Interest Rate Options

Interest rate options can be used by investors to benefit from future changes in interest rates. They provide liquidity and flexibility while also serving as risk management across the US dollar yield curve, for example. Interestingly, the trading of interest rate derivatives in over-the-counter markets more than doubled between 2016 and 2019, demonstrating their popularity with investors.

This guide will cover everything you need to know about trading interest rate options, including what they are, how they work, advantages and disadvantages, plus working examples.

Below we list the top-rated brokers that offer retail options trading in 2026.

Options Brokers

Interest Rate Options Explained

Interest rate options are financial derivatives that enable investors to benefit from changes in interest rates over time. Contracts are often made on different kinds of bonds, such as treasury securities. They also tend to be traded on exchanges like the CME Group or over the counter.

Importantly, interest rate options are different from other options, even though they work in largely the same way in that they rely on the current market rate of the underlying asset, have a strike price and an expiry date, and are subject to market volatility. They are different because while other options depend on the underlying security itself, trading interest rate options depend on the actual rates.

How Interest Rate Options Work

Interest rate options tend to be used as a hedge during economic uncertainty. When the option is purchased, the holder can pay a fixed rate for a rate that will likely vary in the future.

Interest rate options are similar to equity options in that they have premiums attached to them, a fee that the investor must pay to enter into the contract. Also similar to equity options, there are two standard types of contract:

- Call options

- Put options

A call interest rate option gives the holder the right, but not the obligation, to capitalize on interest rates rising. Investors can make money if the interest rates are trading at a higher rate than the strike price at the time that the option is exercised. The rates also need to be high enough that the profit is greater than the premium that was paid for the option.

A put interest rate option, on the other hand, gives the holder the right, but not the obligation, to capitalize on interest rates falling. In this case, the option will be profitable if the option is exercised at a time when the interest rates are lower than the strike price.

The exercise style for interest rate options is European, meaning that the contract can only be exercised at the expiry, and not before, as with American options. This makes interest rate options simple to use and trade with and minimizes the risk that can arise when exercising options too early.

Note, that interest rate options are cash-settled, and the profit is the difference between the strike price and the settlement value.

Strike Price

With regular options, the strike price is the price of the underlying security at the point of exercise. When trading interest rate options, on the other hand, the interest rate does not equate to a strike price, so the value of the option must be established in another way.

With that in mind, the value of an interest rate option is often 10 times the price of the underlying treasury yield. For example, if the underlying treasury yield is 7%, then the value of the option is $70. If the yield were to move to 7.7%, the value of the option would then be $77, and so on.

Caps, Floors & Collars

Caps and floors, plus collars are types of risk management products that are used to hedge interest rate risks. They are typically made up of multiple options with the same strike rate set, operating at successive periods.

Caps are used to set a maximum interest rate. They are made up of a series of options that are priced in accordance with predicted future interest rates. The strike rate tends to be set higher than the current interest rate, as this makes the premium lower for the investor.

An interest rate floor is used to set a minimum interest rate, and the strike rate will usually be set below current market rates to save on the cost of the premium.

Trading interest rate collars combine a cap and a floor, setting both a maximum and minimum interest rate. This is what happens when an investor buys a cap and sells a floor at a lower interest rate. They are a type of spread where one option is either partially or entirely financed by the selling of another option. Usually, interest rate collars are made up of a long cap and a short floor, where the income made from selling the floor is used to offset all or part of the cost of the cap. The issue with this is that if the interest rate drops below the floor, the collar will lose money to the extent that the interest rate has dropped below said floor.

Volatility

Volatility refers to the speed and size of movements in government bond yields or interest rates. Volatility is referenced by two terms: realized volatility and implied volatility. Realized volatility is the volatility that is actually observed in interest rate options, so the more that yields or interest rates move every day, the higher the realized volatility. Implied volatility refers to the expected fluctuation of market prices, and this has a big effect on how options are priced. Higher implied volatility means higher prices.

The volatility risk premium refers to the compensation paid to an options seller. This premium tends to equate to the difference between the implied and realized volatility of the option.

Example

Let’s look at an example to see how an interest rate option works…

You purchase an interest rate call option with a strike price of $40 and an expiry date of June 30th with an underlying benchmark of the 30-year US treasury and a premium of $1.

By June 30th, the yield has increased, and the option is now valued at $45. This would leave your net gain as $4 ($45 – $40 – $1 = $4). The premium must also be used in the equation to find out the total gain from the option. Because the yield increased, the option was worth more, and therefore a profit was made.

However, if the yield had dropped by June 30th and the option was valued at $25, then the option would expire and would not retain any worth, otherwise known as being out-of-the-money. In this case, the investor would lose the $1 premium and make no gain from the option.

Advantages

There are many ways in which interest rate options are useful to traders during times of economic uncertainty. The key advantage is that an interest rate option allows the holder to pay a fixed interest rate at a time when the interest rate may vary.

Interest rate options can be used as a hedging tool to help protect from fluctuating interest rates, so when an offsetting position is purchased, it reduces or entirely eliminates the risk that may have been present. Contracts can also help investors to diversify their portfolios.

Disadvantages

One of the drawbacks that some investors find with interest rate options is that they do not come with the opportunity of early exercise like American-type options. This means that they are not as flexible, and investors are not able to take advantage when interest rates are more favorable. There is an opportunity for offsetting the option by entering into another contract, which is a way to negate the contract but is not the same as exercising it.

Interest rate options are also risky in some circumstances. They are more sensitive to market volatility than other trading tools, meaning that fluctuations can wipe out profits. Even if your interest rate option is in-the-money at one point during its lifetime, price fluctuations can change this since the strike price is so tightly connected to the underlying futures price.

Strategy

It is important to have a good understanding of the bond market if you are going to start investing in interest rate options. Ill-informed trading with limited understanding of how trades should be structured, or how options trading in general works, can lead investors to take on excessively risky trades. Importantly, many factors influence interest rates, including announcements from the federal reserve and similar authorities.

Delta Hedging

Delta hedging is where directionality is taken out of the option, locking in profits even as rates move. An option by itself is exposed to directionality because its value moves as rates do, and this directionality is known as the ‘delta’ of the option: the directional exposure the option has to interest rates.

Delta hedging is a trading strategy that takes away the ‘delta’ of the option, by purchasing an offsetting position that has the same amount of delta as the first option, but in the opposing direction.

When an option is delta hedged, it is then protected against the directional movement in interest rates, because any profit or loss that is brought about by the first option is offset by an equal profit or loss brought about by the opposing hedge.

Although delta hedging protects investors by offsetting profit and loss, traders can still profit from volatility during periods of significant movements. When a substantial shift occurs, the exposure can change more than the total of the delta hedge, and therefore generate a larger profit. The hedge then locks in the profit that is made.

Getting Started

To get started, the first step is to look for a broker that offers options trading. Keep in mind what your budget is as commissions and account charges vary. You may also need a margin account so check the rates available and account requirements.

Once your account is live you can start trading. You can enter orders by using an option chain. Option chains are tools that are used to identify the underlying asset, the expiration date, whether the option is a call or a put, and the strike price.

Stay Informed

It is also important to stay up to date on information regarding interest rates and respective markets. This can be done in several ways, from books to PDFs to informational videos. Many informational pieces also come with free PDF downloads, so information can be accessed at no charge.

Know When To Trade

Interest rate options trading typically occurs during usual stock market hours which are 9:30 am to 4:00 pm EST. Getting up early when the market opens can give you a headstart on monitoring market changes.

Final Word On Trading Interest Rate Options

Interest rate options can help hedge against changes in interest rates while providing decent payouts. However before you get started, get up to speed on the ins and outs of the bond market, as well as develop a sound understanding of yields, contract prices, and the factors that play into the rise and fall of interest rates.

FAQs

How Do You Value Interest Rate Options?

The value of an interest rate option is 10 times the underlying treasury yield for that contract. So a treasury with a 5% yield would have an option value of $50 in the associated options market.

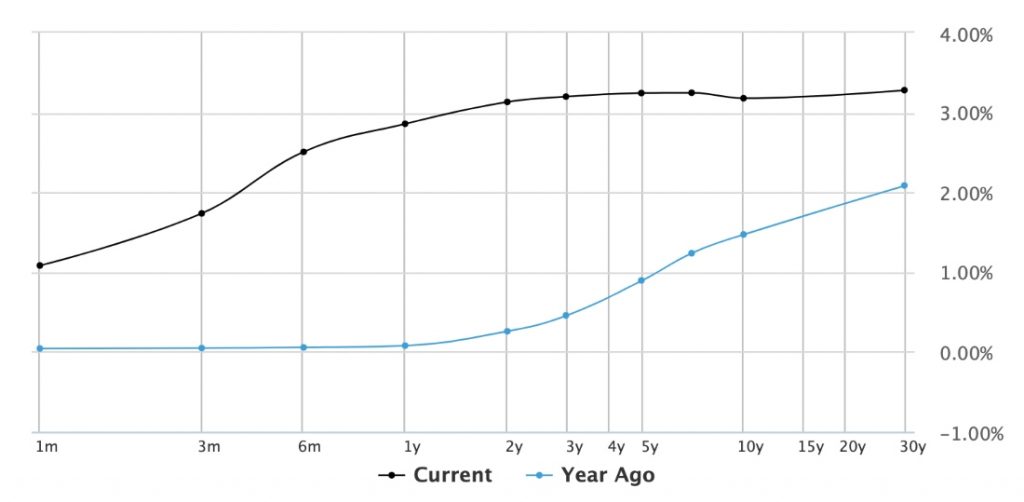

What Is The Yield Curve?

The yield curve plots the direction of treasury yields over a period, for example, two years. When shorter-term treasuries have a lower yield than longer-term ones, the yield curve slopes upwards, and if it’s the other way around then the opposite is true.

Where Can You Trade Interest Rate Options?

Interest rate options trading often takes place through the CME Group, which is one of the largest futures and options exchanges globally. However, some other exchanges and brands also offer suitable products.

Do Interest Rate Options Offer Early Exercise?

No, interest rate options operate like European options, meaning that you cannot exercise them before the expiration date.

How Are Interest Rate Options Settled?

Settlement amounts are converted to a cash value by taking the difference between the exercise strike price of the contract and the exercise settlement value based on the prevailing spot yield.