable forex broker following our years of firsthand tests.

Selection Of Currency Pairs

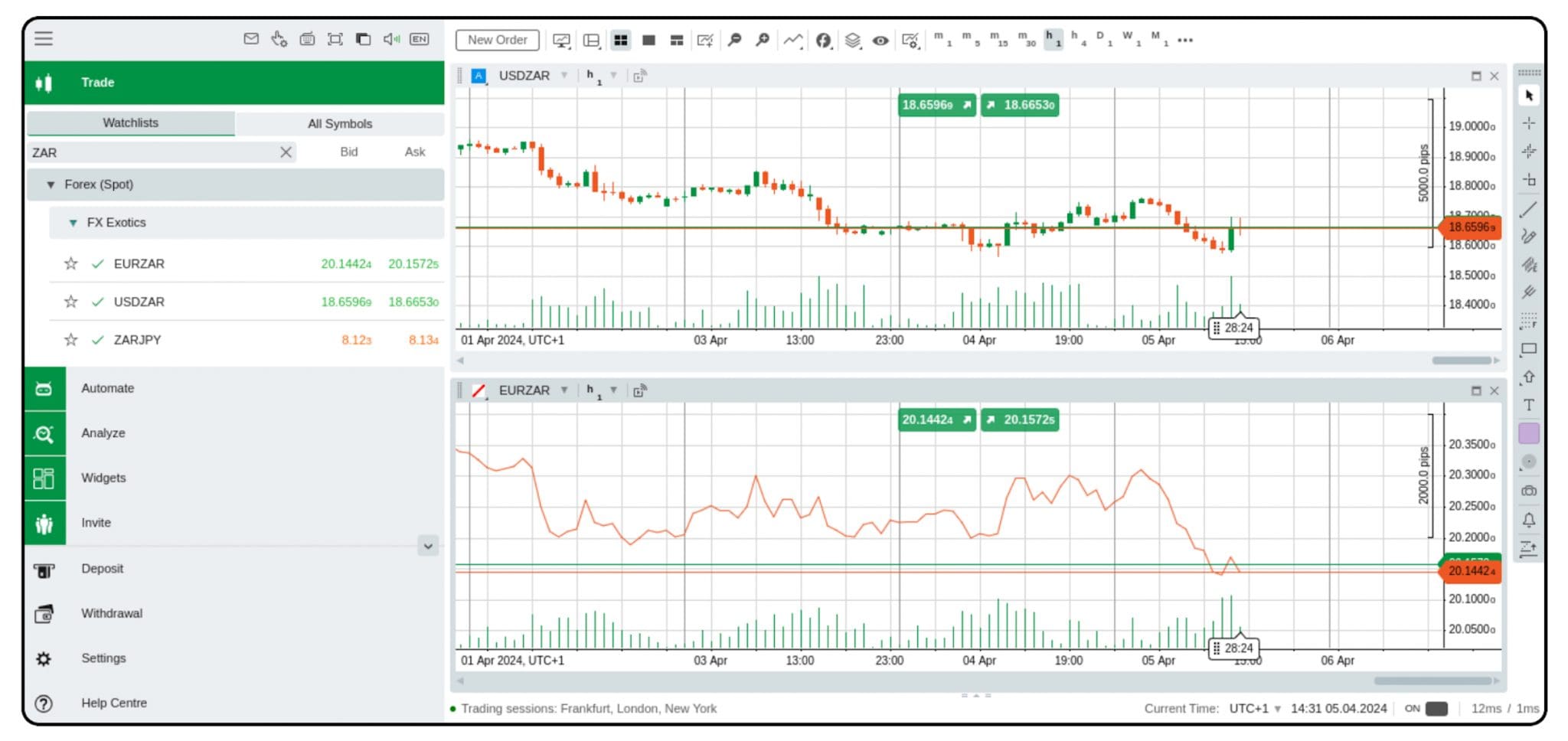

Most of the best forex brokers in South Africa provide opportunities to speculate on the South African Rand (ZAR), normally through the USD/ZAR.

In general, the ZAR is a fairly volatile currency. This is because South Africa is still an emerging economy that is heavily reliant on the prices of its key commodity exports, such as gold and coal, and still suffers from relative political instability.

- IG offers one of the best selections of currency pairs in the market today, including the USD/ZAR, EUR/ZAR, GBP/ZAR and JPY/ZAR, providing opportunities for South Africans to speculate on the relative strength of the Rand.

Attractive Pricing For Active Forex Traders

Low trading fees are a huge draw. However, we don’t recommend choosing these at the detriment of access to stable trading conditions. For example, fast execution speeds and reliable charting platforms are both essentials for serious forex day traders.

Fee structures will differ between South African forex trading platforms and from one account type to another. There are two widely used basic setups:

- The broker charges a spread only. All other fees – except the rollover rate – are included in the spread. This model is popular with newer traders looking for simple pricing.

- Besides a tight/low spread, a commission is charged, which is based on the amount you trade. This model is popular with experienced day traders.

The ZAR’s status as an emerging market currency means it has less liquidity than developed currencies, notably the USD and EUR.As a result, forex pairs with a ZAR component are known as ‘exotics’, and usually come with wider spreads, meaning higher costs.

- Pepperstone continues to stand out as a low-cost forex broker following tests, with minimum spreads on the USD/ZAR of 5 pips and EUR/ZAR of 14 pips. Rebates are also available through its Active Trader program, while there is no inactivity fee catching out casual traders.

Charting And Research Tools

Forex trading often requires technical analysis and fundamental analysis. The best forex brokers in South Africa offer a wide range of functionality on their platforms, including different chart types, indicators, customizable graphs and the ability to set price alerts.

Many forex brokers utilize third-party software, which we’ve been using for years. The likes of MetaTrader 4, MetaTrader 5, cTrader and TradingView excel for their extensive suite of charting tools.

In addition, proprietary software is increasingly being offered by larger forex brokers. This often comes with all the tools and features, but with a more user-friendly design, or functionality to suit the broker’s niche.

Ease of use is especially key when forex trading, particularly for beginners who may find some technical aspects overwhelming initially. We’ve spent hundreds of hours testing forex trading platforms to find those that cater to forex traders at all levels.

- AvaTrade is a stand-out option here. It offers the MetaTrader suite for experienced forex traders but has also clearly invested in developing its own software in recent years, sporting a WebTrader and AvaTrdeGO app that delivers a terrific user experience.

Convenient Account Funding

Smooth account funding should be a given, but our years in the industry have taught us some forex brokers do it better than others.

According to Statista, credit/debit cards and bank transfers are still the top payment methods for South African forex traders, accounting for more than 60% of all online transactions.

However, digital wallets are becoming increasingly popular, notably FNB and PayPal, so forex trading platforms offering accessible e-wallets are worth considering.

- XM is one of the most affordable forex brokers in South Africa with a 5 USD minimum deposit, a ZAR account, and convenient deposit methods like bank cards, wire transfers and e-wallets such as M-Pesa, though this has struggled to take off in South Africa.

Methodology

To identify the best forex trading platforms in South Africa, we located all those that offer forex assets and accept South African traders, then ranked them by their overall rating.

Our ratings are based on rigorous hands-on testing using over 100 data points, with a particular focus on key areas, including:

- Licensing by a reputable authority, such as the FSCA.

- A wide selection of currency pairs for South African traders, especially those including the ZAR.

- Competitive pricing on currency pairs, including low spreads and commissions.

- A choice of third-party and proprietary tools for forex trading and analysis.

- Support for convenient and affordable payment methods.

FAQ

What Is The Best Forex Broker In South Africa?

This depends on your needs. That said, key elements to consider are access to suitable currency pairs such as those with a Rand component, low spreads and commissions, access to user-friendly tools, plus extras like education and demo trading if you’re a beginner.

Use our rankings of the best forex brokers in South Africa to find the right trading platform for you.

How Much Money Do I Need To Start Trading Forex In South Africa?

Our analysis of hundreds of forex brokers accepting traders from South Africa shows you normally need between 0 and 250 USD, around 0 to 4,600 ZAR, to open an account.

However, budget traders can also find forex brokers regulated by the FSCA with no minimum deposit. IG is one of the highest-rated following our real-money tests.

Who Regulates Forex Brokers In South Africa?

The Financial Sector Conduct Authority (FSCA) is the South African authority responsible for regulating financial services, including brokers offering online forex trading services.

Many overseas forex brokers also accept South African traders, but not all will be regulated by the FSCA. Some may be authorized by other trusted bodies like the FCA in the UK or ASIC in Australia, although it’s important to comply with tax rules in South Africa.

Recommended Reading

Article Sources

- Authorized Forex Broker Database - FSCA

- History of the South African Rand - South African Reserve Bank

- South African Rand Forex History - Corporate Finance Institute

- Preferred Payment Methods in South Africa - Statista

- More Consumers Falling Prey to Forex Scams in South Africa - ITWeb

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com