Reflexivity – Exploring George Soros’ Popular Trading Concept

What Is Reflexivity?

Reflexivity is a trading concept popularized by George Soros. It posits that there is a two-way relationship between price and underlying fundamentals.

This means that price movements can influence the underlying fundamentals, which in turn can influence prices.

This theory is based on the idea that people base their decisions on their perceptions, which may not always be accurate. As such, these decisions can end up affecting the fundamental reality, which in turn can influence prices.

Reflexivity is a key concept in Soros’ trading strategy. He believes that by understanding reflexivity, traders can gain an edge in the market.

Essentially, reflexivity is a type of feedback loop. It is based on the belief that people’s perceptions influence the underlying reality, which in turn affects prices.

Reflexivity is a controversial concept. Some traders believe that it doesn’t exist, while others believe that it’s the key to success in the markets.

How Does Reflexivity Work?

There are two key components to reflexivity:

1) The belief that people’s perceptions influence the underlying reality

2) The belief that the underlying reality can influence prices

We do know that the financial economy affects the real economy.

The financial economy allocates capital in a way that influences what happens in the real economy.

A company with a higher stock price can raise more capital and more easily, which can then be used to invest in ways that can make the company successful.

Some companies – especially those that are not profitable and might not make it – tell stories to investors to get them excited about the company as an investment, where executives can then try to use the higher market valuation to turn those expectations into a reality.

In other words, reflexivity is like the financial market equivalent to a “self-fulfilling prophecy”.

Reflexivity in the Housing Market

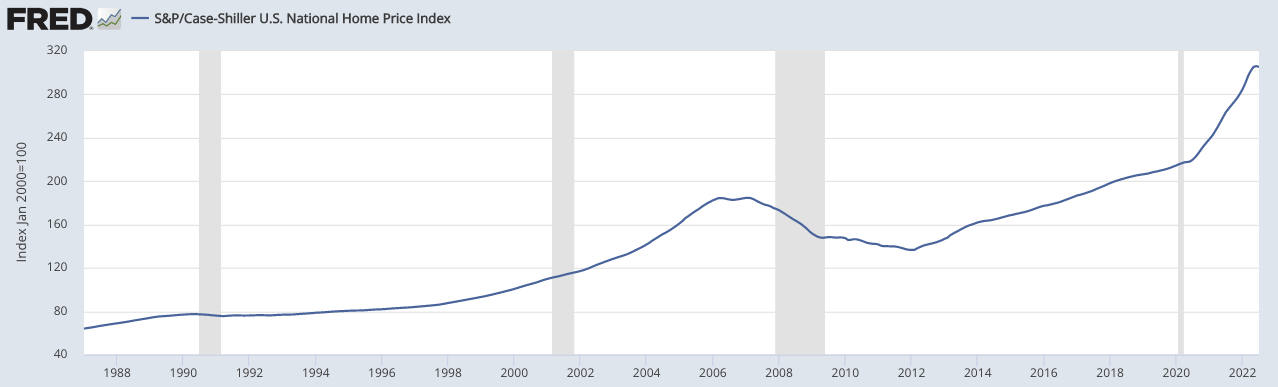

The most famous example of reflexivity is probably the housing market crash of 2008.

In the years leading up to the crash, there was a huge increase in home prices in the US and other developed markets. This led to more and more people buying homes, believing they were a good investment and were missing out, which in turn drove prices even higher.

At some point, however, prices got too high and were heavily financed with debt. Things like NINJA loans meant people could buy homes without proving they had the incomes to tolerate the debt burden.

Houses are also mostly used to simply live in, which means for most people they don’t create an income stream. In fact, they do the opposite (they require upkeep, are taxed, and other payments to keep them functional).

So finding the next buyer for a home requires infusions of new liquidity.

When lending standards or monetary policy is tightened such that it shrinks the amount of available money and credit to buy a home, then things start going in the opposite direction.

The result was that prices started to fall and people started to default on their mortgages. This led to even more defaults and even lower prices, in a self-reinforcing spiral.

US National Home Prices (nominal terms), Case-Shiller Index

Reflexivity in the Stock Market

The same thing can happen in other markets as well.

It’s especially true in the equities market where a lot of the valuations are built on projection because of the long-duration (i.e., theoretically perpetual) nature of the cash flows.

For example, if a company’s stock price starts falling, it might cut costs and lay off workers.

This can then lead to less productivity within the company, and even lower demand for the company’s products, and therefore even lower prices.

Reflexivity can also work in the reverse direction. For example, if a company is doing well and its stock price starts rising, it might use that capital to invest in new products or expansion. This can then lead to even more demand for the company’s products and higher prices.

The main reality is that reflexivity is a feedback loop where people’s perceptions about the company and its earnings influence the underlying reality, which in turn affects prices.

Stock prices are the present value of future cash flows, so lots of projection is baked into a stock price.

This is especially true for companies whose cash flows are projected to be far out in the future, like many technology companies and startups.

This feedback loop can lead to prices becoming disconnected from the underlying fundamentals.

This is why Soros believes that reflexivity is an important factor to consider when trading.

How to Trade Using Reflexivity

The first step is to identify situations where you think reflexivity might be at play.

Look for situations where there is a discrepancy between prices and fundamentals.

For example, if a company’s stock price is rising but its earnings are not going up or falling, that might be a sign that the stock price is disconnected from reality.

You can also look for situations where there is a discrepancy between what people think will happen and what is actually happening.

For example, if prices are rising but economic indicators are weakening, that might be a sign that the market is overreacting to good news or underestimating the potential for bad news.

Once you have identified a situation where reflexivity might be at play, you need to decide how to trade it.

There are two main ways to trade using reflexivity:

1) You can take a long position in an asset that you think is undervalued and will eventually revert back to its fundamental value.

For example, if you think a stock price is too low relative to its earnings, you can buy the stock and wait for the price to go back up.

2) You can take a short position in an asset that you think is overvalued and will eventually revert back to its fundamental value.

For example, if you think a stock price is too high relative to its earnings, you can short the stock and wait for the price to go down.

Inflationary Psychology – Reflexivity in Real Economy Phenomenon

Inflationary psychology is a special case of reflexivity where people’s expectations about inflation influence actual inflation.

Inflationary psychology can lead to a self-reinforcing spiral of higher prices.

As prices start to rise, people expect them to continue rising. This leads them to demand higher wages, stock up on goods and services to get in front of the price increases, and so on, which drives prices even higher.

Reflexivity and the Bandwagon Effect

The bandwagon effect is another form of reflexivity where people’s beliefs influence their actions, which in turn affects prices.

When a certain stock or thing is getting a lot of publicity for going up in price (e.g., the dot-com bubble, houses in 2003-2007, bitcoin, Tesla common stock), there is a rush of people who “get on the bandwagon” and buy in for fear of missing out.

The bandwagon effect can lead to a self-reinforcing spiral of higher prices.

As prices start to rise, people believe that they will continue rising. This encourages more people to buy, which drives prices even higher.

This drives prices even higher, until the bubble eventually bursts and prices come crashing down.

The idea is that the inherent reflexivity component that leads to the bandwagon effect can lead to prices becoming disconnected from reality.

This is why it’s important to be aware of reflexivity when trading.

Reflexivity can work in both directions, so it’s important to be aware of both the potential for prices to go up (due to the bandwagon effect) and the potential for prices to go down (due to a bubble bursting).

FAQs – Reflexivity

What is reflexivity?

Reflexivity is a popular trading concept that was popularized by George Soros.

It is based on the idea that prices can become disconnected from reality and that people’s perceptions can influence the underlying reality.

How does reflexivity work?

Reflexivity works by creating a feedback loop where people’s perceptions influence the underlying reality, which in turn affects prices.

This feedback loop can lead to prices becoming disconnected from the underlying fundamentals.

Why is reflexivity important?

Reflexivity is important because it can help you identify situations where prices are disconnected from reality.

This is why Soros believes that reflexivity is an important factor to consider when trading.

How do you trade using reflexivity?

There are two main ways to trade using reflexivity:

1) Take a long position in an asset or security that you think is undervalued and will eventually go back to its fundamental value.

2) Take a short position in an asset or security that you think is overvalued and will eventually revert back to its fundamental value.

How did reflexivity become popular?

Soros explained it in his book The Alchemy of Finance.

THE ALCHEMY OF FINANCE (BY GEORGE SOROS)

Conclusion – Reflexivity

Reflexivity is a popular trading concept that was popularized by George Soros. It is based on the idea that prices can become disconnected from reality and that people’s perceptions can influence the underlying reality.

Reflexivity works by creating a feedback loop where people’s perceptions influence the underlying reality, which in turn affects prices. This feedback loop can lead to prices becoming disconnected from the underlying fundamentals.

This is why Soros believes that reflexivity is an important factor to consider when trading.

While reflexivity can help you make money in the markets, it is also a risky strategy. This is because you are essentially betting against the market and trying to making tactical bets. This is hard to do versus simply having a balanced approach.

Reflexivity is not for everyone and you should only trade using this strategy if you are comfortable with the risks involved.

If you are new to trading, it is always best to start with a simple strategy and gradually increase your level of risk as you gain more experience.