Plus500 Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Overall Broker 2021 - DayTrading.com

- Best Overall Broker 2020 - DayTrading.com

- Best Overall Broker 2019 - DayTrading.com

Pros

- The customer support team continue to provide reliable 24/7 support via email, live chat and WhatsApp

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

Cons

- Algo trading and scalping are not supported, which may deter some day traders

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

Plus500 Review

In this Plus500 review, I evaluate its features, performance, and suitability for various types of traders, providing ratings based on my firsthand experience using the broker with real money.

I also compare Plus500 to suitable alternatives, emphasizing any areas for improvement.

Note: 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Regulation & Trust

Plus500 has primarily demonstrated that it’s a legitimate, trustworthy broker regulated by several reputable financial bodies.

That said, we’ve recently lowered its trust score following a class action levelled at the Australian entity, which alleges the firm was misleading in its marketing of highly leveraged CFDs.

The brand has also faced concerning lawsuits in other regions, notably Israel after it abruptly paused traders’ accounts following the Brexit referendum, potentially hurting trading portfolios.

On a more positive note, Plus500 Ltd is listed on the London Stock Exchange, which adds to its credibility and is a promising sign that the company is financially stable.

The brokerage is authorized through several subsidiaries:

- Plus500UK Ltd: regulated by the UK Financial Conduct Authority (FRN 509909)

- Plus500AE Ltd: regulated by the Dubai Financial Services Authority (F005651)

- Plus500CY Ltd: regulated by the Cyprus Securities and Exchange Commission (Licence No. 250/14)

- Plus500SEY Ltd: regulated by the Seychelles Financial Services Authority (Licence No. SD039)

- Plus500EE AS: regulated by the Estonian Financial Supervision and Resolution Authority (Licence No. 4.1-1/18)

- Plus500SG Pte Ltd: regulated by the Monetary Authority of Singapore (License No. CMS100648)

- Plus500AU Pty Ltd: regulated by the Australian Securities and Investments Commission (ACN 153 301 681, AFSL # 417727), the FMA in New Zealand (License No. 486026), and the FSCA in South Africa (License No. #47546)

Other reassuring features are segregated client accounts and negative balance protection.

In addition, retail traders in some jurisdictions will be protected by compensation schemes in the case of business insolvency. Investor protection is up to £85k for UK clients, €20k for EU clients, and $0 for other clients.

Accounts & Banking

Unlike many competitors, Plus500 offers one live account. You can access all investment products, platforms and tools with variable minimum trade size and a low starting deposit of $100, making the broker accessible to everyone.

The choice of account currencies is a bonus, including USD, EUR, GBP, and AUD, allowing you to deposit, trade and withdraw in a convenient currency.

A swap-free account is also available at some of the broker’s entities, making Plus500 good for Islamic traders, while high-volume traders can open a professional account if they satisfy two of the criteria below:

- Hold a financial portfolio worth at least €500,000

- Opened 10 positions per quarter over the last four quarters

- Have at least one year of professional working experience in the finance sector

The pro account offers higher leverage, the best order execution and cash rebates. It is also one of the few professional trading accounts I have seen to offer negative balance protection.

Deposits & Withdrawals

Plus500 scores well when it comes to deposits and withdrawals. The broker accepts multiple fee-free and secure payment options, including wire transfers, credit/debit cards, and e-wallets like PayPal and Skrill.

I find that e-wallets offer the fastest processing times, with funds normally available immediately. In contrast, wire transfers can take up to 5 working days, so avoid this if you want to get started quickly.

Looking at the negatives, withdrawal times at Plus500 are slower than some alternatives. PayPal and Skrill can take between 3 and 7 working days, respectively.

On a lighter note, there is no withdrawal limit.

You can compare Plus500’s entry requirements with alternatives below.

| Plus500 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | Variable | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Payment Methods | Apple Pay, Credit Card, Debit Card, Mastercard, PayNow, PayPal, Skrill, Trustly, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Visit | Visit 79% of retail CFD accounts lose money. |

Visit | Visit |

| Review | Review | Review | Review |

Demo Account

Plus500 offers a free demo account. What’s great is that there are no time restrictions, so you can continue using it even after you register for a live account.

Tip: Starting in the demo mode is sensible to get familiar with the in-house platform and its features before trading with real money.

The process to sign up for a Plus500 demo account is reduced compared to a full account. There is no lengthy registration process and you can reset your account balance at any time. In the client portal, simply use the ‘Real Money’ and ‘Demo Mode’ toggles at the bottom of the menu on the left.

Assets & Markets

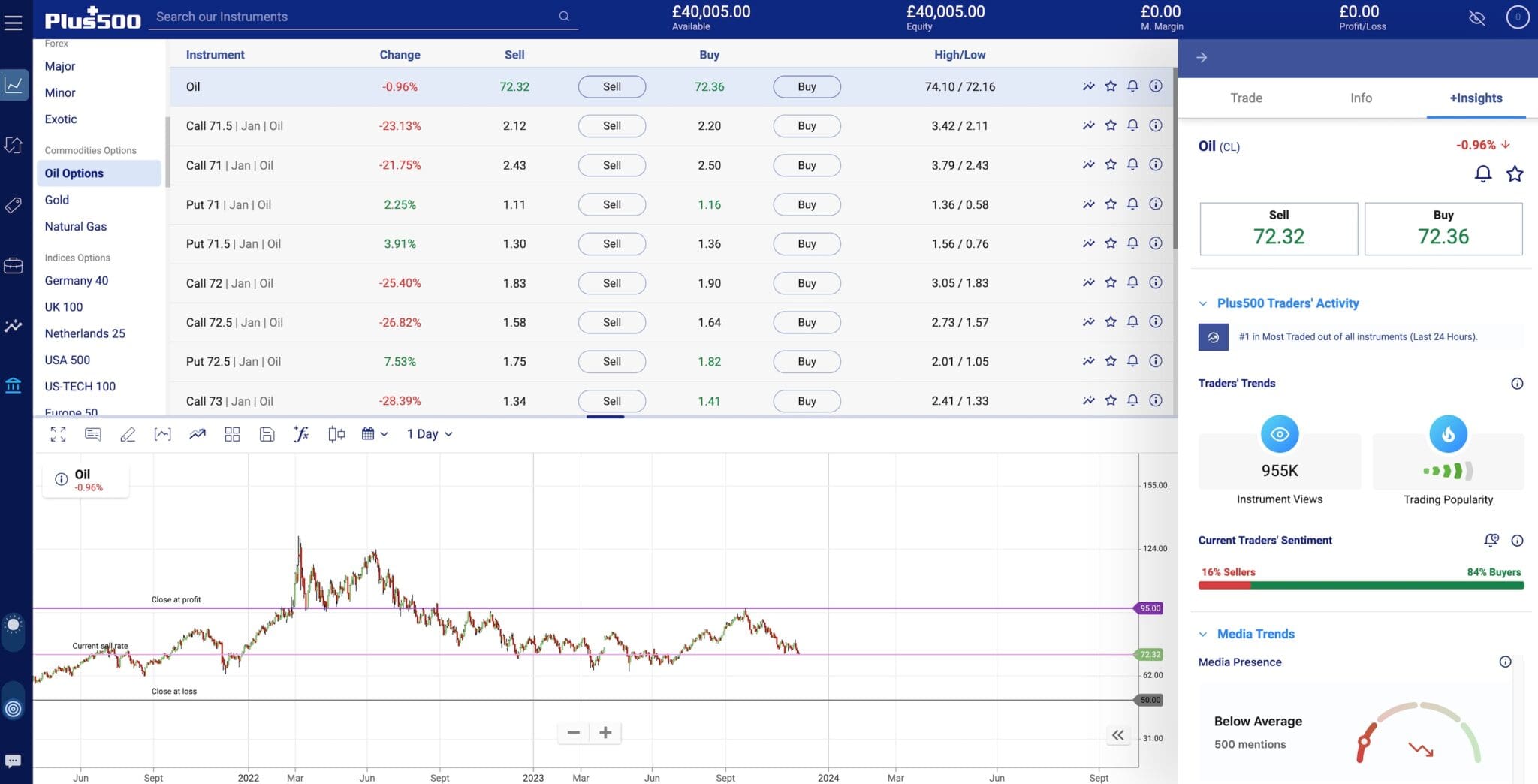

Plus500 specializes in CFDs, encompassing stocks, indices, forex, commodities, and more. Notably, the stock diversity stands out, offering exposure to significant economies and industries. For forex traders, the platform offers dozens of popular currency pairs.

Plus500 distinguishes itself with call and put options, as well as futures (via the Plus500Futures platform, available to individual US residents only), providing an alternative means to speculate on popular financial markets. These options offer leverage and diverse expiry dates, enhancing trading flexibility.

Trading products include:

- Forex: Over 60 major, minor, and exotic currency pairs including GBP/USD, EUR/USD, and EUR/NZD.

- Indices: 30+ country-specific, ESG, and sector index funds, featuring USA 30, Europe 50, France 40, FTSE 100, Japan 225, NASDAQ 100, IBEX 35, Metaverse Giants, and NFT Giants.

- Commodities: 24 agricultural, energy, and precious metal products, such as copper, natural gas, oil, and wheat.

- Shares: 1800+ stocks from companies like LVMH, Amazon, Apple, Tesla, Rolls-Royce, and Lloyds Banking Group, with before and after hours trading now available on 7 US stock CFDs for further opportunities.

- Options: Over 200 popular instruments are available as options contracts, including EUR/USD, natural gas, Deutsche Bank, and the Europe 50 index. Plus500 also added VIX options in 2024, offering greater exposure and volatility than the VIX itself.

- ETFs: More than 90 exchange-traded funds like iShares Silver, Commodity Index Fund, and the PowerShares QQQ Trust ETF.

- Cryptocurrencies: Availability subject to regulation, at the time of writing there are 15 crypto coins including Bitcoin, Ripple, Litecoin, and Ethereum, along with a Bitcoin CFD.

Note that the availability of trading instruments might vary based on your location. For example, CFD trading isn’t available in the US.

You can compare Plus500’s investment offering with alternatives below.

| Plus500 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Visit | Visit 79% of retail CFD accounts lose money. |

Visit | Visit |

| Review | Review | Review | Review |

Leverage

Leverage trading is available at Plus500 in line with local regulatory restrictions. For example, UK and EU investors can trade forex with 1:30 leverage and stocks with 1:5 leverage.

Investors who qualify for a professional account can access leverage up to 1:300. Taking professional status does mean however, that those traders are no longer covered by the ICF and they waive other regulatory protections.

I recommend that all traders approach leveraged trading (including options) with caution – it can amplify both profits and losses.

Make the most of stop-loss orders to protect your capital.

Fees & Costs

Plus500 has reasonable trading fees but trails the cheapest brokers like CMC Markets.

The broker offers commission-free trading with floating spreads that vary depending on market conditions.

During my hands-on tests of the platform, I got 0.6 on the EUR/USD, 0.70 on the S&P 500, 1.20 on the UK 100, and 0.36 on gold.

I also appreciate that Plus500 does not charge for deposits and withdrawals.

The only other significant costs to consider are swap fees for overnight positions and conversion charges up to 0.7% if you trade in a currency other than your base currency.

Casual traders should also be aware that there is a $10 inactivity fee after three months of zero trading. This is fairly common at established brokers, so this isn’t a significant drawback.

Platforms & Tools

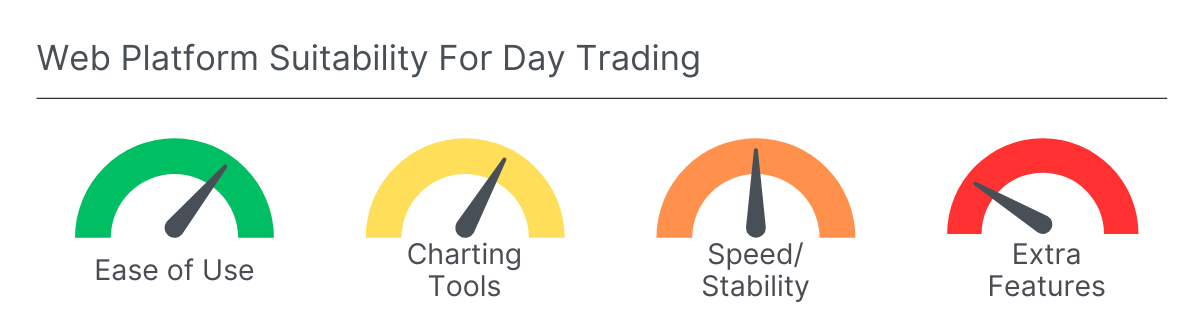

Plus500’s flagship web terminal scores fairly well in terms of its suitability for day trading, especially its clear design and charting functionality.

With that said, it doesn’t particularly stand out against alternatives when it comes to additional trading features.

You can see how it performs overall in key areas below.

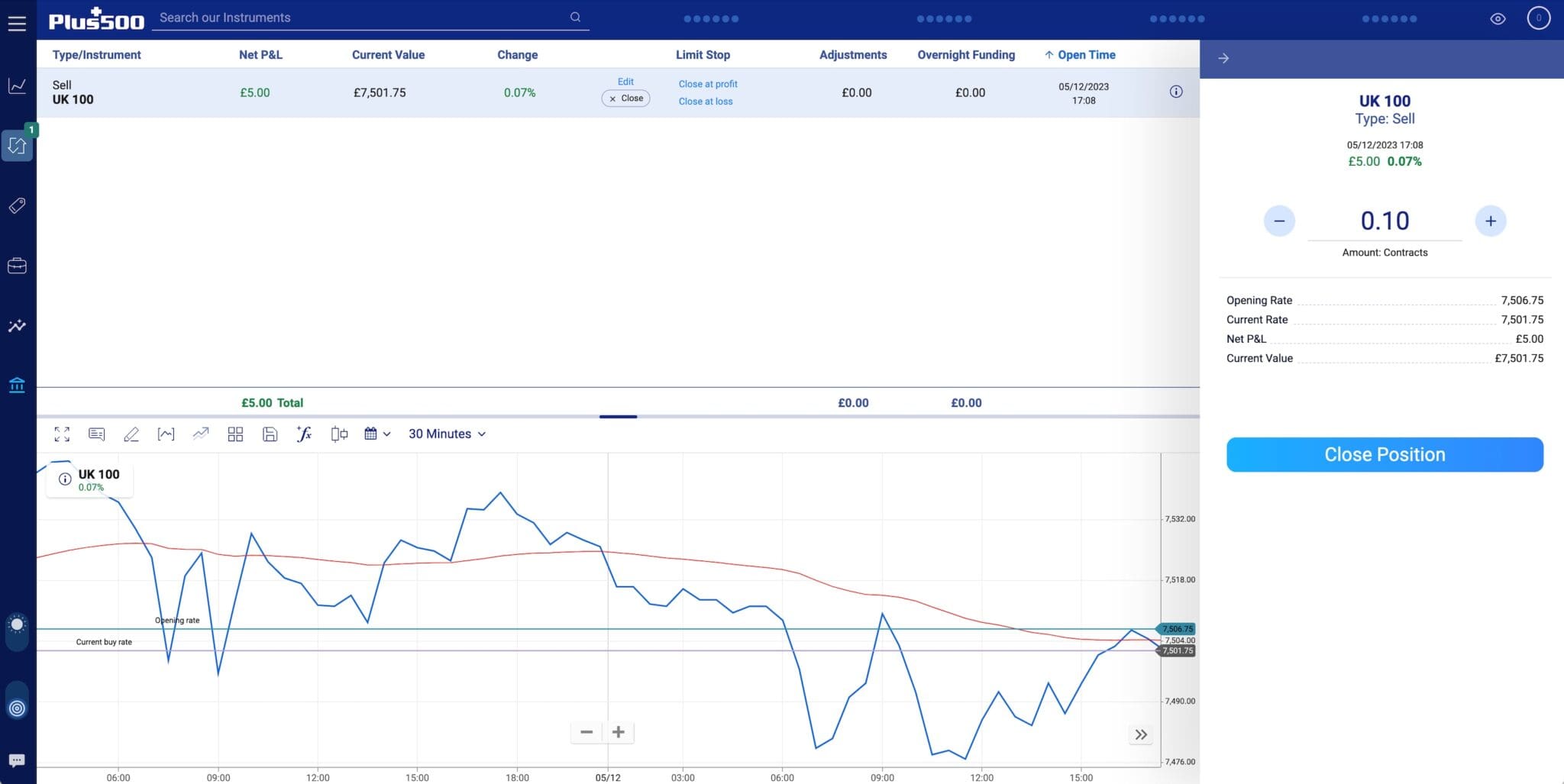

Looking at the positives, I find trading with Plus500 intuitive thanks to its user-friendly platform accessible via a web browser or mobile device.

The platform’s uncluttered design removes much of the complication of opening and maintaining positions and trades.

Moreover, Plus500’s platform offers an array of analysis features that will cater to technical traders and day traders, including a variety of chart types, timeframes, drawing tools, and over 100 technical indicators such as Bollinger Bands, Moving Average, and RSI.

The inclusion of email and SMS alerts, which notify you about price changes and market sentiment even when offline, adds practicality to the trading experience.

Yet while there are essential real-time data like balances, transaction history, and profit/loss breakdowns, I find it frustrating that Plus500 lacks advanced tools for comprehensive analysis of trading activity.

There’s no built-in trading journal or tax accounting tools within the platform, either.

Certain markets on Plus500 offer guaranteed stops, but they involve a wider spread and cannot be applied to trades that have already been opened.

Overall, the web platform does its job and is particularly appealing to those traders looking for a no-fuss approach to online trading.

Weighing the negatives, Plus500 does not support widely used platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader. Those specifically seeking third-party analytical and automation tools in their trading process will be disappointed as none of these tools can be integrated directly. Plus500 does, however, offer Multiple Charts View, which allows you to display up to 9 different charts at a time.

Additionally, Plus500 falls behind its competitors, such as CMC Markets, in terms of automated trading capabilities, lacking support for constructing, testing and deploying algorithmic trading strategies.

It also does not facilitate managing third-party funds through PAMM or MAM trading platforms, nor does it offer copy trading. These features are increasingly popular with aspiring traders and available at alternatives like Vantage.

You can compare Plus500’s platform offering with alternatives below.

| Plus500 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| MetaTrader 4 | No | No | Yes |

| MetaTrader 5 | No | No | Yes |

| cTrader | No | No | No |

| TradingView | No | Yes | No |

| Auto Trading | No | Capitalise.ai, TWS API | |

| Visit | Visit 79% of retail CFD accounts lose money. |

Visit | Visit |

| Review | Review | Review | Review |

Mobile App

The Plus500 app offers almost the same functionality as the desktop solution. You can trade the full suite of instruments, view charts, and manage your account on mobile and tablet devices.

I didn’t encounter any issues during my Plus500 review and enjoyed the modern design and mobile trading experience.

The app is available for download to iOS and Android devices from the Apple App Store or Google Play.

Research

Plus500 lacks extensive research resources, analysis, and commentary. It offers limited in-house research, but does provide economic and earnings calendars as well as a news and market insights section.

The platform includes customizable charts for technical analysis and indicators like ‘Traders’ Sentiment’ and ‘Live Statistics,’ revealing the percentage of buyers and sellers along with performance across different time frames for various instruments.

Other platforms, in particular eToro, offer far superior research tools including analyst recommendations.

Education

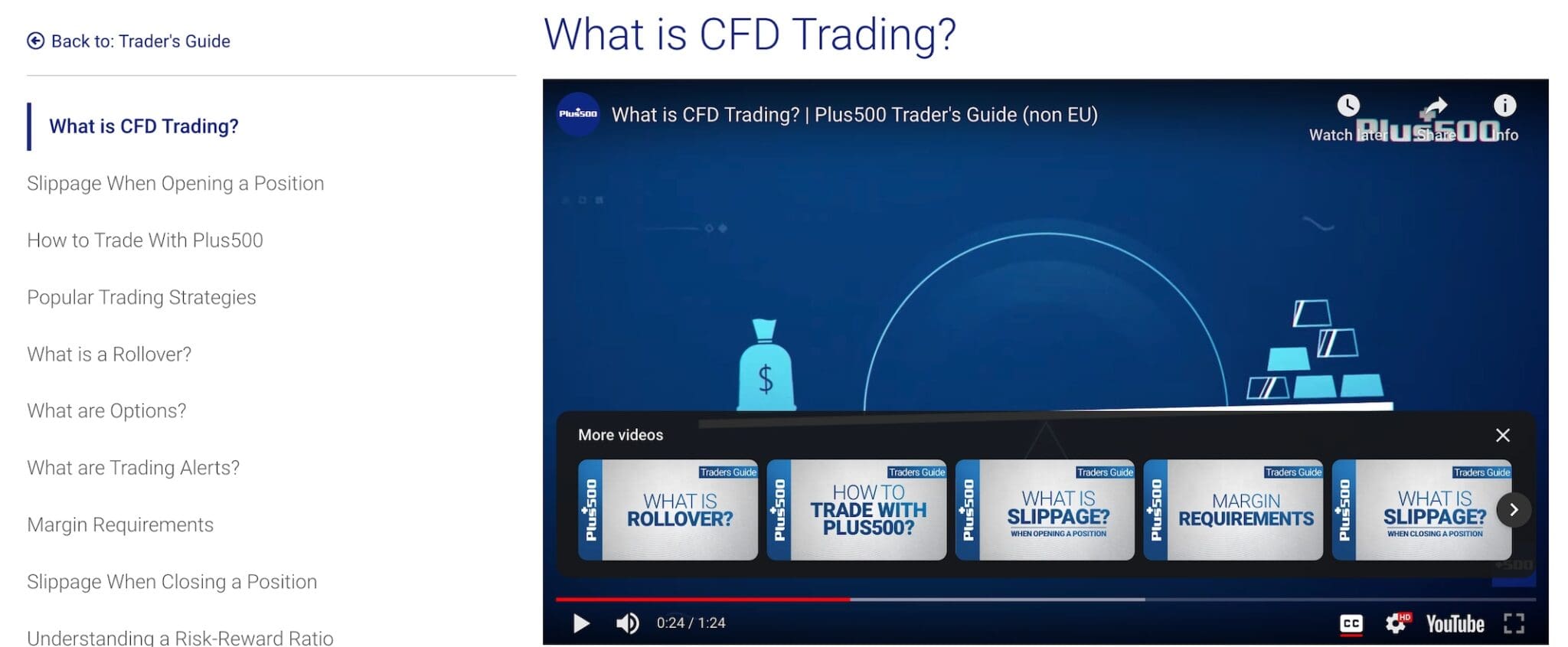

Plus500 performs commendably in its educational offerings, particularly catering to beginners with helpful resources such as e-books, video tutorials, and trading articles.

The video content stands out as a particularly effective resource, offering visual aids that facilitate quicker comprehension compared to written materials.

However, in comparison to some of our highest-rated brokers like AvaTrade, the breadth and depth of educational resources provided by Plus500 are lacking, especially considering the lack of risk management resources and market news.

Customer Support

Plus500 tries to ensure accessible customer support around the clock through live chat, WhatsApp, and email services.

While the absence of a telephone contact number might pose frustration for some traders, the chat support stands out positively, offering excellent assistance based on my experience – responses were consistently received within a couple of minutes during my tests, and agents were notably helpful and professional.

Additionally, the broker provides an extensive FAQ portal covering various topics such as trading software usage, user manuals, withdrawal policies, and account closure/deletion.

Plus500 also maintains an active presence across social media platforms, including Facebook, Twitter, and LinkedIn.

Should You Trade With Plus500?

Following our assessment using a real money account, Plus500 is a well-regulated broker with transparent fees and is worth considering if you are looking to trade CFDs across various markets, including stocks, indices, forex, and commodities. There’s limited options trading, too.

The platform’s user-friendly interface is suitable for traders of all levels, but its lack of support for copy trading and the absence of extensive research tools are disappointing compared to other platforms such as eToro or IG.

FAQ

Is Plus500 Legit Or A Scam?

Plus500 is a legitimate brokerage platform regulated by multiple reputable authorities. Plus500 Ltd is publicly listed on the London Stock Exchange, adding a layer of transparency and accountability.

However, as with any trading platform, it’s crucial to do your own research, understand the risks involved, and trade responsibly.

Can I Trust Plus500?

Plus500 is regulated by multiple prominent financial authorities, ensuring compliance with strict standards and regulations. As a publicly listed company, it also upholds transparency and accountability. Additionally, client funds are segregated from the company’s operational funds, providing an extra layer of security.

While Plus500 has established regulatory compliance and security measures, it’s prudent to perform due diligence, review its terms and conditions, and trade cautiously with any platform to mitigate risks.

Is Plus500 A Regulated Broker?

Plus500 is regulated in various countries through different regulatory bodies. Some of the key regulatory authorities overseeing Plus500 include the Financial Conduct Authority (FCA) in the United Kingdon, the Australian Securities and Investments Commission (ASIC) in Australia, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Financial Markets Authority (FMA) in New Zealand, the Monetary Authority of Singapore (MAS) in Singapore, and the Israel Securities Authority (ISA) in Israel.

Regulatory compliance ensures that Plus500 operates under the guidelines set by these authorities, offering a degree of protection and reassurance for traders in these regions.

Is Plus500 Suitable For Beginners?

Plus500’s user-friendly interface and straightforward platform is suitable for all traders.

Its intuitive design and clear navigation features make it accessible, and there are sufficient risk warnings and educational content about using leveraged products like CFDs.

If you’re new to trading, start with a demo account to practice, and consider seeking additional educational resources before venturing into live trading with real money.

Does Plus500 Offer Low Fees?

Plus500 typically offers relatively tight spreads on various financial instruments, and it does not charge commissions on trades, which can potentially reduce overall trading costs.

However, other fees, such as overnight funding fees for holding positions overnight, inactivity fees, and currency conversion fees, may apply. Review and understand the fee schedule before trading.

Is Plus500 A Good Broker For Day Trading?

Plus500 can be suitable for day trading due to its user-friendly platform and the availability of a wide range of CFDs across multiple markets.

However, the lack of advanced charting tools and order types, and no support for automated trading, may limit its appeal to more experienced traders needing a more extensive platform such as IG, which is tailored specifically for day trading.

Does Plus500 Have A Mobile App?

Plus500 offers a mobile app available for both iOS and Android devices. The mobile app enables you to trade various financial instruments on the go, providing access to the same features and functionalities as the web platform.

You can monitor markets, execute trades, manage positions, and access account information, making it convenient if you prefer trading from your smartphone or tablet.

Is Plus500 A Market Maker?

Plus500 is a market maker, acting as the counterparty to positions opened by its users. As a result, commissions are included in spreads and execution is usually reliable.

Best Alternatives to Plus500

Compare Plus500 with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Plus500 Comparison Table

| Plus500 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4.1 | 4.3 | 3.6 |

| Markets | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | Variable | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | WebTrader, App | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | Yes | 1:50 | 1:200 |

| Payment Methods | 10 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plus500 and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plus500 | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | Yes | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | Yes |

Plus500 vs Other Brokers

Compare Plus500 with any other broker by selecting the other broker below.

The most popular Plus500 comparisons:

- Plus500 vs eToro

- Plus500 vs Tiger Brokers

- Plus500 vs Trading 212

- IC Markets vs Plus500

- Plus500 vs ActivTrades

- Plus500 vs Coinbase

- Crypto.com vs Plus500

- Exness vs Plus500

- Plus500 vs Binance

- Interactive Brokers vs Plus500

- Plus500 vs NinjaTrader

Customer Reviews

4.2 / 5This average customer rating is based on 5 Plus500 customer reviews submitted by our visitors.

If you have traded with Plus500 we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Plus500

For Specific Countries

Article Sources

- Plus500 Website

- Plus500UK Ltd - FCA License

- Plus500AE Ltd – DFSA License

- Plus500CY Ltd – CySEC License

- Plus500SEY Ltd – FSA License

- Plus500EE AS – EFSA License

- Plus500SG Pte Ltd – MAS License

- Plus500AU Pty Ltd - FSCA License

- Plus500AU Pty Ltd - FMA License

- Plus500AU Pty Ltd - ASIC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’ve really enjoyed my time using Plus500. Slick operation with a terrific platform, loads of instruments and their insights are genuinely useful. I’ve often looked at their data on who’s buying and selling, which instruments are hot etc. Also really decent support team when you need them. I had a question about gold options contracts recently and the Plus500 guys resolved it in a few mins.

My experience with Plus500 has been really positive. The platform is straightforward and simple to use, which made getting started easy. I appreciate the wide range of trading options, and the tools they offer help me make informed decisions. Anytime I’ve needed help, their customer service team has been quick to respond and always friendly. I feel confident using Plus500, and it’s made my trading experience enjoyable and hassle-free.

I’m extremely impressed with the wide range of CFD instruments available on Plus500. The platform is very straightforward, so it didn’t take long for me to get comfortable using it. I also appreciate Plus500’s transparency when it comes to their fee structure—right from the start, I knew exactly what fees would apply to my trades. I highly recommend this reliable broker!

Die Plattform ist unglaublich!

Sie funktioniert so gut für mich und der Kundendienst ist nett.

Ich habe noch nichts abgeholt, wir werden sehen.

The platform is incredible! It works so well for me and the customer service is nice. I haven't collected anything yet, we'll see.

I’ve been trading CFDs at Plus500 and have had a mostly good experience. I enjoy the look and feel of the platform while the live analysis from +Insights is excellent. On the downside, I think it’s a shame that scalping isn’t accepted and withdrawals can take the best part of a week.