XTB Review 2025

Awards

- Best Forex Broker for Beginners 2022

- Best Customer Service 2021

- Best Forex Broker for Low Costs 2021

- Best Mobile App for Investing 2020

- #1 EMEA Bloomberg spot for FX accuracy in Q2 of 2020 and Q3 of 2018

- Best Polish Forex Broker 2019

- Best Execution Broker 2019

Pros

- Opening an XTB account is a hassle-free, entirely online process that takes just a few minutes, making the entry into day trading smooth for new traders.

- With over 7000 instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs for UK clients with 3,000 stocks and 700 ETFs for diverse opportunities.

Cons

- XTB discontinued support for MT4, limiting traders to its proprietary platform, xStation, potentially deterring advanced day traders familiar with the MetaTrader suite.

- The research tools at XTB are good but could be great if they went beyond in-house features with access to leading third-party tools such as Autochartist, Trading Central and TipRanks.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

XTB Review

In this XTB review, we balance the pros and cons of registering for an account by evaluating the day trading environment. This is based on our direct testing observations and comparisons from our extensive database of 226 brokers.

Regulation & Trust

4.6 / 5XTB is one of the most trusted brokers. It’s authorized by 5 ‘green tier’ regulators in DayTrading.com’s Regulation & Trust Rating, and is listed on the Warsaw Stock Exchange (XTB:WSE), ensuring a high degree of transparency with regular audits and public financial statements.

XTB is regulated under the following entities:

- XTB Limited is regulated by the UK Financial Conduct Authority (FCA)

- XTB Ltd is regulated by the Cyprus Securities & Exchange Commission (CySEC)

- XTB SA is regulated by the Polish Financial Supervision Authority (KNF)

- XTB MENA Limited is regulated by the Dubai Financial Services Authority (DFSA)

- XTB International Limited is regulated by the Belize International Financial Services Commission (FSC)

- XTB Indonesia Berjangka is regulated by the Bappebti

- XTB MENA Limited is regulated by the UAE Securities and Commodities Authority (SCA)

- XTB secured a securities agent license from Chile’s Financial Market Commission (CMF)

Retail investor money is held in segregated client accounts in line with the broker’s regulatory obligations. This means that your funds are held in a ring-fenced account to XTB’s own capital, preventing the broker from misusing your money.

In the UK, traders’ funds are protected up to £85,000 through the Financial Services Compensation Scheme (FSCS), in case of insolvency. In Europe, traders’ funds are protected up to €20,000 through the Cyprus Investor Compensation Fund (ICF). Clients elsewhere are not covered.

Weighing the negatives, we’ve lowered XTB’s trust score slightly following a $2.2 million fine from the Polish courts for “irregularities in the execution of client orders” – XTB passed on execution losses to its clients between 2014 and 2015, though it’s remained regulated with no further major breaches.

Also, despite expanding to Asia and the Middle East alongside Latin America in recent years, notably adding licenses from Indonesia’s Bappebti and the UAE’s SCA in late 2024, as well as Chile’s CMF in 2025, XTB still holds fewer regulatory licenses than our most trusted broker, IG.

Its track record stretching back to 2002, is extensive, and provides confidence in the stability of the XTB operation.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Trading Accounts

XTB offers three account types, though options may vary by country:

- Standard: Features floating spreads with a minimum spread of 0.5 pips, adjusting based on market conditions. There are no commissions, making it suitable for traders seeking straightforward pricing.

- Professional: Also operates with floating spreads but features a minimum spread of 0.1 pip and incorporates market execution, necessitating a small commission for market-level spreads. Praise must be given to XTB for offering negative balance protection to professional clients, meaning losses cannot exceed deposited funds. Most brokers reserve this safeguard for retail clients only.

- Islamic: Swap-free conditions with no interest fees for Islamic traders in certain countries.

One notable downside is that XTB does not provide a raw spread account for retail day traders. We’re increasingly seeing the best brokers, such as Pepperstone and IC Markets, offer a choice between commission-free and raw-spread/low-commission accounts, catering to day traders at all levels.

XTB also offers a demo account that is credited with €100k in virtual funds. But disappointingly, the demo account is only active for four weeks. This is a notable criticism because I think you should be able to test a platform for as long as you need to before committing funds.

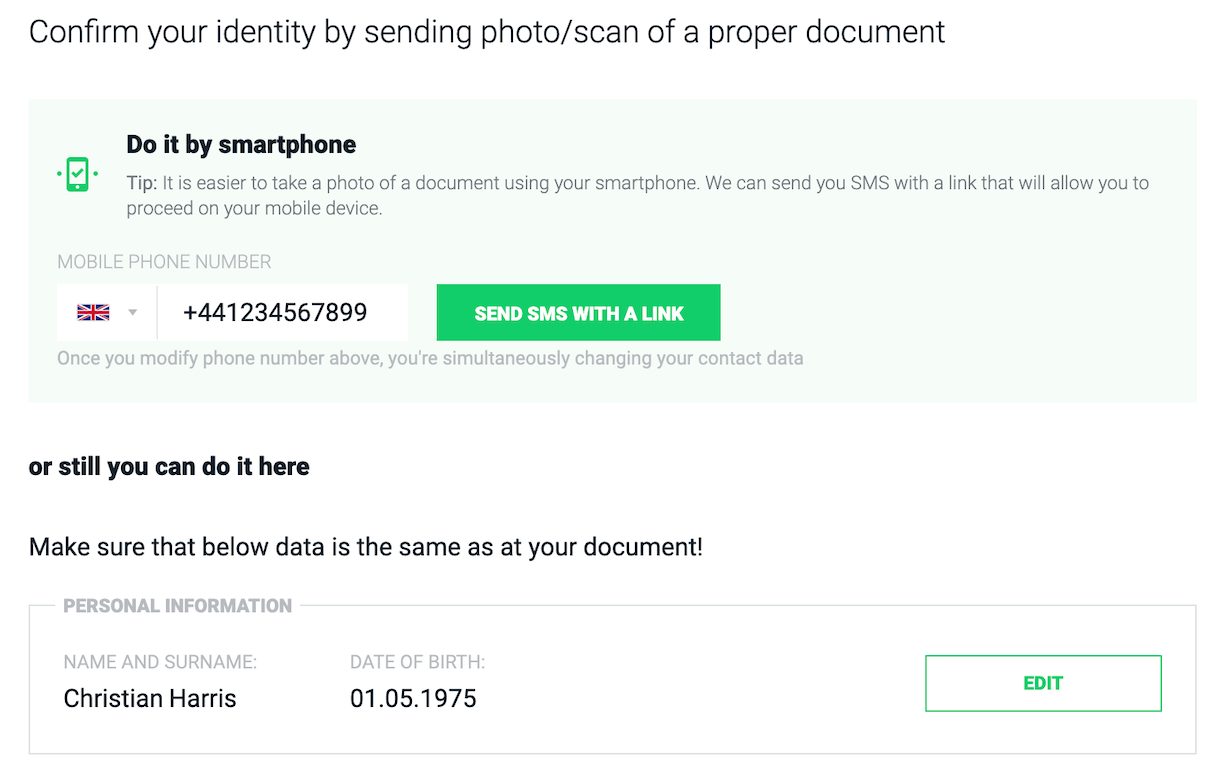

On a lighter note, I found the process of opening an XTB account to be incredibly smooth and easy to navigate, entirely online, and it only took a few minutes from start to finish.

XTB has also distinguished itself by introducing interest on uninvested cash balances, providing an opportunity to earn while assessing potential market opportunities. This interest is automatic, and the rate depends on the deposit size and currency.

We are seeing more brokers introduce interest on idle funds, notably eToro, but you need to deposit $50,000 to qualify for the top rate, whereas at XTB, there is no qualifying balance.

Deposits & Withdrawals

XTB accepts an excellent range of convenient and secure payment methods, including credit/debit cards (Visa, Mastercard, Maestro), e-wallets (Skrill, Paysafe, Neteller), and wire transfers. All options are limited to the country where your account is registered. For example, PayPal isn’t offered to non-EU residents.

The main benefit is that there is no minimum deposit, making XTB an attractive option for beginners and budget traders.

The choice of accepted base currencies includes EUR, USD, GBP, and HUF, which is decent compared to eToro which only offers USD but trails Interactive Brokers, which supports 12 base currencies.

There are no fees for depositing money via bank transfer, or credit and debit cards. UK residents are hit with a 2% fee for Skrill, but EU residents are not.

There are also no fees for withdrawals, but only as long as they are above £60, €80 or $100. It’s very disappointing that XTB has added this minimum withdrawal level, especially as most of the top-tier day trading brokers don’t have one.

You can only withdraw to a verified bank account too (for regulation purposes), which I find really frustrating as I like to withdraw to the same payment sources as my deposits.

From my experience using XTB, withdrawals are typically processed the same day if requested before 1 pm, or on the next business day if made after 1 pm. Withdrawals are transferred to your nominated bank account, requiring appropriate documentation.

While most withdrawals are free of charge, small sums may incur a fee.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Credit Card, Debit Card, Maestro, Mastercard, Neteller, PayPal, Paysafecard, Skrill, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4 / 5XTB provides an excellent range of over 7000 instruments spanning 8 categories: CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs (depending on location).

XTB conveniently categorizes 71 currency pairs, covering major, minor, and emerging (exotic), providing ample opportunities for forex trading.

You can access CFDs, which are suitable for short-term strategies, on more than 2000 shares from various countries, along with over 33 indices from global markets. Again, I like the way XTB categorizes the CFD types. For instance, the ‘Indices’ section is divided into ‘Americas’, ‘Asia-Pacific’ and ‘Europe’, which makes navigating a snap.

Cryptocurrency enthusiasts can trade 50 major coins such as Bitcoin, Litecoin, Ripple, and Ethereum, although this option is not available to UK traders in line with regulatory restrictions.

XTB introduced ‘Investment Plans’ in 2024, enhancing its offering for hands-off traders, allowing you to tailor portfolios from a choice of 700 ETFs based on your risk tolerance, industry preferences, or regional focus. Inconveniently facilitated in the mobile app only, the platform automatically distributes invested funds to each ETF according to specified percentage allocations.

XTB does not provide futures or options trading, nor does it offer share baskets, treasuries, interest rates, bonds, or mutual funds, which would strengthen its investment offering.

Leverage

The leverage offered will depend on your location and local regulations. UK residents, for example, are onboarded to XTB Limited UK. As an FCA-regulated entity, the maximum leverage available is 1:30.

For EU residents, under CySEC regulation, leverage is also available up to 1:30

Non-EU residents have more flexibility with leverage up to 1:500.

Professional traders also get up to 1:500 leverage.

The inability to adjust the default leverage level of products is a frustrating limitation at XTB, as you should have control over this aspect. Manual adjustment of leverage can significantly mitigate trade risk, especially in forex and CFD trading, where preset levels may be excessively high.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (EU) 1:500 (Global) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

4.3 / 5XTB provides competitive pricing but trails the cheapest brokers for day trading, notably IC Markets and IG.

XTB’s fees for trading forex aren’t bad. Spreads are close to industry averages, with the average spread on EUR/USD being 1 pip during peak trading hours. Still, IC Markets stands out for its exceptionally tight spreads among brokers worldwide, boasting an average EUR/USD spread of just 0.1 pips.

On major indices, such as the S&P 500 CFD, 0.6 points is the average spread cost during peak trading hours (the fees are built into the spread). The Europe 50 CFD, on the other hand, has a less competitive starting spread of 2.4 points.

Although there’s no commission for stocks and ETFs if you trade less than €100,000 in a month, this offer isn’t the most competitive compared to platforms like eToro, which provide commission-free trading without any restrictions. For trades exceeding the €100,000 monthly limit on stocks or ETFs, a fee of 0.2% with a minimum of €10 applies.

You also have to consider that XTB applies a 0.5% conversion fee when trading real stocks and ETFs in a currency different from your account’s base currency.

Disappointingly, XTB imposes an inactivity fee on dormant accounts, which occurs after 12 months of inactivity. Subsequently, a $10 deduction is made from the trading account each month. This fee persists until you initiate a position or your account balance reaches zero. To prevent inactivity fees, I recommend withdrawing the balance entirely.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 1.0 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.8 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.03 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.2% | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

4 / 5XTB’s proprietary trading platform, xStation 5, is one of my favourites of the countless platforms I’ve used and stands out for its impressive features and user-friendly interface that I love. Ultimately, it’s a great entry point for newer traders.

Available either as a web or desktop version for Windows and Mac, both offer identical functionality and design. There’s also a slick mobile app for both iOS and Android – including smartwatches, which remains extremely rare among brokers but is super convenient.

I’ve been really impressed with how the platform directly caters to my needs, especially with its top-notch search function that quickly leads me to the instrument I’m looking for.

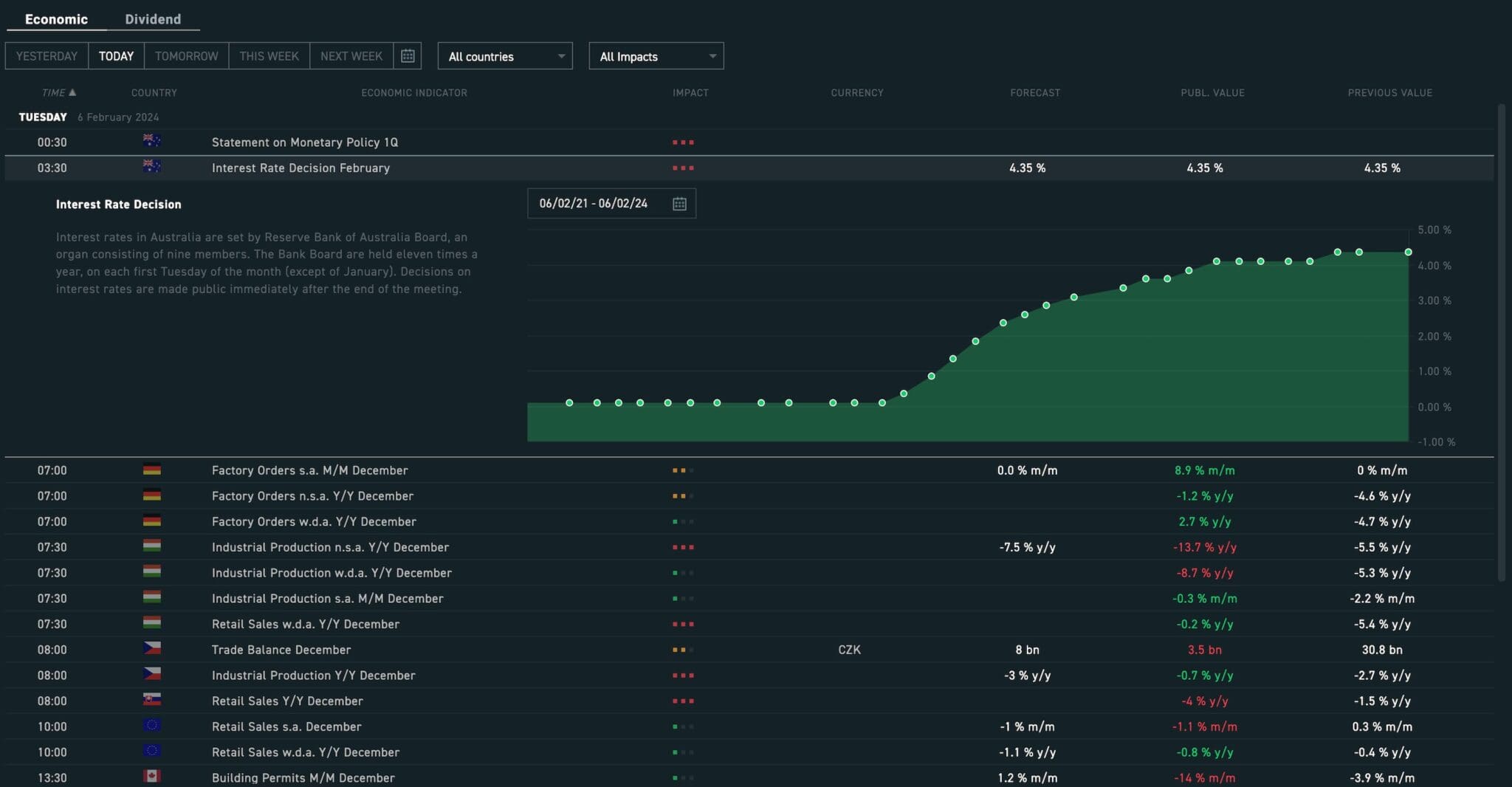

It feels like XTB has thought of nearly everything: a customizable news feed, a comprehensive stock screener, sentiment heatmaps, an economic calendar, and detailed market analysis can all contribute to your understanding of different assets.

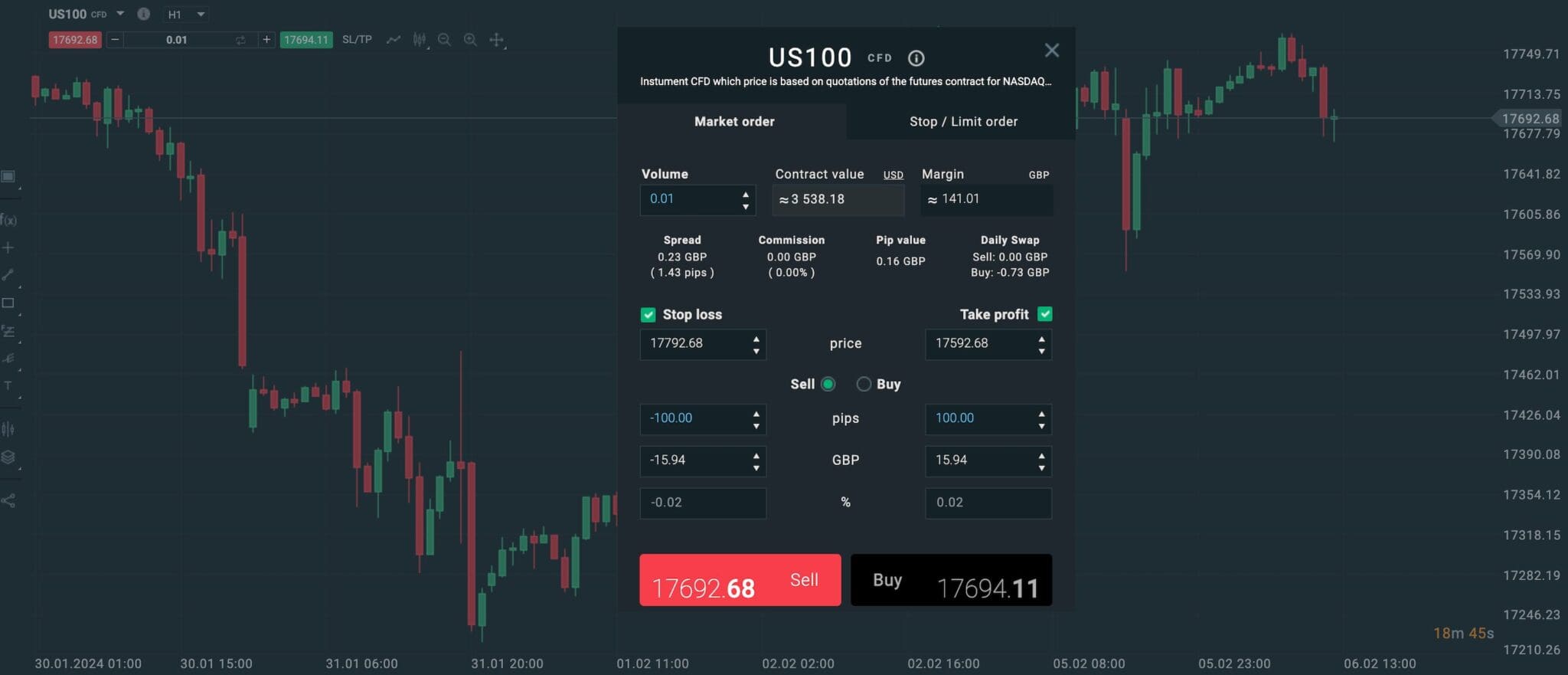

Executing trades also feels intuitive on this platform, thanks to the variety of order types at my fingertips, including Market, Limit/Stop, Stop-loss/Take-profit, and Trailing stop orders.

The trader calculator is another feature I appreciate; it simplifies the process of figuring out vital parameters like margin and commission for each trade.

The addition of order time limits such as Good ’til’ time (GTT) and Good-til-Canceled (GTC) gives me more control over when my trades are executed, enhancing the trading experience further.

Furthermore, xStation features a free market audio commentary – a paid service with other brokers.

Configuring alerts for various events is straightforward, including margin calls, deposits, withdrawals, and changes in open or closed positions. Additionally, the platform supports email, SMS, and push notifications, to help ensure you stay informed about important market developments.

Yet while xStation 5 comes packed with tools to combine fundamental and technical analysis, making for a fantastic trading experience, XTB does not support external trading platforms after discontinuing support for MetaTrader 4 in 2022. This will be a significant drawback for some advanced day traders, who may prefer popular third-party solutions like MetaTrader 4, MetaTrader 5 or TradingView.

This omission is hard to overlook, especially when the vast majority of the day trading brokers we’ve used support MetaTrader 4, and some top firms, notably AvaTrade, support third-party platforms in addition to their own software, providing ultimate flexibility.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | xStation | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

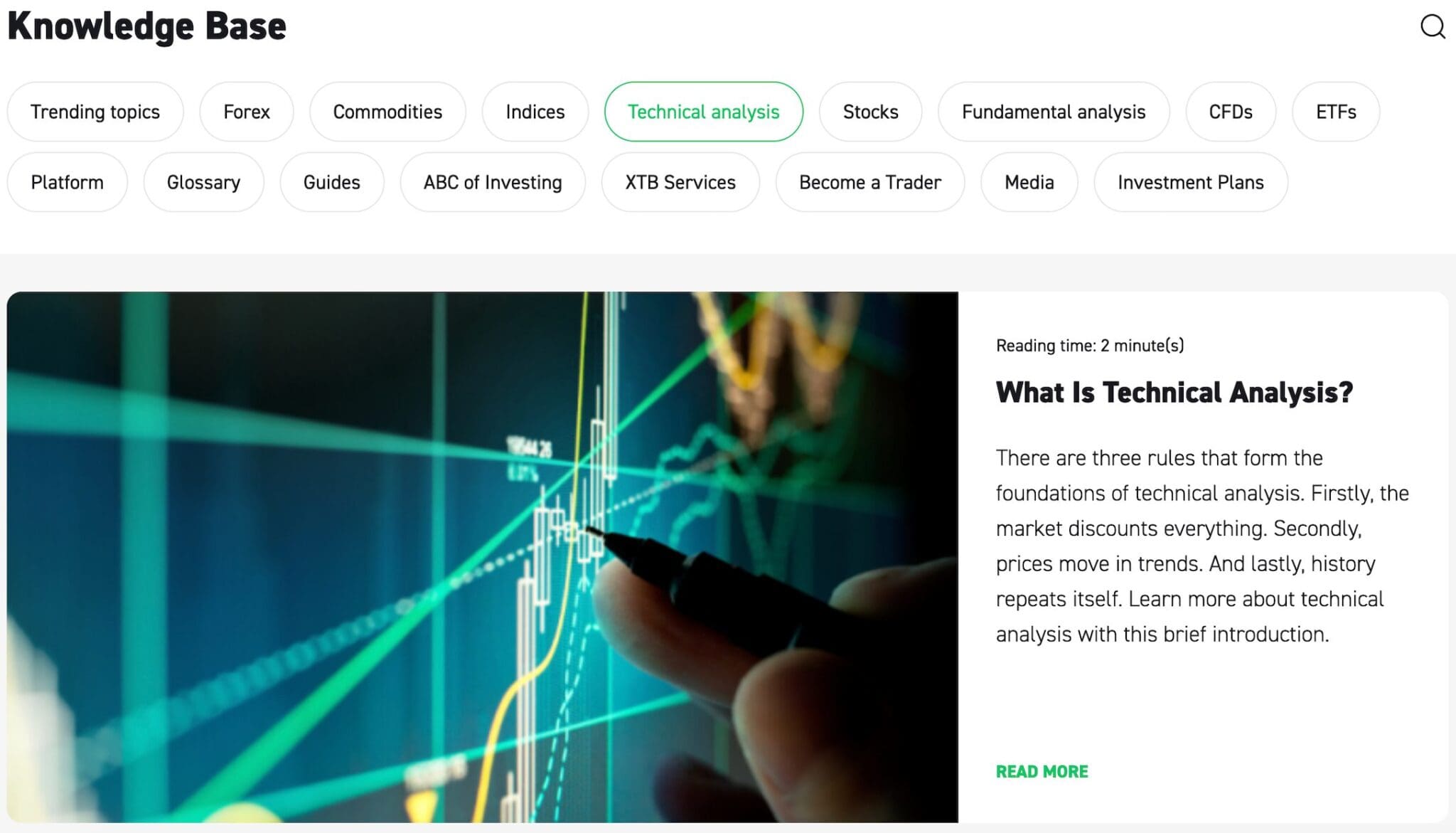

4.1 / 5XTB provides a great range of research tools, all of which can be accessed from the xStation 5 platform and some on the XTB website. The resources are also provided in multiple languages, including English, Arabic, and Chinese.

The platform offers access to fundamental analysis, technical analysis, and market insights. You can find up-to-date news streams provided by XTB’s own research team and economic calendars (with ‘market impact’ meters), though there’s no third-party analysis from reputable sources such as TipRanks or Trading Central, which would strengthen its offering further.

I’m particularly impressed with the economic calendar and market analysis features. They provide an insider’s view with detailed event summaries and crucial stock information like market cap, EPS, and P/E ratios, offering a richer insight than many competitors. This wealth of information is invaluable for refining trading strategies.

I’ve also grown fond of the ‘Stocks Scanner’ and ‘Heatmap’ tools. The scanner streamlines the search for stocks that meet my criteria, acting like a personal trading assistant. Meanwhile, the ‘Heatmap’ visually highlights market trends, making it simpler to identify opportunities.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5XTB offers a diverse array of well-written educational resources, from training videos to online articles covering a range of trading topics and platform guidance.

What stands out to me is the convenience of having educational videos right there on the platform. It saves me the hassle of sifting through the company’s website or scouring YouTube, which is incredibly valuable for someone eager to learn the ropes of trading.

Particularly beneficial for beginner traders, the guides are well-written and cover the most important aspects of trading, managing accounts, and using the xStation 5 platform. However, I’d have liked to have been able to filter education articles by experience level.

Also, some of the videos are quite old. Despite checking multiple times in recent years, the last ‘Live Workshop’ video is still from 2021.

My other complaint is that XTB doesn’t deliver regular live market analysis videos, a notable drawback compared to category leaders IG, which can be excellent for learning from experienced investors and even discovering trading ideas.

While XTB offers a wide range of educational materials, I encountered occasional gaps in the content that left me seeking additional resources elsewhere.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4.3 / 5The reliable customer service team at XTB operates 24 hours per day between Sunday and Friday, providing support via phone, email, and live chat.

XTB also has a presence on social media, should you prefer to make contact via Facebook, X (Twitter), Instagram, or YouTube.

Moreover, you benefit from having a dedicated account manager to address account-related inquiries and concerns.

A neat feature is live chat available within the platform, albeit only within working hours Monday-Friday. I’ve tested the live chat countless times over the years and a service representative always joins my chat within a few minutes and resolves my queries professionally.

| XTB | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With XTB?

You should trade with XTB if you want a beginner-friendly trading platform with zero commissions and access to a huge range of assets, especially CFDs.

Its transition in recent years to longer-term trading products like Investment Plans and direct share dealing will also serve investors and hands-off traders.

FAQ

Is XTB Legit Or A Scam?

XTB is a legitimate and reputable broker regulated by several financial authorities globally, including the UK’s Financial Conduct Authority (FCA). The company is also publicly listed on the Warsaw Stock Exchange.

With over two decades of experience and a large client base, XTB has established itself as a trustworthy broker in the industry, offering a great range of trading services and adhering to stringent regulatory standards.

Is XTB Suitable For Beginners?

XTB is suitable for beginners as it offers a user-friendly xStation platform and app, terrific educational resources, and demo accounts for practising day trading without real money.

Additionally, XTB provides excellent customer support to assist beginners with any questions or concerns they may have as they start their trading journey.

Does XTB Offer Low Fees?

XTB’s fees are generally competitive compared to other brokers. The commission-free stock and ETF trading up to a certain monthly trade volume is a notable advantage, along with the absence of deposit fees for bank transfers and no withdrawal fees above a certain threshold.

However, it’s important to consider factors such as currency conversion fees and inactivity fees, which may impact overall costs depending on your trading habits and preferences.

Is XTB A Good Broker For Day Trading?

XTB is suitable for day trading due to its fast and reliable trading platform, which offers instant execution and a variety of order types, including market, limit, stop-loss, and trailing stop orders.

The platform also provides access to advanced technical analysis tools and features like price alerts and notifications, which can be beneficial for active traders monitoring market movements throughout the day.

Does XTB Have A Mobile App?

XTB’s xStation app is available for both iOS and Android devices and even supports smartwatches. The app is intuitive and puts the online trading world at your fingertips. The slick design means you can easily monitor positions, execute trades, and access real-time data on the move.

Top 3 Alternatives to XTB

Compare XTB with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

XTB Comparison Table

| XTB | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.8 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CySEC, KNF, DFSA, FSC, SCA, Bappebti | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | xStation | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (EU) 1:500 (Global) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 10 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by XTB and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| XTB | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

XTB vs Other Brokers

Compare XTB with any other broker by selecting the other broker below.

The most popular XTB comparisons:

- XTB vs Crypto.com

- XTB vs Admiral Markets

- XTB vs Pepperstone

- Trading 212 vs XTB

- XTB vs Trade Republic

- XTB vs Exness

- XTB vs eToro

- Fusion Markets vs XTB

- XTB vs Revolut

- XTB vs Interactive Brokers

- XTB vs Binance

- ActivTrades vs XTB

Customer Reviews

4.7 / 5This average customer rating is based on 3 XTB customer reviews submitted by our visitors.

If you have traded with XTB we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of XTB

Article Sources

- XTB Website

- XTB Limited - FCA License

- XTB Ltd - CySEC License

- X-Trade Brokers DM SA - KNF License

- XTB Spain - CNMV License

- XTB MENA - DFSA License

- XTB International - FSC License

- Warsaw Stock Exchange: XTB

- XTB - Facebook

- XTB - Instagram

- XTB - X (formerly Twitter)

- XTB - YouTube

- XTB $2.2M Fine

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m a huge fan of XTB because it’s got the easiest app for trading stocks and ETFs I’ve ever used. Easy to set up my watchlist and notifications so I can monitor the US and UK stock markets. I’m also getting interest on the cash sitting in my account and more than I’d get in a poxy savings account.

XTB is one of the easiest stock trading apps I’ve used. Super slick design with loads of guides to help new traders. Gets my vote.

I use XTB for stock trading and it’s decent. There are no commissions and the stock screener is really helpful. I would like to have access to MetaTrader 4 though, so XTB could improve in my opinion.