Yield Curve Control (YCC) Trading Strategies

Yield curve control (YCC) is a monetary policy tool used by central banks to target specific yields on government bonds to influence overall economic conditions.

Traders can leverage YCC strategies to optimize their portfolios and trading strategies.

Key Takeaways – Yield Curve Control Trading Strategies

- Capitalize on central bank interventions by buying bonds at targeted maturities.

- Exploit yield spreads through strategies like carry trades – i.e., borrowing short-term and going long at higher yields.

- Monitor central bank commitment closely. Policy shifts can impact trading positions and require adjustments.

Understanding Yield Curve Control

Central Bank Objectives

Central banks implement YCC to stabilize the economy, control inflation, and manage interest rates.

They influence borrowing costs, spending, and investment by setting target yields for various maturities.

Market Operations

Central banks conduct open market operations to maintain target yields by buying or selling government securities.

Buying is done to help lower yields; selling is done to raise yields.

This intervention directly impacts bond prices and yields, and can create opportunities for traders.

Key Concepts for YCC Trading Strategies

Yield Curve

The yield curve represents the relationship between bond yields and their maturities.

Under YCC, specific points on this curve are targeted by central banks (e.g., 2-year yield, 3-year yield (e.g., Australia) 10-year yield (Japan)) which can shape the entire curve’s behavior.

Bond Pricing

Bond prices and yields have an inverse relationship.

When a central bank buys bonds to lower yields, bond prices rise.

This makes bonds more expensive relative to what they were if they were dictated by the free market.

Trading Strategies in a YCC Environment

Riding the Yield Curve

Traders can capitalize on the central bank’s intervention by following what policymakers are likely to do.

This involves buying bonds at targeted maturities, anticipating that central bank actions will do the same to keep yields low and bond prices high.

Following, or front-running the actions of big players, is a popular strategy in all markets.

Spread Trading

YCC creates opportunities for spread trading, where traders exploit differences between the yields of bonds with different maturities.

By taking long and short positions, traders can profit from changes in the yield spread.

Carry Trade

In a YCC environment, traders can engage in carry trades by borrowing at lower short-term rates and investing in longer-term bonds with higher yields.

The central bank’s commitment to low yields at targeted maturities reduces the risk of significant yield changes.

Case Studies of YCC Trading Strategies

Japan’s Yield Curve Control

The Bank of Japan (BOJ) targeted a 0% yield on 10-year Japanese Government Bonds (JGBs) in 2016, perhaps the most famous case of yield curve control due to Japan’s persistent issues with deflation.

Traders took advantage of this by buying 10-year JGBs in the lead up, confident that the BoJ’s interventions would maintain low yields and high bond prices.

Australia’s Yield Curve Control

In March 2020, the Reserve Bank of Australia (RBA) targeted a 0.25% yield on 3-year Australian Government Securities (AGS).

Traders leveraged this by purchasing 3-year AGS, expecting the RBA to support prices and keep yields low.

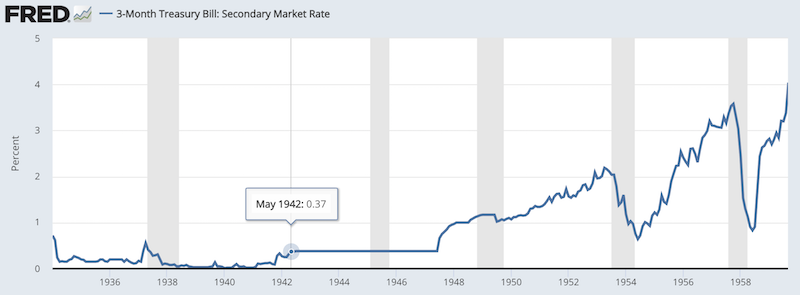

US During World War II

Back then, the high economic demands of World War II required capping funding rates to avoid US government debt – and eventual servicing requirements – from getting out of hand.

From May 1942 to June 1947, short-term interest rates were held at 0.375 percent.

(Source: Board of Governors of the Federal Reserve System (US))

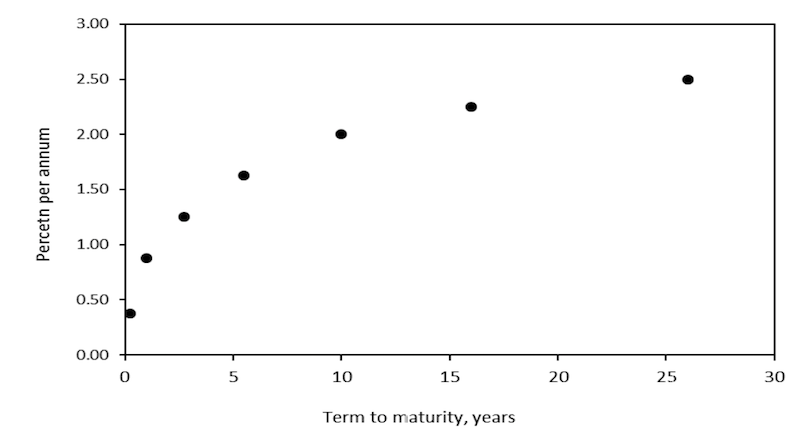

Other yields included:

- a 0.875% yield on 1-year bills

- a 2% yield on 10-year notes, and

- a 2.25% yield on 16-year bonds.

- Yields of 2.5% were assigned to 31-year issues.

(Source: New York Federal Reserve)

The specific pattern of rates chosen was chosen because they were simply the financing rates that existed at the time.

Interest rates were already low due to ongoing recovery from the heavily deflationary debt bust that came to a head in 1929.

Nominal rates were kept fixed independent of growth and inflation trends and there was little interest in adopting market-clearing rates.

A trading strategy that was employed at the time was borrowing cheaply in the short-term market and investing it at higher rates.

Risks and Considerations in YCC Trading

Central Bank Commitment

The effectiveness of YCC trading strategies depends on the central bank’s commitment to maintaining target yields.

Any sign of wavering commitment can lead to market volatility and impact trading positions.

Market Distortions

YCC can distort natural market dynamics, which can make it challenging to predict price movements accurately.

Exit Strategy

When central banks decide to exit or adjust YCC (e.g., Japan in 2024), it can cause significant yield fluctuations.

Traders need to monitor central bank communications closely to anticipate potential shifts in policy and adjust their strategies.

Understand the Drivers of Yields

Moreover, it’s important to understand what causes policymakers to change decisions.

A weakening currency is an issue for policymakers and can cause internal strife (e.g., favoring exporters over consumers).

It can also feed inflation if yields are artificially kept too low.

If inflation is above the central bank’s target, keeping yields low is less tenable.

Advanced YCC Trading Techniques

Yield Curve Slope Strategies

Traders can implement strategies based on changes in the yield curve slope.

For example, they might take positions anticipating a steeper or flatter yield curve, depending on economic conditions and central bank actions.

Curve trading strategies are often called “steepeners” and “flatteners.”

Duration Management

Managing the duration of a bond portfolio is important in a YCC environment.

Traders can adjust the duration to align with central bank targets.

Hedging Strategies

Given the potential for policy shifts, hedging strategies can be important.

Traders can use interest rate derivatives, such as swaps, futures, and options, to protect against adverse movements in yields.

Example Trading Strategy: Carry Trade Using YCC

Scenario

The central bank maintains low short-term interest rates and targets a low yield on long-term bonds.

Steps to Implement the Trade

Research/Analysis:

- Identify low short-term interest rates and central bank targets on long-term bonds.

- Understand the risk of interest rate changes and central bank policy shifts.

Borrow Funds:

- Borrow $1,000,000 at a short-term interest rate of 0.25%.

Invest in Long-Term Bonds:

- Put the borrowed funds in 10-year government bonds yielding 0.5%.

- If 10-year bonds are trading at $95 per bond, purchase 10,526 bonds ($1,000,000 / $95 per bond).

Monitor and Manage:

- Monitor the yield curve, central bank announcements, and the short-term borrowing rate.

- Be sure the yield spread remains favorable to cover borrowing costs and generate a profit.

Close the Trade:

- Sell the long-term bonds when the central bank’s policy indicates a potential rise in short-term rates or when achieving desired returns.

Expected Outcome

- The carry trade benefits from the positive yield spread between long-term bonds (0.5%) and short-term borrowing costs (0.25%).

- This would net to $2,500 per year.

- Profits are generated from the interest rate differential, assuming stable market conditions and central bank support.