Federal Financial Supervisory Authority (BaFin) Brokers 2026

The Federal Financial Supervisory Authority, better known as BaFin, is Germany’s chief financial regulator that oversees online brokers. Considered a ‘green-tier’ regulator in line with our Regulation & Trust Rating, it ensures excellent safeguards for traders in Germany.

Authorized platforms must comply with various regulations, notably the Securities Trading Act. Brokers that fail to comply risk hefty penalties, with the BaFin issuing 40 fines totaling over €8.1 million in 2023 alone.

We’ve identified the best brokers regulated by the BaFin, after personally verifying their credentials on the regulator’s Database of Companies.

Top BaFin Brokers

These 4 BaFin-regulated trading platforms go the extra mile for day traders:

-

1

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

2

FXCM

FXCM -

3

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money. -

4

MultiBank FX

MultiBank FX

Here is a summary of why we recommend these brokers in January 2026:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- FXCM - FXCM is a respected forex and CFD broker, established since 1999. The British-headquartered broker has won multiple awards and operates in various jurisdictions, including the UK and Australia. With zero commissions, over 400 assets, and a range of analysis tools, FXCM remains a popular choice for day traders. The broker is also regulated by top-tier authorities including the FCA, ASIC, CySEC, FSCA, BaFin.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

- MultiBank FX - MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms.

BaFin Brokers Comparison

| Broker | Regulated by BaFin | EUR Account | Minimum Deposit | Markets |

|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| FXCM | ✔ | ✔ | $50 | Forex, Stock CFDs, Commodities CFDs, Crypto CFDs |

| CMC Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| MultiBank FX | ✔ | - | $50 | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

FXCM

"FXCM maintains its position as a top pick for traders deploying automated trading strategies, with four powerful platforms, strategy backtesting and algo trading through APIs. The broker is also great for active traders, with discounted spreads and low to zero commissions on popular assets."

William Berg, Reviewer

FXCM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Commodities CFDs, Crypto CFDs |

| Regulator | FCA, CySEC, ASIC, FSCA, BaFin, CIRO |

| Platforms | Trading Station, MT4, TradingView, Quantower |

| Minimum Deposit | $50 |

| Minimum Trade | Variable |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, AUD |

Pros

- Alongside the 4 charting platforms, FXCM also offers a market-leading range of specialist software for experienced investors, including QuantConnect, AgenaTrader and Sierra Chart

- Traders can utilize several top-tier trading tools including a market scanner, forex signals and third-party research site, eFXPlus

- The broker offers spread discounts and other excellent perks for experienced traders in the Active Trader account

Cons

- The live chat support can be slow and unreliable compared to the top competitors

- There is no choice of retail accounts for traders, nor any Cent/Micro account options

- Although FXCM continues to gear their services towards experienced traders, it’s a shame that there are no managed accounts on offer

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- CMC Markets has added an AI News feature, using AI to surface and summarise market stories rather than place trades for you, hinting at where broker research tools are heading.

- We've bumped up its 'Assets & Markets' rating after almost monthly product additions in early 2025, from extended hours trading on US stocks to new share CFDs.

- CMC offers excellent pricing, including tight spreads and low trading fees for all but stock CFDs. The Alpha and Price+ schemes also offer perks for active traders with up to 40% discounts on spreads.

Cons

- While CMC offers an above-average suite of assets, there is no support for trading real stocks and UK clients can’t trade cryptocurrencies.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

- Trading stock CFDs incurs a relatively high commission, especially compared to the cheapest brokers like IC Markets.

MultiBank FX

"MultiBank FX is a great option for active forex traders with 55 currency pairs, spreads from 0.0 pips and high leverage up to 1:500."

Tobias Robinson, Reviewer

MultiBank FX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

| Regulator | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC |

| Platforms | MultiBank-Plus, MT4, MT5, cTrader |

| Minimum Deposit | $50 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 |

Pros

- MultiBank has a global presence with 10+ regulatory licenses, including ASIC (Australia) and MAS (Singapore), boosting its trust score

- MultiBank is expanding its presence in the Middle East with an Abu Dhabi office and stock CFDs from the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX)

- MultiBank revamped its web and mobile platform in 2024, now offering a slick design that matches the website and a powerful TradingView charting package

Cons

- MultiBank charges a $60 monthly inactivity fee, which is significantly higher than the industry average from our broker tests

- The $5,000 minimum deposit required to access the tightest ECN spreads makes for a high entry barrier for many retail traders

- The education and market research from MultiBank still needs work, trailing the best brokers in this category like IG and XTB

Methodology

To identify the top brokers regulated in Germany, we:

- Scanned our database of 140 brokers to identify those who claim to be regulated by the BaFin

- Ran their company credentials through the public register to verify they were authorized

- Ranked them by their rating, blending 100+ data points with the findings of our testers

How Can I Check A Broker Is Regulated By The BaFin?

Checking a broker is regulated by the BaFin is straightforward:

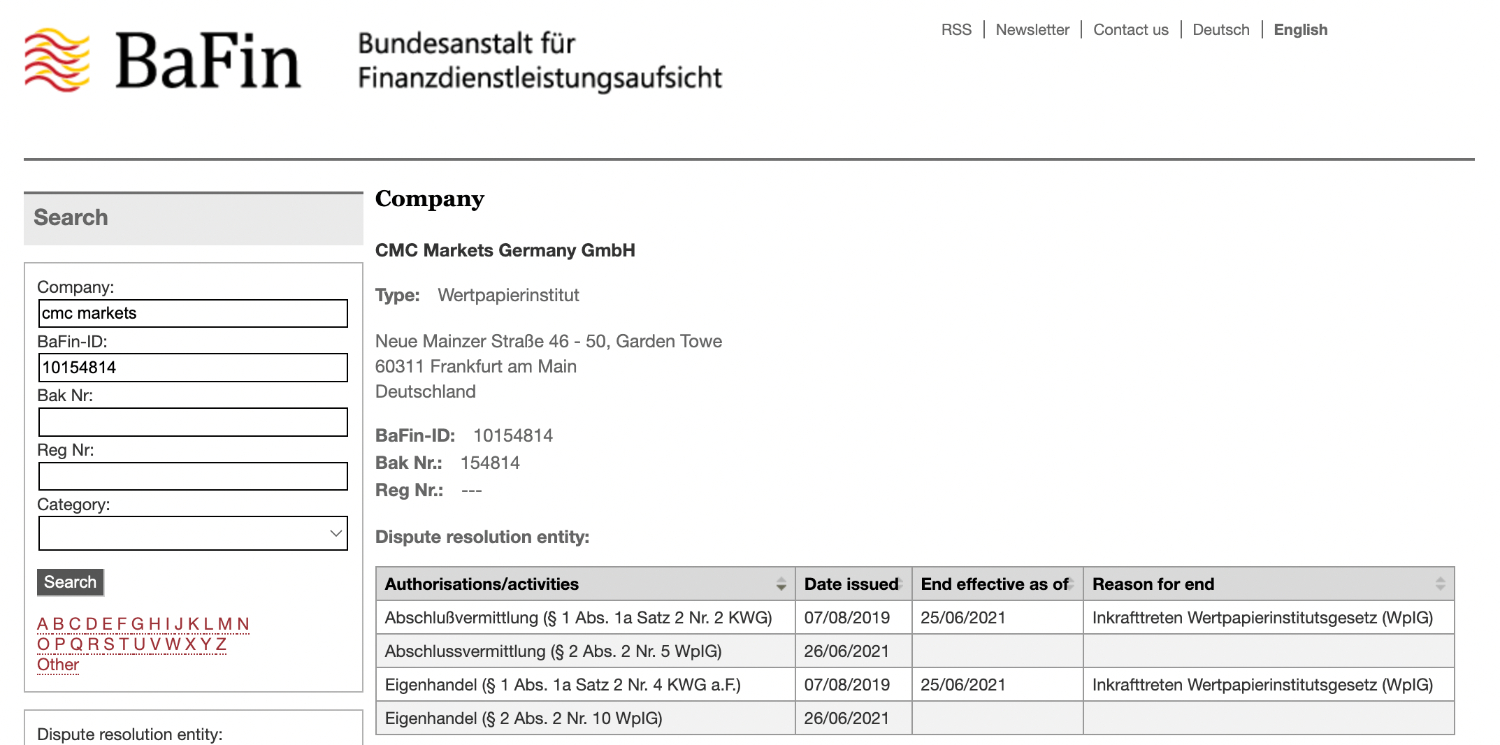

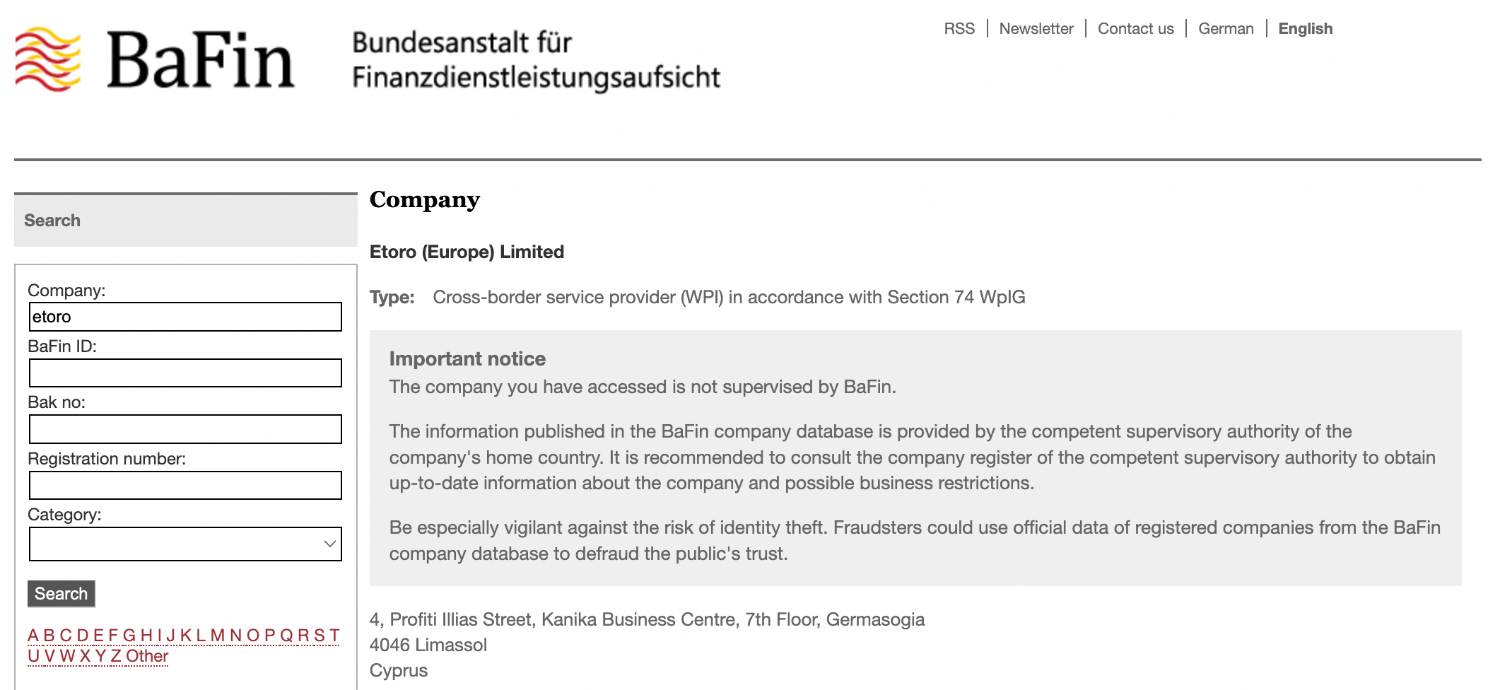

- Navigate to the BaFin’s Database of Companies

- Enter the broker’s name or BaFin-ID in the left-hand search bar and press ‘search’

- Click on the ‘selected’ companies to check details, such as authorized activities and date issued

Below you can see the results of a search I ran on CMC Markets (sports one of the best charting platforms I’ve used), showing the broker is authorized.

Below you can see the results of a search I ran on eToro (offers a fantastic social trading network), showing the broker is not authorized.

Below you can see the results of a search I ran on eToro (offers a fantastic social trading network), showing the broker is not authorized.

What Rules Must BaFin-Regulated Brokers Follow?

Online brokers regulated by the German Bundesanstalt für Finanzdienstleistungsaufsicht, or Federal Financial Supervisory Authority, must follow a robust set of rules to safeguard retail investors and the country’s financial system, notably:

- Brokers must deliver high-quality order execution, considering speed, price and likelihood of execution (key for short-term traders).

- Brokers must display risk warnings on websites, apps and social media, indicating the number of clients losing money trading products like CFDs (vehicle of choice among many day traders).

- Brokers must not offer leverage beyond 1:30 and should close out open CFD positions when an account’s total margin drops to 50%.

- Brokers must provide negative balance protection so clients can’t lose more than their balance while trading on margin (popular with active traders).

- Brokers must use segregated accounts with German banks to protect client money in case of broker insolvency.

- Brokers must routinely report financial and other relevant information to the BaFin.

- Brokers must not use bonuses to entice investors to deposit more money.

- Brokers must meet minimum capital requirements of €750,000.

Brokers that fail to satisfy the regulator’s rules risk enforcement action. For example, Degiro, one of the largest brokers in Europe and part of German-listed Flatex bank, was handed a €1,050,000 fine in 2023 for internal control failings relating to its money laundering and risk management systems.

The BaFin have also published a number of useful reports over the years that aim to educate retail investors about the risks of online investing, popular short-term trading products, and trends in the German financial markets.

I recommend reading the articles I’ve collated below.

- Beware of fraud

- New crypto tokens are a risk for consumers

- Risks of CFDs – every other provider fails to comply with the requirements

- The promises neo-brokers make – and the ones they keep

Bottom Line

Choosing a broker regulated by the BaFin is advisable for German day traders. This highly trusted, widely respected and proactive regulator helps ensure authorized brokers provide a secure, transparent and fair trading environment.

That said, online trading remains risky, even when you use a German-regulated broker. As such, only deposit what you can afford to lose.

Article Sources

- Federal Financial Supervisory Authority (BaFin) Website

- Database of Companies - BaFin

- Securities Trading Act - BaFin

- European Passport for Securities Trading Firms - BaFin

- Degiro Fine - BaFin

- Financial Services Fine Tracker - SteelEye

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com