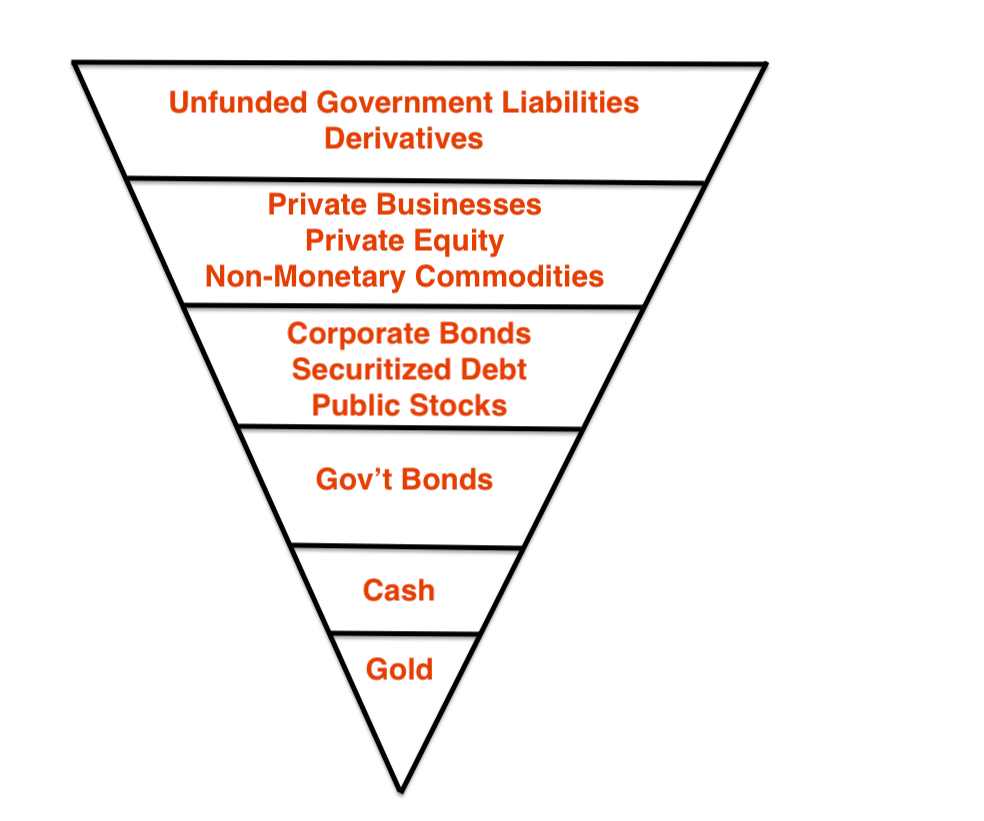

Exter’s Pyramid – Understanding the Hierarchy of Assets

Exter’s Pyramid, developed by John Exter, a central banker and economist, is a model that represents the liquidity of different asset classes.

It serves as a visual framework for the hierarchy of assets, typically during times of financial stress.

The pyramid ranks assets from the most to the least liquid, reflecting their safety and risk levels.

Key Takeaways – Exter’s Pyramid

- Liquidity Hierarchy: Exter’s Pyramid categorizes assets based on their liquidity during financial stress, with gold consider, in Exter’s view, the most liquid and reliable at the top (bottom when inverted) and derivatives and unfunded liabilities as the least liquid at the bottom.

- Indicator of Stability: The pyramid is used as a visual tool to assess risk, particularly in weak economic conditions, illustrating the so-called flight to quality where investors move to safer, more liquid assets.

- Strategic Planning: It provides a framework for investment strategies, emphasizing the importance of liquidity and the balancing of risk and return, especially during times of greater unknowns.

Structure of the Pyramid

Exter’s Pyramid is frequently shaped in an inverse way, showing the safest and most liquid (and also smallest by size) at the bottom and the least safe, least liquid, and largest by notional size at the top.

The Most Liquid Assets at the Apex of the Pyramid (Bottom)

At the top (bottom when inverted) of Exter’s Pyramid is gold.

Exter’s reasoning was that gold’s placement is due to its widespread acceptance as a store of value.

It’s especially true during for someone during his lifetime (1910-2006) who went through two World Wars, developed world hyperinflations, financial wealth wipeouts in various countries (also often war-related), the 1930s depression, and long spells of reserve currency countries being pegged to the gold standard.

During trying economic times when faith between countries and within countries is low, gold becomes comparatively more attractive as a medium of exchange and store of value.

For example, if one country owes a rival country payment, the creditor fears being paid in “printed money” and wants it in something more tangible.

When Germany faced war reparations payments for WWI, it was contractually obligated to deliver them in gold.

Gold is not someone else’s liability and doesn’t require a third party to fulfill a contract or promise.

Related: The History of Money

Currency and Deposits

Just below gold are cash and cash equivalents, including currency and short-term government securities.

These are considered the next safest assets, being highly liquid and typically backed by governments.

Government Bonds

Further down are longer-term government bonds.

While still relatively secure, these assets are less liquid than cash and carry more risk.

This includes interest rate risk, devaluation risk, and potential default in many cases.

Corporate Debt, Securitized Debt, Securities and Stocks

Securities such as stocks, bonds, ETFs, and mutual funds form the next layer.

Corporate credit and securitized debt also go here.

Their market value can fluctuate, sometimes significantly.

And their liquidity can vary, which places them lower on the pyramid.

Private Businesses, Real Estate, Non-Monetary Commodities

Private business interests and real estate go here.

Non-monetary commodities like oil also fall into this bucket.

Their liquidity is lower than the previous tier and they also often have higher risk.

The Base: Riskier Assets

At the bottom of the pyramid are the least liquid and riskiest assets.

These include derivatives and unfunded government liabilities.

Often, their value can be highly speculative.

Plus, it’s often unknown whether the counterparty will ultimately honor them.

Exter’s Pyramid in Weak Economic Conditions

Role in Assessing Risk

Exter’s Pyramid sometimes gains attention during economic downturns as traders/investors seek to understand the liquidity and stability of their investments.

It acts as a guide for moving assets towards greater liquidity and less risk.

Indication of Flight to Quality

The pyramid illustrates the concept of “flight to quality,” where investors move their funds up the pyramid to more secure assets during a crisis.

During bad times, more people want cash.

They need it to fund their obligations/liabilities and out of a desire to be safer.

It underscores the shifting preference for stability over returns in such times.

Investment Strategies

The pyramid informs investment strategies by highlighting the importance of liquidity.

Diversifying across different levels can balance risk and return, adapting to changes in economic conditions.

Conclusion

Exter’s Pyramid remains a relevant tool for traders, investors, and economists.

It shows the intrinsic hierarchy of assets in terms of liquidity and risk, particularly when there is more risk.

Understanding where assets fall within the pyramid can lead to more informed decisions and a balanced approach to risk management.