War & The Impact on Reserve Currencies

The Russia-Ukraine conflict got people talking about reserve currencies. Specifically, what is the impact of war on reserve currencies?

The US (which has large reserve status through the USD) and developed Europe (which has reserve status through the EUR and, to a lesser extent, the GBP) imposed sanctions on Russia to punish its economy and try to halt its aggression.

These sanctions tend to be effective to very effective because having a reserve currency means lots of business is done with it. If they can’t do business in a certain currency, it often means they’ll have trouble doing business altogether.

There are also impacts in other ways.

For example, Saudi Arabia and China do a lot of their oil trade in US dollars. Let’s say China or both countries wanted to switch to using Chinese yuan (CNY, aka the renminbi) to reduce dollar dominance.

The issue, in this case, is that Saudi Arabia’s currency, the riyal, operates under a dollar peg.

Exchange rate pegging is common in emerging countries who want to limit exchange rate volatility on economic outcomes. They typically peg to the world’s dominant reserve currency or to the currency of their main trading partner.

Gold as a reserve asset during periods of geopolitical stress

Gold tends to shine during periods of geopolitical conflict.

This is because:

- it can’t be printed

- It’s nobody’s liability

- it ultimately outlasts other currencies (which history has shown are either destroyed, merged, or significantly devalued over time), and

- gold is the coin of realm* during war periods because of the distrust between countries of accepting other currencies that can ultimately be devalued

(*along with silver and other forms of real assets that could serve as barter)

Gold flew higher during the early stages of the conflict, when the invasion triggered a freezing of FX reserves and a consequent increased demand for gold.

But then it essentially reversed the entire rally, and was mostly back to where it started.

Shifting away from USD?

There is lots of talk about reserve managers not wanting to hold US dollars, now that geopolitical strife has shown that the money isn’t safe.

This is because the US can unilaterally choose not to honor its obligation or devalue its obligations significantly.

At the same time, it’s not easy to find alternatives to a reserve currency, especially not since the Fed, ECB, BoE, and BoJ all took the same action as it pertains to Russia and its aggression.

This could mean more of a shift toward:

a) “neutral” currency reserve assets like gold or

b) toward “emerging” reserve assets, such as the CNY

The CNY could take more of a role in the future as China grows economically, technologically, militarily, geopolitically, and in terms of its capital markets.

The CNY is about 2 percent of global FX reserves versus just shy of 60 percent for the USD.

That 20x to 30x spread is expected to get more in line over time, given the spread is narrower in virtually every fundamental way between the US and China, including GDP per capita.

But this also brings up the questions of:

- Do you really want to hold a lot of your reserves in gold?

- Do you really want to hold a lot of your reserves in CNY?

There are no easy options. This is especially true for China, which can’t hold its own currency as a reserve.

Currency regimes take time to pass

Reserve manager shifts can be important. And they can drive currency shifts over multi-year horizons.

But it takes a lot to change the status quo in currency regimes. This is because they become so embedded in the way business and transactions are done globally.

A widely used currency is akin to having a widely used language. It tends to stay around because it’s been habitually used for so long rather than the strengths that had made it so commonly used in the first place.

For instance, Spanish is one of the most popular languages in the world because the Spanish empire spread its language to new parts of the world in the late-1400s through the 1600s when it was a dominant global power. But with how the world has changed in those 400+ years, Spain is now a smaller country with very limited geopolitical influence.

The Spanish language and its widespread popularity has outlasted Spain’s economic power with a long lag, as languages get passed from generation to generation.

Currency regimes tend to change slowly as well. This is why reserve status always falls with a lag relative to other fundamental measures about a country or empire.

The Dutch didn’t lose their reserve currency status until the Fourth Anglo-Dutch War (1780-1784), which overlapped with the British engagement in the American Revolutionary War (1775-1783).

Despite multiple ongoing conflicts, the British easily beat the Dutch both on economic and military fronts.

Accordingly, the British would become the world’s new undisputed leading empire and leading reserve currency.

The expense incurred from the war bankrupted the Dutch. It caused the collapse of Dutch debt and equity markets, as well as the value of the Dutch guilder, as illustrated in the following diagram versus gold, silver, and the British pound (GBP).

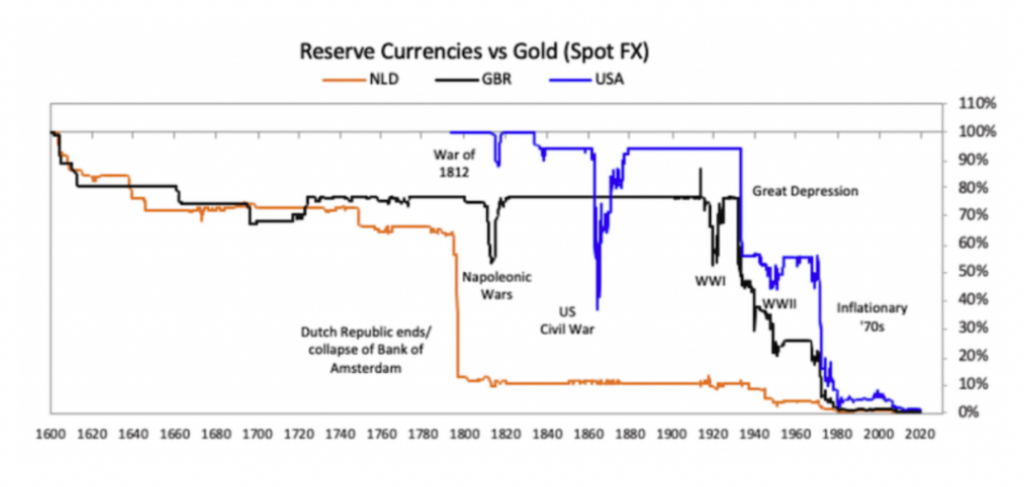

The fall of the Dutch Guilder, British Pound, and US Dollar in relation to gold can be summed up in the following graph.

The US had large devaluations in 1933 (Great Depression) and 1971 (large spending on overseas military engagements and social programs).

These big fissures were caused by the severance of the dollar from the gold standard at each time.

However, it did not cost the US its reserve status.

Gold is a non-credit-dependent asset so it bears no risk from being excessively “printed” unlike fiat currencies. As a result, gold functions similarly to the inverse of money.

As currency and reserves in circulation increase, the price of gold often follows over the long-run relative to whatever currency it’s being marked to.

Gold’s popularity tends to gain when the real returns on financial assets decline. It’s a type of currency hedge and long-duration store of value.

Gold is commonly thought of as a cash alternative.

As a result, reserve managers often want to own gold in some fashion.

This is especially true during periods of wars, heightened geopolitical conflict, or when there are large-scale devaluations going on globally (due to debt crises, conflicts, and other dire situations).

Final word

Historical events unfolded in February and March 2022.

However, there was no evidence from price action or from flows that a historical allocation shift in reserves followed.