Corridor Variance Swap

A Corridor Variance Swap is a derivative contract that pays out based on the realized variance of an underlying asset, but only when the asset price falls within a specified corridor (price range).

Unlike a standard variance swap that captures all price movements, this instrument only accumulates variance when the underlying asset trades between predetermined upper and lower barriers.

Key Takeaways – Corridor Variance Swap

- Targeted Volatility Exposure – Corridor variance swaps accumulate variance only when the asset trades within a defined price range. You make money on a corridor variance swap when the realized variance of the asset, measured only while it stays within the specified price corridor, exceeds the strike variance agreed upon in the contract.

- Tail Risk Reduction – They filter out extreme price movements. Accordingly, they offer cleaner exposure to volatility inside predictable zones.

- Strategic Hedging – Institutions use them to hedge portfolio risk where volatility is most impactful, within specific market corridors.

- Used Around Known Events – Effective during earnings, central bank decisions, or macro releases where bounded volatility is expected.

- Indirect Access for Individuals – Retail/individual traders can replicate corridor logic using options spreads, structured products, or synthetic API models.

- Simulations – We do simulations below.

Portfolio Integration and Strategic Role

Portfolio Hedging Applications

Corridor variance swaps are sophisticated hedging instruments within institutional portfolios, offering targeted volatility exposure with specific risk parameters.

Investors may use variance contracts as a hedging vehicle in order to hedge against decreasing liquidity conditions, with corridor versions providing additional precision in managing volatility exposure.

These instruments are particularly valuable for:

- Equity Portfolio Protection – Hedging against volatility spikes within specific price ranges

- Options Portfolio Management – Offsetting gamma exposure when underlying assets trade within expected ranges

- Volatility Risk Management – Providing targeted exposure to variance when conventional volatility products are too broad

Risk Management and Diversification

Corridor variance swaps enable portfolio managers to implement more nuanced risk management strategies.

Unlike traditional variance swaps that capture all volatility, corridor variants allow managers to hedge against specific scenarios where volatility matters most – i.e., typically when assets remain within trading ranges where portfolio sensitivity is highest.

The conditional nature of variance accumulation makes these instruments attractive for structured products and portfolio overlays where volatility exposure needs to be precisely calibrated.

Trading Strategies and Market Applications

Directional Volatility Trading

Directional traders use variance trades to speculate on future levels of volatility for an asset, spread traders use them to bet on the difference between realized volatility and implied volatility, and hedge traders use swaps to cover short volatility positions.

Corridor variance swaps enhance these strategies by allowing traders to:

- Range-Bound Volatility Plays – Bet on volatility levels only when assets remain within expected ranges

- Trend vs. Range Trading – Distinguish between trending market volatility and consolidation volatility

- Targeted Speculation – Focus volatility exposure on specific price levels where the trader expects heightened activity

Volatility Arbitrage Strategies

The corridor feature creates additional arbitrage opportunities beyond traditional variance swap strategies.

Traders can exploit differences between:

- Implied volatility across different strike ranges

- Market expectations of time spent within corridors

- Correlation between directional movement and volatility

Delta-Neutral Strategies

Corridor variance swaps provide better precision for delta-neutral approaches.

Traders can construct delta-neutral positions that benefit from volatility within specific ranges while remaining relatively insensitive to directional price movements.

Market Timing and Usage Patterns

Elevated Volatility Environments

Their use typically increases during times where implied volatility is elevated and/or trending higher.

Corridor variance swaps become attractive during:

- Volatility within Defined Ranges – When traders expect volatility but within defined ranges

- Earnings Seasons – For single-stock applications where volatility is expected within analyst price target ranges

- Central Bank Policy Events – When market participants anticipate volatility around specific policy rate levels

- Macro Data Releases – When volatility is expected around CPI, jobs reports, or GDP, but within anticipated economic ranges

Range-Bound Market Conditions

These instruments are valuable when markets exhibit:

- Consolidation Phases – Where volatility exists but within well-defined support and resistance levels

- Mean Reversion Patterns – When assets are expected to remain within statistical ranges

- Technical Trading Ranges – Where chart/statistical patterns suggest bounded volatility

Institutional Applications

Asset Management

Large asset managers use corridor variance swaps for:

- Overlay Strategies – Adding volatility exposure to existing portfolios without changing underlying positions or taking away from core portfolio positions

- Risk Budgeting – Precisely allocating volatility risk within specific market scenarios

- Performance Enhancement – Generating alpha through targeted volatility exposure

- Volatility Targeting Funds – Used to maintain portfolio volatility within pre-set bounds for mandates tied to risk-targeting strategies

Insurance and Pension Funds

These institutions particularly value corridor variance swaps for:

- Liability Matching – Hedging against volatility that affects specific liability calculations

- Regulatory Capital – Managing volatility exposure within regulatory frameworks

- Long-term Risk Management – Protecting against adverse volatility scenarios over extended periods

- Accounting Smoothing – Helps reduce earnings volatility in financial statements tied to market-sensitive liabilities or reserve levels

Proprietary Trading

Investors who take a long volatility position by purchasing futures contracts on the fear index can benefit from increased volatility, with corridor variance swaps offering more sophisticated alternatives.

Prop trading desks use these instruments for:

- Volatility Market Making – Providing liquidity while managing risk exposure

- Cross-Asset Arbitrage – Exploiting volatility relationships across different markets

- Structured Product Creation – Building complex derivatives with embedded corridor variance features

Comparative Advantages

Versus Traditional Variance Swaps

Corridor variance swaps offer several advantages over vanilla variance swaps:

- Targeted Exposure – Volatility exposure only when it matters most

- Reduced Tail Risk – Protection against extreme moves outside corridors

- Enhanced Precision – Better alignment with specific trading or hedging objectives

Versus Options Strategies

Compared to traditional options-based volatility strategies:

- Cleaner Exposure – Direct volatility exposure without delta, gamma, or theta complications

- Customizable Parameters – Precise control over volatility exposure conditions

- Efficient Capital Usage – No need to manage complex multi-leg option positions

Let’s do a simulation…

Mathematical Framework

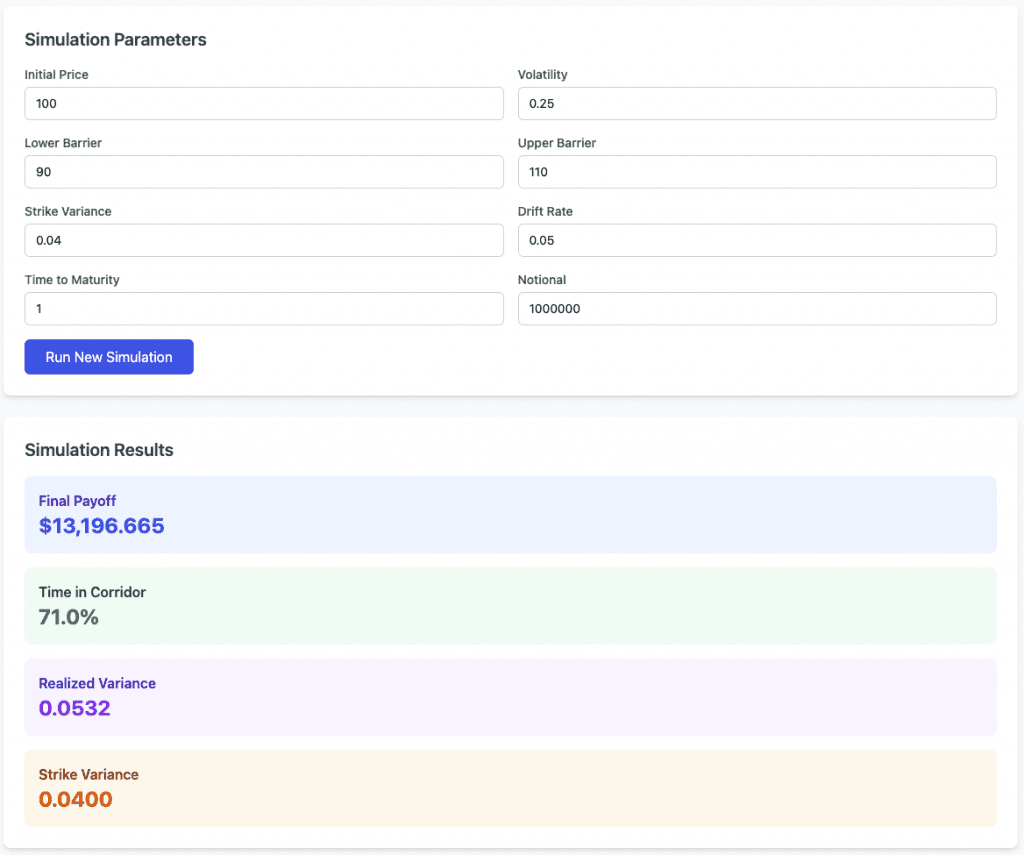

The key components of our model:

- Underlying Asset Dynamics – We’ll use a geometric Brownian motion model

- Corridor Boundaries – Upper/lower price barriers

- Variance Accumulation – Only occurs when asset is within the corridor

- Payoff Structure – Based on realized vs. strike variance

Key Features of the Simulation:

1. Mathematical Foundation

- Geometric Brownian Motion – Models the underlying asset using dS = μSdt + σSdW

- Corridor Logic – Only accumulates variance when the asset price is between lower and upper barriers

- Variance Calculation – Uses squared log returns, which is the standard approach in variance swap pricing

Specifically:

- Underlying Asset Dynamics: dS = μSdt + σSdW

- Corridor Condition: L ≤ S(t) ≤ U

- Variance Accumulation: Only when S(t) is within [L, U]

- Realized Variance: σ²_realized = (1/T_corridor) ∑[log(S(t+dt)/S(t))]² (when in corridor)

- Payoff: N × (σ²_realized – σ²_strike)

2. Real-Time Simulation

- Daily Time Steps – Simulates 252 trading days per year

- Monte Carlo Approach – Uses random normal variables to generate price paths

- Dynamic Variance Tracking – Continuously monitors and updates realized variance

3. Parameters

Key parameters:

- Initial asset price and volatility

- Corridor boundaries (upper and lower barriers)

- Strike variance (the benchmark against which realized variance is measured)

- Time to maturity and notional amount

4. Visuals

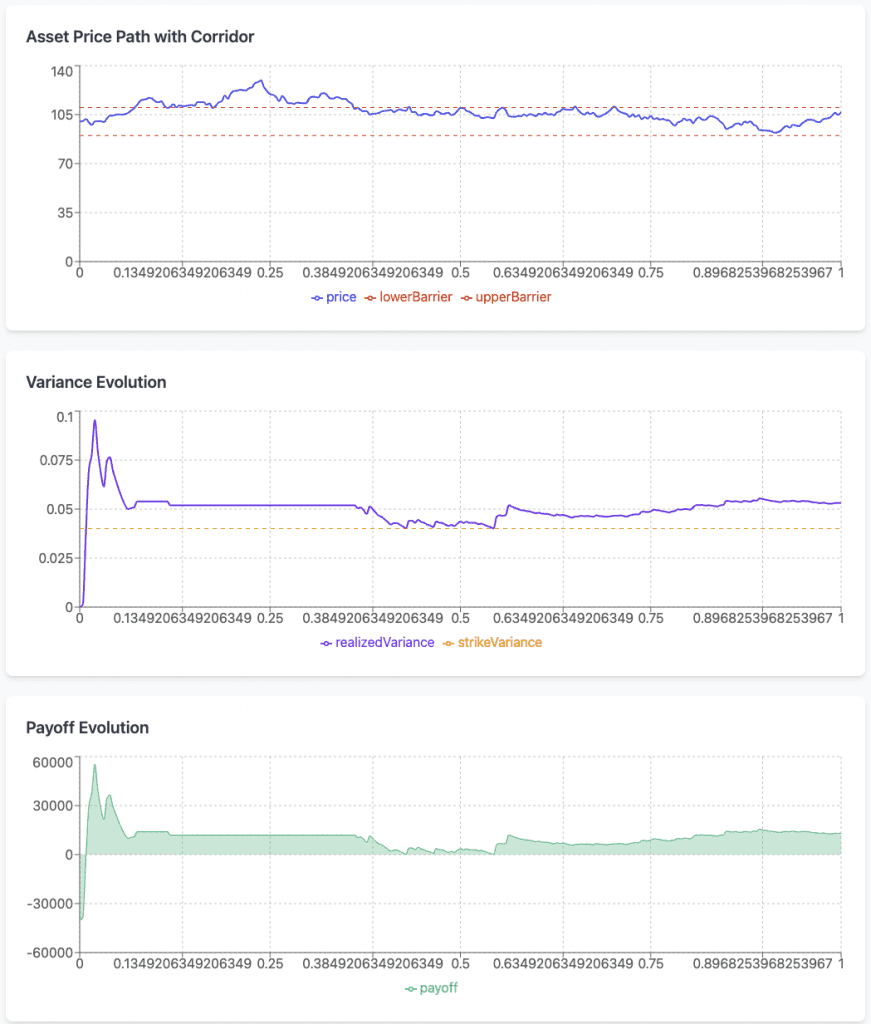

The simulation provides three critical charts:

- Price Path – Shows the asset price evolution with corridor boundaries

- Variance Evolution – Compares realized variance against strike variance over time

- Payoff Evolution – Demonstrates how the swap’s value changes throughout its life

5. Insights

The model reveals important characteristics of corridor variance swaps:

- Time Sensitivity – The percentage of time spent within the corridor directly affects the payoff

- Variance Accumulation – Only occurs when the asset trades within the specified range

- Risk Profile – Even in volatile markets, the payoff can be negative if the asset frequently exits the corridor

How Can Individual Traders Access Corridor Variance Swaps?

Corridor variance swaps are sophisticated, over-the-counter (OTC) derivatives typically traded by institutional players, not directly accessible to most individual traders.

However, there are several indirect or adjacent ways retail and smaller professional traders can gain similar exposures or replicate aspects of corridor variance swap strategies:

1. Structured Products via Private Banks or Brokers

Some high-net-worth individuals (HNWIs) can access custom-structured notes through private banking relationships.

These notes may embed corridor variance logic, such as payout structures based on realized volatility within a defined price range.

The trader doesn’t trade the swap directly, but the payoff profile mirrors a corridor variance swap.

Example: A note that pays out based on the S&P 500’s realized volatility, but only if the index stays between 5200 and 6800.

2. DIY Replication via Options

Retail traders can approximate a corridor variance exposure using options strategies that focus on a specific price range and volatility outcome:

- Short straddles/strangles with wings – Selling a straddle or strangle and buying protective OTM options further out creates a payoff that benefits from volatility inside a range.

- Butterfly spreads – A long butterfly can profit when realized volatility remains within a narrow band, mirroring some of the payout behavior of a corridor variance swap.

- Calendar spreads near expected events – Can mimic exposure to volatility in a specific window and range.

While these are imperfect proxies, they allow thoughtful positioning around expected range-bound volatility with capped risk.

3. Tradeable Volatility Instruments

Some retail-accessible products allow indirect positioning on volatility, though they don’t offer corridor targeting:

- VIX futures & options – Provide broad exposure to implied volatility, useful for directional volatility bets.

- Volatility ETFs/ETNs – Like VXX, SVXY, or UVXY. While not corridor-based, combining them with price-level options can form hybrid structures.

- Variance swap ETFs or structured volatility indexes (if available in the future) – Still emerging, but institutions may eventually offer retail-accessible wrappers.

4. Mini OTC Contracts via Prime Brokers

For semi-professional traders or those using prime brokerage services, it’s sometimes possible to negotiate access to customized OTC instruments like corridor variance swaps, especially if trading through family offices, hedge fund incubators, or prop platforms.

5. Synthetic Access via Broker APIs

For technically skilled individuals or quants, some brokers (like Interactive Brokers, Deribit for crypto, or Tastytrade for equity options) offer the ability to:

- Model corridor-based exposures

- Execute synthetic baskets of options across multiple strikes and expiries

- Automate trading using APIs to simulate corridor logic dynamically

This requires capital, risk controls, and infrastructure, but it’s a viable path for algorithmic traders.

Final Note

Individual access is limited not because of strategy secrecy, but because of OTC counterparty, margin, and customization requirements.

Nonetheless, creative use of public-market instruments, well-structured option trades, and relationships with advanced brokerages can provide functional equivalents to corridor variance swaps, especially for those targeting volatility within a specific price corridor/range and timeframe.