Creditor Surplus Countries vs. Debtor Deficit Countries (FX Trading)

Foreign exchange (FX) trading is not an easy game, with various factors influencing the movements of global currencies.

One such factor is the economic status of a country, specifically, whether it is a creditor surplus country or a debtor deficit country.

This article looks at the characteristics of these countries and how their respective statuses impact their currencies in the FX trading landscape.

We will explore the concepts of creditor and debtor countries, surplus and deficit countries, and how these classifications can lead to currency appreciation or depreciation.

Key Takeaways – Creditor Surplus Countries vs. Debtor Deficit Countries

- The economic status of a country as a creditor or debtor influences its currency in foreign exchange (FX) trading.

- Creditor countries, with positive net external assets (positive NIIP), are often seen as financially stable and reliable, while debtor countries, with negative net external liabilities (negative NIIP), may face financial vulnerabilities and challenges in attracting foreign investment.

- Surplus countries, with positive balance of payments and/or fiscal surpluses, tend to have stronger credit ratings, lower borrowing costs, and more attractive investment opportunities.

- Deficit countries, with negative balance of payments and/or fiscal deficits, may experience higher borrowing costs, lower credit ratings, and reduced investment appeal.

- Creditor surplus countries often see their currencies appreciate due to factors such as strong economic performance, healthy balance of payments, positive trade balances, and prudent fiscal management.

- Debtor deficit countries, conversely, tend to experience currency depreciation due to weaker economic performance, chronic trade deficits, fiscal holes, and lower investor confidence.

- Some example trade ideas that can be melded from this below.

What Is a Creditor Country?

A creditor country is one that has invested more money in foreign assets than it has received in investments from foreign entities.

In other words, it lends more than it borrows globally. It has a positive NIIP – i.e., a country that has net external assets.

This position typically results from strong economic performance, a healthy balance of payments, and prudent fiscal management.

As a result, creditor countries are often seen as more financially stable and reliable.

Examples of creditor countries include Germany, Japan, and China.

What Is a Debtor Country?

In contrast to a creditor country, a debtor country is one that has received more investment from foreign entities than it has invested in foreign assets.

Essentially, it borrows more than it lends internationally. This means it has a negative NIIP – namely, a country that has net external liabilities.

This situation can arise from various factors, such as weaker economic performance, persistent trade deficits, or fiscal imbalances.

Debtor countries are often perceived as being more financially vulnerable and may face challenges in attracting foreign investment.

Examples of debtor countries include the United States, Italy, and Brazil.

What Is a Surplus Country? (Balance of payments, fiscal)

A surplus country is one that has a positive balance of payments and/or a fiscal surplus.

In terms of balance of payments, a surplus country exports more goods and services than it imports, leading to a positive trade balance.

This outcome can be attributed to competitive industries, strong demand for the country’s products or services, or a relatively undervalued currency.

A fiscal surplus, on the other hand, occurs when a government’s revenue exceeds its expenditures, indicating prudent fiscal management and healthy public finances.

Surplus countries often enjoy stronger credit ratings, lower borrowing costs, and more attractive investment opportunities.

What Is a Deficit Country? (Balance of payments, fiscal)

A deficit country, in contrast, has a negative balance of payments and/or a fiscal deficit.

In the context of balance of payments, a deficit country imports more goods and services than it exports. This results in a negative trade balance.

This can occur due to uncompetitive industries, weak demand for the country’s goods or services, or an overvalued currency.

A fiscal deficit arises when a government’s expenditures exceed what is takes in in revenue, which may signal fiscal mismanagement or an unsustainable level of public debt.

Deficit countries may face higher borrowing costs, lower credit ratings, and reduced investment appeal.

Why Does a Creditor Surplus Country See Its Currency Tend to Appreciate?

Creditor surplus countries tend to see their currencies appreciate due to various factors.

First, their strong economic performance and healthy balance of payments often attract foreign investors, who must purchase the local currency to invest in the country’s assets, driving up demand for the currency.

Second, a positive trade balance leads to a higher demand for the country’s currency, as foreigners require it to buy the country’s exports.

Finally, prudent fiscal management and a fiscal surplus often result in lower inflation and good economic growth rates, which is generally supportive of currency appreciation.

Of course, currencies are a relative game, so it’s always appreciation or depreciation relative to another.

What Does a Debtor Deficit Country See Its Currency Tend to Depreciate?

Conversely, debtor deficit countries tend to experience currency depreciation.

This is because weaker economic performance, persistent trade deficits, and fiscal imbalances can erode investor confidence and deter foreign investment.

As a result, demand for the country’s currency may decline.

Additionally, a negative trade balance requires the debtor country to sell its currency to purchase foreign currencies, putting downward pressure on its value.

Lastly, fiscal deficits often contribute to higher inflation rates, which can weaken the currency’s purchasing power and further drive depreciation.

Broadly speaking, if policymakers don’t provide an interest on the currency that compensates traders/investors for their inflation rate and any depreciation pressure on the currency due to the underlying capital flow, the currency will fall.

Relevance in Macroeconomic Analysis

- Debtor-Developed vs. Creditor-Emerging Markets – Most debtor countries are developed nations and borrow from poorer, emerging market countries (creditors).

- Independent vs. Linked Policies – Distinguish between countries with independent currency policies and those with linked currency and interest rate policies.

Debtor vs. Surplus Countries (Examples)

- United States and England – These countries can print their own money and generally find themselves in less trouble in bad economic circumstances compared to those with linked currency policies, like Spain, due to their autonomy in monetary policy.

- Countries like Spain – Traditionally, they’ve had poorer circumstances because they can’t print money and have linked currency policies (tied to the euro), which exacerbates their debt problems.

Role in Economic Predictions

- Foreign Investment Withdrawal – A trader might foresee a decrease in foreign investors’ willingness to fund debtor nations like the United States if the yields on the debt are too low and impact currency valuations.

Independent vs. Linked Policies

Let’s look at the case of China, which is a creditor country lacking an independent monetary policy due to its currency peg.

China has traditionally been a country that suffers from imported inflation due to its more limited ability to print money, unlike the United States and England.

China as a Creditor Country

- Trade Surpluses – Accumulates foreign reserves through consistent trade surpluses.

- Foreign Debt Holdings – Holds significant amounts of foreign debt, notably US Treasury securities.

China’s Monetary Policy

- Managed Exchange Rate – Operates under a fixed or managed exchange rate, limiting currency fluctuation.

- Pegged Currency – The renminbi (RMB) value is pegged to the US dollar, not freely floating.

- Currency Stability – Aims to avoid excessive RMB printing to prevent depreciation and maintain stability.

Monetary Limitations

Has constrained ability to independently expand the money supply due to exchange rate policy.

Inflation Dynamics

- Imported Inflation Risk – Could experience inflation imported from US policy changes due to currency peg.

- Interest Rate Challenges – May need to adjust interest rates in response to US monetary policy shifts.

Comparison with US and England

- Monetary Independence – Both countries have the autonomy to print their currencies and manage inflation.

- Flexible Policies – Possess the flexibility to utilize monetary tools without a fixed exchange rate constraint.

Trade Ideas

Using the example of China above, here are some potential trade ideas:

Currency trades

- Go long USD/CNY (buy US dollar, sell Chinese yuan) if the Federal Reserve is expected to tighten monetary policy more aggressively than China. The logic is that China may need to follow suit to maintain its currency peg and lead to a stronger US dollar.

- Go short USD/CNY (sell US dollar, buy Chinese yuan) if the Fed is expected to ease monetary policy or if China signals a potential widening of its currency trading band (allowing for more RMB appreciation).

Fixed income trades

- Go long Chinese government bonds if the People’s Bank of China (PBOC) is expected to raise interest rates due to imported inflation pressures from the US, as bond prices would likely rise.

- Go short Chinese government bonds if the PBOC is expected to keep rates low despite rising US rates, as bond prices could fall due to the potential for higher inflation in China.

Equity trades

- Go long Chinese export-oriented stocks or sectors if the PBOC maintains a relatively weak RMB policy to support exports, as a weaker currency would benefit exporters.

- Go short Chinese import-oriented stocks or sectors if the RMB is expected to appreciate, given a stronger currency would make imports more expensive.

Commodity trades

- Go long commodity futures or stocks of Chinese commodity producers if the PBOC allows RMB appreciation, as a stronger currency would make commodity imports cheaper for China.

- Go short commodity futures or stocks of Chinese commodity producers if the PBOC maintains a weak RMB policy, as a weaker currency would make commodity imports more expensive for China.

Relative value trades

Identify pricing inefficiencies or relative value opportunities between Chinese and US fixed-income securities or derivatives, as differences in monetary policies and inflation expectations could create mispricing.

Carry trades

Engage in carry trades by borrowing in low-interest-rate currencies and investing in higher-yielding Chinese fixed-income instruments if the interest rate differential is attractive and currency risk is manageable.

These are just some examples, and actual trades would depend on specific market conditions, risk preferences, and investment objectives. It’s important to conduct thorough research and analysis before executing any trades.

Impact on Markets – Currencies vs. Bonds vs. Equities

- For countries that experience high inflation levels and are tightening monetary policy, this is beneficial for their currencies but harmful for bonds.

- Currency appreciation can hurt equities as it makes a company less competitive internationally, and asset prices increase along with the currency.

FAQs – Creditor Surplus Countries vs. Debtor Deficit Countries (FX Trading)

How does the status of a country as a creditor or debtor impact its credit rating?

Credit ratings agencies, such as Standard & Poor’s, Moody’s, and Fitch Ratings, assess a country’s ability and willingness to repay its debt.

Creditor countries generally have higher credit ratings due to their strong economic performance, healthy balance of payments, and prudent fiscal management.

Conversely, debtor countries often have lower credit ratings because of weaker economic performance, trade/current account deficits, and fiscal deficits.

Can a country transition between being a creditor and debtor country or a surplus and deficit country?

Yes, a country’s economic status can change over time due to various factors, such as shifts in global trade patterns, changes in productivity rates, population growth (or declines), changes in government fiscal policies, or fluctuations in currency exchange rates.

A debtor country can transition into a creditor country by improving its economic performance, reducing trade deficits, and adopting prudent fiscal management.

Likewise, a deficit country can become a surplus country by boosting its exports, reducing imports, or enhancing its fiscal position.

In the end, it just comes down to producing more and consuming less.

How do exchange rate regimes impact creditor and debtor countries?

Exchange rate regimes can influence the balance of payments and fiscal positions of creditor and debtor countries.

Under a fixed exchange rate regime, a country pegs its currency to another currency or a basket of currencies, which can lead to imbalances in trade and capital flows.

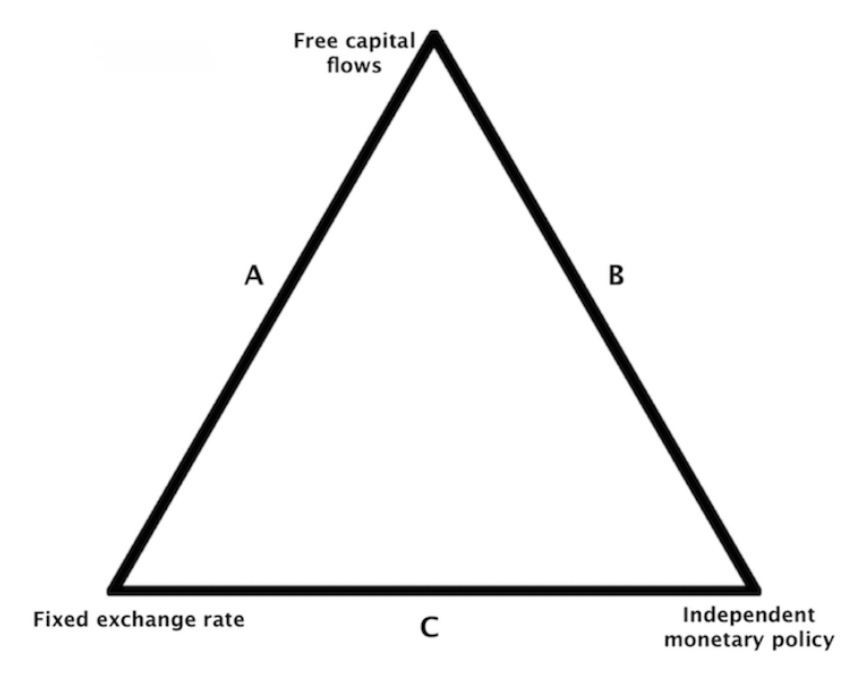

This produced a “trilemma” problem that we discussed in other articles where countries have to choose between a fixed exchange rate, monetary autonomy, and open capital flows.

Conversely, a floating exchange rate regime allows market forces to determine the value of a currency, providing more flexibility for countries to adjust their economic policies and correct imbalances.

Generally, if countries free float, they want a fairly valued currency that creates a two-way market for it.

How do currency appreciation and depreciation impact a country’s competitiveness?

Currency appreciation can make a country’s exports more expensive and imports cheaper, potentially leading to a decline in the trade balance.

This can reduce the competitiveness of domestic industries and slow economic growth.

On the other hand, currency depreciation can make exports cheaper and imports more expensive, which can improve the trade balance and support domestic industries.

However, excessive depreciation can lead to inflationary pressures and financial instability.

How do central banks intervene in the FX market to manage their currencies?

Central banks can intervene in the FX market to influence the value of their currencies, either through direct intervention (buying or selling foreign currencies) or indirect intervention (adjusting interest rates or implementing macroprudential policies).

For example, a central bank may sell its currency to prevent excessive appreciation or buy its currency using FX reserves to counter depreciation, thereby stabilizing its exchange rate and mitigating the impact on trade and capital flows.

How can investors and traders take advantage of the differences between creditor surplus countries and debtor deficit countries?

Understanding the factors that drive currency appreciation or depreciation in creditor surplus and debtor deficit countries can help investors and traders identify potential opportunities in the FX market.

For instance, they can take long positions in currencies of creditor surplus countries, which are expected to appreciate, and short positions in currencies of debtor deficit countries, which are expected to depreciate.

However, it’s not so easy.

For example, debtor deficit countries sell debt. This, in turn, may have enough demand among free-market participants to support those deficits and stabilize the currency.

But by monitoring economic indicators, such as trade balances, fiscal positions, and inflation rates, traders/investors can refine their strategies and manage their risk exposure.

Conclusion

The distinction between creditor-surplus countries and debtor-deficit countries plays a significant role in currency movements and FX trading.

Understanding the underlying factors that drive currency appreciation or depreciation in these countries can provide insights for investors and traders looking to trade currencies.

The interplay between these factors and their impact on currency values will remain an important area of study for participants in these markets.