What Causes A Currency to Fall? [Top Factors]

Currencies rise and fall for various reasons, but FX is a fundamentally macro asset class.

While equities may move a lot based on idiosyncratic factors happening at the company or the individual trading patterns of a singular entity, currencies are much more heavily influenced by country- or jurisdiction-level factors.

Factors that influence the fall in a currency

There are a few important ones, in particular, to keep in mind:

- Current account balance (typically expressed as a percentage of GDP)

- Net international investment position (NIIP)

- Fiscal account (typically expressed as a percentage of GDP)

- Private sector debt

- Balance of payments

Current account

The current account is a measure of how much a country is earning through trade and other international activity, relative to its spending.

A current account surplus indicates that a country is generating more income than it is spending, while a deficit indicates the opposite.

A large current account surplus will lead to an appreciation in the currency, as there will be more demand for the currency to buy goods and services from abroad. A current account deficit has the opposite effect and can lead to a depreciation in the currency.

Net international investment position (NIIP)

The NIIP is a measure of all foreign assets held by a country, minus all foreign liabilities.

A positive NIIP indicates that a country is a net creditor to the rest of the world, while a negative NIIP indicates that it is a net debtor.

A country with a large NIIP surplus will see its currency appreciate as foreign investors seek to buy assets in that country. A country with a large NIIP deficit will see its currency depreciate, as it will need to offer higher returns on its assets to attract investment.

Fiscal account

The fiscal account measures the government’s revenue and spending.

A budget surplus indicates that the government is collecting more revenue than it is spending, while a deficit indicates the opposite.

A budget surplus will lead to an appreciation in the currency, as there will be less need for the government to borrow money from abroad. A budget deficit has the opposite effect and can lead to a depreciation in the currency.

Private sector debt

Private sector debt is the total debt of all households and businesses in a country.

A high level of private sector debt can lead to a currency crisis, as it can become difficult for households and businesses to service their debts.

This can lead to defaults, which can cause a large-scale selling of assets.

Balance of payments

A country’s balance of payments is a measure of all its transactions with the rest of the world.

The balance of payments is made up of the current account, the capital account, and the financial account.

The current account measures trade in goods and services, while the capital account measures investment flows. The financial account measures all other flows, such as debt repayments and interest payments.

A country with a large balance of payments surplus will see its currency appreciate, all else equal, as there will be more demand for the currency to buy goods and services from abroad.

A country with a large balance of payments deficit will see its currency depreciate, ceteris paribus, as it will need to offer higher returns on its assets (i.e., higher interest rates) to attract investment.

While there are many other factors that can affect a currency’s value, these five are some of the most important ones to keep an eye on. Understanding how they work will help you to better understand why currencies move the way they do.

Why do currencies fall?

Developed market currencies (often referred to as DM FX) are often a fairly staid asset class. It’s rare that you get large intraday movements and big bursts and plunges.

However, in 2022, as developed markets struggled with excess inflationary pressures, currency volatility picked up.

By and large, if:

- the value of a country’s goods and services imports is above its exports – i.e., there’s a Current Account deficit – and…

- if the value of its external debt is much higher than the foreign assets it owns – i.e., a net debtor country under the Net International Investment Position…

It will not be in a good position to handle exogenous shocks.

In 2022, this heavily came in the form of a terms of trade shock from higher energy prices.

This impacted developed Europe significantly.

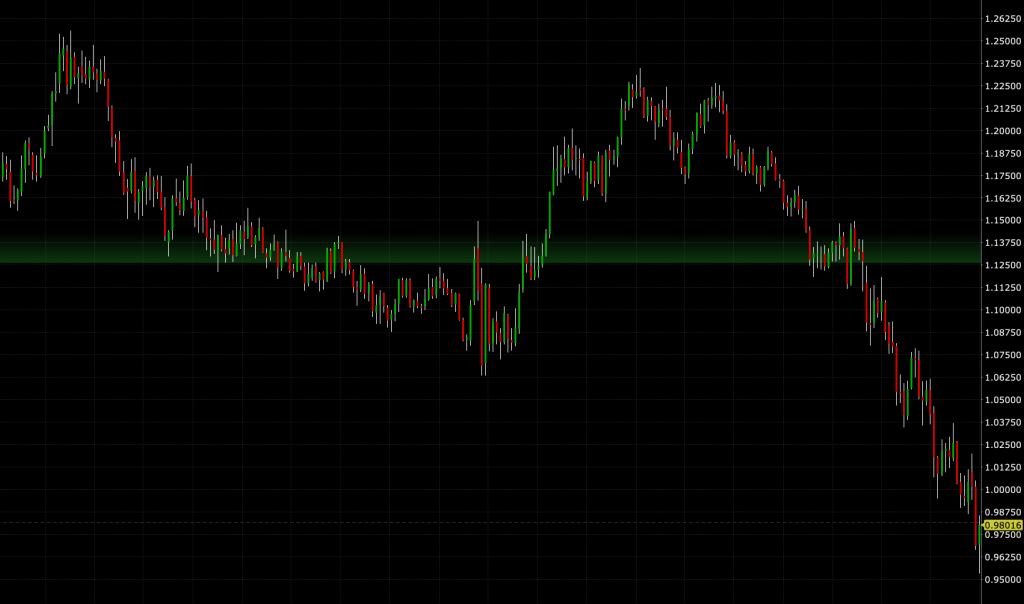

This produced a large fall in the Euro:

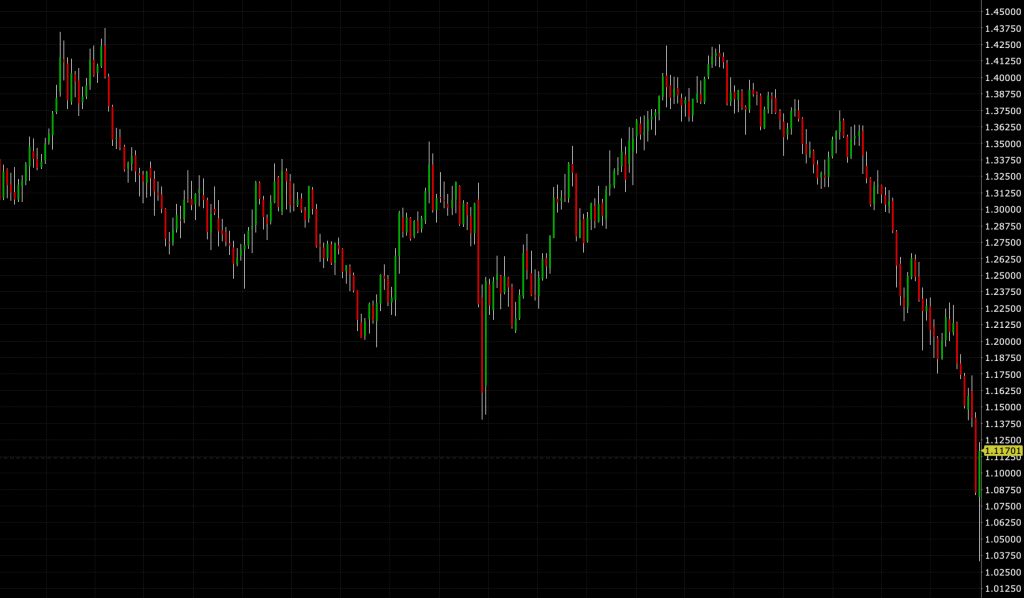

As well as the British Pound:

This produced supply-side related inflation on top of existing demand-side related inflation.

If a country makes use of large Fiscal Deficits (e.g., the UK), then that’s even worse.

Moreover, if Private Sector Debt is already high relative to output that makes tightening monetary and fiscal policy difficult to offset an inflationary shock.

This is because it risks debtors seeing higher interest payments due to higher interest rates and seeing their debt obligations significantly eat into their cash flow, as well as debt rollover difficulties, causing financial problems.

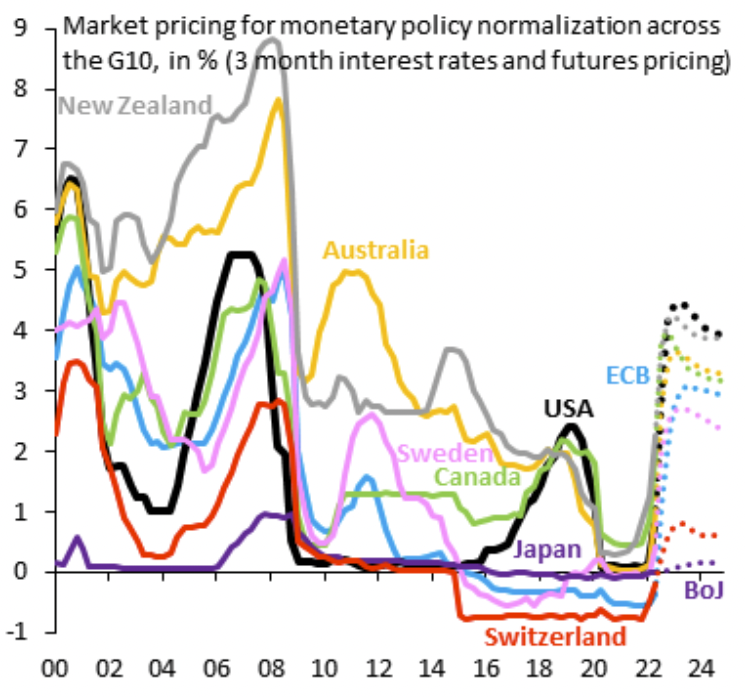

All of these factors influence forward interest rate expectations many years out, which can be observed in the term structure of interest rates:

Domestic traders vs. International traders

Domestic traders and international traders have different motivations.

Domestic traders care about their real returns. That is, they care about the nominal return they’re getting in the currency (i.e., its interest rate) relative to the inflation rate.

Investors generally want positive real returns to make an investment worth considering. After all, the basic purpose of why we trade and invest our money is to preserve its buying power at a minimum.

International (foreign) investors care about the currency. Are they going to get an interest rate that at least compensates for any depreciation pressure?

When investors don’t get the yield they demand, they sell.

How do policymakers get a currency to stop falling?

To get a currency to bottom, policymakers need to choose an interest rate on the currency that offsets both the inflation rate and depreciation rate of the currency (which is based on the underlying capital flow) to create at least a zero real yield.

But this route is often painful because of higher credit and debt servicing costs. Accordingly, devaluation is the common path.

A falling currency is simply a self-correcting mechanism.

When a currency falls, this makes a country’s goods and services cheaper in relative terms.

For example, when a Country A’s currency falls 10 percent relative to Country B’s, now Country B can get 10 percent more for the same price or get the same amount for 10 percent less.

This helps to close a country’s current account deficit – at least to a level at which it’s adequately funded – and rectify its balance of payments issues.

What is a balance of payments crisis?

A balance of payments crisis is when a country experiences large and persistent deficits in its current account and capital account.

The current account is the sum of a country’s trade balance (exports minus imports of goods and services), net income (from investments abroad), and net transfers.

The capital account is the sum of a country’s net foreign investment and net lending/borrowing.

A balance of payments crisis occurs when:

1) There’s an outflow of capital that exceed inflows and/or…

2) The current account deficit isn’t being adequately funded by inflows on the capital account.

This causes a run on the currency as people attempt to convert it into other currencies or assets, leading to sharp depreciation pressure.

In this case, a country has a couple basic options:

a) allow interest rates to rise to high levels to defend the currency – that is, compensate investors enough for holding it – or…

b) print money to buy the debt, which further reduces the value of the money and debt denominated in that currency.

Central banks almost always choose the second choice in printing money, buying the debt, and devaluing their currency.

It can’t allow rates to rise to such levels that significantly reduce economic activity, so it chooses to devalue the currency.

This process typically goes on in a self-reinforcing way because the interest rates the government is paying on the money and debt are not enough to compensate investors for the depreciating value of the currency.

This process typically goes on to a point where the currency and real interest rates establish a new balance of payments equilibrium.

Either policymakers let the currency depreciate enough or they set an interest rate on the currency and debt that offsets the depreciation pressure to create a positive real yield.

So the pain is felt either through the currency side (depreciation) and/or through interest rates (and by extension the bond market, through rising yields and falling prices).

FAQs – What Causes A Currency to Fall?

Why do higher interest rates help a currency appreciate?

When a country raises its interest rates, this attracts foreign investment as higher returns are available on deposits in that currency.

The increased demand for the currency and causes appreciation, holding all else equal.

What drives changes in exchange rates?

Exchange rates are driven by demand and supply conditions in the foreign exchange market. When demand for a particular currency is strong relative to the supply, the currency’s value will increase.

The opposite is also true: If demand for a currency is weak relative to the supply, its value will decrease.

The most important levers over this supply and demand include a country’s current account, net international investment position, fiscal account, private sector debt, and balance of payments.

What can central banks do to influence exchange rates?

Central banks can influence exchange rates by buying or selling their country’s currency in the foreign exchange market.

By doing so, they can increase or decrease the money supply in the market, which in turn affects demand for the currency.

In addition, central banks can also set interest rates, which can influence demand for a currency (as discussed above).

What are some other factors that can cause a currency to appreciate or depreciate?

Other factors that can influence exchange rates include a country’s inflation rate, economic growth, and political stability.

Higher inflation rates will typically lead to a depreciation of a currency, as investors will demand higher returns for holding assets denominated in that currency.

This is especially true among domestic investors, who will demand greater yield to hold onto the currency and debt/assets denominated in the currency.

Similarly, slower economic growth or increased political instability will also lead to a depreciation of a currency.

This is because these conditions make a country’s assets and investment opportunities less attractive to foreign investors, leading to a decreased demand for the currency.

Do developed market currencies act differently from emerging market currencies?

Developed market currencies tend to have reserve status, which means a global bias to hold that currency and debt.

This is because developed countries have deep and well-developed financial markets, which offer greater safety and liquidity to investors.

In contrast, emerging market currencies do not have reserve status and are therefore more susceptible to capital flight. This means that investors are more likely to pull their money out of an emerging market country when conditions deteriorate, leading to a depreciation of the currency.

Is the Chinese renminbi (RMB) considered a reserve currency?

China’s reserve currency status is emerging.

There are several reasons why traders, investors, and reserve managers do not yet hold China’s currency at a level commensurate with its global output.

– The RMB is not widely used globally. Few transact in it, save in it, or use it for investments outside of China.

– China’s government has a different way of operating internally relative to Western democracies and Japan. China has a type of top-down system that doesn’t have the widespread trust of global investors. Some believe China’s way of operating is not conducive to good returns on investment given the government’s desire to control how various types of resources are allocated.

– China is viewed as a geopolitical risk. China’s rise as an economic power and its different ways of operating is causing conflict with the US and its Western allies. So China is still not a big part of global portfolios in relation to its economic output.

– Its capital markets are not yet as well developed even though they are large.

– Shanghai and Shenzhen are not yet considered global financial centers.

– China’s payments clearing system is not yet well developed.

Why do central banks hold foreign reserves?

Central banks hold foreign exchange reserves as a way to stabilize their currencies and manage exchange rates.

By holding assets denominated in foreign currencies, central banks can intervene in the foreign exchange market to buy or sell their own currency and influence its value.

In addition, foreign reserves can act as a buffer against economic shocks by providing a source of liquidity that can be used to support the domestic economy in times of need.

Finally, central banks use foreign reserves to manage their countries’ exposure to international financial risks, such as changes in interest rates or sudden outflows of capital.

What is the difference between a currency and a reserve asset?

A currency is any form of money that is widely accepted in exchange for goods and services.

A reserve asset is a type of currency that is held by central banks and other large financial institutions as a way to stabilize their currencies and manage exchange rates.

Reserve assets typically have a low level of risk and are highly liquid, making them ideal for use in times of economic stress.

The most common reserve asset is the US dollar, followed by the euro, gold (a type of currency asset that functions as no one’s liability), the Japanese yen, and the pound sterling.

Other important reserve assets include the Swiss franc, the Canadian dollar, and the Australian dollar.

Conclusion – What Causes A Currency to Fall?

A currency can fall for a variety of reasons, but the most common cause is due to concerns about the country’s economic stability or geopolitical risk.

When investors sell off a currency, it leads to depreciation.

Central banks can intervene to stabilize their currencies, but if the underlying conditions are not addressed, the currency will continue to fall.

Related FX Content

- Currency Valuation Models: How Are Exchange Rates Determined?

- What Is A Currency Defense?

- Currency Overlay – Strategies & Instruments

- Reserve Currency History, Status, and Benefits

- Real Exchange Rates – Why They Matter

- Turkey’s Currency Crisis of 2021

- Currency (FX) and Commodities Trading: A Rebirth in Popularity?

- Is a Currency War the Next Big Global Macro Event?