Capital Structure Arbitrage (Trading Strategy)

Capital structure arbitrage (CSA) is a financial strategy used by hedge funds and proprietary trading desks.

This strategy involves taking advantage of pricing discrepancies in a company’s capital structure.

A company’s capital structure is comprised of its mix of debt, equity, and other securities.

These pricing discrepancies can occur due to a number of reasons, including market inefficiencies, liquidity constraints, regulations, tax laws, changes in risk premiums (i.e., risk appetite), and asymmetric information being the main factors.

Capital structure arbitrage is considered a relative value strategy, focusing on the relationship between various financial instruments.

Here we look into the specifics of the capital structure arbitrage trading strategy, understanding its mechanisms, benefits, risks, and real-world applications.

Key Takeaways – Capital Structure Arbitrage

- Capital structure arbitrage is a financial strategy used by hedge funds and proprietary trading desks to take advantage of pricing discrepancies in a company’s mix of debt, equity, and other securities.

- This strategy involves long-short positions on undervalued and overvalued securities, with the aim of profiting from price differences between them.

- Capital structure arbitrage offers potential high returns and can serve as a hedge against market risk, but it also comes with complexity and risks, requiring sophisticated analysis and substantial capital.

Capital Structure Basics

- Equity – Represents ownership in a company. Equity holders have residual claims on the company’s assets after all debts have been paid.

- Debt – Represents a loan made to the company. Debt holders have a higher claim on assets than equity holders in the event of liquidation.

There are other types of debt, equity, and debt-/equity-hybrid securities, but those are the basics.

Capital Structure Arbitrage Mechanics

At the core of capital structure arbitrage lies the concept of price relationships between different securities of a single entity.

It often involves long-short positions, where the investor is long on undervalued securities and short on overvalued ones.

In a simplified scenario, an arbitrageur might buy a company’s debt, which is undervalued, and short-sell the company’s equity, which is overvalued.

The rationale behind this approach is that the value of the company’s debt should increase, and the value of its equity should decrease, thus leading to a profitable spread.

Benefits of Capital Structure Arbitrage

One major benefit of capital structure arbitrage is the potential for high returns.

This strategy can yield substantial profits in volatile markets, as it takes advantage of pricing discrepancies that often occur in such conditions.

Another significant advantage is its hedge against market risk.

Because it involves long and short positions on related securities, it can provide a built-in hedge against market movements.

This feature is especially beneficial during economic downturns, making capital structure arbitrage a popular strategy during less-than-good times.

It’s essentially a pure alpha type of strategy, given it aims to generate returns without taking on directional risk.

Risks and Challenges

Despite its potential benefits, capital structure arbitrage comes with its own set of risks and challenges.

One major risk is the complexity of the analysis required.

Assessing the correct value of securities and predicting their future movements is not a straightforward task, and it requires a deep understanding of financial markets and the specific company’s situation.

Another risk is the potential for severe losses if the securities don’t move as predicted.

Just as with any other investment strategy, there is no guarantee of success, and incorrect bets can result in significant losses.

Even with a long side and a short side to the trades, both can potentially lose money together.

Also, the strategy requires a significant amount of capital and access to sophisticated financial instruments, which can be a barrier for individual investors.

Real-World Applications

Many sophisticated investors, including hedge funds and proprietary trading desks, use capital structure arbitrage as part of their trading strategies.

These players have the necessary resources, skills, and risk tolerance to leverage this strategy.

One of the notable examples of successful application of capital structure arbitrage is the hedge fund Long-Term Capital Management (LTCM) in the 1990s.

Though LTCM eventually collapsed due to its highly leveraged positions and an unexpected market event, it had some years of extremely high returns, thanks in part to its use of capital structure arbitrage.

Example #1 of a Capital Structure Arbitrage Trade

Step 1: Identify the Target Company

- Objective = Find a company with a disparity between its debt and equity prices, often due to market inefficiency or mispricing. We also, of course, want this difference to be greater than our transaction costs.

- Example Company = Let’s call it ABC Corp.

Step 2: Analyze Financial Health

- Objective = Evaluate the company’s financial statements to understand its leverage and the risk of default.

Let’s say we find this:

- Debt Levels: $500 million in bonds.

- Equity Market Cap: $200 million.

- Interest Coverage Ratio: 3.5x.

Step 3: Compare Debt and Equity Valuations

- Objective = Identify the mispricing between the debt and equity markets.

- Bond Trading Price: 80% of par value.

- Equity Price: $10 per share.

- Credit Default Swap (CDS) Spread: 500 basis points.

Step 4: Establish the Trade Hypothesis

- Objective = Formulate a hypothesis that the debt is undervalued relative to the equity.

- Hypothesis: The bond market overestimates the default risk, leading to an undervaluation of the bonds compared to the equity.

Step 5: Construct the Arbitrage Trade

- Objective = Simultaneously execute long and short positions to capitalize on the mispricing.

- Long Position: Buy ABC Corp’s bonds at 80% of par value.

- Investment: $8 million for $10 million face value of bonds.

- Short Position: Short sell ABC Corp’s equity at $10 per share.

- Short Sale Proceeds: $2 million for 200,000 shares.

- Long Position: Buy ABC Corp’s bonds at 80% of par value.

Step 6: Hedge the Credit Risk

- Objective = Hedge the credit risk of the long bond position using a CDS.

- CDS Purchase: Buy protection for $10 million of bonds with a 500 basis points spread.

- Annual CDS Premium: $500,000.

Step 7: Monitor and Adjust Positions

- Objective = Continuously monitor the market for changes in debt and equity prices and adjust positions as necessary.

- Debt Market: Track bond prices and yields.

- Equity Market: Monitor stock price and volume.

- Credit Market: Observe changes in CDS spreads.

Step 8: Exit the Trade

- Objective = Close positions to realize profits once the mispricing corrects.

- Scenario 1: Mispricing Corrects in Favor of Bonds:

- Bond Price: Increases to 95% of par value.

- Equity Price: Remains stable or decreases.

- Profit Calculation:

- Bond Sale: $9.5 million from selling bonds.

- Equity Buyback: $2 million for 200,000 shares (assuming no price change).

- Net Profit: $(9.5 million – 8 million) – $500,000 (CDS premium) = $1 million.

- Scenario 1: Mispricing Corrects in Favor of Bonds:

Summary Table

| Step | Action | Details |

| 1 | Identify Target Company | ABC Corp |

| 2 | Analyze Financial Health | Debt: $500M, Equity: $200M, Interest Coverage: 3.5x |

| 3 | Compare Debt and Equity Valuations | Bonds at 80%, Equity at $10/share, CDS spread: 500 bps |

| 4 | Establish Trade Hypothesis | Bonds undervalued relative to equity |

| 5 | Construct Arbitrage Trade | Long Bonds ($8M), Short Equity ($2M) |

| 6 | Hedge Credit Risk | Buy CDS, Premium: $500K/year |

| 7 | Monitor and Adjust Positions | Track bond prices, stock prices, CDS spreads |

| 8 | Exit Trade | Bond Price: 95%, Equity Price: $10 |

| Profit | Calculate Net Profit | $1 million |

Overall

This hypothetical example illustrates how capital structure arbitrage can be executed step-by-step.

By exploiting the mispricing between a company’s debt and equity, traders can potentially realize significant profits while managing risks through hedging strategies like CDS.

Example #2 of a Capital Structure Arbitrage Trade

1. Identifying the Opportunity

Imagine a company (we’ll use the same name – ABC Corp), which has both publicly traded stocks and bonds.

Our goal is to identify a mispricing between the stock and the bond.

2. Example Scenario

- Stock Price: $50 per share

- Bond Price: $950 per bond (with a face value of $1,000)

We run various valuation methods – e.g., DCF, comps – and find that the market is currently undervaluing ABC Corp’s stock relative to its bonds.

3. Analyzing the Situation

- If the company’s outlook improves, both stock and bond prices are expected to rise.

- If the company defaults, bondholders have priority over stockholders in asset claims, making bonds safer than stocks.

4. The Arbitrage Strategy

- Short the Bond: Sell ABC Corp.’s bond at $950.

- Buy the Stock: Purchase ABC Corp.’s stock at $50 per share.

By shorting the bond, you are betting that the bond price will decrease or not increase as much as the stock price.

You’re on the hook for paying the coupon payment.

By buying the stock, you are betting that the stock price will increase more relative to the bond price.

5. Executing the Trade

- Short Sell 1 Bond: Borrow and sell one bond for $950.

- Buy 19 Shares: Use the $950 to buy 19 shares of ABC Corp. stock at $50 per share.

6. Outcomes

If the Company Performs Well:

- Stock Price Increases to $60: The value of your stock holdings rises to $1,140 (19 shares x $60).

- Bond Price Increases to $980: The cost to buy back the bond is $980.

- Profit Calculation:

- $1,140 (stock value) – $980 (bond repurchase) = $160 profit.

If the Company Defaults:

- Stock Price Drops to $10: The value of your stock holdings drops to $190 (19 shares x $10).

- Bond Price Drops to $500: The cost to buy back the bond is $500.

- Loss Calculation:

- -$760 (loss on the stock) + $450 (gain on the bond) = −$310 loss.

7. Risk Management

- Hedging – Use options or other derivatives to hedge against adverse movements in the bond or stock prices.

- Diversification – Avoid concentrating the strategy in a single company or sector.

Corporate Finance Theory in Capital Structure Arbitrage

Understanding corporate finance theories is necessary for capital structure arbitrage traders because these help understand how firms choose between equity and debt financing – i.e., they impact their cost of capital and financial risk.

Knowledge of these principles helps traders:

- identify mispricings between a company’s debt and equity

- better understand market reactions to financial decisions, and

- execute more informed and profitable strategies

Let’s look through a few of them:

Market Timing Hypothesis

The market timing hypothesis suggests that firms choose between debt and equity financing based on current market environments.

Firms issue equity when stock prices are high and debt when interest rates are low – i.e., looking to minimize their cost of capital.

This theory assumes that firms can detect market mispricings better than the financial markets can.

Pecking Order Theory

Pecking order theory posits that firms prefer to finance new investments in the follow order:

- first with internal funds (retained earnings)

- then with debt, and

- finally with equity

This avoids the adverse selection costs associated with issuing new equity.

This hierarchy reflects a preference to minimize financing costs and information asymmetry.

Trade-Off Theory

The trade-off theory asserts that firms balance the tax advantages of debt financing (interest tax shields) against the bankruptcy costs associated with excessive debt.

Firms aim to reach an optimal capital structure where the marginal benefit of debt equals its marginal cost, balancing the benefits and risks to maximize firm value.

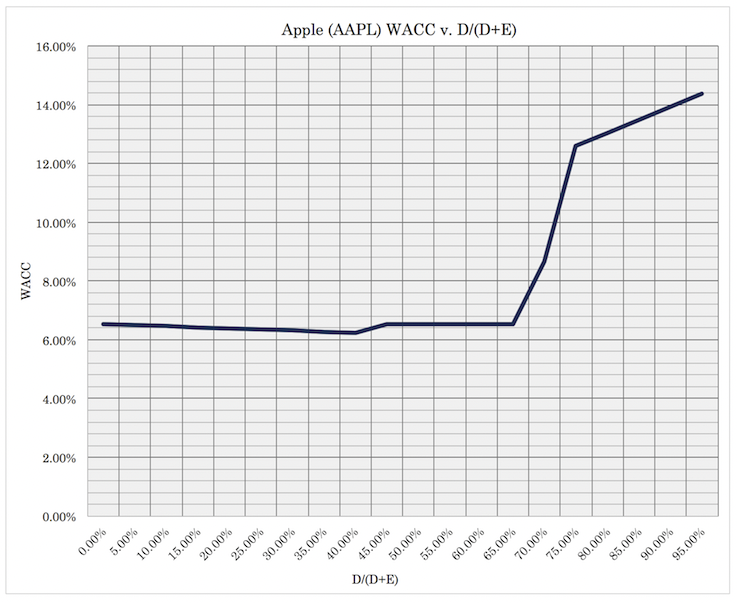

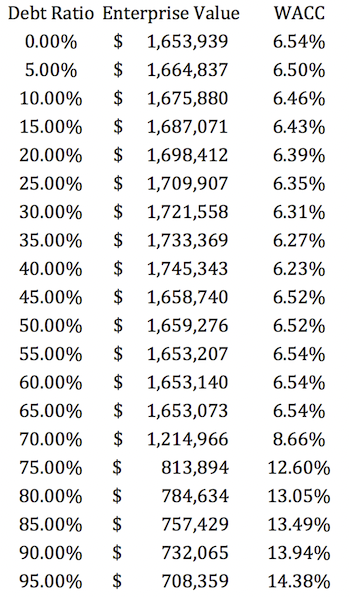

In our article on Apple (AAPL), we looked at its capital structure and found that issuing debt up to a point is realistic before it becomes too expensive:

‘Hot Debt’ vs. ‘Hot Equity’ Periods

“Hot Debt” periods occur when interest rates are low.

This makes debt financing cheaper and more attractive for firms.

“Hot Equity” periods arise when stock prices are high.

This encourages firms to issue new equity at favorable prices.

Firms leverage these periods to optimize their capital structure by minimizing the cost of financing and maximizing the capital raised, based on whatever market conditions dictate.

The market timing hypothesis suggests that firms strategically issue debt or equity during these respective periods to capitalize on market valuations and overall conditions.

FAQs – Capital Structure Arbitrage

1. What is capital structure arbitrage?

Capital structure arbitrage is a trading strategy used by hedge funds and other sophisticated investors.

It involves exploiting pricing inefficiencies between different types of securities issued by the same company.

These securities can include equities, bonds, convertible bonds, and even options.

The strategy relies on quantitative models to predict the direction of the price difference and the probability of default of a company.

2. How does capital structure arbitrage work?

Capital structure arbitrage works by identifying the mispricing between a firm’s debt and equity.

This strategy is implemented when a trader perceives the firm’s credit risk as reflected in its stock price, differs from that reflected in its bonds or credit default swaps.

If the stock price suggests the firm is doing well, while the credit instruments suggest it is in financial distress, a capital structure arbitrageur might short the equity and buy the credit instruments, or vice versa.

3. What kind of market conditions are favorable for capital structure arbitrage?

Capital structure arbitrage tends to work best in volatile markets where price discrepancies between different securities are more likely to occur.

These discrepancies can arise due to reasons such as asymmetric information, liquidity constraints, tax effects, regulatory changes, or changes in the risk appetite of investors.

4. What are the risks associated with capital structure arbitrage?

Like any trading strategy, CSA is not without risk.

One of the primary risks is model risk, where the models used to identify pricing inefficiencies could be incorrect or incomplete.

Liquidity risk is another significant concern, as it may not always be easy to unwind positions quickly without causing significant price impact.

Finally, macroeconomic risks can impact the performance of the strategy, such as changes in interest rates or credit market conditions.

5. How can investors manage the risks of capital structure arbitrage?

Risk management in CSA is critical, given the complexity and potential downside of the strategy.

Effective risk management strategies might include diversification across different companies and sectors, stress testing of portfolios under different market scenarios, careful monitoring of liquidity, and ongoing refinement of the models used to identify mispricing.

6. Is capital structure arbitrage accessible to individual investors?

Typically, capital structure arbitrage is a strategy used by institutional investors such as hedge funds.

It requires sophisticated quantitative models and a deep understanding of a company’s financial structure.

Moreover, it also requires significant resources to monitor and manage the risks associated with the strategy.

Therefore, it may not be easily accessible or suitable for individual investors.

7. How does capital structure arbitrage contribute to market efficiency?

Capital structure arbitrage contributes to market efficiency by helping to correct mispricing between different securities of the same company.

By taking advantage of these mispricings, arbitrageurs help to ensure that prices reflect the true fundamental value of securities, thereby promoting more efficient markets.

8. What is the relationship between capital structure arbitrage and event-driven strategies?

Capital structure arbitrage is a type of event-driven strategy, meaning it seeks to profit from price discrepancies that occur around specific corporate events such as mergers, acquisitions, bankruptcy, or restructuring.

However, unlike other event-driven strategies that may focus on a single event, capital structure arbitrage involves ongoing monitoring of a company’s entire capital structure.

9. How can one gain exposure to capital structure arbitrage strategy?

Exposure to CSA can typically be gained through investing in hedge funds or other alternative investment vehicles that employ this strategy.

Due to the complexity and risks associated with the strategy, it is generally suitable for sophisticated investors who understand the risks involved.

It’s a strategy that’s generally run by specialists.

10. How has technology impacted capital structure arbitrage?

Technology has had a significant impact on capital structure arbitrage.

Advances in financial technology have made it easier to gather and analyze vast amounts of financial data, leading to more sophisticated and accurate pricing models.

This, in turn, has enabled traders to identify mispricing opportunities more efficiently and execute trades more rapidly, enhancing the effectiveness of the strategy.

However, it has also increased competition, potentially reducing the profit margins of the strategy.

11. What skill set is required for capital structure arbitrage?

Skill Set Required for Capital Structure Arbitrage:

- Financial Analysis

- Proficiency in analyzing financial statements and understanding key metrics like debt levels, interest coverage ratios, and equity valuations.

- Market Knowledge

- Deep understanding of bond and equity markets.

- Knowledge of factors affecting their pricing and movements.

- Quantitative Skills

- Strong mathematical and statistical skills to model and predict price movements and identify arbitrage opportunities.

- Risk Management

- Ability to assess and mitigate risks, including credit risk, interest rate risk, and market volatility.

- Hedging Techniques

- Knowledge of derivatives and hedging strategies, such as using Credit Default Swaps to manage risk.

- Economic and Corporate Finance Theories

- Understanding theories like market timing, pecking order, and trade-off theory and their uses and flaws when it comes to real-world trading.

- Technical Skills

- Proficiency in financial software and tools for data analysis, modeling, and trading.

- Attention to Detail

- High level of precision in analyzing data and executing trades.

- Communication Skills

- Ability to clearly articulate trade ideas and strategies to stakeholders and team members.

Conclusion

Capital structure arbitrage is a complex but potentially rewarding trading strategy.

It leverages pricing discrepancies within a company’s capital structure to yield profits.

While the strategy is not without risks and challenges, it can be a great tool in the hands of savvy investors who are highly trained in this type of specialty.

As always, anyone considering using this strategy should do so only with a thorough understanding of the mechanics, benefits, and potential risks involved.