Best Brokers With EUR Accounts 2026

Looking for a broker that supports EUR accounts? Whether you’re a European trader or dealing in high-volume Euro trades, having a EUR-denominated account can save on conversion fees and streamline transactions.

Dig into our selection of the top brokers with Euro accounts to find the perfect match for your needs.

Top 6 Brokers With EUR Accounts 2026

After evaluating 140 brokers through hands-on testing, we’ve identified the 6 best brokers for EUR accounts:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Why Are These Brokers With EUR Accounts The Best?

Here's a snapshot of why we believe these are the top trading platforms for EUR accounts:

- Interactive Brokers is the best broker with a EUR account in 2026 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

How Safe Are These Brokers Offering EUR Trading Accounts?

See the measures our top brokers follow to help safeguard your Euros:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ |

Compare Mobile Trading

Find out how these brokers with EUR accounts scored in our tests of their mobile trading apps:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are The Top Brokers For EUR Accounts Good For Beginners?

Beginners should use brokers that offer demo trading before depositing Euros and other features for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Are The Top Brokers For Euro Accounts Good For Advanced Traders?

Experienced traders should seek sophisticated tools to elevate the trading environment:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

Compare The Ratings Of The Top Brokers That Accept Euro Accounts

See how the top EUR trading account providers scored in key areas following our in-depth tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| FOREX.com |

Compare Trading Fees

Depositing to a EUR account is low-cost, but trading fees can add up so here's how the top platforms compare:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| eToro USA | ✔ | $10 | |

| Plus500US | ✘ | $0 | |

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 |

How Popular Are These Trading Platforms With EUR Accounts?

Many traders prefer the most popular brokers that have trading accounts in Euros, i.e those with the most clients:

| Broker | Popularity |

|---|---|

| Plus500US | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Open A EUR Trading Account With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Open A EUR Trading Account With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

Why Open A EUR Trading Account With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

Why Open A EUR Trading Account With Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Although support response times were fast during tests, there is no telephone assistance

Why Open A EUR Trading Account With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- Day traders can enjoy fast and reliable order execution

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Why Open A EUR Trading Account With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

How Did DayTrading.com Choose The Best Brokers With EUR Trading Accounts?

We investigated and verified which brokers offer EUR-denominated accounts using our evolving database, sitting at 140 providers in February 2026. From there, we ranked them based on overall ratings, which combine:

- Hard Data – 200+ metrics, including account currencies, fees, execution speed, and regulation.

- Real Trader Insights – Hands-on testing by our active European traders and industry experts who sit on our testing panel, factoring in platform experience, usability, and reliability.

What Is A EUR Trading Account?

A EUR trading account is a brokerage account where your funds are held and traded in Euros (€).

It’s perfect for European traders and forex investors dealing in EUR, as it can help avoid conversion fees, speed up transactions, and simplify trading in Euro-based markets.

If you deposit cash in another currency, such as US dollars, then your capital will automatically be converted into Euros.

Pros Of Brokers With Euro Accounts

- No Conversion Fees: European traders can keep more profits when depositing and withdrawing to EUR accounts, minimizing or avoiding exchange costs.

- More Broker Choices: Our research shows the Euro is the second most popular base currency after the US Dollar (USD), offering active traders plenty of broker options.

- Fast, Low-Cost Transactions: Many brokers we’ve tested offer near-instant deposits via bank transfer, cards and e-wallets to EUR-based trading accounts.

- Regulated Brokers: Many top EUR account brokers we’ve evaluated are regulated by trusted European bodies like the CySEC (Cyprus) and BaFin (Germany), providing peace of mind.

- Seamless for EU Traders: Manage trading funds in the same currency as daily expenses, reducing headaches when dealing with frequent trading transactions.

How Can I Check A Broker Offers A EUR Account?

Finding out if a broker supports Euro accounts is simple – I know I’ve done it dozens of times.

Follow these four steps:

- Check the Website: Visit the broker’s accounts section for available base currencies.

- Look in the FAQ: Many brokers we’ve evaluated list supported currencies in their FAQ portal.

- Contact Support: Live chat and phone support often provide instant answers, while emails typically get a response within a day.

- Sign Up for an Account: During registration, a drop-down menu usually displays available fiat currencies.

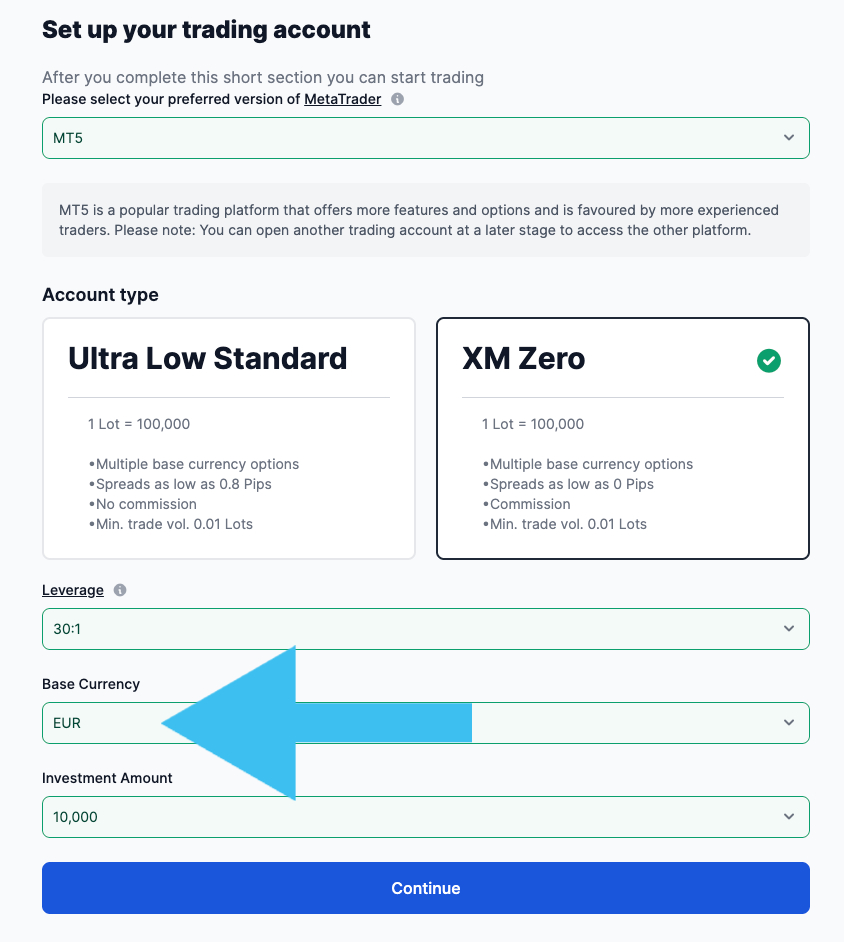

To bring this to life, below you can see where I verified that XM offers a EUR trading account during the sign-up process.

How To Choose A Euro Trading Account

When choosing a broker with a EUR trading account, focus on these six factors:

- Regulation & Security: If you’re a European trader, look for EU-regulated brokers (e.g., CySEC, BaFin, AMF etc) for strong investor protections.

- EUR Trading Pairs: If you’re a forex trader, check for access to popular currency pairs like EUR/USD, EUR/GBP, EUR/AUD, and EUR/CAD.

- European Assets: If you’re a stock trader, check if the broker offers stocks on major European exchanges like Germany’s DAX and France’s CAC.

- Fees in EUR: Compare spreads, commissions, deposit/withdrawal fees, and any charges for extra tools – all ideally displayed in Euros.

- Trading Platforms: Beginners may prefer proprietary software, while experienced traders might look for MetaTrader 4, MetaTrader 5, or cTrader.

- Demo Accounts: Use a paper trading account, denominated in Euros, to test the broker’s fees, platforms, and asset selection before going live.

FAQ

What Is The Minimum Deposit For A Euro Trading Account?

We’ve watched minimum deposit requirements come down in recent years, resulting in many brokers now providing EUR trading accounts with a minimum deposit of less than €250, and some, like Pepperstone, even having a €0 minimum.

Is My Money Safe In A EUR Brokerage Account?

Your funds are relatively safe with a reputable, EU-regulated broker, but security depends on a few key factors:

- Regulation: Choose brokers regulated by EU authorities for strict investor protections.

- Segregated accounts: Top brokers keep client funds separate from company money to prevent misuse.

- Deposit protection: Some EU regulators offer compensation schemes, like the ICF (up to €20,000).

- Secure payment methods: Use secure options like SEPA bank transfers, credit cards, or e-wallets for safe deposits and withdrawals.

What Do I Need To Open A Euro Brokerage Account?

We’ve been through the process of opening a EUR trading account, and most brokers require:

- Basic contact details: Name, email, phone number.

- Photo ID: Passport, driver’s license, or national ID.

- Proof of address: Utility bill or bank statement.

These checks are standard at regulated brokers to ensure security and compliance.