Anzo Capital Review 2025

Awards

- Best Broker of the Year 2023 - Mindanao Traders Expo

Pros

- MetaTrader 4 platform

- Demo profile

- Tier 1 liquidity providers including Goldman Sachs and HSBC

Cons

- Week regulatory oversight

- Limited asset range

- Not available in the US

Anzo Capital Review

Anzo Capital Limited offers over 100 forex, CFD and commodity trading instruments. The broker boasts both STP and ECN account models, alongside MT4 access and multilingual customer support. This 2025 Anzo Capital review will explore the broker’s markets, fees, login security, demo accounts, regulation and more. Find out if our experts think you should trade with Anzo Capital.

Anzo Capital Headlines

Founded in 2015, Anzo Capital is registered in Belize and has its headquarters in Belize City. The company has an additional office in Melbourne, Australia.

Clients are primarily concentrated in Asian countries like Thailand and the Philippines, though the broker accepts traders from all over. With that said, US clients are not accepted.

Anzo Capital is regulated by the Financial Services Commission of Belize, registration number; 000331/281. The brokerage also holds client funds in segregated accounts and is authorized by the Financial Conduct Authority in the UK and the Financial Services Agency in St. Vincent and the Grenadines.

Account holders benefit from competitive trading conditions, including 0.0 pip spreads alongside a $2 commission per side. Anzo Capital also offers trading signals, a VPS, a MAM account, plus automated copy trading.

New users can get started with a $100 minimum deposit.

Trading Platforms

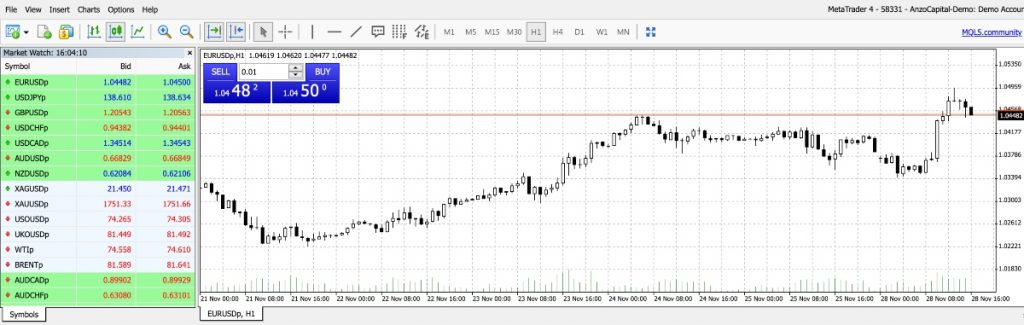

MT4

Anzo Capital offers the world-leading MetaTrader 4 (MT4) platform that is often used for forex and CFD trading.

MT4 is a fast and reliable software package that can be downloaded onto both mac OS and Windows computers. The platform can be used as a desktop client or a browser-based platform with the MT4 WebTrader. Platform features include:

- Copy trading

- 9 timeframes

- Multi-Terminal

- One-click trading

- 3 execution modes

- Trading signals

- Automated trading via EAs

- Trading operations history

- 3o built-in indicators, 2000 free custom indicators + 700 paid custom indicators

MT5

Anzo Capital also offers MetaTrader 5. The MT5 software can be downloaded to desktop devices or accessed through web browsers and a mobile app.

MT5 is a step up for active traders, with more advanced features, additional indicators and drawing tools, plus more order types. The flexible trading system also offers extensive customization, a newsfeed, plus MQL5 signals.

For traders seeking professional technical and fundamental analysis tools, MetaTrader 5 is a good option.

How To Trade

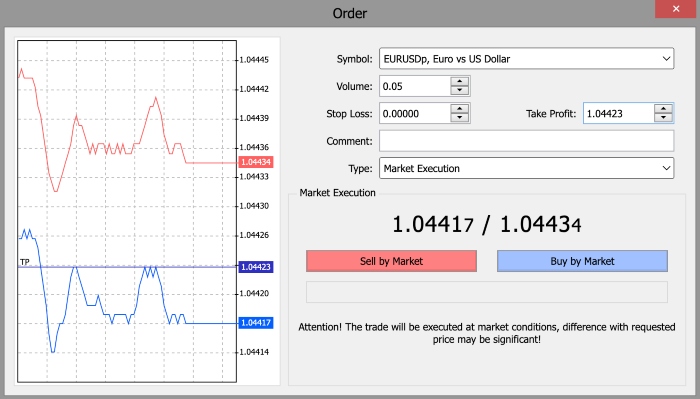

Making a trade on the Anzo Capital MT4 and MT5 platforms is straightforward:

- Login to the desktop software, web terminal or mobile app

- Use the instrument menu on the left to find an asset

- After you have overlaid any indicators and analysis, select the new order icon (white page with green plus)

- Select the execution mode – market execution or pending

- Enter the position size in the volume box

- Input any risk management parameters

- Click on Sell or Buy to confirm the trade

Assets & Markets

3 / 5Clients of Anzo Capital can trade on 100+ instruments:

- Forex – Over 45 currency pairs split into two groups: major & minor pairs have lower spreads and exotic pairs have higher spreads. Maximum leverage rate of 1:1000

- CFDs – Brent & WTI oil, 13 equity indices and 30 US and European company stocks. The maximum leverage offered is 1:500

- Precious Metals – Gold and silver with leverage up to 1:100

While a relatively decent range of trading assets, our experts did note that some alternatives offer a wider selection of instruments, including cryptocurrencies.

Spreads, Commissions & Fees

Anzo Capital primarily earns its money through spreads and commissions. For a major pair like EUR/USD, STP account spreads are targeted at 1.4 pips, whereas ECN account spreads have a much lower target of 0.0 pips. Exotic pairs, such as EUR/SEK, target 22.1 pips and 7.2 pips for STP accounts and ECN accounts, respectively. ECN accounts also have a USD/EUR 4 commission per round turn lot.

Additionally, there is a dormancy fee of USD 15 per month on an account if there has been no activity, such as trades, deposits or withdrawals for 90 calendar days. If there are no funds in the account, the account is archived.

Furthermore, if users wish to make a withdrawal from an account without having conducted any trading activities, they are charged a 6% administrative fee.

Anzo Capital Mobile App

Anzo Capital users that wish to trade on the go have the option to download the MetaTrader 4 or MetaTrader 5 apps that are available for both Apple iOS and Android devices.

These applications have most of the functionality of the MT4 or MT5 platforms on desktop software or browsers, with many indicators and charting objects. Additionally, users can manage their accounts and make deposits and withdrawals from within the mobile interface.

Payment Methods

When we used Anzo Capital, we could fund our trading account using various payment options:

- Wire Transfer – 2-5 business days for the funds to be deposited into your account. Minimum deposit of USD/EUR 100 with no maximum limit. Third-party fees are borne by the broker if the deposit is over USD/EUR 3,000.

- Credit Cards & Debit Cards – Immediate, free transfer of funds. Minimum deposit of USD/EUR 100 and maximum of USD/EUR 3,000.

- Digital Wallets – Skrill (USD/EUR), Neteller (USD/EUR), and Sticpay (USD) can all be used to deposit funds easily into Anzo Capital accounts. Funds are deposited immediately at no cost and with no maximum limit. Skrill & Neteller have a minimum deposit of USD/EUR 20, while Sticpay payments must be more than USD 100 and cannot be enacted in EUR.

- Online Banking – THB, MYR, IDR, VND and NGN accepted. Immediate and free deposits.

- Cryptocurrencies – Deposits can be made in Bitcoin (BTC), Tether (USDT) and USD Coin (USDC).

Demo Account Review

Anzo Capital offers users a free 30-day demo account funded with up to USD 100,000. The demo account has access to all the features of MetaTrader 4 and MetaTrader and up to 1:1000 leverage, so traders can gain valid, realistic experience with the platforms.

Regulation & Licensing

Anzo Capital is a legitimate broker that holds a license with the International Financial Services Commission (IFSC) of Belize, with registration number 000331/172. Belize has committed to adhering to the objectives of the UN.

The company is also authorized by the St Vincent & The Grenadines Financial Services Authority and the UK Financial Conduct Authority.

Our experts found that Anzo Capital segregates client capital from the broker’s operational funds. This helps to protect traders in the event that the broker goes bankrupt.

Note that NFA and CFTC regulations prevent US-based traders from opening an account with non-US regulated brokers.

Promotions & Bonuses

Anzo Capital offers new users a welcome deposit bonus up to $500. Clients need to trade a certain number of lots to release staggered bonus funds. The trading credit is usually available in user accounts within two days. Profits from the joining bonus can also be withdrawn. A 10% bonus on subsequent deposits is also available.

The broker also offers other promotions and deals periodically. Check the firm’s website or social channels for the latest offers.

Account Types

Anzo Capital clients can open either STP or ECN accounts.

ECN

- USD/EUR 4 commission per round turn lot

- USD/EUR 500 minimum deposit

- Dedicated 24/5 account manager

- Corporate accounts supported

- 1:500 maximum leverage

- Floating spreads

- 80% margin call

- 50% stop out

- Micro lot trading

- Training guidance

- EAs

STP

- USD/EUR 100 minimum deposit

- 1:1000 maximum leverage

- No commissions

- Floating spreads

- 80% margin call

- 50% stop out

- Micro lot trading

- Training guidance

- EAs

When you first register an account and login to Anzo Capital, you must provide supporting documents for validation. These are for proof of identification and residence.

Leverage

The maximum leverage available at Anzo capital is 1:1000. However, this will depend on your account equity:

- Up to $5,000 (forex only) – 1:1000

- Up to $50,000 – 1:500

- Between $50,001 and $100,000 – 1:300

- Between $100,001 and $250,000 – 1:200

- Above $250,001 – 1:100

Anzo Capital Additional Features

Anzo Capital offers copy trading through Myfxbook Autotrade. This allows users to copy the positions of other traders directly through the MT4 platform. Users get detailed performance statistics and can access various instruments and strategies.

Simply register for a Myfxbook Autotrade ECN account and meet the $1000 minimum deposit requirement. The commission is $12 per lot roundturn.

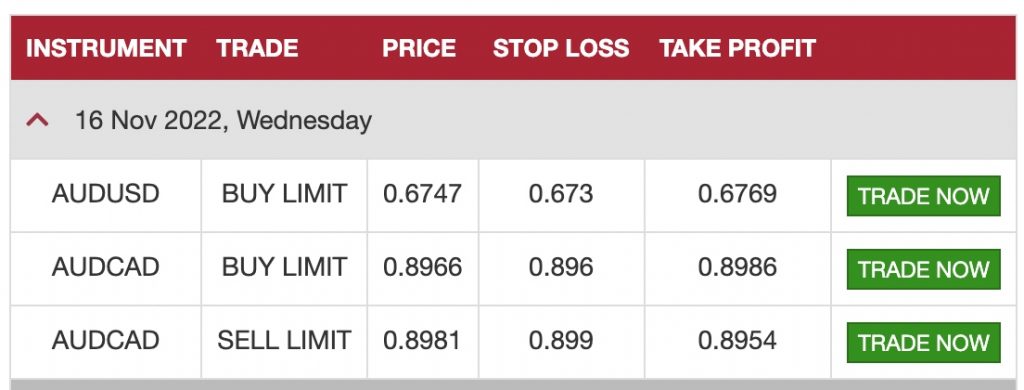

There is also a Research & Tools tab on the Anzo Capital website that provides a wide range of helpful information and guides such as forex guides, economic calculators, daily insights and trading signals.

In addition, Anzo Capital hosts a VPS, allowing users to trade 24/7 without any downtime or technical interruptions. There is no lag and clients can trade remotely via the MT4 and MT5 platforms. The VPS is free of charge to traders with an average daily balance of $5000 and that trade 5 lots round turn each month.

Customer Support

3 / 5While using Anzo Capital, we found customer service is offered in several languages, including English, Nigerian, Spanish and Vietnamese.

Live chat is available 24/5 and responses to email tickets (support@anzocapital.com) can be expected within two hours during working hours. Additionally, the broker is available on social media like Facebook, Twitter, Reddit and YouTube.

Anzo Capital Verdict

Anzo Capital is an accessible forex and CFD broker that offers low minimum deposit and trade limits, alongside high leverage and a range of payment methods and multilingual support. The implementation of the world-leading MetaTrader 4 and MetaTrader 5 platforms, plus copy trading through Myfxbook and STP/ECN executions, means Anzo Capital offers a competitive investing experience. The only major drawbacks are the limited regulatory oversight, narrow range of products, and inactivity fees.

FAQs

Is Anzo Capital Legitimate?

Yes, the broker is regulated by the International Financial Services Commission based in Belize. Anzo Capital acts per industry regulations to ensure that client funds are held in accounts separate from the company funds and customers have legal protection in the event of malpractice.

In Which Countries Are Residents Permitted To Make Anzo Capital Accounts?

The only countries in which residents cannot make an account with the broker is the USA and Japan. This means that traders based in any other country, including Nigeria, the Philippines, Indonesia and South Korea, can trade with Anzo Capital.

How Do I Open An Anzo Capital Account?

To make an account with Anzo Capital, you need to fill in a registration form that you can find on the broker’s website, submit the verification documents and deposit at least USD 100 for an STP account or USD 500 for an ECN account.

What Trading Platforms Are Available on Anzo Capital?

Traders can use the MetaTrader 4 or MetaTrader 5 platforms on any of their devices. This means clients can use the desktop browser version, the computer application that is downloadable on both Mac OS and Windows and the mobile app available on Apple iOS and Android.

Does Anzo Capital Provide A Demo Account?

Yes, there is a free 30-day demo account available for all users and prospective clients. If you are an inexperienced trader, you can take advantage of this service to learn about the different markets and platforms by using the USD 100,000 in digital funds and 1:1000 leverage.

Top 3 Alternatives to Anzo Capital

Compare Anzo Capital with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Anzo Capital Comparison Table

| Anzo Capital | World Forex | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 4.3 | 3.9 |

| Markets | CFDs, Forex, Precious Metals, Stocks | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $1 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSC, SVGFSA, FCA | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 20% Deposit Bonus up to $10,000 | 100% Deposit Bonus | – | $100 No Deposit Bonus |

| Education | No | No | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 9 | 10 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Anzo Capital and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Anzo Capital | World Forex | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Anzo Capital vs Other Brokers

Compare Anzo Capital with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Anzo Capital yet, will you be the first to help fellow traders decide if they should trade with Anzo Capital or not?